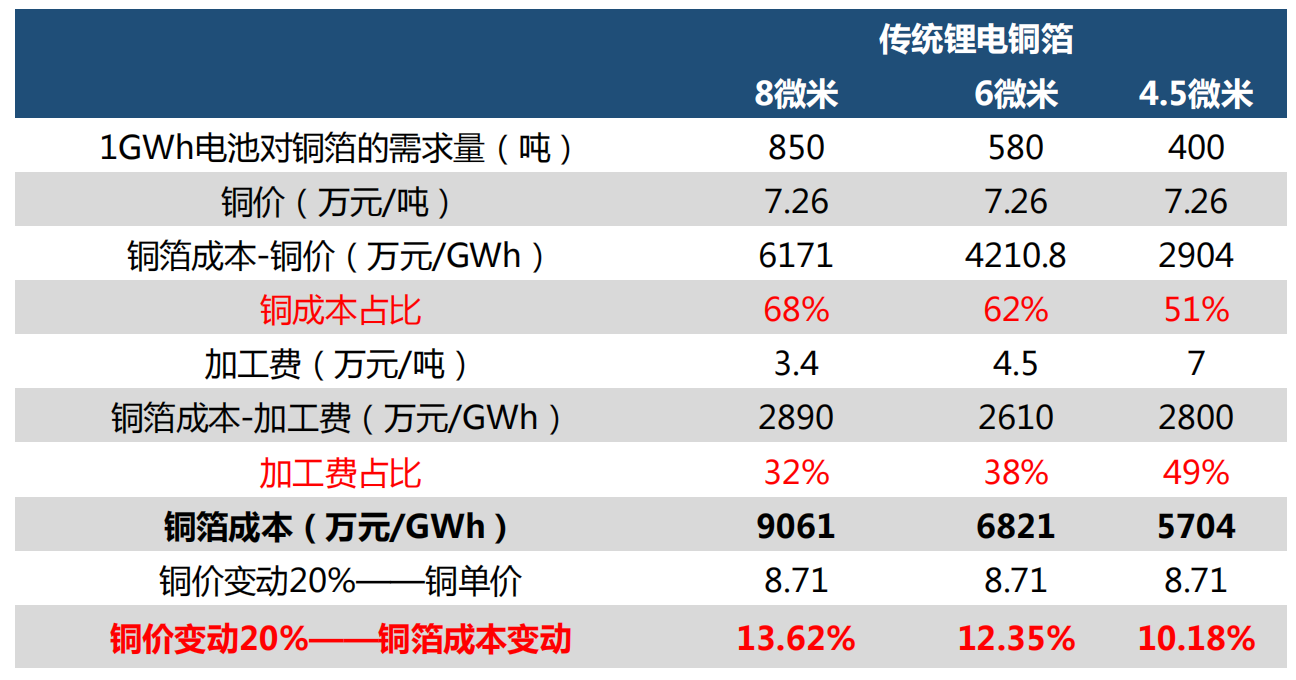

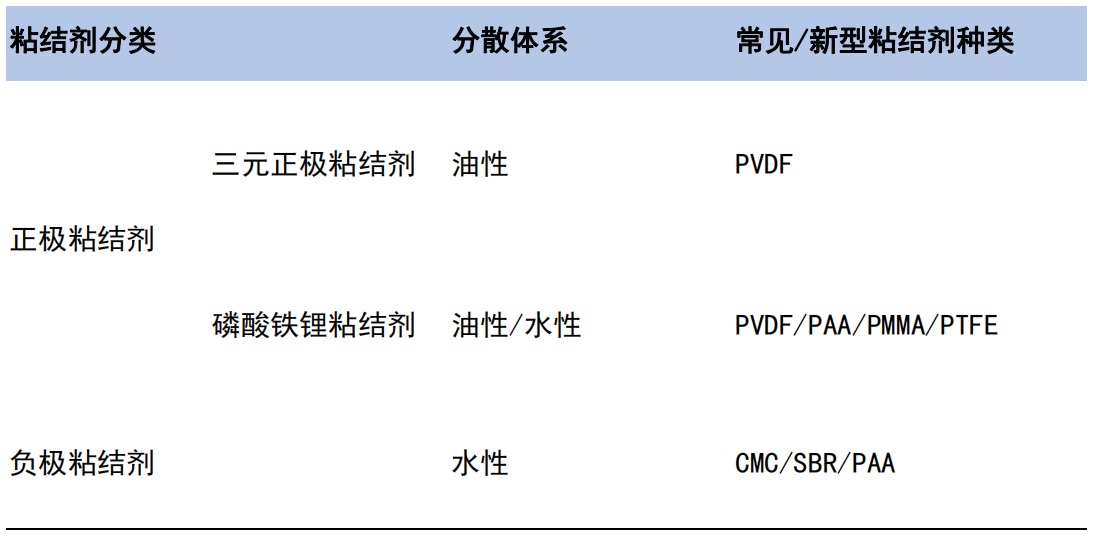

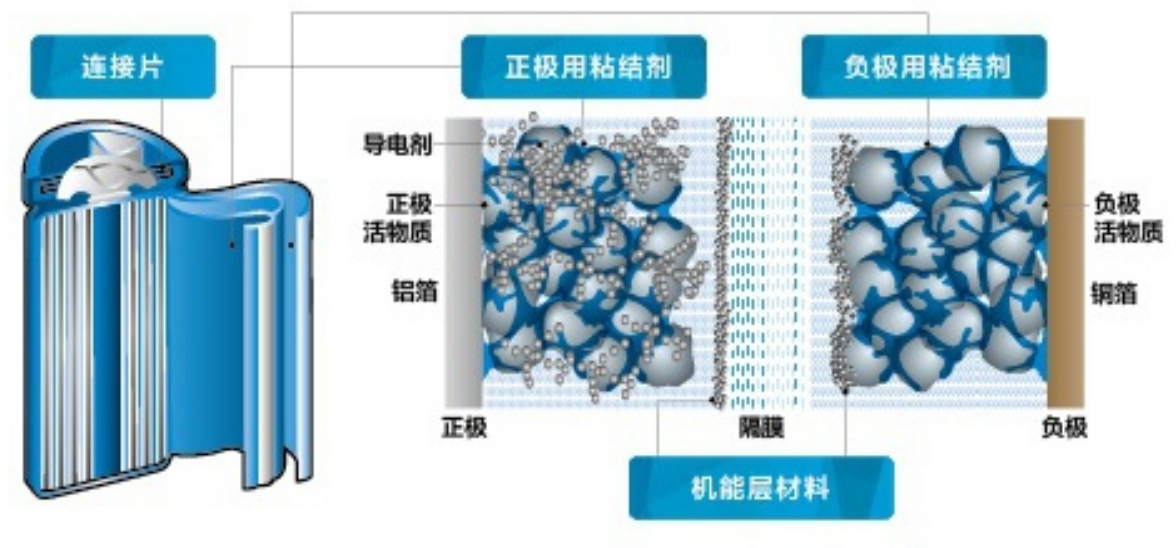

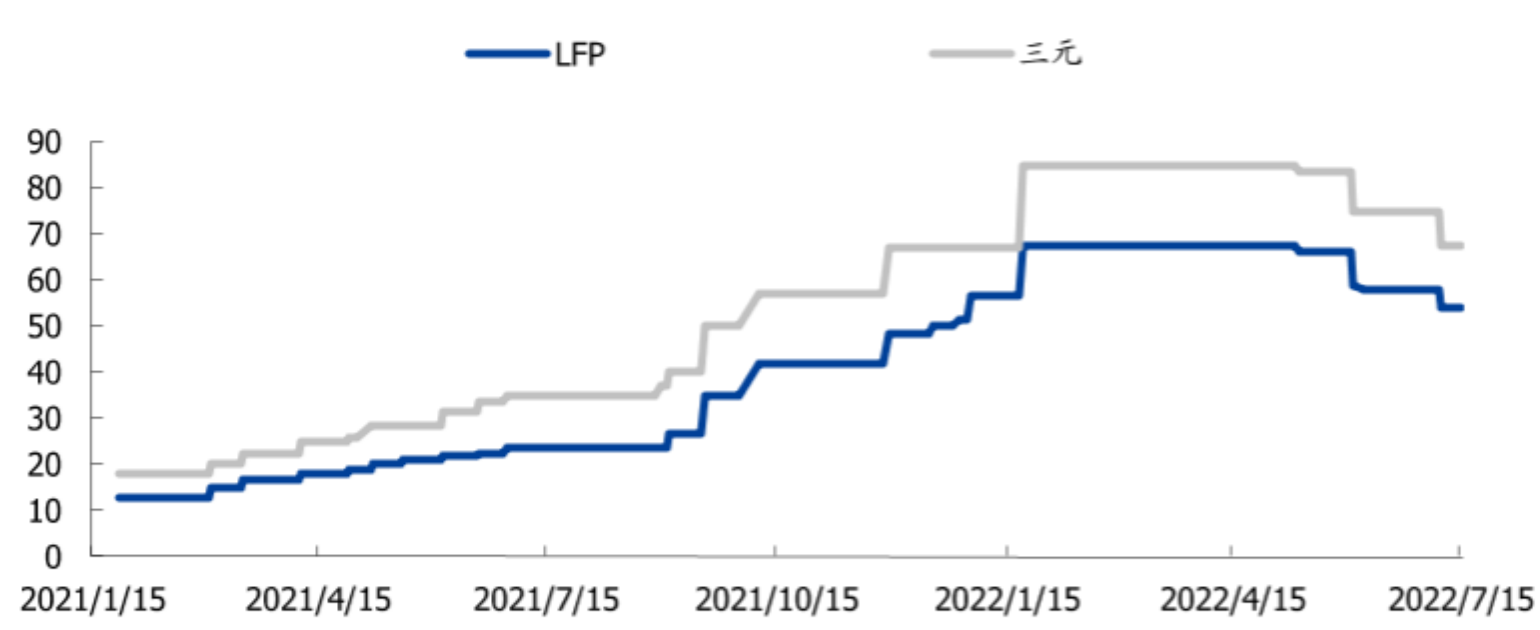

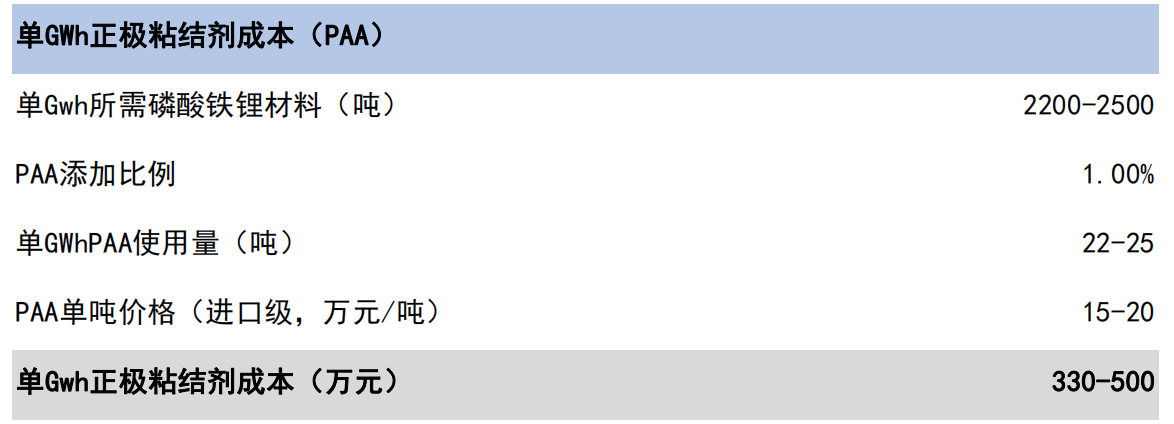

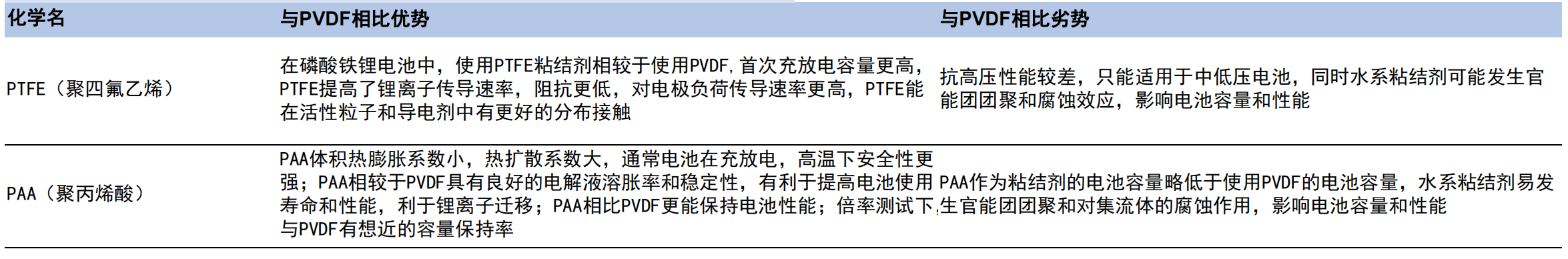

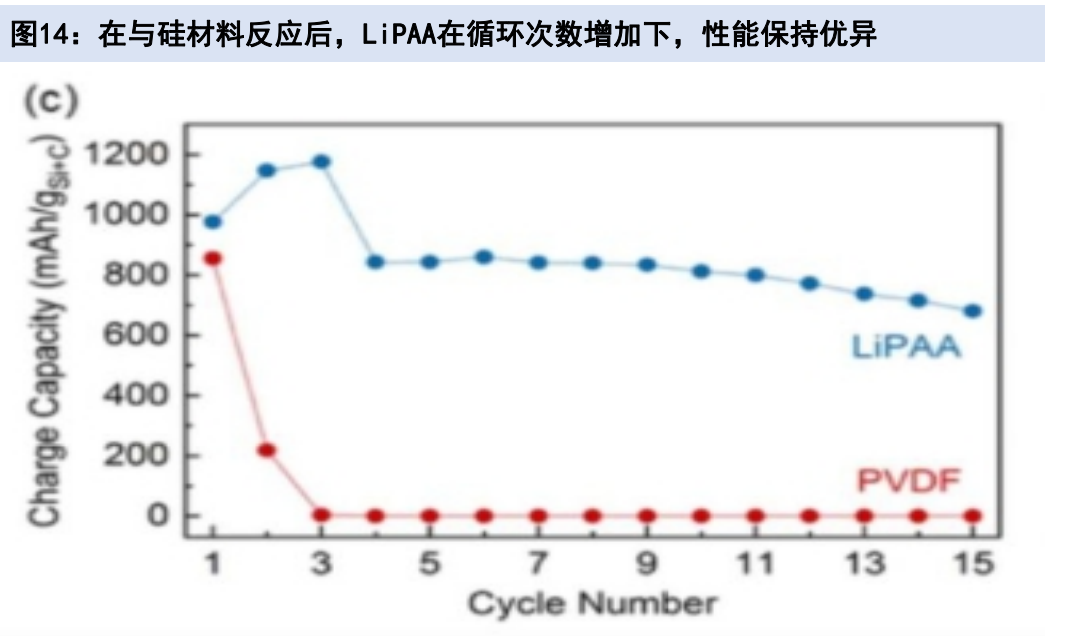

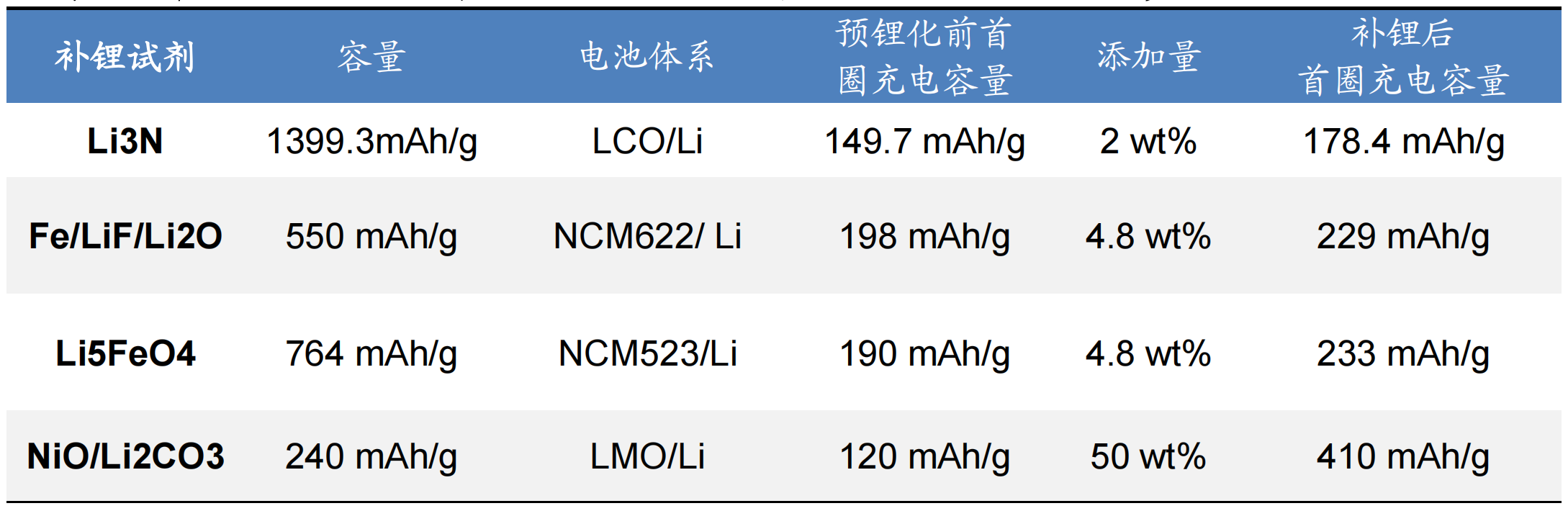

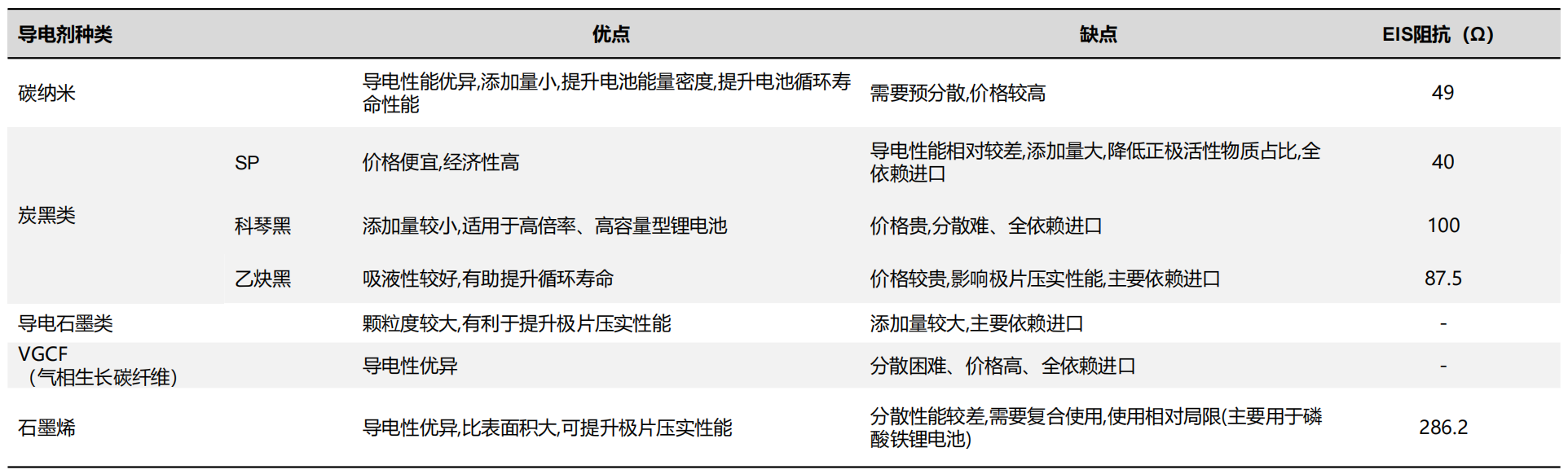

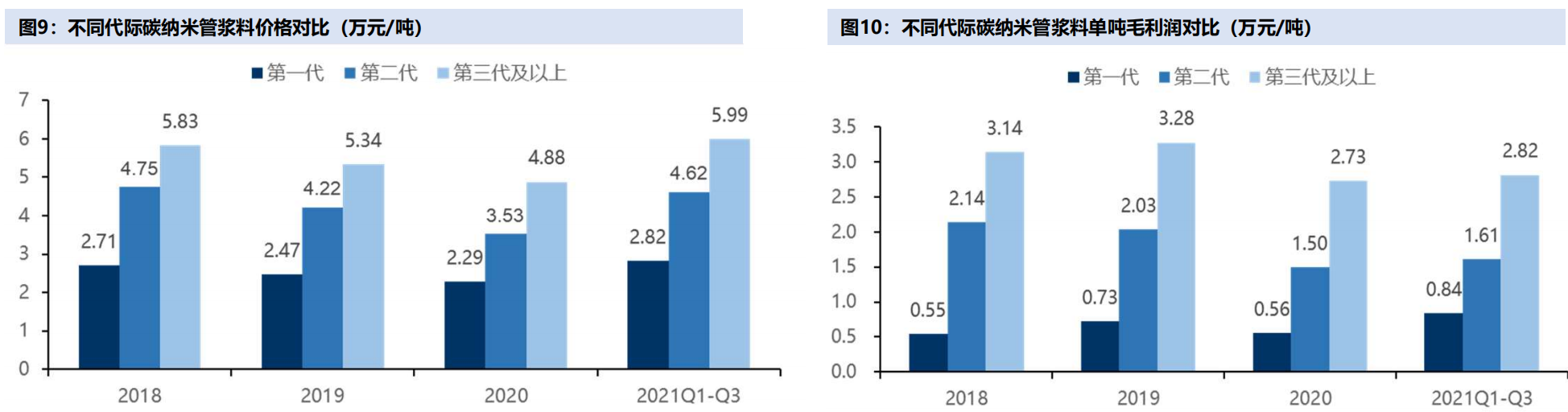

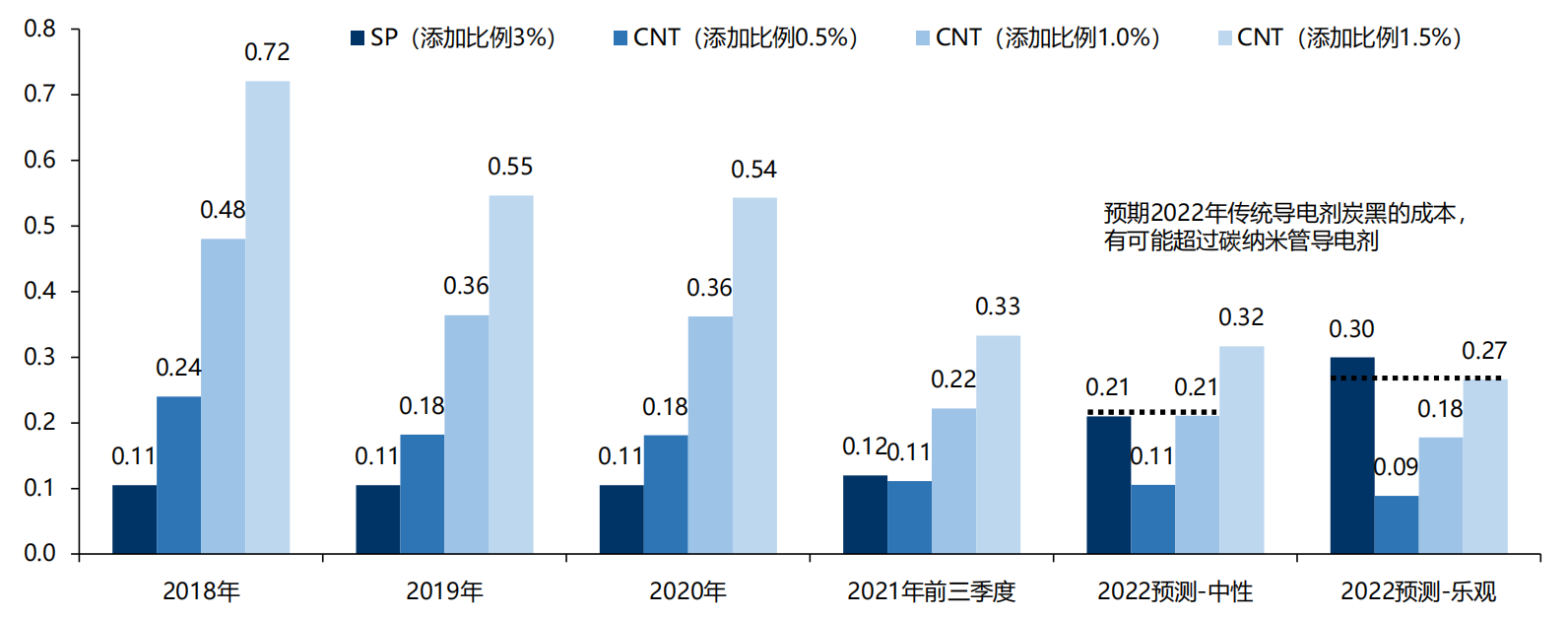

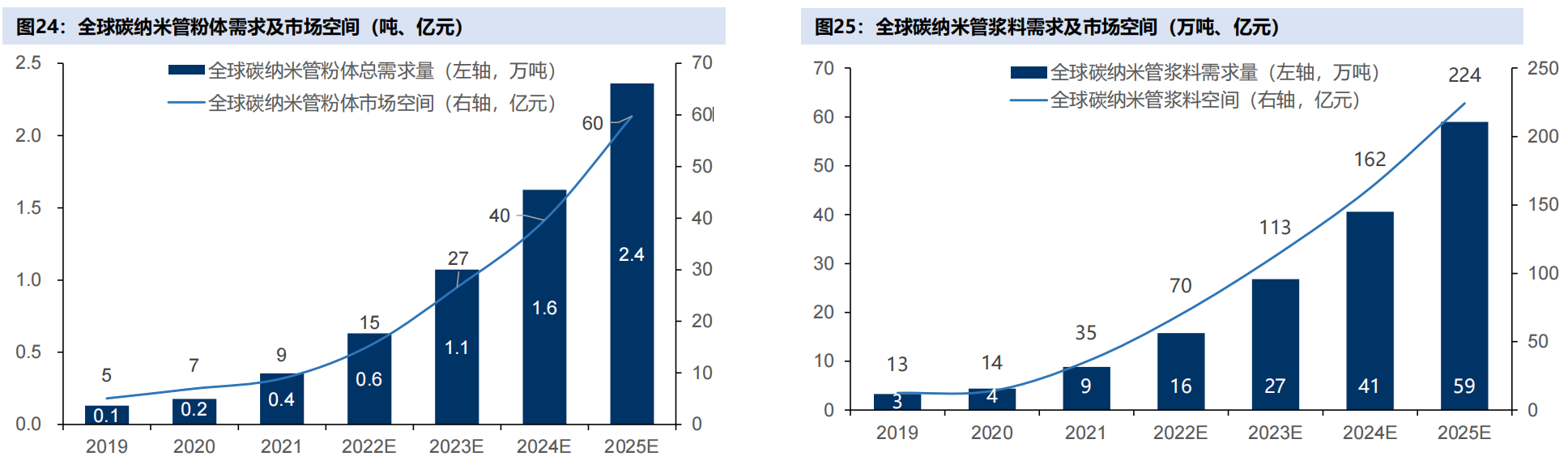

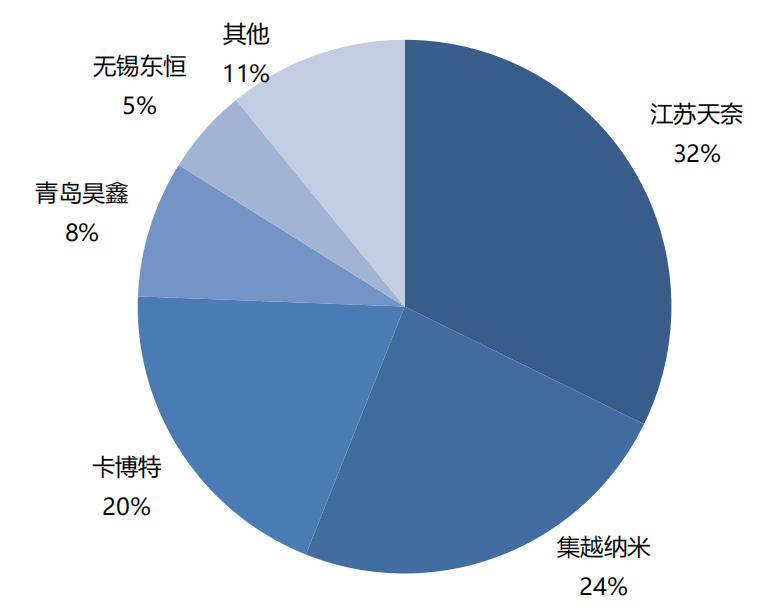

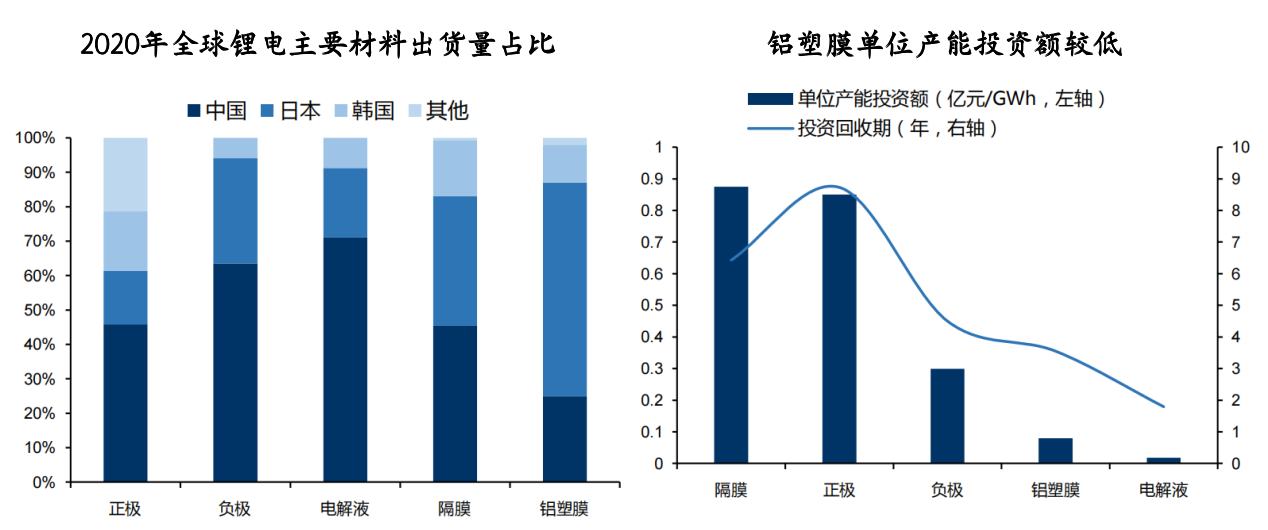

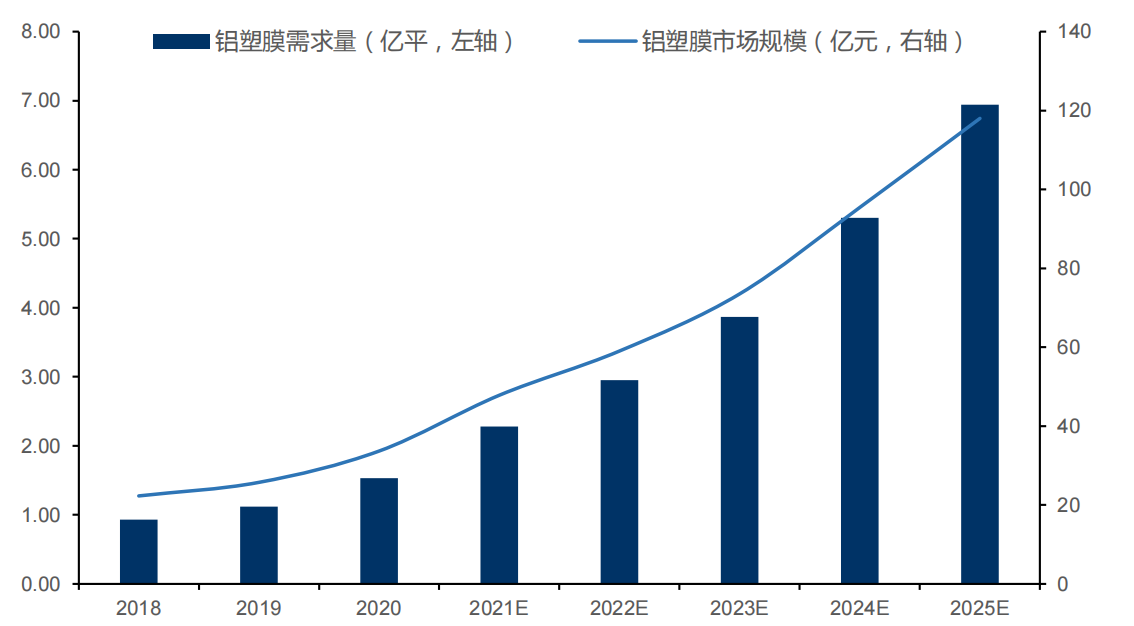

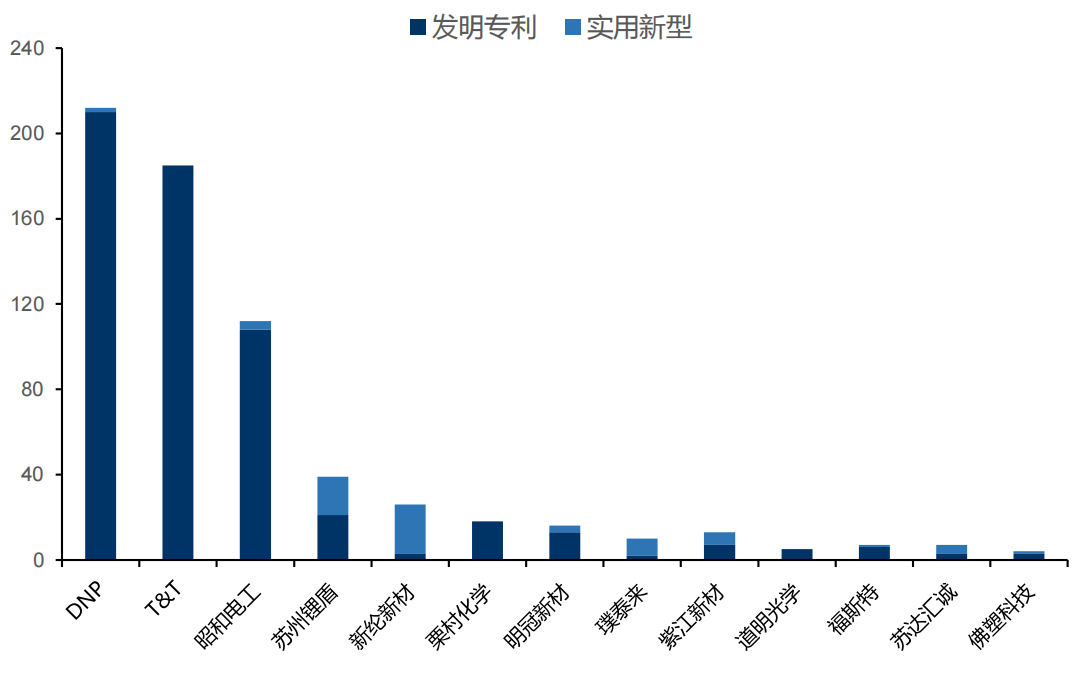

|Current collectors: composite current collectors become the development trend Copper foil and aluminum foil are the negative and positive current collectors of lithium batteries, accounting for about 8% of the battery cost. From 2018 to 2021, the proportion of copper foil of 6 μm and below in my country’s lithium battery copper foil will increase from 20% to 89%. The thinner the copper foil, the higher the energy density of the battery and the lower the cost of production materials. Thinning is an important direction of development. Composite copper foil (PET copper foil): It has a typical "metal conductive layer-polymer support layer-metal conductive layer" sandwich structure, with insulating molecular film as the support substrate, and a composite current collector obtained by depositing metal copper layers on both sides , which is characterized by thin thickness and small copper consumption, which effectively improves the safety and energy density of the battery. In addition, the raw material cost of traditional copper foil accounts for about 83%, while the raw material cost of PET copper foil accounts for about 31%, and the equipment cost accounts for 50%. There is huge room for cost reduction in the future. Target: 1) Guangdong Tengsheng: The composite copper foil vacuum coating magnetron sputtering equipment was first mass-produced in China. 2) Chongqing Jinmei New Materials: The company's main product, multi-functional composite current collector copper foil (MC), has been commercialized and entered the stage of mass production. In cooperation with CATL, the total investment in the first phase is 1.5 billion yuan. 3) Haichen New Energy: The company is actively deploying the production and application of composite current collector materials, and the industrialization layout is expected to accelerate. |Binder: Domestic substitution and technological iteration parallel The basic situation and market space of the binder: the binder mainly interacts with the positive and negative electrode active materials and conductive agents, and binds to the current collector, which plays a role in maintaining the integrity of the electrode during charging