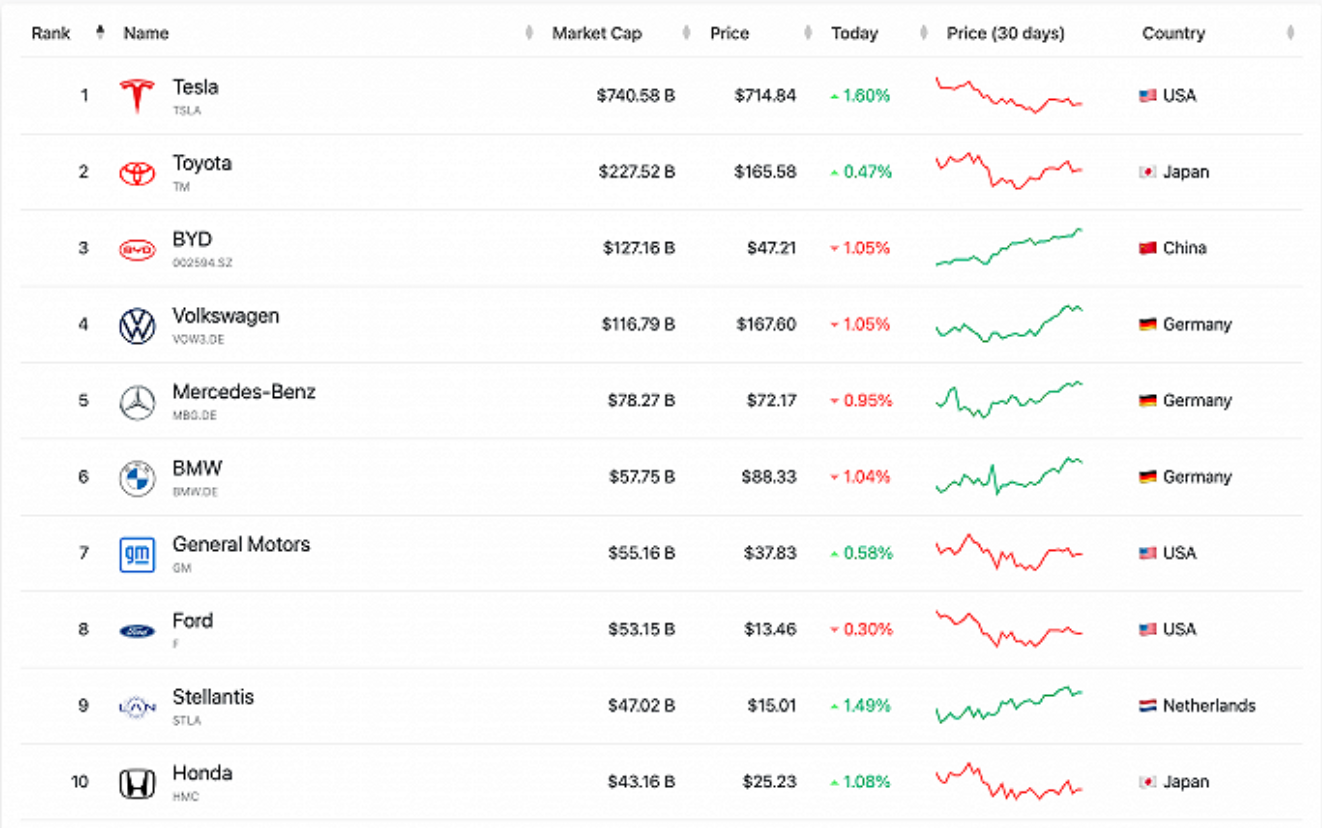

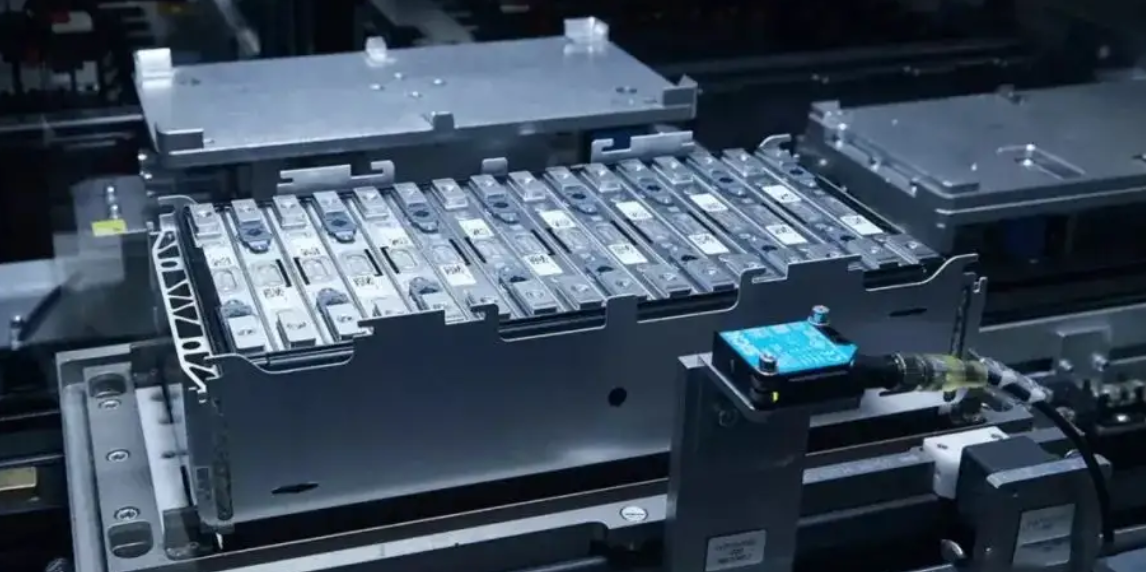

On June 10, BYD's share price hit a record high, and its market value exceeded one trillion yuan for the first time. Correspondingly, the overall performance of the new energy vehicle sector has been eye-catching recently. Lithium batteries, charging piles and other sectors in the industry chain are also very active and attract much attention. What investment opportunities are there in the new energy vehicle industry? |New energy vehicle industry is maintaining rapid growth As of the close on the 10th, BYD's A shares rose by 8.19% in a single day, closing at 348.8 yuan per share, with a total market value of 1,015.4 billion yuan. Since then, BYD has become the first domestic auto brand to enter the trillion-dollar market value club . The latest data shows that in May 2022, BYD sold 114,943 new energy vehicles, and the monthly sales exceeded 100,000 in the third month. According to the latest data from the China Association of Automobile Manufacturers, in May this year, domestic sales of new energy vehicles were 447,000 units, a month-on-month increase of 49.6% and a year-on-year increase of 105.2%; from January to May, domestic new energy vehicle sales were 2.003 million units, a year-on-year increase. 111.2%. From a global perspective, from January to April 2022, the sales of new energy vehicles in the broad sense were 3.75 million units, and the sales of new energy passenger vehicles in the narrow sense were 2.56 million units, an increase of 73% compared with the same period last year. Among them, the sales volume of new energy passenger vehicles in China accounted for 57%, realizing the "half of the country" in the true sense. This series of data not only shows the development potential of BYD, but also reflects the fiery trend of the entire new energy vehicle industry represented by it. |New energy industry chain has become an investment outlet Statistics show that a total of 10 new energy vehicle listed companies in the A-share market have disclosed their operating data in May, and 7 companies have increased their sales of new energy vehicles by more than 50% year-on-year in May this year. Among them, BYD and Xiaokang Co., Ltd. doubled their sales of new energy vehicles in May this year. The reasons for the surge in the performance of new energy vehicle companies are mainly due to three factors: First, there are frequent favorable policies. In May, the central and local governments successively introduced a number of stimulus policies to stimulate consumption by issuing consumer coupons, lottery lottery and other means, driving the sales of most car companies to increase month-on-month in May. Second, the