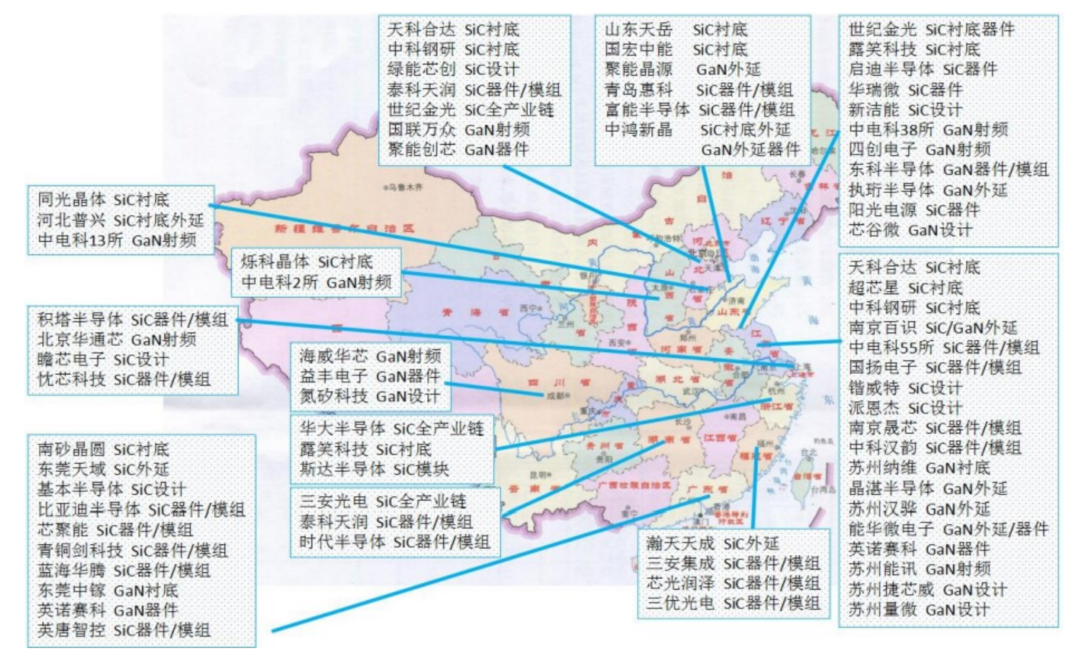

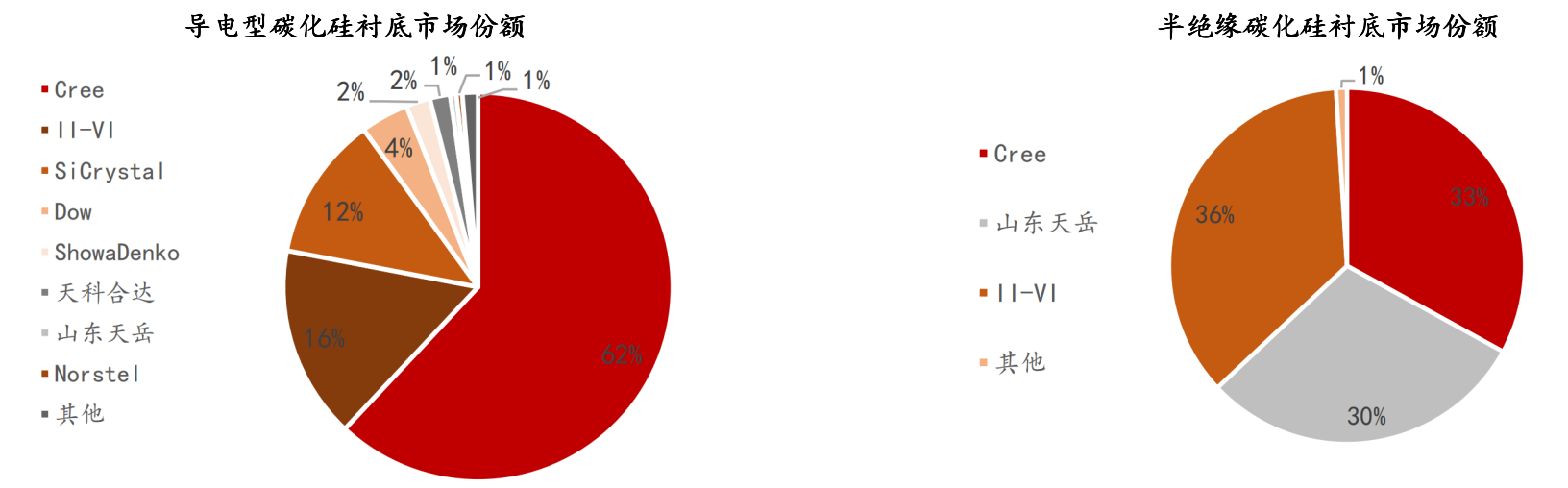

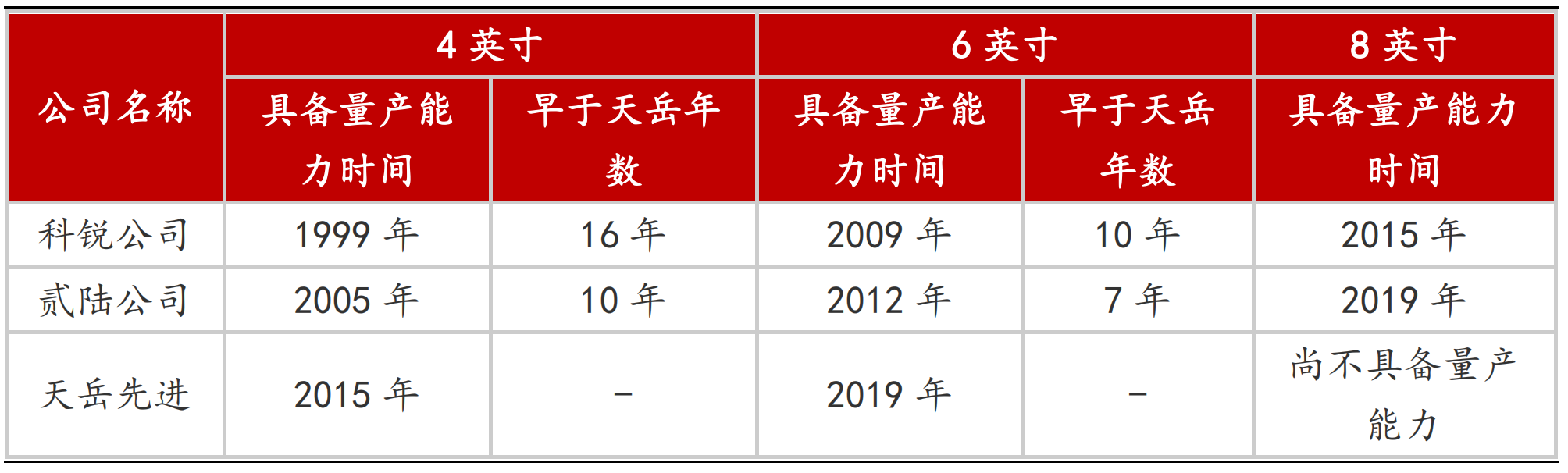

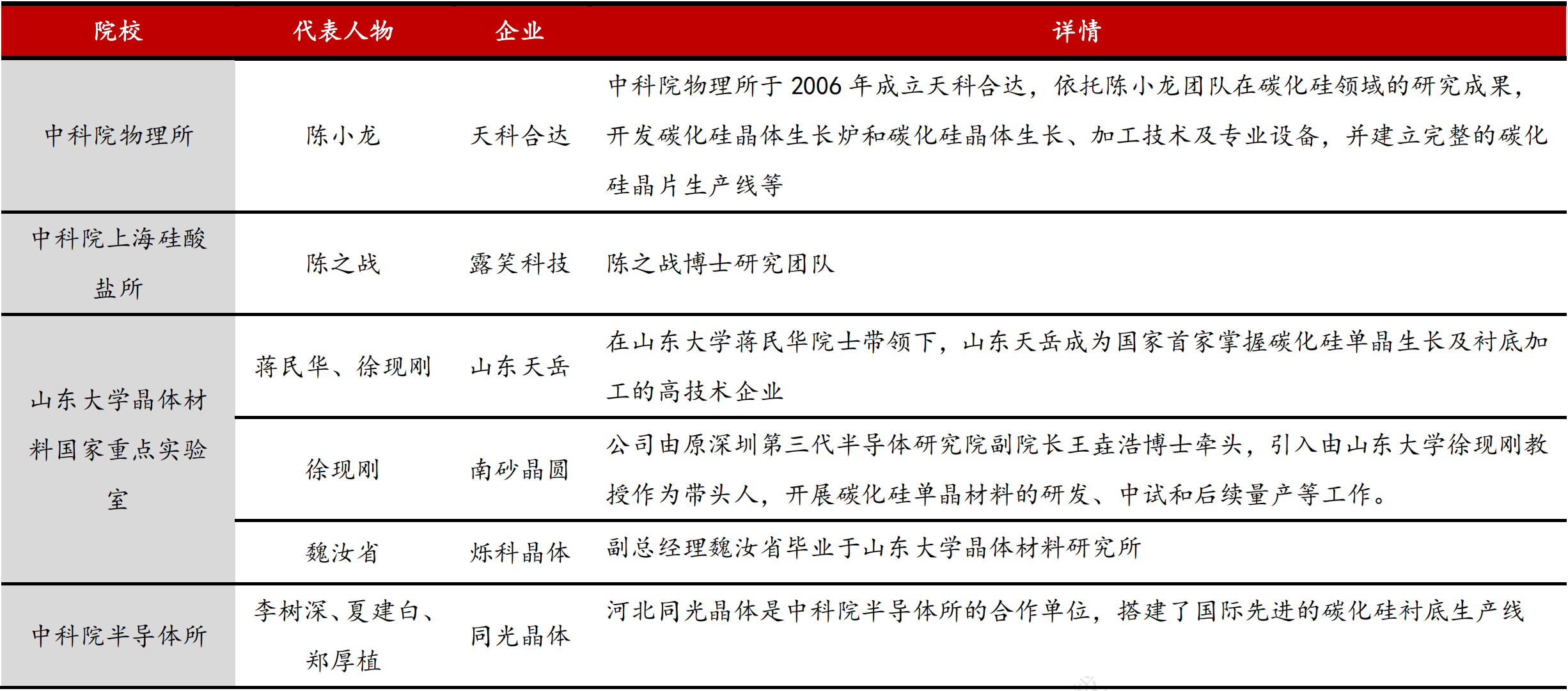

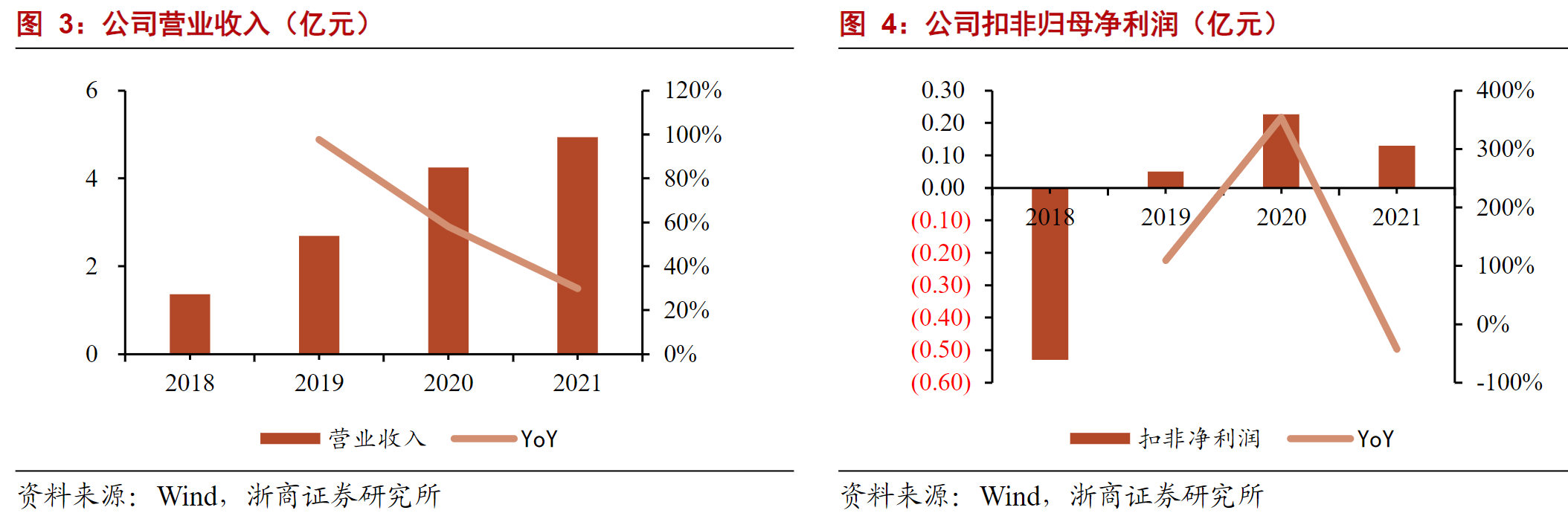

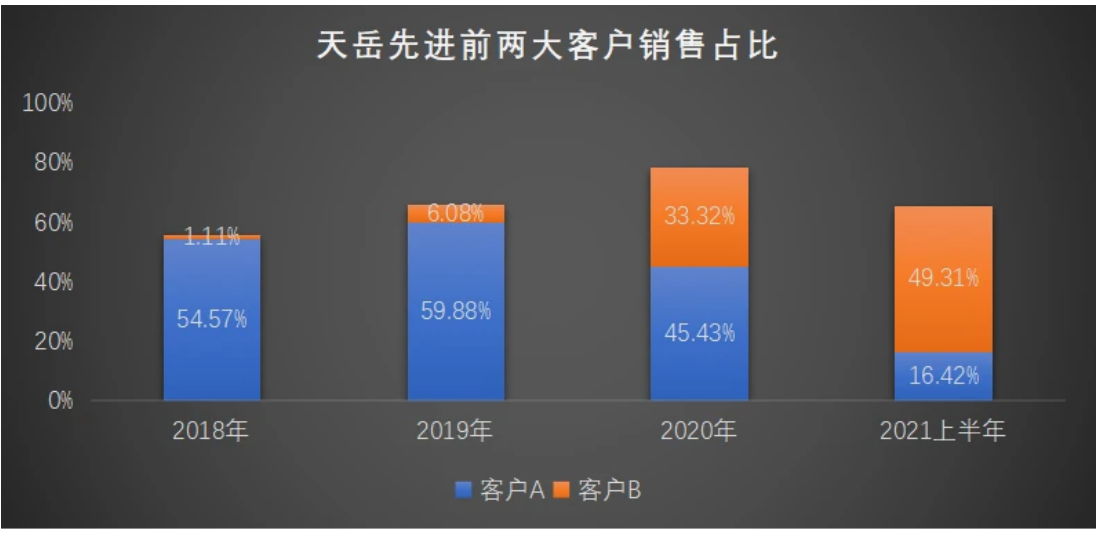

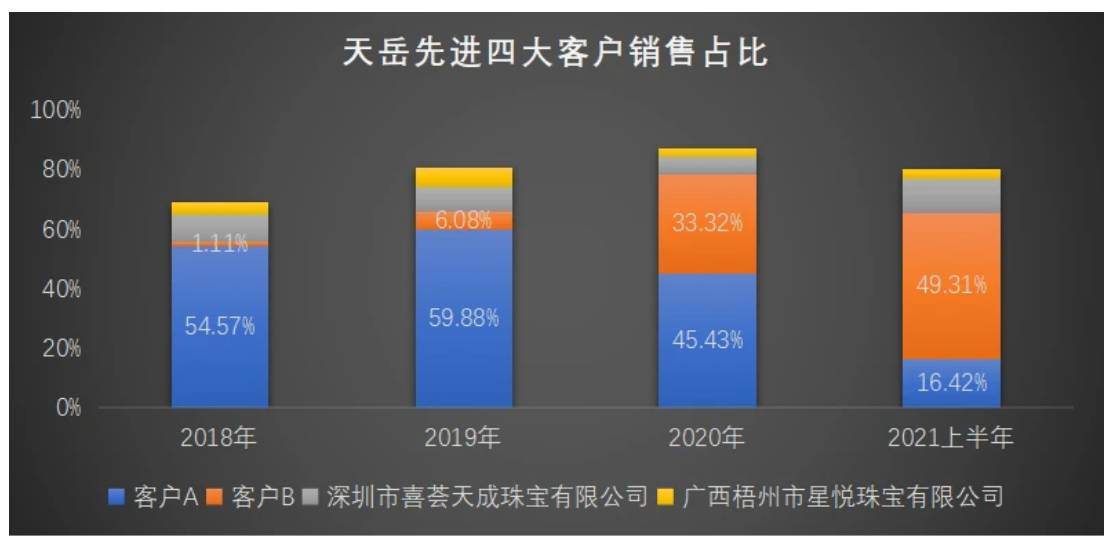

|Statistics on the layout of major SiC substrate projects in China According to CASA Research, 6 international giants announced 12 expansion projects in 2019, mainly for the expansion of substrate production capacity. and New York State to build a new automotive-grade 8-inch power and RF substrate manufacturing facility. |Statistics on the layout of major fourth-generation semiconductor projects in China |SiC competition landscape: The gap between domestic and foreign countries is gradually narrowing, and domestic replacement can be expected Competitive landscape of SiC substrate suppliers: overseas leading monopoly, realizing large-scale supply of 6 inches, and marching to 8 inches. Domestic manufacturers mainly focus on small size and enter 6 inches. Conductive SiC substrates (mainly used in new energy vehicles, photovoltaics, etc.) 1) Global market: American Cree (Wolfspeed) occupies more than 60% of the market share, basically controlling the international market price and Quality Standard. Other companies include: US II-VI (II-VI), Germany SiCrystalAG, Dow Corning (DowCorning), Japan Nippon Steel, etc. Mainstream products have completed the transformation from 4 inches to 6 inches. 