|Domestic: Subsidies decline + raw material prices rise, new energy vehicles are fully transformed into demand-driven

At the beginning of 2022, according to the policy of the Ministry of Industry and Information Technology, the subsidies for new energy vehicles will be reduced by 30% on the original basis, and the first round of price increases for new energy vehicles will begin.

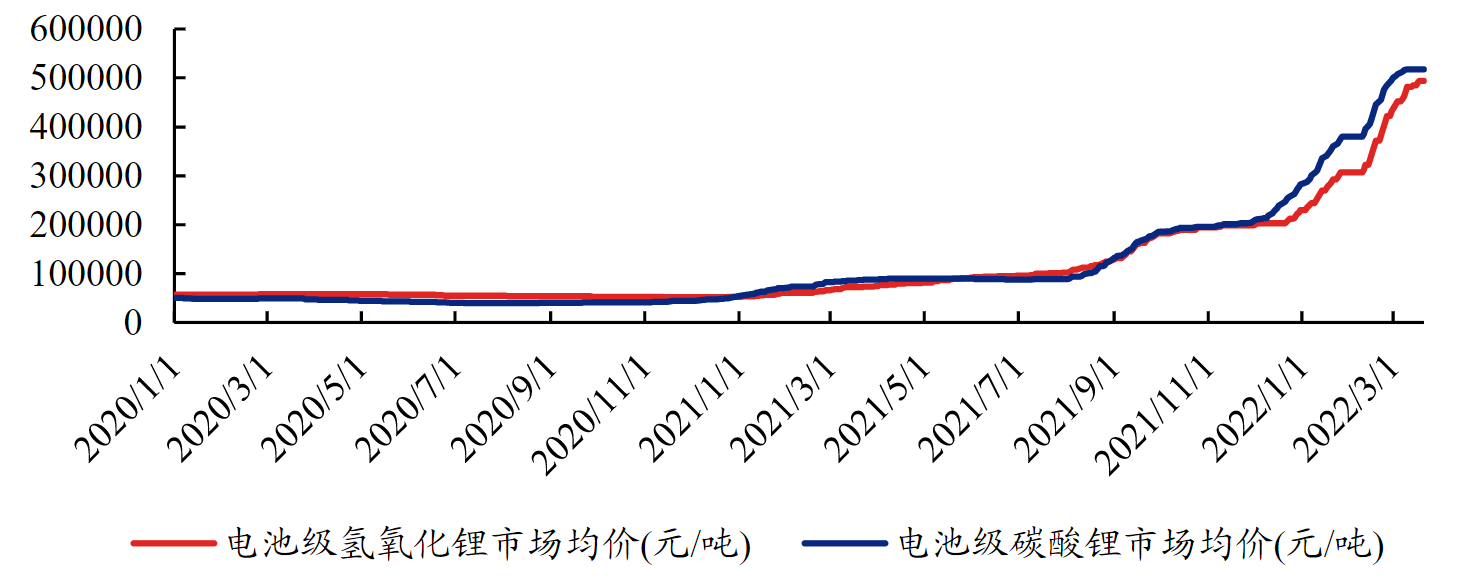

The impact of raw material prices continued to rise, and the price of lithium carbonate soared from 50,000 per ton to 500,000 per ton, leading to a new round of price hikes by car companies starting in March. The price increase of most models has covered the decline. At present, various manufacturers have sufficient orders. The current round of new energy vehicle price increases has not had a substantial impact on sales.

|Domestic: Demand recovery exceeds expectations, and downstream high prosperity promotes benign cost transmission

