The energy crisis in Europe continues, with electricity prices in Germany and France hitting records almost daily, with both key markets surging more than 25% on Friday.

|French electricity prices rise at least 11 times a year

In August, according to Agence France-Presse, the price of electricity in France reached a new high. On the same day, the bulk purchase price of electricity in France in 2023 exceeded 1,000 euros per megawatt-hour (MWH), up from about 85 euros per megawatt-hour in the same period last year. At least 11 times.

There are many reasons for the surge in electricity prices. On the one hand, the Russian-Ukrainian conflict has led to rising energy prices, pushing up electricity prices. On the other hand, France is a big country in nuclear power, but this year, due to the corrosion of nuclear reactors, EDF shut down many nuclear reactors, resulting in a decline in the supply of French nuclear power.

France has traditionally been one of Europe's largest net exporters of electricity, but that status is a thing of the past as the country's nuclear generation this year fell to a more than 30-year low. The availability of EDF's nuclear reactors was only 42 percent as of Friday, data from grid operator RTE showed.

Utility company EDF announced that several of its nuclear plants will resume operations later than previously expected. With natural gas still scarce, these nuclear plants will be France's main source of electricity this winter.

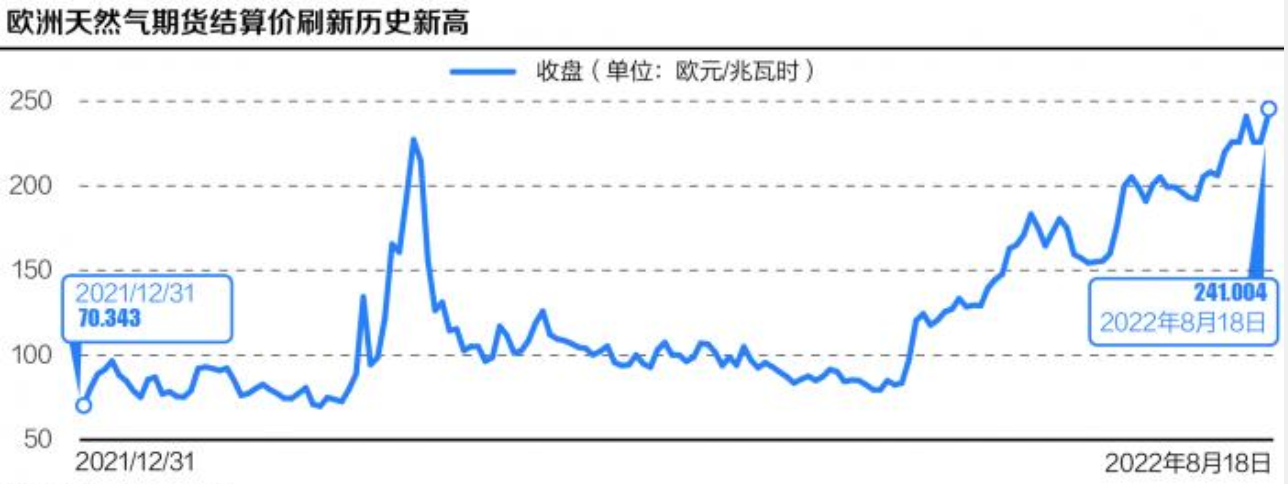

On the other hand, the natural gas market continued to worry about Russia's supply and the lack of gas in winter, and TTF gas prices continued to soar. Under the situation of water shortage, lack of nuclear power and high temperature and no wind, the European electricity spot market basically determines the electricity price by the cost of thermal power units or even oil-fired units. The rising gas price is directly transmitted to the soaring electricity price in Western Europe. At the same time, the carbon price has also increased due to the increase in the output and carbon emissions of thermal power units, further pushing up the electricity price.

| 11 times? everything is just the beginning

The weather this winter is quite critical. The first is the precipitation in northern and western Europe in the next two months. Can the water storage capacity of northern European reservoirs be increased? Can the water level of the Rhine be restored? Then there are northern and western Europe temperatures in the fourth quarter of this year and the first quarter of next year, will they be above or below the historical average? If the next weather forecast shows that Western Europe will face a cold winter, then gas and electricity prices will continue to rise, and the price of electricity in some countries has easily risen to 1,000 euros.

In the UK, for example, the UK could face a power shortfall of about one-sixth of its peak demand this winter, even after emergency coal-fired power plants are activated, according to the latest government analysis. is also like this. Britain is expected to have four days in January to activate emergency measures to save gas, and factories and even households may have to undergo "organized" blackouts .

People and businesses will also be greatly impacted. A quarter of Britons will not be able to pay their electricity bills after the Office for Gas and Electricity Markets raised their electricity cap again in October, according to a survey published by CitizensAdvice. If the UK does not take action, the situation will be much worse in the future. People desperately need further support or face a desperate winter.

There is no doubt that the EU is in recession, it is only a question of how long it will last. Germany's energy regulator has warned of tight energy supplies for the next two winters.

|Energy ripples could change the European economic landscape

The metals sector, which has been hit hardest by the energy crisis, has a huge demand for electricity, so as electricity prices soar, so do its production costs. Aluminium is one of the most energy-intensive metal industries to produce: producing 1 tonne of aluminium requires around 14 megawatt hours of electricity, enough to power an average British household for more than three years. The smelting of zinc also requires a lot of electricity, with about 4 megawatt hours of electricity needed to produce every ton of zinc. As electricity supply continues to tighten in the future, the European metal smelting industry may also usher in a larger-scale shutdown.

