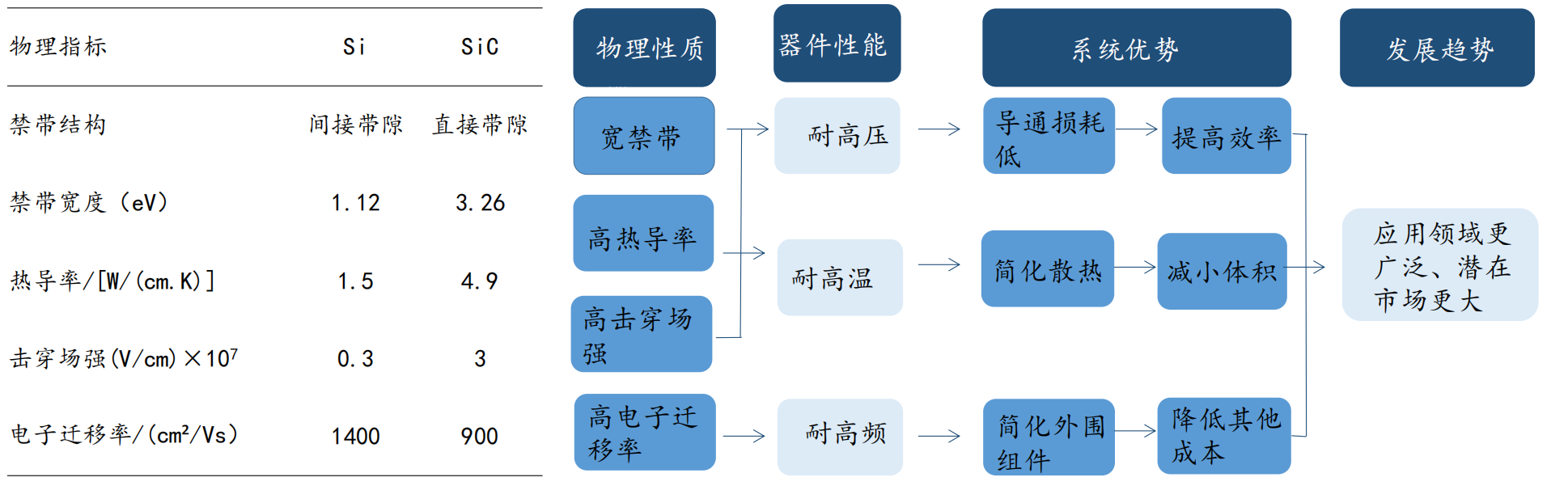

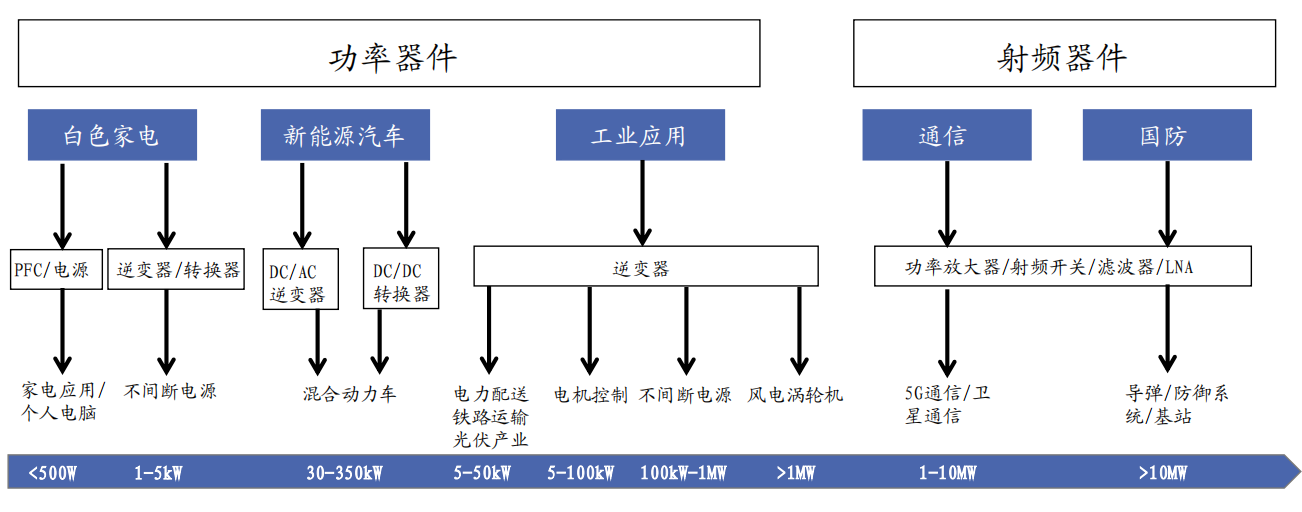

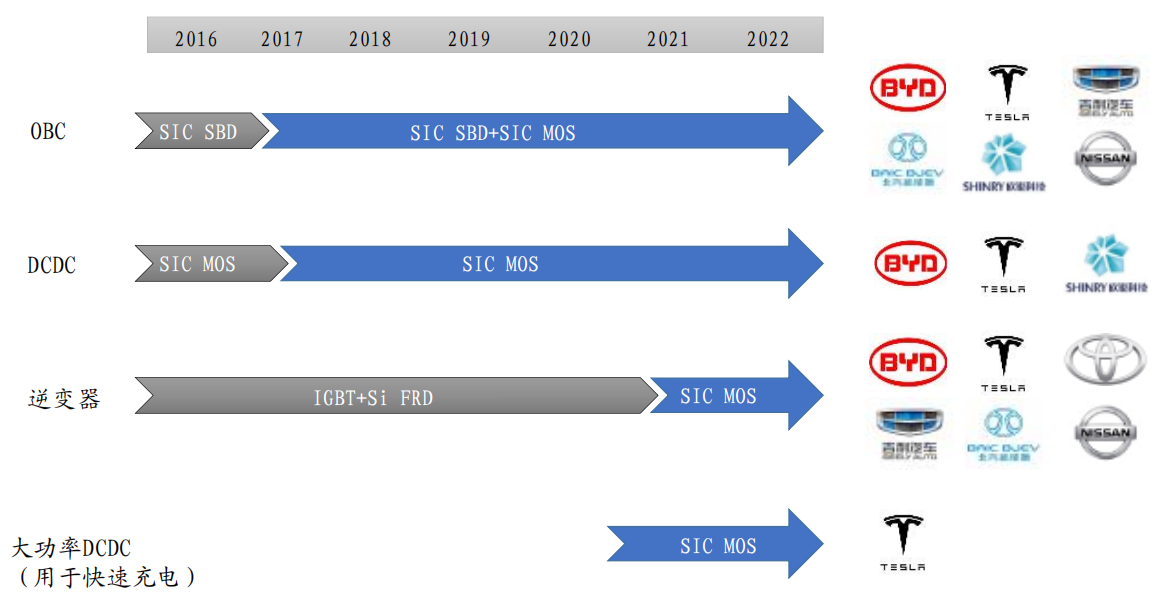

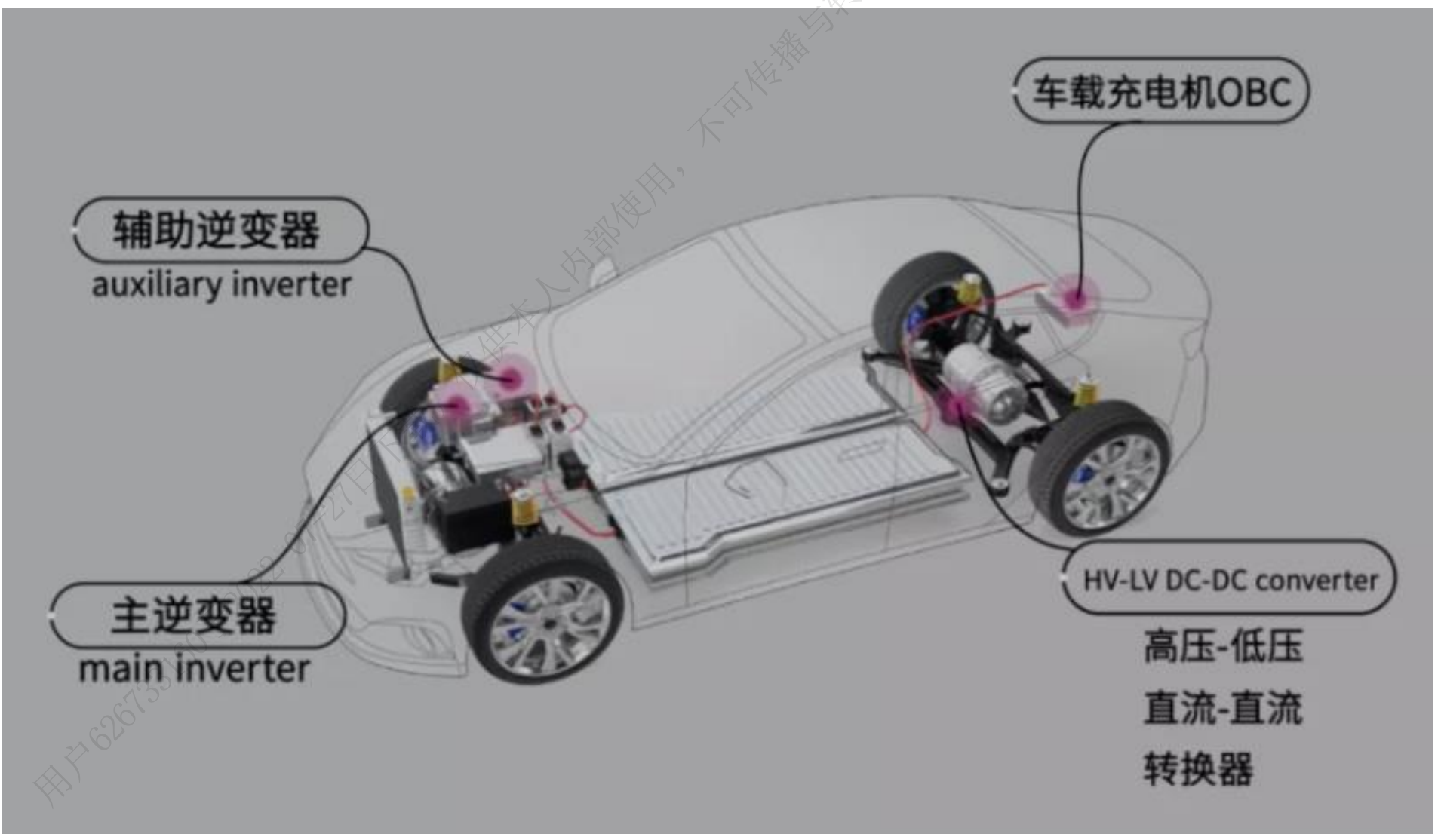

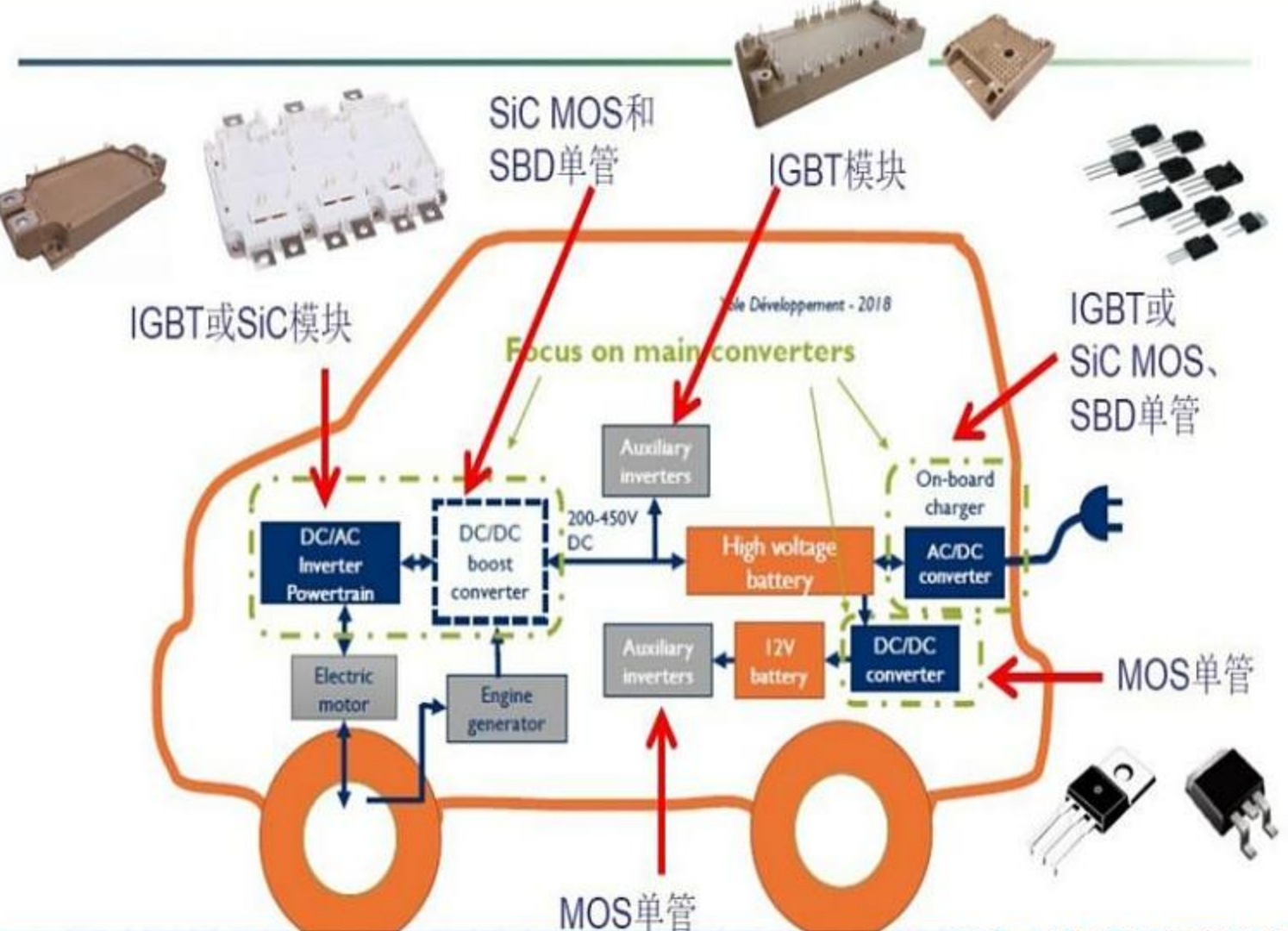

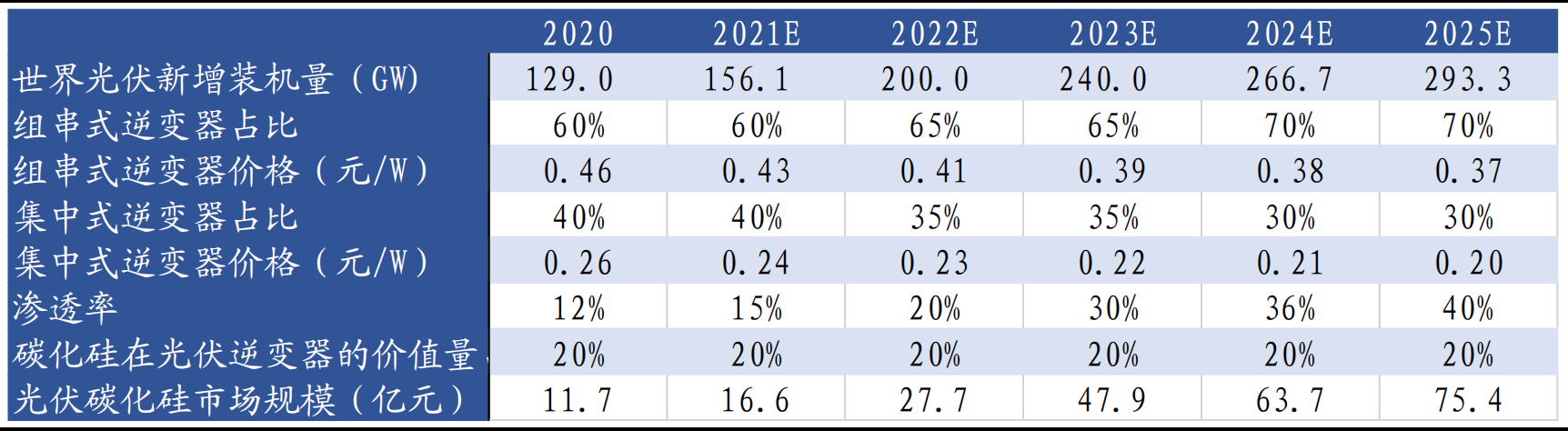

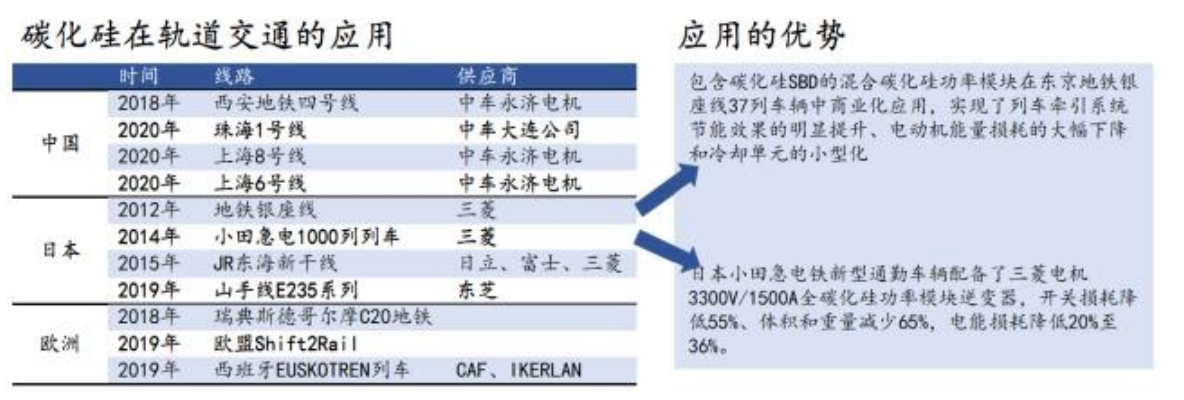

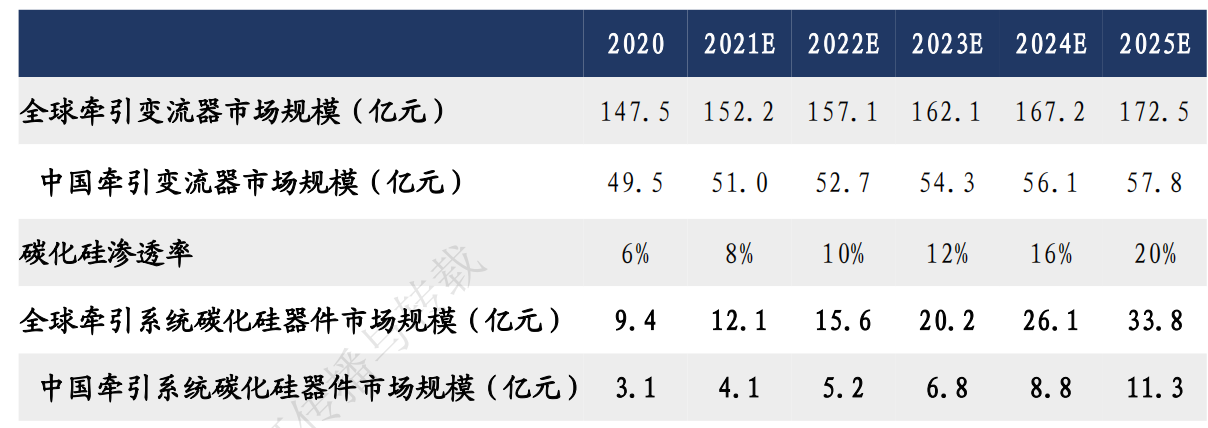

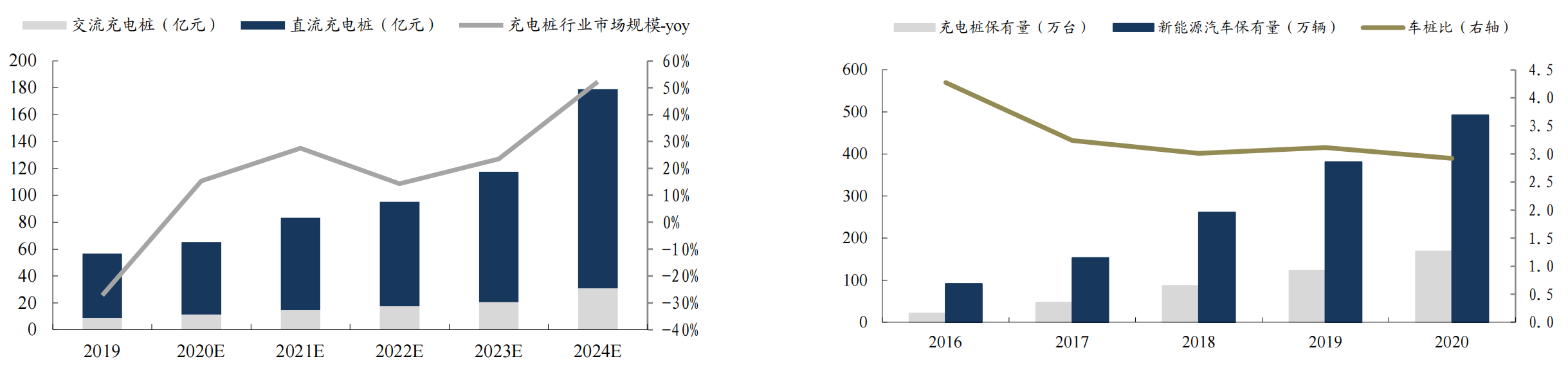

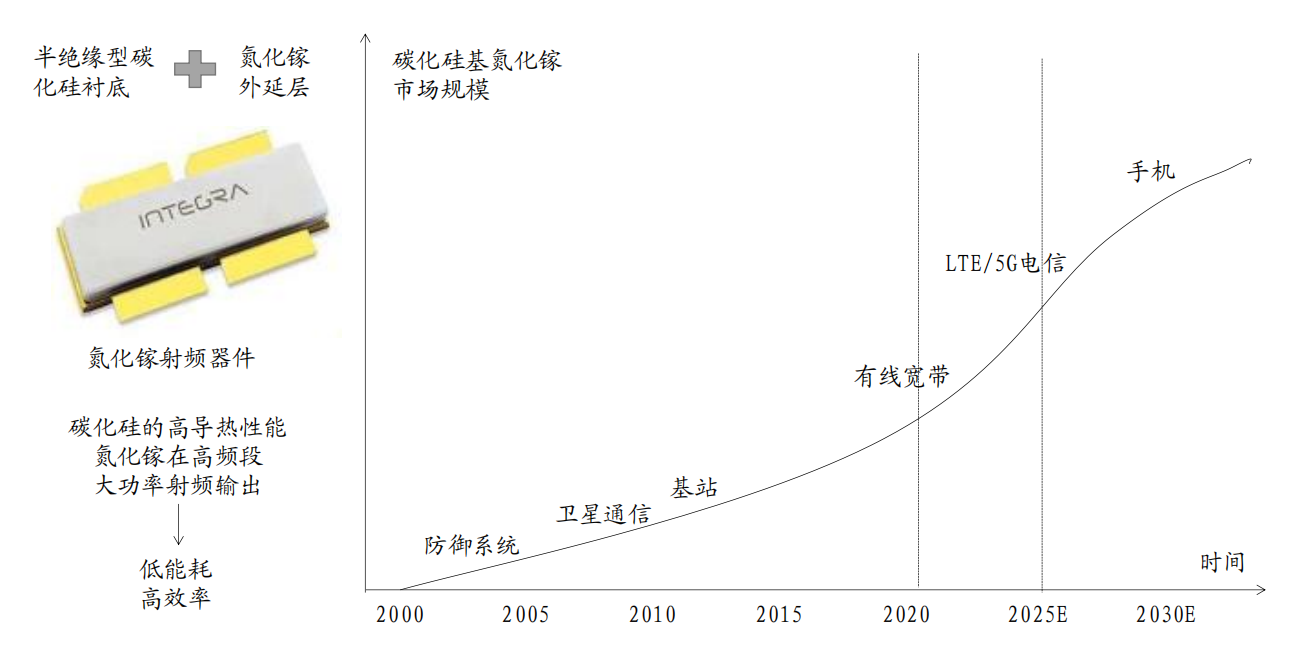

NATION Demand side: Because silicon carbide has the properties of high pressure resistance, high temperature resistance and high frequency, it has considerable application scenarios in new energy vehicles, new energy power generation, charging piles and other fields. As a wide-bandgap semiconductor, silicon carbide has excellent physical properties and can increase the switching frequency. In recent years, the application market has been opened with the cost reduction. According to Yole data, the global silicon carbide market in the power electronics field is expected to exceed US$3 billion in 2025, of which new energy vehicles will contribute more than half of the increase. Supply side: The technical process barriers are relatively high, and the domestic supply chain continues to expand production. Substrate materials and devices are the key links in the silicon carbide industry chain, and the PVT method is the current mainstream production method. The gap between domestic manufacturers and European and American manufacturers is generally more than 5-8 years. Domestic projects have been put into production one after another, and production capacity is expected to be released quickly. It is necessary to closely track the verification of downstream customers and judge the effective