and discharging. The positive electrode material basically uses oily binder PVDF (polyvinylidene fluoride), and the high-end lithium battery basically uses imported PVDF material. The current market space is about 24.9 billion. The positive electrode binder accounts for 1.4%-1.65% of the cost of ternary lithium batteries, accounting for phosphoric acid. The cost of iron-lithium batteries is about 2.2%-2.5%; in terms of anode materials, the graphite anode uses CMC+SBR (sodium carboxymethyl cellulose + styrene-butadiene rubber). At present, the products mainly rely on Japan and Europe and the United States, which currently account for 1.07%-1.37% of the cost of lithium batteries. , the silicon-based anode will use PAA (polyacrylic acid) as a binder, and the market space for the binder in the anode part is about 10.9 billion. In the early stage of PVDF industry, only foreign companies Arkema, Solvay, and Kure Yu mastered the production process of lithium battery-grade PVDF, and adopted technical blockade. Domestic companies are gradually mastering the production process. In 2021, domestic mainstream companies have a production capacity of 46,500 tons. With a production capacity of 242,000 tons, Sanaifu and Dongyue Chemical have the most effective production capacity in China. In terms of SBR binders, lithium battery companies currently use more imported materials, such as Japan's Zeon, Japan's JSR, A&L, Germany's BASF, etc.; domestic manufacturers include Indile, Shenzhen Yanyi, Jingrui Electric and so on. CMC adhesives also mainly use imported materials, such as Daicel and Nouryon from Japan, and Esteeland from the United States. Domestic manufacturers include Jinbang Power, Chongqing Leehom, and Songbai. The localization rate of battery-grade CMC and SBR is about 10%, and there is huge room for domestic substitution. Water-based binders have domestic alternatives and technical iteration routes: 90% of positive electrode binders currently use oil-based binder PVDF. In terms of PVDF positive electrodes, due to the high price of PVDF and the toxicity of the matching solvent NMP, the industry is actively developing new water-based binders. Such as PTFE (polytetrafluoroethylene), SA (sodium alginate), PMMA (polymethyl methacrylate), HNBR (hydrogenated nitrile rubber), etc. are used to replace PVDF, and the new water-based binder is used in the lithium iron phosphate cathode. The output value space may reach 3 billion; in terms of negative electrodes, the performance of domestic materials is close to that of foreign countries, and the price is low. It is estimated that the demand space for domestic materials may reach 2.76 billion. PAA is a new type of binder for silicon-based anodes: silicon-based anodes are the next-generation anode materials with excellent performance, but there are problems such as large