" Recently, Berkshire Hathaway's shareholders meeting has just ended. This is a grand event known as the Spring Festival Gala in the investment community, which instantly focused the attention of global investors. Buffett and his long-time friend Bill Gates, JPMorgan Chase CEO Jay M. Dimon and Apple CEO Tim Cook were present.

The event lasted for nearly 7 hours, and the content was colorful but complicated. What important information was at the conference, Jingtai will interpret it for you.

|Interpretation 1: In times of market turmoil, cash is king and it is never wrong

"One thing that doesn't change is that we always have a lot of cash on hand," Buffett said at the start.

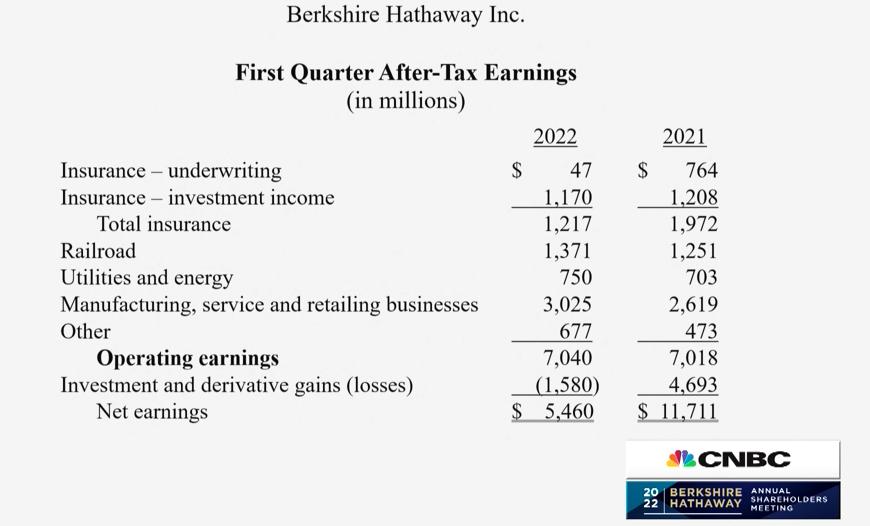

The company bought a total of $51.8 billion in stock in the first quarter, while selling $10.3 billion. Among them, between the end of February and the middle of March, he bought $41 billion in stocks in one go. Despite the sharp drop in cash levels, Buffett said the company will keep enough cash safe that the company has not launched a share buyback since April.

Berkshire's activities in the first quarter included increasing its holdings in Occidental Petroleum and Chevron, and acquiring an 11.4% stake in Hewlett-Packard Co. for $4.2 billion.

Buffett revealed that Berkshire Hathaway is always flush with cash and can be "better than banks" at extending lines of credit to companies in need.

Significantly increased stocks in the first quarter, but always kept enough cash .

|Interpretation 2: Beware of "New Forms of Currency"

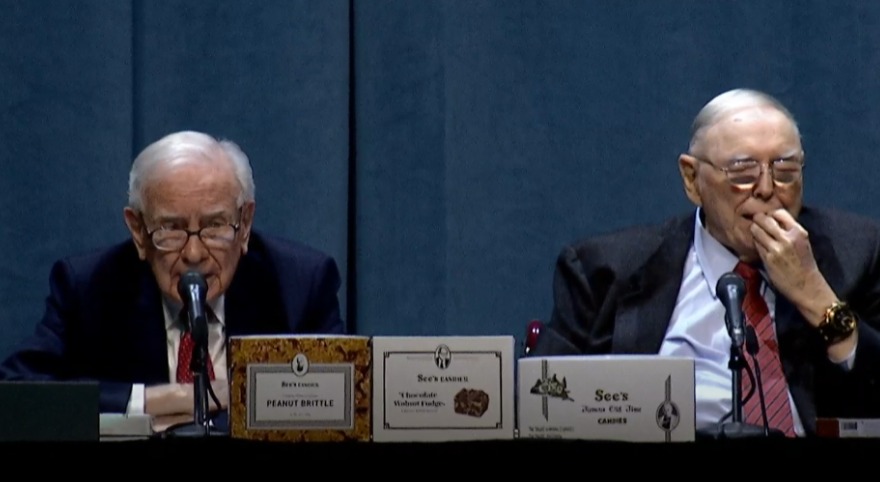

Buffett recalled the 2008 financial crisis, making shareholders wary of "new forms of money." When the audience asked Buffett and Munger what they thought of Bitcoin and virtual currencies, Buffett said: I would not buy Bitcoin.

Munger also said, "In my life, I have tried to avoid something that is stupid, evil, and makes me appear worse than others, and I think Bitcoin accounts for all three."

Buffett further stated that Bitcoin does not generate value, its price will only depend on how much the next person who buys it is willing to pay. Cryptocurrencies may now have magical appeal because of the hype, but they are not productive by themselves. But in essence, if an asset is to be valuable, it must be able to deliver productivity and deliver its value.

If someone tells him that he can own all bitcoins at a certain price, he won't accept it because he's not sure what he can do with it.

|Interpretation 3: Adhere to investment strategies, rather than short-term fluctuations in the stock market

Buffett said he never figured out how to time the market in time and missed the opportunity to buy stocks at the bottom in March 2020. "We have no idea what's going to happen when the stock market opens on Monday," he said in response to questions from the audience.

Sticking to a value investing strategy rather than focusing on short-term volatility in the stock market is an important characteristic of Berkshire Hathaway. "We're not good at timing," Buffett said. "What we're good at is figuring out when to get enough money for us. We don't know when to buy what, but we keep hoping that (the market) will be there for a while. Downside, so we might buy more."

Asked how to seize market opportunities, Buffett said he never figured out how to time the market, insisting, "Never speculate on the market's timing."

We don't have the slightest idea of what the market will do when the market opens on Monday. We never buy stocks based on how the stock market will go. Nor can we accurately time the market. Buffett also said, "In March 2020, I completely missed the market opportunity. "He said bluntly: "You can come to work directly with me if you do well at the right time." "

Buffett sticks to a value investing strategy and advises against spending time answering questions like how to outperform the S&P 500 this year.

|Interpretation 4: The "Casino Theory" of the Stock Market, Reason is More Important than Wisdom

Talking about the deal to buy Occidental, Buffett said the good performance prompted his decision to invest. He showed the entire process of the buy operation on the screen, acquiring 14% of the latter's outstanding shares in two weeks.

He then said that the stock market environment has become elusive in the past two years, like casinos, or it may be that the stock market has been too bullish in the past two years. Sometimes the market is investment-oriented, but other times it's like a casino where everyone gambles, especially in the past two years.

However, Buffett believes that short-term volatility caused by a "gambling mentality" earlier this year has led him to good long-term opportunities. Berkshire can invest when the market is doing crazy things, not because Berkshire is smart, but because it is sensible.

|Interpretation 5: The best way to resist inflation is to invest in yourself

Asked about his previous remarks about inflation "robbing" stock investors, Buffett said the damage from rising prices goes far beyond that. “Inflation also hits bond investors, robbing people who have their money under the mattress. It robs pretty much everyone,” he said.

Buffett pointed out that inflation also increases the capital required by businesses, and maintaining inflation-adjusted profits is not as simple as simply raising product prices. He advises against listening to those who claim to be able to predict inflation trends. "The answer is no one knows."

Buffett reiterated that the best defense against inflation is to invest in your skills. At this time, what is more important is your personal ability. What others trade is your ability. The best investment is to develop yourself.

The article is an information point compiled by Jingtai and does not constitute investment advice. Please read it carefully.