Recently, the debate over photovoltaic technology routes has sparked heated market discussions. On the evening of September 19th, Longji Green Energy announced its plan to invest in the construction of the Tongchuan 12GW high-efficiency single crystal battery project, with an estimated total investment of 3.915 billion yuan. Over the next 5 to 6 years, the following products will gradually adopt the BC technology route. This news has caused a huge shock in the photovoltaic market. Currently, photovoltaic cell technology is still dominated by TOPCon and HJT. So, can BC technology, which has always been low-key, really shoulder the heavy responsibility of the future mainstream route?

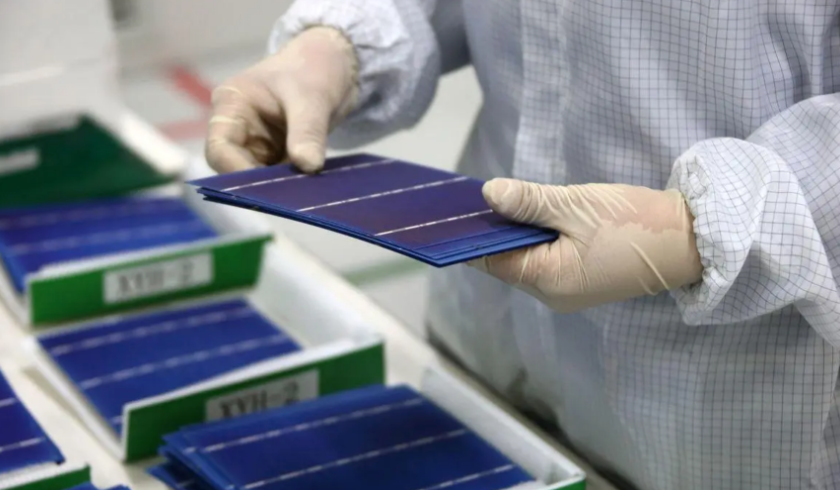

What is a 01 | BC battery? BC type batteries, also known as back contact batteries, are a platform type structure that can be combined with multiple routes. Traditional PERC batteries, as well as popular conventional structures such as TOPCon, heterojunctions, and stacked batteries, have gate lines distributed on both sides of the battery, requiring conduction on both sides. However, both types of gate lines in BC batteries are on the back, meaning that components using BC batteries have no barrier lines on the front. It is widely believed in the industry that BC structured batteries have more prominent advantages in distributed photovoltaics due to their aesthetics. BC technology can theoretically stack various battery technologies, such as PERC, TOPCon, heterojunction, stacked battery, etc. For example, HBC batteries (Heterojunction Back Contact batteries) that combine heterojunction and IBC batteries, TBC batteries that combine TOPcon and IBC, etc. Compared to PERC and TOPCon, heterojunction technology has fewer process steps, higher double-sided efficiency, and is easier to achieve thinness. At the same time, it is more suitable for making perovskite technology layers, and there is also great room for future efficiency improvement. However, the disadvantage of IBC batteries lies in the difficulty of large-scale production and high production costs. The production process of IBC batteries is complex, difficult, and has certain barriers. Compared to battery technologies such as TOPCon and HJT, there are currently not many companies in the industry that are deploying IBC battery technology.

02 | Why did Longji bet? Longji Green can put a lot of effort into BC batteries, which may seem unexpected, but it is reasonable. Over the past two years, the photovoltaic industry has conducted many studies and discussions around battery technology, and the iteration of new photovoltaic cells has accelerated. In this round of competition, Jingke Energy (688223. SH), one of the top companies, took the lead. During a period of uncertainty among many companies, it firmly believed in TOPCon technology and quickly entered the mass production stage. The decision of Jingke Energy has triggered a leading effect, coupled with TOPCon's cost advantage, making it the best choice for enterprises. Whether it is many "cross-border players" or leading enterprises, most have chosen TOPCon technology for expansion. According to InfoLink's forecast, TOPCon's nominal production capacity will increase to nearly 500GW by the end of 2023. But there are also a few companies such as Huasheng New Energy and Dongfang Risheng (300118. SZ) that are more optimistic about the efficiency and other advantages of heterojunctions, thus choosing the heterojunction route. Against this industry background, Longji Green Energy, the industry leader known as the "photovoltaic powerhouse," has been hesitant to make a statement, only claiming to have a layout for various technological routes.