expansion and poor cycle life. PAA binders can be adapted to silicon-based anodes. Market in 2025 The space can reach 1.7-2.4 billion. At the same time, PAA is also expected to partially replace PVDF in the positive electrode binder. The total market demand for positive and negative electrodes can reach 2.8-4.5 billion. Unicorn think tank data shows that the amount of PVDF added in 4680 batteries will be greatly increased. Considering that 2% is the positive electrode binder (the rest is the separator coating part), the value of the positive electrode binder for a single GWh battery will be 19 million yuan; 4680 The battery will use silicon-based negative electrodes. At present, the PAA binder is suitable for silicon-based negative electrodes. If all silicon-based negative electrodes use PAA and the addition ratio is assumed to be 3%, the value of the negative electrode binder for a single GWh battery is 4.8 million yuan. It is estimated that The total value of the binder part of a single GWh battery is 23.8 million yuan. |Lithium supplement material: positive electrode pre-lithiation is the current mainstream, negative electrode pre-lithiation deserves attention In order to make the silicon material have high capacity and good cycle performance, the battery system using silicon negative electrode is pre-lithiated. Positive electrode pre-lithiation: Positive electrode pre-lithiation specifically refers to storing additional active lithium in the positive electrode material to compensate for irreversible lithium loss, so as to ensure that the amount of active lithium in the battery can still maintain a high level after the first cycle. The positive lithium-rich additives mainly include binary lithium-rich additives Li2O, Li2S and Li3N, and ternary lithium-rich additives Li2CO3, Li2C2O4 and Li5FeO4. The characteristics are: 1) The mass energy density and volume energy density are much higher than the current commercial cathode materials; 2) It can effectively release active lithium within the voltage range of the cathode material, but does not store lithium within the voltage range of the cathode material, that is, the process of delithiation irreversible. Negative pre-lithiation: Negative electrode pre-lithiation specifically refers to pre-storing a certain amount of active lithium in the negative electrode material to compensate for the irreversible lithium loss caused by the formation of the SEI film and other side reactions during the first cycle of charging, or to directly make the negative electrode surface SEI film and other side reactions. The reaction occurs in advance to solve the problem of lithium loss. Common methods of supplementing lithium for the negative electrode include: rolling lithium foil to the surface of the negative electrode to supplement lithium, supplementing lithium with lithium