Introduction: in 2022, despite the market volatility caused by COVID-19, the investment management industry performed well.

Since 2021, COVID-19 has triggered market volatility, but the investment management industry has been inspiring. There are significant regional differences in the performance of global active asset management companies. In 2020, the performance of active asset management companies in the eurozone, the UK and Japan exceeded their regional Benchmarks (4.2%, 8.0% and 2.9% respectively). Australian portfolio managers, whose average performance is 0.2% below the benchmark, still need to catch up. The volatility and uncertainty of global financial markets may help active asset management companies reverse the performance trend. Time will tell.

01

It is imperative to realize agile talent management

In 2022, investment management institutions will help employees keep up with the development of products, asset classes, processes and technologies through training. Investment in employee training can benefit enterprises a lot. Providing training opportunities according to employees' personal goals will help improve employees' cooperation ability and happiness, and reflect the corporate culture.

65% of the respondents in the front office Department strongly agree or agree that their institutions carry out employee skill training in an orderly manner, but only 35% of the respondents in other functional departments said that the company has paid much more attention to learning since the outbreak of the epidemic. One of the feasible ways to bridge this gap is to provide personalized training programs based on the needs of employees. Instead of requiring employees to participate in existing training courses, it is better to give employees the right to choose training and let them control their career development. On the contrary, this can reduce the turnover rate of employees. When employees realize that the training opportunities provided by the organization can just meet their career planning, they will be more engaged in work.

02

Reinvestment promotes business transformation

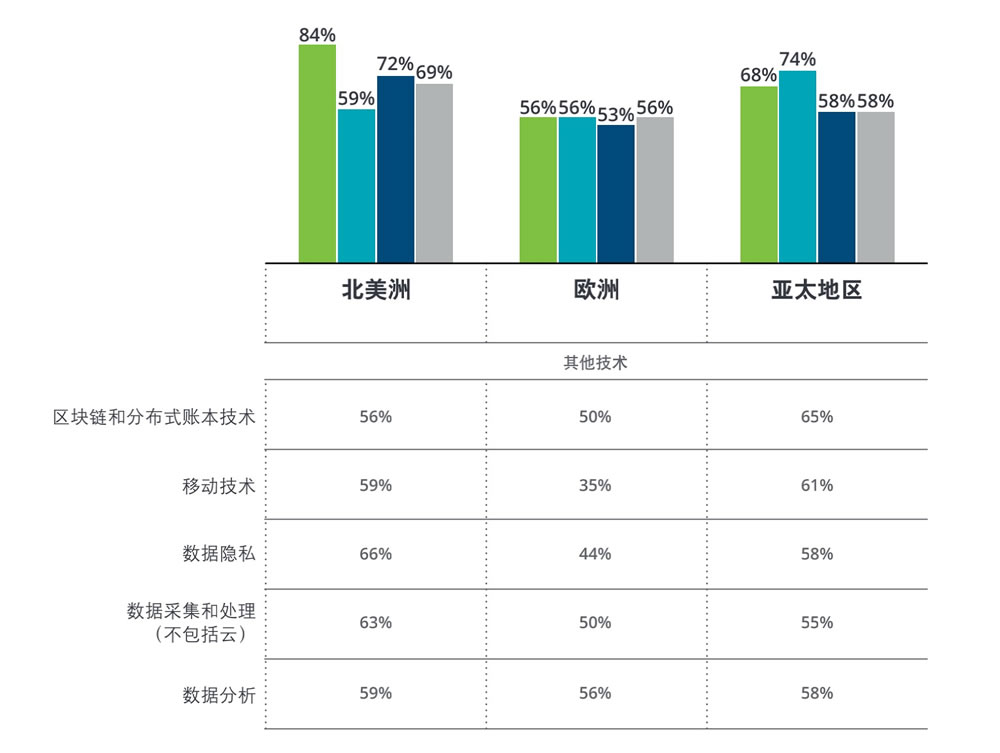

As institutions focus on "reinvestment" to promote business process transformation, the company's largest capital investment will support the construction of core technologies that can bring the most value. Its core technology construction is usually of great significance to the digital strategy.

Enterprises with modern core infrastructure can rely on internal investment to further strengthen technological innovation and improve their investment decision-making process and customer service. Institutions that maintain traditional technology infrastructure can only realize advanced technology and data analysis through other ways. Organizations with a low degree of digitization can turn to the cloud service platform provided by a third party to achieve a unified view of all customer data.

This approach helps enterprises quickly obtain value from data, accelerate product innovation, and avoid risks related to internal technology development projects. Promoting business transformation through reinvestment is a difficult task. Consistency in the strategy and vision of all departments of the organization is a key to success. Another key is to strengthen talent management through training and communication. When the collaborative development of these key factors is successfully realized, the organization may better realize the long-term differentiation advantage.

03

Practically realize the modernization of operation

Compared with the past few years, the investment management industry will usher in more and faster changes in 2022. The more powerful the management is, the more likely it is to lead the company to achieve excellence. Further improve the efficiency of ESG investment and stakeholder data processing strategies.

Asset management companies are using artificial intelligence to process new data sets to meet customers' ESG requirements and return on investment expectations. The sense of achievement brought by these efforts can also promote the virtuous circle mentioned above. Customer demand is driving investment, operation and product supply to a better development, and this change may continue or even accelerate in 2022.

— END —

Article data source: Deloitte insights