production capacity. Core focus: cost reduction capabilities. The cost reduction rate of silicon carbide is closely related to the penetration rate, and the cost reduction rate of the substrate is greater than that of the device. As far as substrates are concerned, the cost reduction factor can be disassembled into increased crystal growth efficiency, reduced slicing loss, increased yield, increased wafer size, and increased production capacity. The core of which is the improvement of crystal growth efficiency. Competitive landscape: The silicon carbide industry is similar to the first-generation semiconductors. CR5 maintains a high market share, but the overall trend is declining. As the market cake grows, domestic manufacturers are expected to grow large companies. At present, overseas Wolfspeed (formerly cree) has an absolute advantage, but the localization rate is expected to increase, and the long-term share is expected to increase by more than 10%. The industry is expected to witness a wave of mergers and acquisitions in the later stage of development. At present, the substrate is the core value point, but the technological strength of the leading Tianyue Advanced and Tianke Heda is still more than 10 years behind overseas companies. Second in extension, focus on leading technology companies and exit from listing or mergers and acquisitions; device companies focus on leading and industrial companies entering the game. Discussion on the market value space: In the review of Wolfspeed's stock price, the industry demand continued to improve and the performance exceeded expectations, driving the company's stock price to record highs. The current technology and products of domestic manufacturers