powder, and electrochemically supplementing lithium. |Conductive agent: carbon nanotubes are a new generation of conductive materials with broad application prospects As a key auxiliary material for lithium batteries, the conductive agent is added in an amount of about 3% of the mass of the positive electrode. The traditional conductive agents such as carbon black and conductive graphite have low relative value and have been monopolized by foreign suppliers for a long time, and the participation of domestic production enterprises is low; while the new conductive agents mainly based on carbon nanotubes have the characteristics of less addition and strong conductivity. get applied. Carbon nanotubes have significant performance advantages and high barriers to catalysts, dispersion systems and equipment. Carbon nanotubes (CNTs) are one-dimensional quantum structures surrounded by graphene. According to the difference in the number of graphene layers, CNTs can be divided into single-walled and multi-walled. The main advantages of single-walled carbon tubes are: 1) The chemical properties are more stable; 2) The mechanical properties are good; 3) The adhesion of the pole piece is improved. CNT technical barriers are mainly reflected as: 1) The catalyst is the core of the process; 2) The equipment technology determines the level of continuous and macro-quantitative preparation, and the leading enterprises develop their own equipment to improve production efficiency. 3) The dispersion system is the core step of slurry preparation, and the degree of dispersion directly determines the performance of the slurry. Carbon black conductive agents are the mainstream in the market, and the permeability of carbon nanotubes is gradually increasing. Due to its price advantage, carbon black conductive agents are currently the mainstream in the market, with a market share of 60% in 2021. Carbon nanotubes have increased their market share year by year due to their performance advantages. It is estimated that from 2021 to 2025, the market share of carbon nanotube conductive agents will increase from 27% to more than 60%. Carbon nanotube products have fast iterations, and the performance and profitability of different generations vary significantly. The difference in the preparation methods of carbon nanotubes between different generations is mainly reflected in the catalyst formulation and the macro preparation method. According to the announcement of Tiannai Technology, its carbon nanotube products are roughly divided into four generations, and each generation of products corresponds to different catalyst formulations and different subdivision application fields. The launch time interval of each generation of products is 2-3 years, the price difference is significant, the cost difference is small, but the price difference is