The most direct consequence of rising energy prices is to push up energy costs for users, which will not only force factories to shut down and reduce production, but also affect the public. The European metal industry, glass industry, and chemical industry continued to have companies announced to suspend production due to high energy prices. Although European countries have introduced various subsidies or price limit measures to deal with price increases, they are only a drop in the bucket and cannot cover all industries.

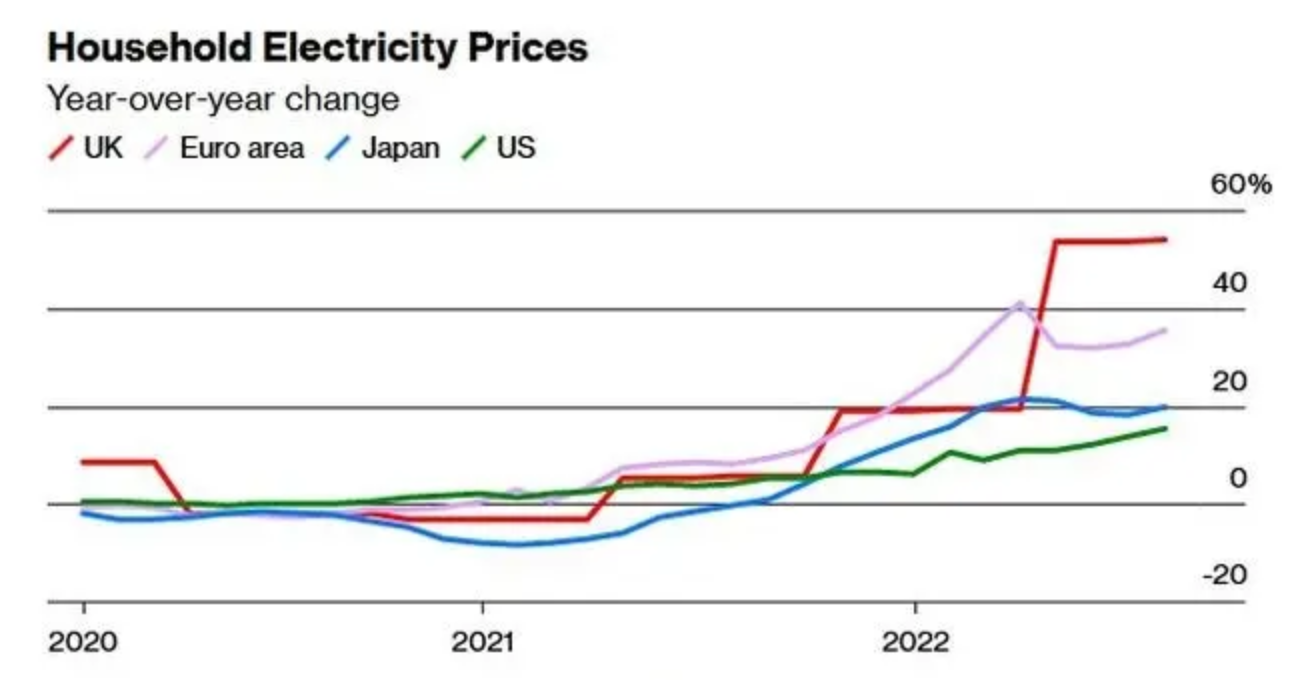

At a time when the energy crisis is intensifying, Europe is also facing an unprecedented threat of inflation, and the outlook may be more pessimistic than that of the United States. The inflation rate in the euro zone was as high as 8.9% in July, and the CPI in the United Kingdom soared to 10.1% in July, both hitting a record high.

A long-term rise in energy prices could eventually change the continent's economic landscape, said Simone Tagliapietra, a senior fellow at Europe's top think tank Bruegel. "Some industries will be under severe pressure and will have to rethink production in Europe."

|Will the situation deteriorate further in the future?

The European energy crisis is already extremely bad. The next key question is, will the situation worsen further in the future?

Currently, the Nord Stream 1 natural gas pipeline, which transports natural gas from Russia to Germany, is only 20% of its maximum capacity. But what needs to be vigilant is that even this 20% supply is at risk of being cut off in the future.

Klaus Mueller, head of Germany's energy regulator, the Federal Network Agency, said that once supplies from Russia come to a complete stop, even if Germany fills underground gas storage facilities to 95% of its total capacity by November, Germany's natural gas The reserves are also only enough for heating and industrial facilities to run for about two to two and a half months. Germany needs to survive at least two winters, and the public needs to be prepared for long-term high energy bills.

With cooler-than-usual temperatures this fall and the possibility of supply disruptions from the Nord Stream 1 pipeline at any time, reaching the target of 85% natural gas inventory levels in October may be difficult.

For Europe, bigger challenges clearly lie ahead. In fact, the current spiral of gas and electricity prices in Europe is because the market is worried about the energy supply in the winter, which is equivalent to digesting this risk in advance, and the gas and electricity prices in Europe will remain high in the future. The biggest uncertainty is still Russia's natural gas supply, such as whether the Nord Stream 1 will be completely cut off. Although Germany is actively replenishing natural gas inventories and has achieved 75% of the target ahead of schedule, even if the inventory reaches more than 95% in the future, it will still need to rely on pipeline gas for the winter, so the winter situation is not optimistic.