are still immature, subject to production capacity, and their revenue volume is small. Combined with the benchmarking of analog chips and semiconductor equipment, it is found that domestic companies generally have PE and PS valuation multiples more than 4 times that of overseas leaders, and higher valuation levels indicate optimistic expectations for growth. As a leader in the silicon carbide industry, Wolfspeed's market value of tens of billions of dollars has benchmark significance. |SiC: the third-generation semiconductor star, with superior performance in high-voltage and high-power application scenarios Silicon carbide is the third generation semiconductor material. Compared with the traditional silicon material (Si), the forbidden band width of silicon carbide (SiC) is 3 times that of silicon; the thermal conductivity is 4-5 times that of silicon; the breakdown voltage is 3 times that of silicon. 8-10 times. Compared with silicon-based MOSFETs with the same specifications, the size of SiC-based MOSFETs can be greatly reduced to 1/10, and the on-resistance can be reduced to at least 1/100 of the original. The total energy loss of SiC-based MOSFET of the same specification can be greatly reduced by 70% compared with that of Si-based IGBT. Silicon carbide power devices will greatly improve the energy conversion efficiency of existing silicon-based power devices. The main application areas in the future include electric vehicles/charging piles, photovoltaic new energy, rail transit, and smart grids. |The application fields of silicon carbide are rich, and the market scale is constantly expanding According to Yole statistics, the market size of SiC silicon carbide power devices in 2020 is about 