large. This fast iterative product is also an important foundation for the high profitability of carbon nanotubes. Multifactor catalyzed carbon nanotube permeation: 1) The performance advantage meets the downstream needs. The amount of carbon nanotubes added is 1/6-1/2 of that of traditional carbon black, but it can significantly increase energy density, prolong cycle life, improve fast charging performance, and optimize high and low temperature performance. 2) The economy of carbon nanotube products is gradually reflected. Due to rising raw material and energy prices, the price of carbon black will increase from 45,000 yuan/ton to nearly 100,000 yuan/ton by the end of 2021. The average price of Tiannai carbon nanotube powder in the first three quarters of 2021 has dropped to 222,000 yuan / ton, a decrease of 38.6% compared with 2020. Considering the smaller additions, the price difference is not much or even lower. 3) Go up together with the installed capacity of iron-lithium batteries. CNTs can comprehensively improve the performance of lithium iron phosphate batteries, especially enhance the surface conductivity of the positive electrode and the current collector, reduce the local polarization of electrons in the electrode, accelerate the electron migration, and improve the rate performance. The proportion of CNT conductive agent added to lithium iron phosphate batteries is higher. With the increase in the proportion of lithium iron phosphate installed capacity, CNT shipments are expected to grow rapidly. 4) High nickel cathodes and silicon-based anodes drive the demand for carbon nanotubes. High-nickel cathodes have poor electrical conductivity, and carbon nanotubes (especially single-walled carbon nanotubes) are the most suitable conductive agents for silicon-based anodes. 1) Excellent electrical conductivity. Compared with graphene, its one-dimensional structure is easier to build an effective conductive network, which makes up for the poor conductivity of silicon-based negative electrodes; 2) High elasticity and strong mechanical properties, especially single-wall carbon tubes have better elasticity (3-10 times that of multi-wall carbon tubes), which can tightly connect each particle when the volume of silicon material collides, improve structural stability and reduce activity material shedding; 3) Large specific surface area and excellent hollow structure, which can relieve the stress of the volume change of the silicon-based negative electrode during the charging and discharging process, reduce material collapse, and improve the cycle life; 4) Improve rate characteristics, high and low temperature performance, etc. At present, OCSIAl has mass-produced single-wall carbon tubes that can be used in silicon-based negative electrodes; Tiannai Technology has proposed a method of mixing single-wall carbon tubes and multi-wall carbon tubes to optimize the dispersion of the slurry. 