2) Domestic companies: Generally in the early stage of development, mainly focusing on 4-inch small-size production capacity. In 2018, Tianke Heda ranked sixth in the world and first in China with a market share of 1.7%. Other companies include Shandong Tianyue, Hebei Tongguang, Century Jinguang, CLP Group 2, etc. In the global market of semi-insulating SiC substrates (mainly used in 5G radio frequency and other fields), American Cree (WOLFSPEED) and II-VI (II-VI) still account for nearly 70% of the market share. The domestic company Shandong Tianyue has been squeezed into the top three in the world, with a market share of 30% in 2020. |SiC competition landscape: The gap between domestic and foreign countries is gradually narrowing, and domestic replacement can be expected In the trend of large-scale development of SiC substrates, it can be observed that domestic enterprises have caught up, and the gap between domestic and foreign is narrowing. Domestic manufacturers plan to invest on a large scale, but the investment landing situation is less than expected, and the effective production capacity is insufficient. According to the statistics of the Semiconductor Materials Branch (CEM) of the China Electronic Materials Industry Association, as of mid-2021, the planned investment of silicon carbide substrates in the country exceeds 30 billion yuan, and the planned annual production capacity is expected to reach 2 million pieces, while the national silicon carbide production capacity in 2020 is only About 110,000 pieces. According to CASA's follow-up survey on various domestic silicon carbide investment projects, the declared investment amount exceeds 10 billion yuan every year, but there are still few projects with investment in place, construction and production. The main reasons are summarized as follows: 1) Some projects have long construction periods and slow progress; 2) The project has a large demand for funds and high coordination requirements, and it has not actually been implemented in the end; 3) The planning of some projects is out of reality, making it difficult to implement subsequent implementation. |SiC competition landscape: "production, education and research" is an important driving force for the development of domestic silicon carbide substrates The research on SiC single crystal in domestic universities and scientific research units started around 2000, mainly including the Institute of Physics of the Chinese