710 million US dollars, and it is expected to grow to 4.5 billion US dollars in 2026, with a CAGR of nearly 36% in 2020-2026. Among them, new energy vehicles are the most important downstream application market of SiC power devices, and the demand is expected to explode rapidly in 2023. |New energy vehicles: the rapid increase in penetration rate is an important driving force for the silicon carbide market SiC power devices are mainly used in new energy vehicle inverters, equipped with silicon carbide power modules; some are used in DC/DC converters, motor drivers and on-board chargers (OBC), equipped with single-tube devices. Previously, the main constraint affecting the volume of silicon carbide devices was the issue of cost economy. Now, with the decline in wafer production and manufacturing costs, the price gap with silicon-based devices continues to shrink. At the same time, considering the cost savings of heat dissipation systems, space savings, and improved performance of electric drive systems. With added value such as the jump in the value of the whole vehicle, silicon carbide devices already have a certain competitive advantage. The SIC main inverter of a single vehicle is about 5,000 yuan, and the OBC and DC/DC are about 800 yuan. Considering the current penetration rate of Tesla about 100%, BYD’s penetration rate of 30%, and the fact that other car companies have less applications, it is estimated that China The new energy vehicle SIC market will grow from 1.46 billion yuan in 2020 to 16.47 billion yuan in 2024, with a compound annual growth rate of 83.2%. |New energy vehicles: the rapid increase in penetration rate is an important driving force for the silicon carbide market At