This year's National Two Sessions, the construction of new energy vehicles and related infrastructure has been included in the "Government Work Report" for the fifth consecutive year. Topics such as car charging piles, clean energy, chip research and development, and automotive supply chain stability have also become representative members and social media. hotly debated. In the context of realizing the "dual carbon" goal, the momentum of both supply and demand in the new energy vehicle market continues unabated.

|Global car companies electrification transformation and process re-acceleration

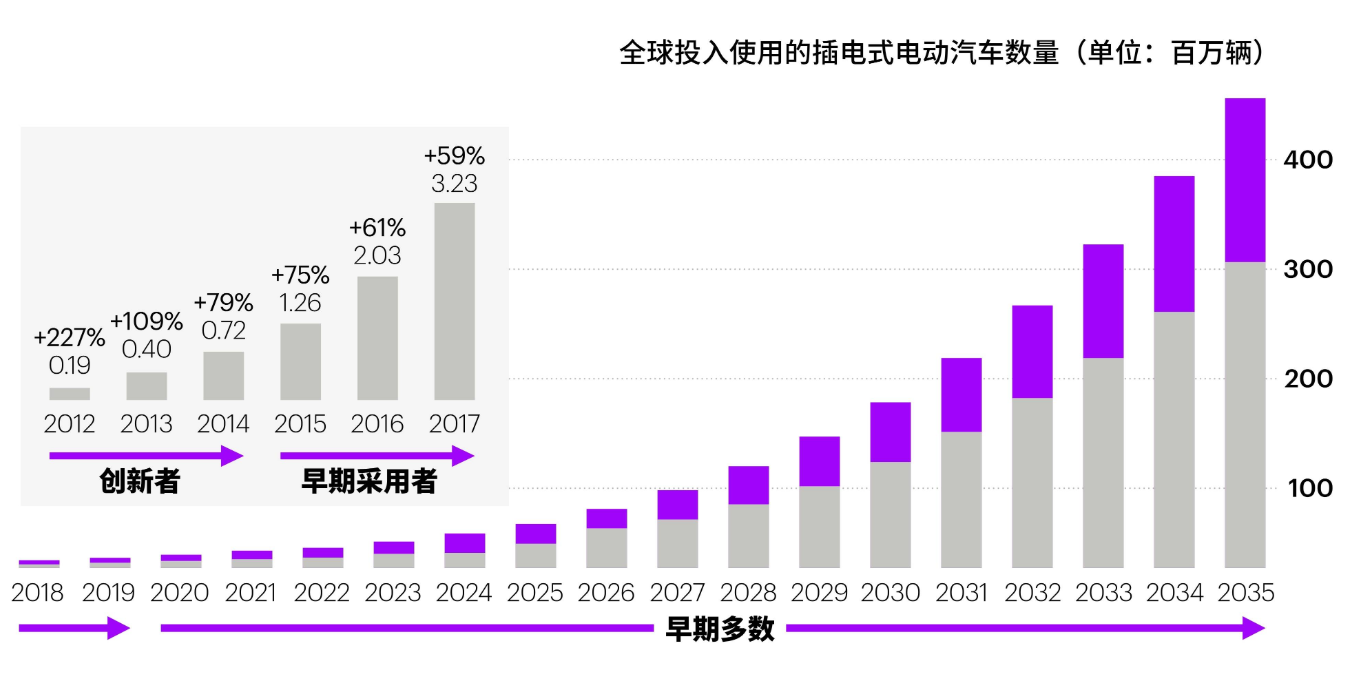

According to the International Energy Agency, global sales of electric vehicles will reach 6.6 million units in 2021, accounting for 8.6% of all new vehicle sales and more than double the market share in 2020. Electric vehicle sales will account for about 30% of total vehicle sales by 2030.

The global auto industry is already actively trying to sell more electric vehicles, with some major auto companies pledging billions of dollars to expand their lineups. Research predicts that sales of electric vehicles could outstrip sales of combustion-engine vehicles over the next decade, prompting a frantic transition among automakers.

