The global healthcare industry is on the fast track, health technology is changing the way we diagnose and treat diseases, and healthcare systems are enabling remote care and becoming more efficient.

The surge in health demand driven by the epidemic has also brought fiery investment. Driven by a sharp increase in valuations, mergers and acquisitions and accelerated IPOs, the fundraising of venture capital funds in the health care industry has reached a new high.

▍What is computational biology?

Computational Biology is a branch of biology that refers to the development and application of data analysis and theoretical methods, mathematical modeling and computer simulation techniques for the study of biology, behavior and social group systems. Subject.

The ultimate goal of computational biology is not limited to sequencing, but to use computer thinking to solve biological problems, and to use computer language and mathematical logic to construct, describe and simulate the biological world.

▍Computational biology - a new model for drug discovery and development

In recent years, an increasing number of companies are developing algorithms using massive biological datasets to gain deeper understanding of disease and fundamentally change the drug discovery and development process. Accelerators and incubators work together to create a structured space for the field of computational biology to carry out cooperation and experiments on data management and analysis in the healthcare industry. Venture capital investment in the space has accelerated dramatically over the past three years.

Computational biology companies are required to meet the following criteria by consulting the individual company websites:

Specializing in drug discovery or development (biopharmaceuticals/R&D tools); Apply new computational tools to obtain biochemical research results; have the ability or potential to create a platform; Have a team with experience in developing algorithms.

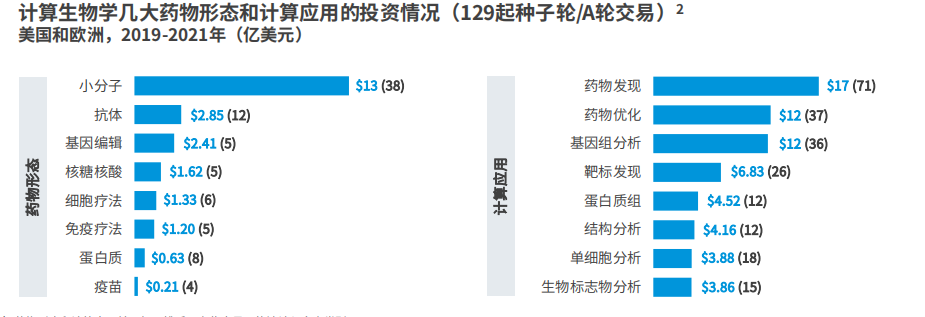

Computational biology companies accounted for 129 (18%) of the 707 biopharmaceutical and R&D tools companies that completed their first seed/Series A financing since 2019. 2021 will see a surge in investment in computational biology companies, nearly double the amount raised in 2019 and 2020 combined.

Computational biology companies in Massachusetts and Northern California have raised the most in the past three years, with seed/series A deals doubling from 2020 to 2021. Notably, there are also eight deals in the UK in 2021 and none in 2020.

Of these 129 computational biology companies, 89 (69%) incorporated machine learning or artificial intelligence algorithms into their technology, most often applied to genomic analysis, to aid in the discovery of small molecule therapeutics.

▍ Computational biology: the field with the most early-stage investment

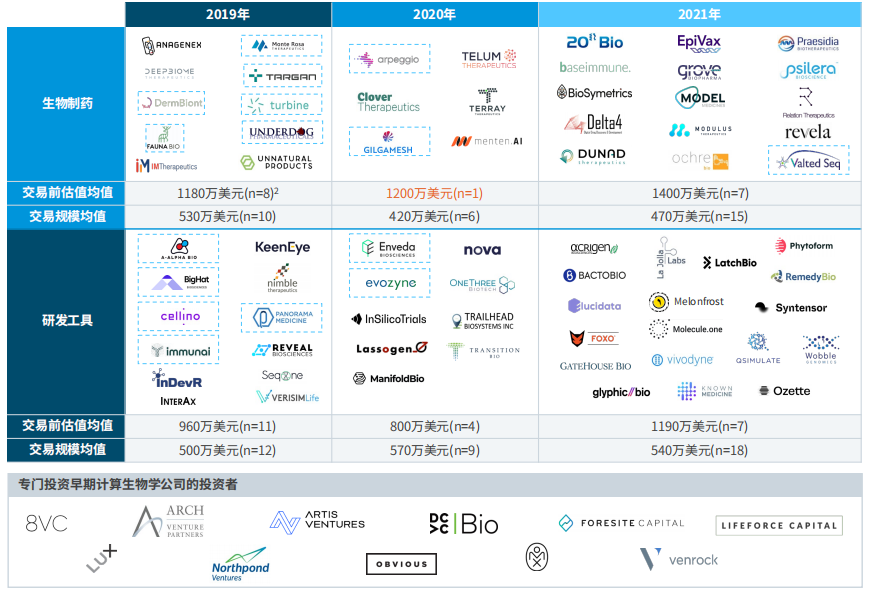

The research house catalogued 70 early-stage companies with smaller funding rounds (raised between $2.5 million and $10 million) that have boosted the field since 2019. 16 of these companies (23%) have completed new rounds since their first seed/series A round.

The websites of these companies were consulted and categorized based on whether the companies publicly stated that they were developing their own therapies (biopharmaceuticals) or technologies that enabled drug discovery and development (R&D tools). Many R&D tool companies have gradually started to develop or register new therapies, and some of the current R&D tool companies may transform into biopharmaceutical companies in the future.

The investment institutions that invest the most in early-stage computational biology companies are usually the lead investors or cornerstone investors of the seed round/round A financing.

To identify promising early-stage companies, these investors typically look for companies with novel computing methods, differentiated data, and strong founding teams. Most investors willing to take a seed/Series A risk have expertise in life sciences and technology, enabling them to provide key resources, including referrals to top talent, partners, and new investors.

▍ Computational Biology: Enhancing Value During Subsequent Investments and Exits

For computational biology companies that have completed seed/series A and next rounds of financing in the past three years, valuations have increased significantly, with a median increase of 2.1x. Both traditional and cross-border investors in the life sciences have participated in many follow-on financings, demonstrating their belief that computational biology will play an integral role in future drug discovery and development.

To gain investor support, companies often seek to collaborate to demonstrate the value of their platforms, demonstrate the company's position in the pharmaceutical industry, offset operating costs with returns on revenue/milestone events, and stimulate M&A interest.

Example: Outpace Bio (biopharmaceutical company) completed a $30 million Series A in 2021 and partnered with Lyell to bring cancer immunotherapy to market.

Since 2019, 13 (25%) of the 52 listed biopharmaceutical and R&D tool companies with a market value of over $1 billion are computational biology companies. The stock prices of these companies rose hugely after listing, with their total market capitalization increasing to 3.7 times, and the median post-listing stock price increase was 54%.

▍Investment trends in computational biology

LIPO transactions will continue the activity in the fourth quarter of 2021 or decrease, so investment in this area may decrease, and the financing valuation of Series B and subsequent rounds may decrease.

Research institutions believe that IPOs will be reduced by about 50% (more than 50 IPOs), favoring companies with differentiated and distinctive features and strong internal financial backing. In 2022, M&A should pick up, but it will focus more on newly public companies with depressed share prices and private companies in the preclinical stage.

The article is an analysis point of view of Jingtai and does not constitute investment advice. Please read it carefully.