present, the SiCMOSFET of Tesla Model 3 is only used in the main drive inverter power module, with a total of 48 SiCMOSFETs, corresponding to a single car consumption of about 0.25 pieces of 6-inch SiC substrate. If it is extended to include OBCs, DC/DC converters, high-voltage auxiliary drive controllers, main drive controllers, chargers, etc. in the future, the usage of SiC devices in a single vehicle will reach 100-150, and the market demand will further expand (the consumption of a single vehicle is expected to increase. up to 0.5 pieces of 6-inch SiC substrate). Assuming that Model 3/Model Y will produce 1.5 million units in 2022, and a single car consumes 0.25 6-inch SiC wafers, it corresponds to 375,000 6-inch SiC wafers per year. In 2018, the supply-side production capacity was tight. |Photovoltaic: The new installed capacity of photovoltaics in the world continues to rise, and the application market of silicon carbide is broad Silicon carbide is mainly used in photovoltaic inverters, which can improve conversion efficiency and reduce system costs. Although the cost of traditional inverters based on silicon-based devices is low (only about 10% of the system), it is one of the main sources of system energy loss. The data shows that the use of silicon carbide power devices in photovoltaic inverters can increase the conversion efficiency from 96% to more than 99%, reduce energy loss by more than 50%, greatly improve equipment cycle life and reduce production costs. According to CASA forecast, by 2048, silicon carbide power devices will account for 85% of photovoltaic inverters. Silicon carbide is mainly used in string photovoltaic inverters and centralized photovoltaic inverters in the