Since Facebook changed its name in October 2021, setting off a wave of metaverse, more and more Internet companies have begun to enter the social arena. On the one hand, Metaverse social products cater to the trend, on the other hand, users have the courage to try out Metaverse social products, and the capital market has also begun to show strong interest in Metaverse social products.

Oasis is moving users into a virtual trial world

The Metaverse interactive social platform Oasis has recently completed a series B financing of tens of millions of dollars. The leading investors are Wuyuan Capital, Oasis Capital, BAI Capital, and Echo Capital as the exclusive financial advisor.

Oasis has previously received investment from Wuyuan Capital, BAI Capital, Zhichun Capital, Xianfeng K2VC and Qinghan Fund. According to SensorTower statistics, Oasis has grown by more than 6 million registered users in Q4 2021, and has become one of the fastest-growing metaverse social products in the world.

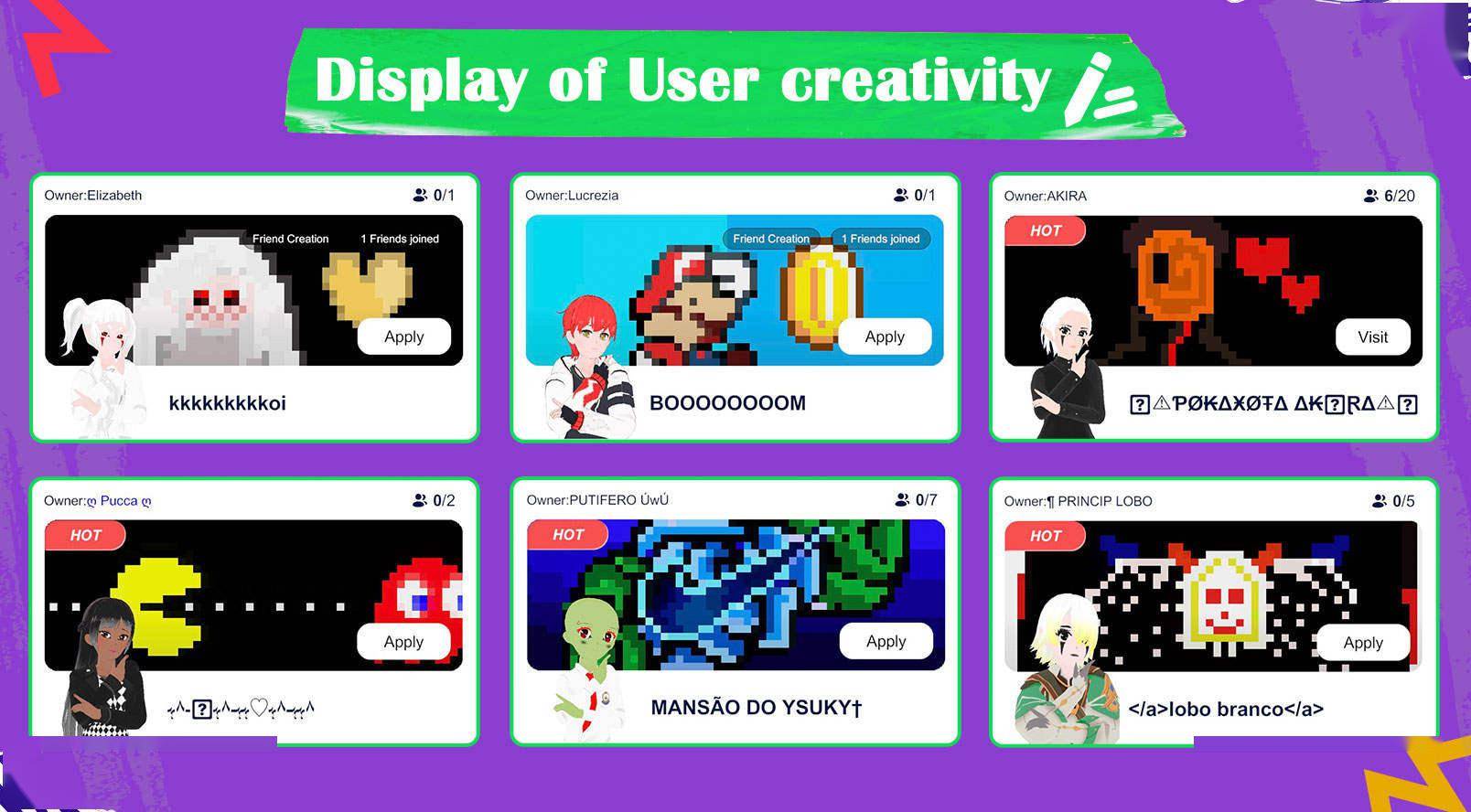

Oasis' social metaverse is mainly composed of "virtual activities", "acquaintance relationship chain of virtual identity" and "various organizational forms". The team is building a new virtual economic ecology around these three aspects. On the Oasis platform, users can complete a large number of real activities in the virtual world, including watching movies together, watching live broadcasts, singing, playing cards, playing chess, playing board games, and even working and taking classes.

From the perspective of gameplay and user population, Oasis is different from other content ecosystems that use small games as a user attraction point. Many virtual activities mapped from real life are more user-friendly. After many users in Oasis complete social activities with friends, We will continue to log in to the platform to explore more ways to play in the future.

Official statistics show that the average daily time of Oasis users exceeds 110 minutes, and the daily time of retained active users is close to 200 minutes, which means that a large number of users have moved "real activities" into the virtual world.

Oasis is seeing global growth

While continuously improving core functional modules, Oasis is ushering in global growth. Up to now, the Oasis platform has been online for 8 months, covering many countries around the world. Among them, Oasis has reached the top of the Brazilian social app list within 2 months of its launch, and then ranked as a social app in the United States, the Philippines and other countries. Top of the list.

At present, the Oasis platform has more than 2 million new users every month, and nearly 1 million daily active users. It is expected that the daily active users will exceed 5 million by the end of 2022. It is worth mentioning that the VR version of Oasis is also updating some functions simultaneously.

It is understood that when virtual events, acquaintance relationship chains and organizations begin to appear in Oasis in batches, the R&D team will start to build a platform-specific economic system. Different from the economic system of "creators sell content" of traditional Internet products, Oasis will empower users in a decentralized manner with the formulation of economic agreements, the distribution of virtual property rights, and the governance of social rules.

The product functions and features laid out by Oasis will take some time to realize, and there is a recent controversy about the metaverse industry.

Oasis confirms investment trends

A constant trend over the past few decades has been the continuous convergence and formation of new networks between the digital world (programs and protocols) and the physical world (humans and machines). This is not a trend, but a long-term trend, so whether it is "virtual world", "metaverse", or "all-real Internet", it is only an annotation of this trend. Whether it is AI or communication, to achieve randomness and openness, the boundary expansion of these two items, Oasis focuses on these two points in product innovation, which is very meaningful.

The above views are only for analysis and reference, not investment advice, please read carefully