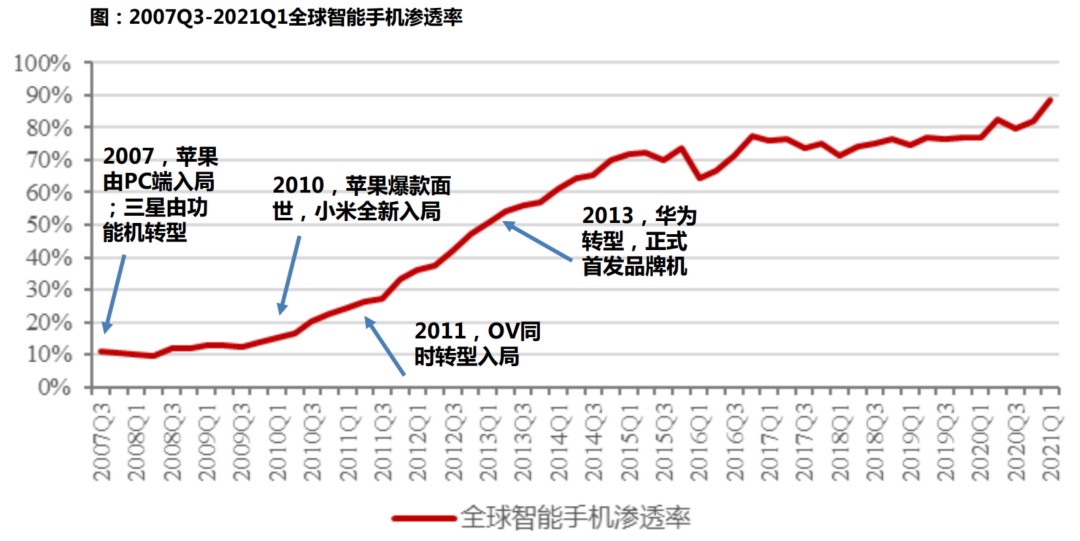

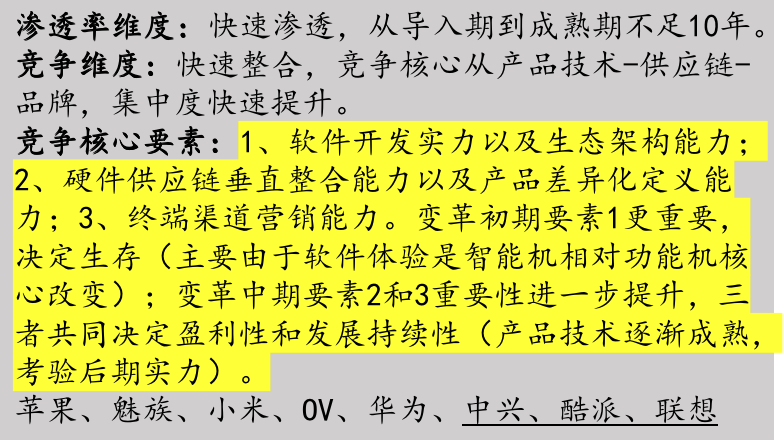

|Global Smartphone History Review and Elements Summary Looking back at the penetration rate of the smartphone industry and the company's key time nodes: 1) Apple stands at the starting point of the outbreak of the global smartphone industry, with a penetration rate of about 10% (2017). From the perspective of software and hardware, what is a "smart phone" defined; 2) Samsung stands at the starting point of the outbreak of the global smartphone industry, with continuous hardware iterative upgrades + high vertical integration of the supply chain to benchmark Apple, and continue to follow; 3) Xiaomi stands at the starting point of the outbreak of China's smartphone industry, with a global penetration rate of about 15% (2010), and takes the founder's Internet operation ideas as the core to define what an "Internet smartphone" is; 4) OV stands in the early stage of the global smartphone boom, with a penetration rate of about 25% (2011), and quickly identifies its own characteristics such as "photography/music/fast charging", and supplements it with carpet marketing to define what is "distinguished" cost-effective smartphones”; 5) Huawei stands in the fastest growing period of smartphones in the world, with a penetration rate of about 50% (2013). With the endorsement of hard-core technology, the multi-dimensional development of cost-effectiveness + brand + marketing has successfully intervened. |Global Smartphone History Review and Elements Summary Review of smartphone manufacturers in 2007-2017: software-hardware-channels are indispensable. Every play has a capability boundary. Apple: Closed-loop hardware and software can create high barriers . As an industry leader, Apple has the strongest comprehensive capabilities, not only with a software closed-loop model, but also with the ability to master the world's best supply chain and chip self-design capabilities at the hardware level, plus good channel management and control, so as to ensure the high-end market leader and strong profitability. Samsung: Vertically highly integrated hardware industry chain . Relying on the capabilities of Samsung Group, it implements the strategy of following and surpassing with strong hardware control as the guide, following Apple in the whole cycle, and dropping the price to the mid-to-low-end market, using hardware advantages to achieve full price coverage. Xiaomi: "Triathlon" creates core competitiveness . "Software + Hardware + Internet" is Xiaomi's triathlon, software + hardware guarantees product quality, and Internet thinking helps to create a comprehensive and differentiated competitive element for Xiaomi from brand positioning to product marketing. Huawei: Continue to invest in R&D to achieve hard technology transformation . In the early stage, we missed many industry hype periods, and in the later stage, we quickly followed up with strong investment determination and R&D strength. The strengths in various fields such as software + hardware + brand image promotion + channel layout fully followed and learned and surpassed. OV: Online and offline carpet marketing channels win . On the basis of hardware advantages, we will continue to fill the shortcomings of software, create differentiated products that are benchmarked in specific fields, and use the advantages of channel layout to promote through carpet marketing, and rise with the explosion of the low-end demand market. In general, technological innovation is the foundation for the survival of mobile phone manufacturers . To meet the user's cost-effective needs - to meet the user's individual needs - to create a better lifestyle for users, the higher the level of manufacturers to obtain a higher brand premium. |XR terminal investment logic: The current industry is still in the early stage, and the focus of competition is on product power, but due to the immaturity of upstream technology, the differences in product power are not large, and Oculus and Sony, which have dominant content ecosystems, have outstanding advantages. Referring to the development history of mobile phones, terminal competition will rapidly integrate after entering the channel competition stage, and a large number of enterprises will be quickly eliminated; enterprises with outstanding supply chain competitive advantages and marketing resource advantages will still have opportunities to enter after their products/technologies are mature. According to this, in addition to Oculus, the annual shipments of second-tier companies such as Pico and Dapeng are only about 500,000 units. Compared with the 100 million-level shipments after the industry matures, the current leading companies in sales are not directly It is linked to competitive leadership, and most of them will be eliminated in the future. Core focus: 1. Software development strength and ecological architecture ability; 2. The ability of vertical integration of hardware supply chain and the ability to define product differentiation; 3. Terminal channel marketing capability. |Smartphone Industry Chain