photovoltaic field. With reference to the proportion of string type and centralized type in CIIA photovoltaic inverters, and the penetration rate of silicon carbide in photovoltaic inverters predicted by CASA, the global silicon carbide market size in the photovoltaic field is estimated, and it is expected to reach 7.54 billion yuan in 2025. |Railway: Energy-saving and high-efficiency boosting silicon carbide penetration railroad traction system Traction converter is the core equipment of high-power AC transmission system of locomotive. Silicon carbide device can reduce the comprehensive energy consumption of traction converter due to its high temperature, high frequency and low loss characteristics, and improve the overall efficiency of the system, which is in line with the large capacity of rail transit. , lightweight and energy-saving application requirements. After the loading test and test, the full silicon carbide traction inverter for subway trains jointly developed by CRRC Zhuzhou Institute and Shenzhen Metro Group has excellent performance in energy saving, reducing the comprehensive energy consumption by more than 10% compared with the silicon-based IGBT traction inverter. The noise in the middle and low speed section is reduced by more than 5 decibels, and the temperature rise is reduced by more than 40 °C. According to data from the China Urban Rail Transit Association, if silicon carbide is fully adopted in urban rail transit across the country, 1.526 billion kWh of electricity can be saved in 2019 alone, and the electricity saved is enough for the entire rail transit in Beijing. The penetration of silicon carbide into rail transit is supported by policy. In August 2021, the expected