1) In 2022, the total global demand for carbon nanotube powder is 6,000 tons, and the powder market space is 1.52 billion yuan; in 2025, the demand is 24,000 tons, and the market space is 5.97 billion yuan. 58%. 2) In 2022, the total global demand for carbon nanotube slurry is 158,000 tons, and the market space is 7 billion yuan; in 2025, the total demand is 590,000 tons, and the market space is 22.4 billion yuan. The average compound growth rate from 2022 to 2025 will reach 47 million yuan. %. There is still room for improvement in the localization rate: in 2020, domestic carbon nanotube shipments will account for 54% of the world's total, which is lower than that of anodes and electrolytes, and there is still a lot of room for improvement. High industry concentration: In the carbon nanotube industry from 2018 to 2020, CR3/CR5 increased from 68.0%/87.7% to 75.7%/89.1% respectively, and the industry continued to be concentrated. In terms of horizontal comparison, the concentration of the carbon nanotube industry is significantly higher than that of the four major lithium battery main materials. Tiannai Technology has a solid position in the carbon nanotube industry: according to GGII data, in 2020, Tiannai Technology has ranked first in the domestic carbon nanotube conductive paste industry in terms of shipments for many years, with a market share of 32.3%, mainly supplying high-end lithium batteries. Market; Jiyue Nano ranked second with a market share of 23.8%; Cabot ranked third. Among the overseas companies, Cabot acquired Sanshun Nano to enter this field, and LG Chem relied on its own chemical advantages to research and develop itself. Main barriers of carbon nanotube industry: 1) The technical difficulty is high. The traditional conductive agent is mainly prepared by pyrolyzing the fuel through a reactor, and the carbon nanotube is prepared by the nano-scale chemical vapor deposition method. There are significant differences in the preparation process and equipment, and it is difficult to cut directly; 2) The certification cycle of the conductive agent is long, and the cost ratio is low, so the customer stickiness is high. |Aluminum plastic film: a good business with light assets, high return and high threshold The aluminum-plastic film industry has light assets and high returns. The battery packaging material aluminum-plastic film is a three-layer composite structure composed of aluminum foil, nylon layer, and CPP (cast polypropylene), which accounts for 10-20% of the battery material cost. Horizontally comparing all aspects of lithium battery materials, aluminum-plastic film still relies on imports, the domestic industry has the highest concentration, the domestic profit rate is the same as that of anode & electrolyte, low