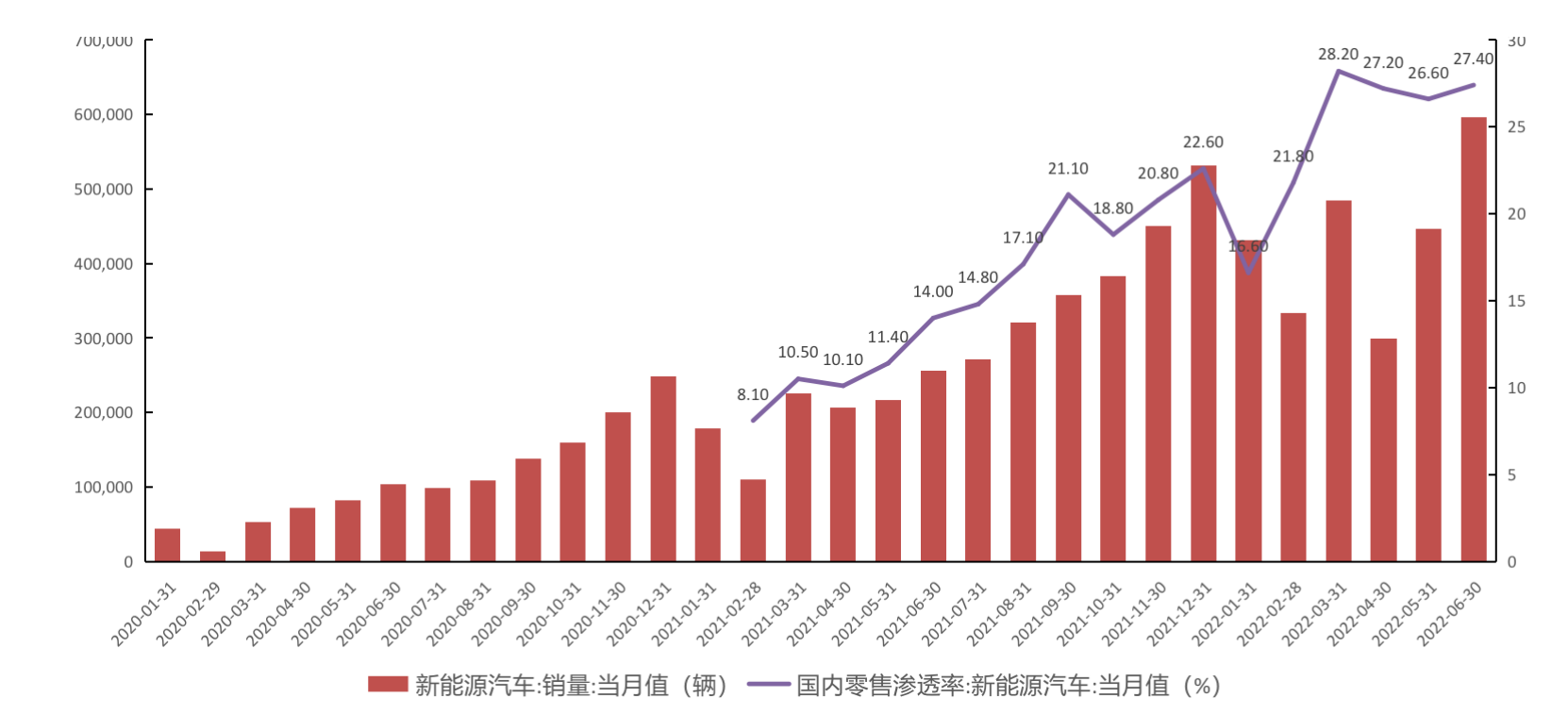

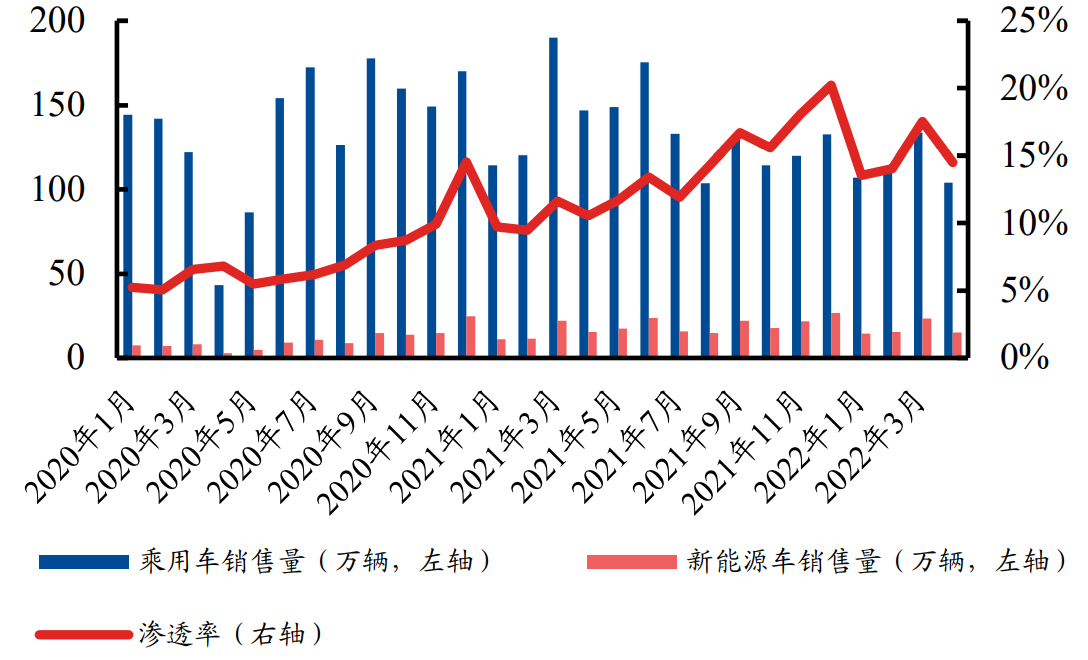

As of the end of June 2022, the cumulative sales of new energy vehicles reached 2.591 million units, a sharp increase of 117% from 1.194 million units in 2021.