results proposed and released by the Ministry of Transport include: forming the application technology route of silicon carbide devices and the application technology route of power electronic transformers; Completed the application of silicon carbide MOSFET in the urban rail traction system. In the field of rail traction converters, the global silicon carbide device market size will reach 3.38 billion yuan in 2025, with a 5-year CAGR of 29.2%; 5-year CAGR of 29.5% |Charging pile: The charging infrastructure industry continues to grow rapidly, and the application of silicon carbide has broad prospects The scale of China's charging pile market has generally increased from 2015 to 2020, from 1.25 billion yuan in 2015 to 6.53 billion yuan in 2020, with a CAGR of 39.2%. According to the statistics of the China Charging Alliance, as of December 2021, the national charging infrastructure has reached 2.617 million units, and the member units in the alliance have reported a total of 1.147 million public charging piles, a year-on-year increase of 56.4%, of which 470,000 DC charging piles. , a year-on-year increase of 52.1%. Silicon carbide is mainly used in DC charging piles. Its high power can improve charging efficiency and shorten charging time, which is expected to accelerate penetration. According to the guidelines of the "Carbon Peaking Action Plan before 2030" issued by the State Council and the planning of the Ministry of Industry and Information Technology, it is expected that by 2025, my country's vehicle-to-pile ratio should be between 2:1 and 3:1, and by 2030, it will be close to a reasonable value of 1:1. . Referring to a silicon carbide-based DC fast charging pile provided by Tyco Tianrun, the