unit capital expenditure, high barriers, and large space for import substitution. The technical barriers are high, mainly reflected in: 1) Raw materials: The raw materials determine many key performances such as drawing depth, liquid resistance, and service life; the aluminum foil has high requirements for properties such as stiffness and purity; the composition of the binder is complex, and the formula is kept secret, which requires upstream and downstream collaborative research and development. 2) Process: The process level determines the batch-to-batch consistency, stability, product yield, etc. Japanese and Korean companies are the first to have the know-how advantage and have patent blockade. 3) Equipment: core equipment such as coating machines have high precision, long customization cycle, and great difficulty in research and development. |Aluminum-plastic film: The penetration rate of soft packs has steadily increased, resulting in strong growth of aluminum-plastic film Lithium-ion batteries can be divided into three types: cylindrical, square, and polymer soft packs according to their shape and packaging materials. Soft pack lithium-ion batteries have comprehensive advantages in terms of energy density, cycle life, and flexibility. There are deficiencies in consistency and group efficiency, but the shortcomings are gradually being filled. The European new energy vehicle market pouch battery is gaining momentum. In the early stage of the development of new energy vehicles in Europe, LG Energy and SKI supplied soft pack batteries, so the penetration rate of soft packs was relatively high. According to EVsales data, 15 of the top 20 models sold in Europe in 2020 are equipped with soft-pack batteries. The total sales of these 15 models accounted for 47% of the total sales of new energy vehicles in Europe. Daimler, Ford, Nissan, Hyundai-Kia and other car companies are equipped with soft-pack batteries for their mainstream models, and will all tend to adopt the soft-pack route in the future. The penetration rate of domestic soft packs is low, and the future prospects are bright. In 2020, the installed capacity of domestic soft pack batteries will account for 5.7%. 1) Advantages of high energy density and high safety; 2) Compatible with solid-state batteries; 3) The shape of the battery can be designed. It is estimated that the global shipment of soft pack batteries is expected to reach 638GWh in 2025, and the corresponding demand for aluminum-plastic film is expected to reach 690 million square meters. The CAGR from 2021 to 2025 is 32%, and the corresponding market size is about 11.8 billion yuan. . |Aluminum-plastic film: Japan and South Korea have significant first-mover advantages, and domestic substitution is accelerated Japanese and Korean companies have a significant first-mover advantage, accounting