Recently, US President Biden officially signed the "Chip and Science Act", which plans to provide up to 52.7 billion US dollars in government subsidies for the US semiconductor industry. In a related statement issued by the White House, the purpose of the "Chip Act" is summarized as reducing costs, creating jobs, strengthening supply chains and confronting China.

|What impact will the "Chip Act" have on China's semiconductor industry?

The final signed "Chip Act" will provide $52.7 billion in grants for U.S. semiconductor research, development, manufacturing, and workforce development, of which $39 billion will be used for manufacturing incentives and $13.2 billion for chip R&D and workforce development; $500 million to secure communications and semiconductor supply chains. In addition, it provides a 25% tax break for the semiconductor manufacturing industry.

The bill also imposes strict regulations on the use of these funds: companies that receive incentive bonuses will not be able to expand advanced production capacity in "concerned countries", including China, for ten years. Otherwise, the subsidy will be fully recovered.

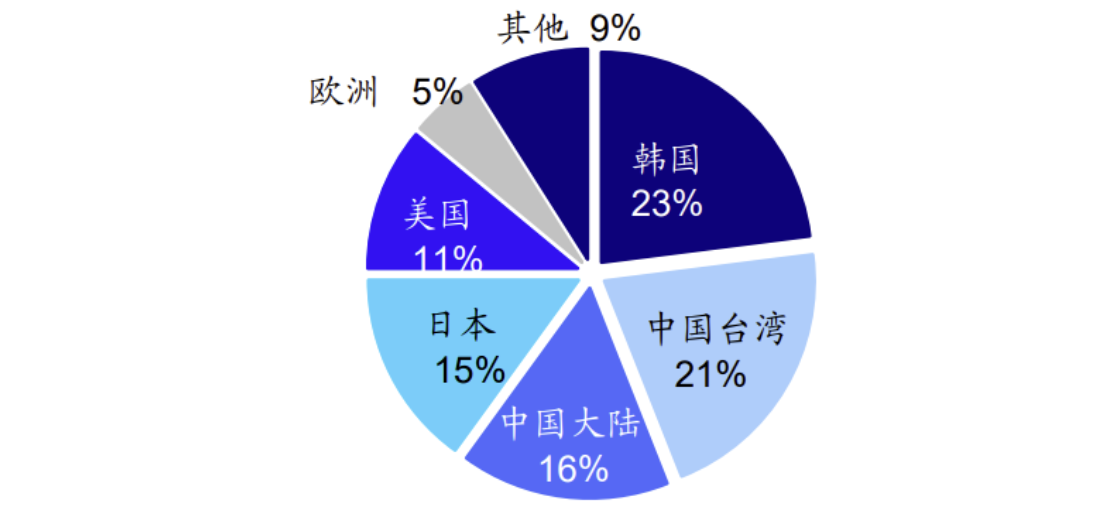

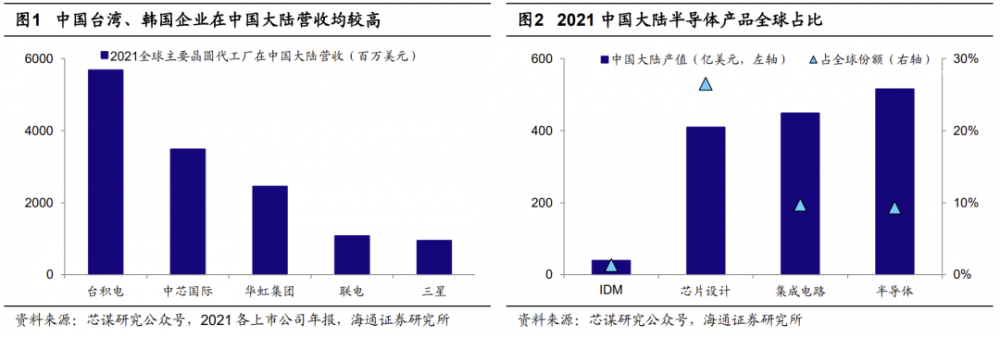

Therefore, the "Chip Act" will directly threaten the supply security of China's semiconductor industry chain. The semiconductor market is a typical market where strong suppliers have the right to speak. Semiconductor technology, equipment, materials, and foundry are controlled by a few giants. From the perspective of the current semiconductor industry distribution, the United States has a dominant position in core chips and semiconductor equipment; Taiwan's output value in wafer foundry processing in 21 years accounted for 62% of the global share; South Korea's market share in memory chips in 21 years reached 71% ; Japan also has an important position in semiconductor equipment and materials.