output power is 60kw, and its volume is about 30-35% smaller than that of a silicon-based charging pile with the same output power, so it can pass the heat dissipation performance and occupied space. cut costs. According to CASA's calculations, the penetration rate of silicon carbide charging modules in DC charging piles in 2019 is about 10%, and it is expected that the penetration rate will further increase as the cost decreases in the future. According to estimates, the market size of silicon carbide power devices used in DC charging piles in my country will reach 2.71 billion yuan in 2025, and the CAGR from 2020 to 2025 will be 72.7%. |RF: 5G base station GaN RF devices are widely used, driving the silicon carbide substrate market The global gallium nitride radio frequency device market is expanding rapidly, and gallium nitride on silicon carbide (GaN-on-SiC) is the mainstream product and technical solution. According to Yole's forecast, by 2023, the market size of GaN RF devices will account for 45% of the RF power market above 3W. By 2024, the global GaN RF device market will reach 2 billion US dollars, and the CAGR from 2018 to 2024 will be approximately twenty one%. In the next 10 years, GaN will become the mainstream technology for RF applications. GaNHEMT is the mainstream technology of 5G base station RF power amplifier, and silicon carbide substrate is the mainstream solution, and the market space will continue to break through. Based on the data of the Ministry of Industry and Information Technology, according to our estimates, by 2023, the market size of silicon carbide substrates in China's 5G RF field will reach 2.09 billion yuan, and the CAGR from 2020 to 2023 will reach 17.4%.