for more than 70% of the share, but most of the aluminum-plastic film is a small business under the large business department. Representative companies include Dainippon Printing DNP, Kurimura Chemical, T&T, etc. According to EVTank data, Dainippon Printing DNP will occupy 50% of the global market share in 2020, followed by Showa Denko and Kurimura Chemical, and Japanese and Korean companies together account for 73% of the global aluminum-plastic film market share. After the acquisition of Japanese T&T, the domestic Synlun Technology ranks fourth in the world, and Zijiang Enterprise ranks fifth in the world. At the same time, Japanese and Korean companies are blocking technology through a huge patent system. By the end of 2019, Showa Denko and DNP had 112/212 patents respectively, much higher than Zijiang New Materials' 13 patents. Domestic replacement of aluminum-plastic film looks at consumer electronics and two-wheelers in the short term, BYD blade batteries in the medium term, and power soft packs and solid-state batteries in the long run. The development level of the domestic lithium battery industry chain is internationally leading, and the overall situation will be determined, focusing on new technologies, new materials, and new processes in the lithium battery industry chain, as well as cross-border entry of new players with strong industrial foundations. Power battery: The industry pattern is basically determined , focusing on: 1) New technology: CTP/CTB; 2) New material: Na-ion battery/solid-state battery; 3) New player: Ruipu Energy (Qingshan Holdings) Positive and negative electrode materials: The leading companies have basically been listed , focusing on: 1) new positive electrode materials: lithium iron manganese phosphate, high nickel; 2) new negative electrode materials: silicon-based negative electrode, carbon-based negative electrode Diaphragm: The leading advantage is outstanding , but the equipment and coating material process have a strong domestic alternative logic. Focus on: 1) New materials: all kinds of new coating materials; 2) Equipment localization: Zhongke Hualian Electrolyte: The gap between the first and second echelons has widened. It is not recommended to invest in companies other than the top five . However, electrolyte is a field with rich applications of new technologies and new materials, and there are relatively many investment opportunities. Attention: 1) New materials : New solute LiFSI, etc., new solvent, new additive, various modifiers; 2) Solid electrolyte Other concerns: New technologies: composite current collectors; various modifiers; new conductive agents for carbon nanotubes; binders such as PAA. Domestic substitution: carbon nanotube new conductive agent; binder (positive electrode PVDF, negative electrode water-based SBR, CMC); aluminum plastic film, etc.