In terms of technology, the chip4 alliance will form a closed technology alliance to the outside world. The United States has great advantages in underlying supporting technologies such as EDA, materials, equipment, high-end components, and high-end design. The alliance has formed exclusivity through opening, sharing, and collaboration in some key links, and long-term Chinese companies will also be excluded from the formulation of technical standards. .

In terms of supply security, if the alliance is established, it will bring greater uncertainty to the security of domestic chip supply in mainland China. The United States will further strengthen the control of the industrial chain, and the production capacity will be given priority to supply the alliance. In addition, restrictions on semiconductor materials and equipment will also affect domestic capacity expansion and technological progress.

In terms of talents in the chip industry, the supply will fluctuate, and the introduction of overseas talents by domestic companies will encounter obstacles. The advancement of the bill will inject a large amount of funds into the scientific research field in the United States, and indirectly create about 100,000 scientific research positions, which will block the channels and methods of communication between Chinese chip talents and overseas in all fields.

In terms of the capital market, the Act has a greater impact on international capital, while the investment strategies of domestic investment institutions are basically unaffected.

|How should China deal with this situation?

The first is to give full play to the advantages of the new national system to accelerate the realization of scientific and technological self-reliance in the semiconductor field. At the same time, basic research in the field of semiconductors is the source of the industrial system and the aggregation of all technical issues. Once breakthroughs are made in basic research and key technologies, the impact will be subversive.

The second is to continue to increase investment in the semiconductor industry, unblock semiconductor capital channels and fund support, and do a good job in capital management and effective tracking of semiconductor projects. In view of the particularity of the semiconductor industry, increase the inclination of government funds to core technologies, semiconductor supply chain security and other fields.

The third is to strengthen the support of talents in the semiconductor industry and attract global technical talents to develop in China. In this regard, we must fully learn from the United States' practice of attracting global scientific and technological talents, as well as the emphasis and policy measures on intellectual property rights and original technologies.

The fourth is to encourage the leading role of leading enterprises in the industry to make the market bigger and stronger. Driven by the dividends of the Sci-tech Innovation Board, localization strategies, and lack of cores, China's semiconductor industry has made great progress in the past three years. There has been a relatively large development in terms of enterprise development and capital.

In the short term, the domestic market will be affected; in the long run, the process of domestic substitution of semiconductors will be further accelerated, and the Chinese chip industry will have a relatively large development potential. In addition, the huge domestic market dividends and demand can still attract many international companies. Come to China for investment and development.

In the future, China's semiconductor localization will have three important directions: third-generation semiconductors, semiconductor equipment, and artificial intelligence/computing chips. For example, in the field of semiconductor equipment, at present, domestic enterprises have made great progress in cleaning, PVD, furnace tube, etching and other fields. Under the regulatory pressure of the US Chip Act, the demand for localization of semiconductor equipment has further increased.

From the perspective of the current global chip manufacturing and supply chain, East Asia is still the most important production base and consumer market in the world. As for the US chip bill and a series of combined punches, the competition pattern and distribution pattern of the global semiconductor industry will undergo considerable changes. SK, TSMC, etc. announced to increase investment in the United States, which has shown that the expansion and investment logic of international semiconductor giants will not be the same. The factors of market, efficiency and cost must be fully considered, and more consideration will be given to political factors and such unreasonable bills in the United States.

In addition, the passage of this bill also has another more important impact. Even including China, Europe, Japan, South Korea and other countries will also consider their own industrial security, launch corresponding industrial policies, and safeguard the interests of local enterprises and national interests, which will reshape the global industrial chain pattern and generate a new round of semiconductors. Industrial migration, which in turn triggers competition in the global semiconductor industry.