Academy of Sciences, Shandong University, Shanghai Institute of Silicate, 46 CLP Group, Xi'an University of Technology, Xi'an University of Electronic Science and Technology, etc. The leading domestic silicon carbide substrate companies such as Tianke Heda and Tianyue Advanced were born. |Relevant company valuation level At present, domestic silicon carbide enterprises can be divided into three categories: One is the entrepreneurial silicon carbide enterprises such as Tianyue Advanced and Tianke Heda; One is the entry of traditional silicon-based material companies into the silicon carbide business; There is another type of cross-border entry of other companies into the silicon carbide field. The following table summarizes the valuation levels of the first two types of companies: |Tianyue Advanced: Semi-insulating SiC substrate leader Tianyue Advanced was established in 2010 and is currently the world leader in semi-insulating SiC substrates (30% of the global market share for semi-insulating SiC substrates in 2020). Its products are mainly 4-inch semi-insulating SiC substrates. Compared with semi-insulating substrates, conductive SiC substrates have more room for future demand in new energy vehicles, photovoltaics and other fields, and the localization rate is also lower. Therefore, the company's IPO raised 2 billion yuan to build 6-inch conductive SiC linings The bottom project is to develop conductive SiC substrates. The project will start trial production in 2022, and is expected to reach full production in 2026 (corresponding to 300,000 6-inch conductive SiC substrates per year). From 2018 to 2020, the company achieved operating income of 136 million yuan, 269 million yuan, and 425 million yuan respectively, a year-on-year increase of 97.79% and 57.99%, respectively; the net profit after deduction of non-return to the parent was -52.96 million yuan, 5.23 million yuan, and 22.69 million yuan respectively. Yuan. On January 12, Tianyue Advanced was officially listed on the Science and Technology Innovation Board, with an issue price of 82.79 yuan per share. Because of Huawei's strong platform in 2019, the company's valuation has risen 10 times in a year. Guessed that the stock price fell below the issue price the day after the listing. As of the close on January 13, Tianyue Advanced reported 81.99 yuan per share, a decrease of 4.11%. Some market participants believe that Tianyue Advanced has not yet achieved profitability is an important reason for the poor performance of the company's stock price, and some industry chain sources pointed out that the company still has major shortcomings in actual production capacity and technology. Lack of market cross-validation. From 2018 to 2020, the total revenue contributed by the company's top five customers exceeded 80%. In the first half of 2021, it reached an astonishing 91.68%, showing a trend of increasing concentration. In particular, the top two customers contribute about 60% of the total revenue, of which Company B is Huawei, a related party of the company. Unqualified business accounted for a large proportion. Unqualified products can be used as gem crystal rods to be processed into jewelry and enter the consumer goods market. Two jewelry customers are firmly in the company's top five customer camps. The company's other businesses account for 22%, and the gross profit of other businesses (40%) is even higher than that of the main business (<30%). |Tianke Heda: Leading Conductive SiC Substrate in China The company was jointly established by Xinjiang Tianfu Group and the Institute of Physics, Chinese Academy of Sciences in September 2006. It is one of the leading enterprises of conductive silicon carbide substrates in China and ranks fourth in the global conductive silicon carbide market share. The business covers silicon carbide single crystal furnace, silicon carbide single crystal growth raw material and silicon carbide single crystal substrate.