03 | Why are there fewer companies currently deploying this technology? Firstly, the technical threshold is relatively high. The process is complex and the difficulty of industrialization is relatively high, so it still requires a lot of support from the industrial chain. In the early stages, ordinary enterprises, especially those in China, have made attempts, conducted research and development, and even small-scale industrialization. However, their cost-effectiveness was insufficient, and the industrialization development was relatively slow. Secondly, the technology cannot be achieved, leading enterprises or mainstream enterprises have insufficient investment in BC technology, and only a small number of enterprises are optimistic about investing in this technology. Many of our Chinese photovoltaic companies only focus on the mature technology in front of us. However, in recent years, especially after the vigorous development of Longji's official announcement of BC technology, many enterprises have been laying out research and development, emphasizing the industrialization exploration of BC technology. In a sense, it indicates that various enterprises are optimistic about this technology. Especially the leading enterprises are all researching and developing, and some are already doing some industrial layout. Thirdly, people have different understandings of mainstream discourse. In the early days, before going online at affordable prices, people used to measure the cost of electricity per kilowatt hour, and the lowest cost of electricity per kilowatt hour was a good and mainstream technology. So the overall development trajectory of PERC, TOPCon, and HJT is very clear. However, in the current pattern of affordable, competitive, and low-priced internet access, customers may have differentiated needs in different application scenarios, so 2-3 technologies may become the mainstream of photovoltaic technology in the future. At present, TOPCon has a certain premium compared to PERC, while HJT also has a premium compared to PERC and TOPCon. BC technology has a higher premium compared to other related technologies, which is also a customer's application choice for different products. Starting this year, everyone's emphasis on BC technology is unparalleled compared to the previous two years. In such a good atmosphere, the development of BC technology in the next 3-5 years will definitely not be as slow as before.

04 | Which companies are in the layout? On the evening when Longji Green Energy announced its BC battery route, TCL Central published a meaningful article on its official account titled "Insight into the Industry's Future, Differentiated Technology Route Boosts Industry Development", implying that it has laid out BC battery technology. TCL Central stated that based on Maxeon's intellectual property rights and technological innovation advantages in IBC technology and laminated tile components, it will further enhance the company's overall global commercial competitive advantage. Another representative photovoltaic enterprise in the industry that follows the BC battery route is Aixu Co., Ltd. (600732. SH). Aixu Co., Ltd. owns its self-developed all-new generation full back contact solar crystal silicon battery ABC (AllBack Contact). The company has stated that it is the world's first silver free photovoltaic cell technology, which solves the problems of low-cost large-scale production, double-sided power generation, and efficiency improvement of BC type batteries. Overall, due to technological barriers and other reasons, there are still a few companies in the market that choose the BC route. As of now, only Longji Green Energy and Aixu Co., Ltd. have truly embarked on the path of mass production. It is expected that in the short term, BC type battery technology may find it difficult to overturn the mainstream TOPCon production capacity that has been launched. In addition, if scale effects cannot be formed, the discourse power of BC battery manufacturers in the market will be in a weak position.

05 Jingtai Discussion | Will there be significant changes in the technological route of photovoltaics? With the development of photovoltaic technology, the appeal of leading enterprises is very, very strong, as the entire industry chain will support it. The development of a technology requires the support of the entire industry chain. Whether it's the original PERC, the current TOPCon, or the future HJT, they all need the leading role of leading enterprises. Although BC technology has been a technology for over 50 years, its true industrialization began in 2004. Through nearly 20 years of development, its technological development has been very slow, and so far, its annual shipment volume may be less than 2GW, accounting for less than 1%. However, in the current new situation, especially with the leading role of leading enterprises, the support within the industry, and the large market development space, BC technology has ushered in a very good opportunity. Another reason is that no matter what technology is now entering the affordable internet, the affordable internet should accommodate 2-3 differentiated technologies that are suitable for different application scenarios. In this context, BC technology should have significant development in the next decade, far surpassing the past 20 years, and will become a very important link in photovoltaic technology in the future.