At present, the automobile industry is undergoing great changes. European car companies such as Volkswagen, BMW, and Mercedes-Benz have announced electrification strategies two years ago, and now they are accelerating the process of electrification. American car companies such as Ford and GM, And South Korean car companies such as Hyundai are also catching up.

In March 2022, the BMW Group also announced at the annual financial report annual meeting that the electrification process will be accelerated again. By 2025, it will invest more than 30 billion euros in R&D and innovative technology, and electric mobility and digitalization will account for the majority of these investments. .

In 2022, Mercedes-Benz will offer pure electric models in all market segments, and in 2025 will release 3 pure electric vehicle architecture platforms, and from 2025 onwards, all newly released model architectures will be pure electric platforms , each model will provide a pure electric version, and the penetration rate of pure electric vehicles will reach 100% by 2030.

In 2021, global sales of new energy vehicles have reached a new high, reaching 6.75 million units, a year-on-year increase of 108%. In the next three years, global electrification will accelerate. For now, the world's major traditional automakers are in a race against time, but none have come ashore.

|Splitting and integrating the electric vehicle business will be the general trend

Spin-off business: The electric vehicle and gasoline vehicle segments are separated and operated independently

In early March this year, Ford announced the establishment of FordModel e, an independently operated electric vehicle business unit, and FordBlue, a gasoline vehicle business unit. Ford resolutely split the electric vehicle and fuel vehicle sectors for independent operation, and the new business unit is expected to achieve independent operation and self-financing in 2023. This approach still shocks the industry.

It may be time to break up the electric vehicle business. This move will be a major trend in recent years. In fact, not only international OEMs, but also domestic OEMs will also separate some new energy brands.

Integrate business: establish joint venture relationships and share supply costs

At present, some large car companies such as Volkswagen have invested heavily in setting up joint venture factories to ensure their own electric vehicle battery supply. Now, these automakers are also looking to expand their business further, hoping to reduce production costs, secure the supply of sought-after parts and gain more control over the quality and performance of car batteries.

Tesla is one of the first automakers to insource more electric vehicle battery production, a move that has helped the electric vehicle pioneer become the world's most valuable automaker.

In recent weeks, Volkswagen and Stellantis NV have announced deals to lock in lithium supplies, while Volkswagen also plans to build a similar cathode materials plant with Belgian Materials. These moves show that the auto industry is once again starting to integrate vertically.

![]()

![]()

|The construction of a mature electric vehicle supply chain has a long way to go

In the future, having more control over the supply chain could help OEMs shield themselves from price hikes and parts shortages. The disruption caused by the Covid-19 pandemic and the recent shortage of semiconductors is further driving the auto industry in this direction, prompting manufacturers to reduce their reliance on global outsourcing.

The global electrification process is still accelerating, so the demand for power batteries will double. Global automakers are scrambling to reserve key raw materials for electric vehicle batteries, and continue to "bind" supply agreements with upstream raw material manufacturers. However, the construction of production capacity requires a period of time, and most of them will not be put into production until after 2023.

From the perspective of supply and demand, the problems of lack of cores, parts and raw materials for batteries have made the entire automobile industry understand that the competition of new energy in the future is not a battle between car companies and car companies, but a battle between the industrial chain and the ecological chain. All-round competition .

As of April this year, except for BYD, the supply chains of other car companies are basically affected. The reason why BYD can stand alone is that its supply chain is highly vertical, and core components can be produced and supplied by itself. On the other hand, those car companies that do not have the ability to produce and supply themselves are gradually losing their right to speak.

The ability to produce cars no longer depends on the strength and output of car companies, and the supply chain determines the life and death of car companies . In this context, which car company is most likely to survive this "cold winter"? Splitting and integrating the electric vehicle business should be an inevitable trend. Black swan events occur frequently, and embracing change is the new way out.

The article is an information point compiled by Jingtai and does not constitute investment advice. Please read it carefully.