tension in the supply chain has eased , and the shortage of spare parts has been gradually resolved, which has contributed to a substantial increase in vehicle production and sales. Third, the phenomenon of poor logistics has been effectively improved . The previous situation where a large backlog of orders could not be delivered in the warehouse has been alleviated, and the smooth logistics has greatly promoted the increase in sales of new energy vehicles in May. In terms of investment opportunities, driven by favorable factors such as policy support and the release of consumer demand for car purchases, it is expected that sales of new energy vehicles will continue to grow at a high rate in the future. The activities of new energy vehicles going to the countryside are actively promoted, and it is expected that the prosperity of the new energy vehicle industry will further increase in the second half of the year. It is recommended to pay attention to leading companies with strong competitiveness in the fields of upstream lithium resources, midstream battery manufacturers, and downstream OEMs. |Lithium battery sector rose more than 23% The data shows that as of June 10 this year, there were 282 listed companies in the lithium battery sector of the A-share market, with a total operating income of 3.43 trillion yuan in 2021, a year-on-year increase of 34.69%; in the first quarter of 2022, the total operating income was 944.738 billion yuan. , a year-on-year increase of 34.08%. Relevant listed companies attach great importance to R&D investment. In the lithium battery sector, 274 listed companies disclosed their total R&D investment last year, totaling 126.938 billion yuan. Among them, 21 companies accounted for more than 10% of their total R&D investment in their operating income last year. At present, the price of battery cells has risen, and the gross profit margin of battery manufacturers has improved; however, the increase in the price of cathode materials lags behind the increase in cost, and the gross profit margin of companies with weak bargaining power over upstream raw materials may decline. Taking into account the increasing demand for energy storage and the fact that some regions have begun to provide subsidies for the consumption of new energy vehicles, we are still optimistic about the investment opportunities in stocks related to the lithium battery industry chain. In the second half of this year, new energy vehicles are expected to accelerate their penetration into the sinking market, thereby driving the increase in overall sales. Among them, the battery side will benefit greatly, especially the upstream branch fields such as lithium ore, lithium materials, and electrolytes.