|XR Industry Chain Investment Logic: Head Companies with High Tech Barriers

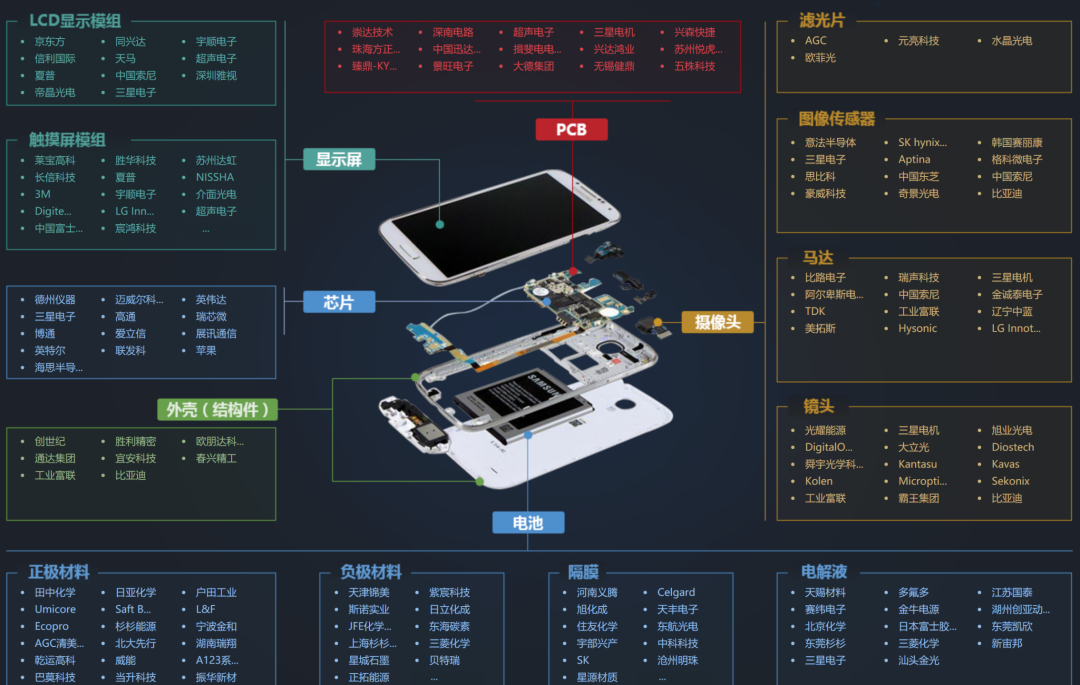

Referring to the smartphone industry chain, most of the devices from the PC industry chain are used, and XR forecasts that the smartphone industry chain will continue to be used. The investment logic based on this is as follows:

1) Hardware supply chain: Most of the traditional supply chain components are used, focusing on core components such as chips, optics, and displays, and focusing on investment by leading companies . The traditional supply company has strong financial strength and rich industrial foundation, and still has strong competitiveness in the XR industry chain. Leading start-ups have outstanding technological advantages, stronger capital and resource endowments, and are expected to grow into important players in the industry along with terminal enterprises; while the possibility of latecomers breaking the game is relatively small.

2) Software supply chain: VR/AR software is at the high end of the value chain, and relevant investment targets are scarce. Focus on early-stage projects and mature head projects with many applications . The software segment is dominated by overseas, especially the system platform market is basically dominated by foreign companies. Unity3D, Unreal and other 3D engine companies, Lail3D, Microsoft and other UI, Oculus, Google and other OS systems occupy the majority of the system software market, domestic companies are still relatively weak in this link, with fewer corporate layouts and weaker technical strength.

Such projects have high technical barriers and application barriers, and resources are scarce.

On the one hand, pay attention to the more mature companies at the top, and focus on whether they have successful applications, whether they have a relatively benign financial situation, and whether they have an industrial ecology. On the other hand, focus on early start-up projects, focusing on team strength, technical path, and ecological planning.

3) Content and applications: Big Internet companies have prominent advantages in content platforms and are the main battleground for their competition, with few high-quality investment opportunities, focusing on a prosperous developer ecosystem + strong self-research capabilities + IP migration capabilities, etc. A prosperous developer ecosystem and content production have positive feedback (a good developer community - attracting developers to settle in - more content - more prosperous developer ecology).

The key is to establish a good developer ecological environment and strong self-research capabilities. Self-research capability is the key to building content industry barriers (refer to Tencent's game business).

On the one hand, the self-research capabilities established by major game companies in the mobile Internet era can be transferred to VR (The Elder Scrolls 5: Skyrim, Fallout from Company B, Half-Life: Alyx from Company V, etc. are all VR classic 3A level game).

On the other hand, VR content is still in the early stage of development, and many small and medium-sized game studios can also contribute high-quality original VR games. IP migration capability: Big IP games in the PC and mobile Internet eras are expected to be migrated to VR to be monetized again. The authorization and migration capability of blockbuster IP is the guarantee for VR content expansion (“Half-Life: Alyx” is the VR migration of Half-Life IP Version).