Except for January, the penetration rate of new energy vehicles fell to 16.6%, the rest of the month was above 20%, and the annual penetration rate is estimated to be around 25%, far exceeding the national plan of 20% penetration rate in 2025.

|Domestic: The recognition of new energy vehicles has been significantly improved, and the structure has also been optimized

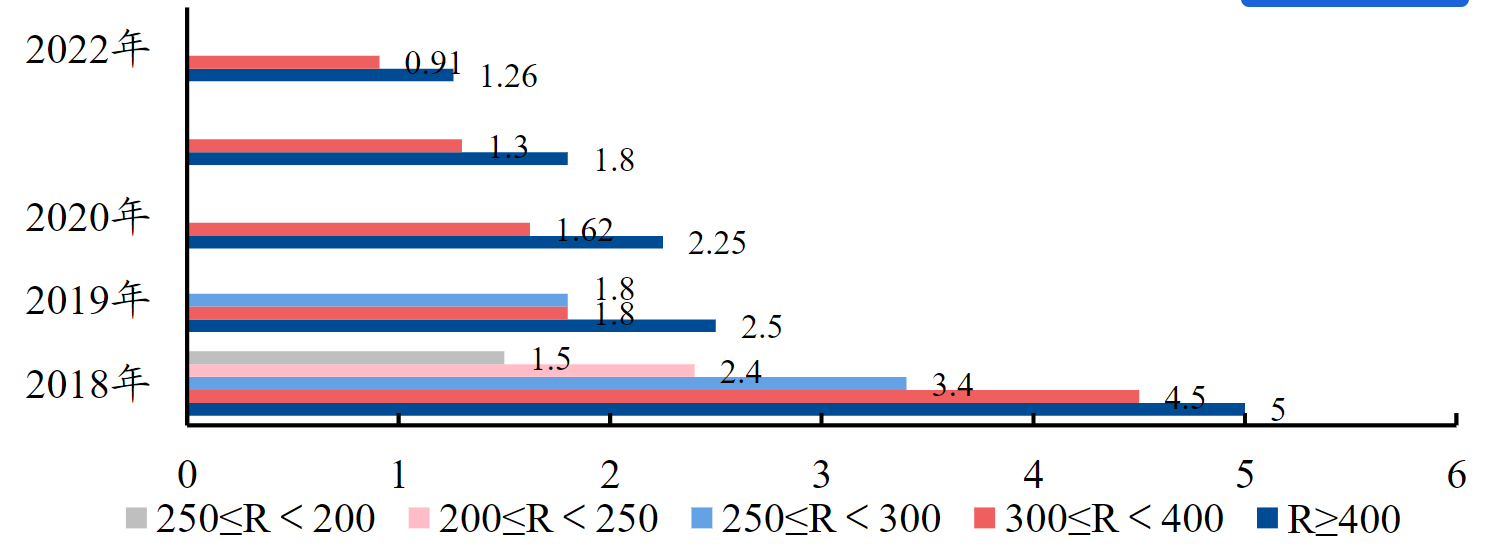

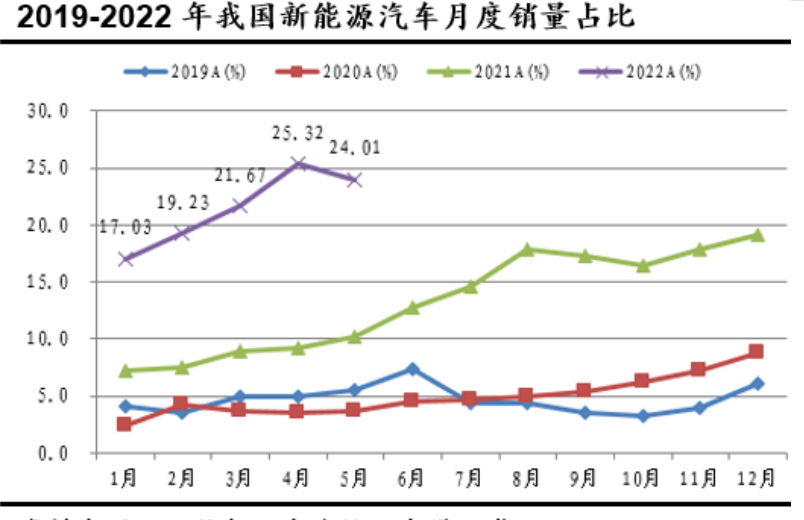

From the perspective of penetration rate, the penetration rate hovered at 5%-10% in 19-20 years, quickly broke through to 15%-20% in 2021, and further broke through to 25% since the beginning of the year in 2022. The latest June data penetration rate was 27.4% , pay attention to the data in the second half of the year to see whether it can exceed 30%, which will affect the judgment of the subsequent trend.

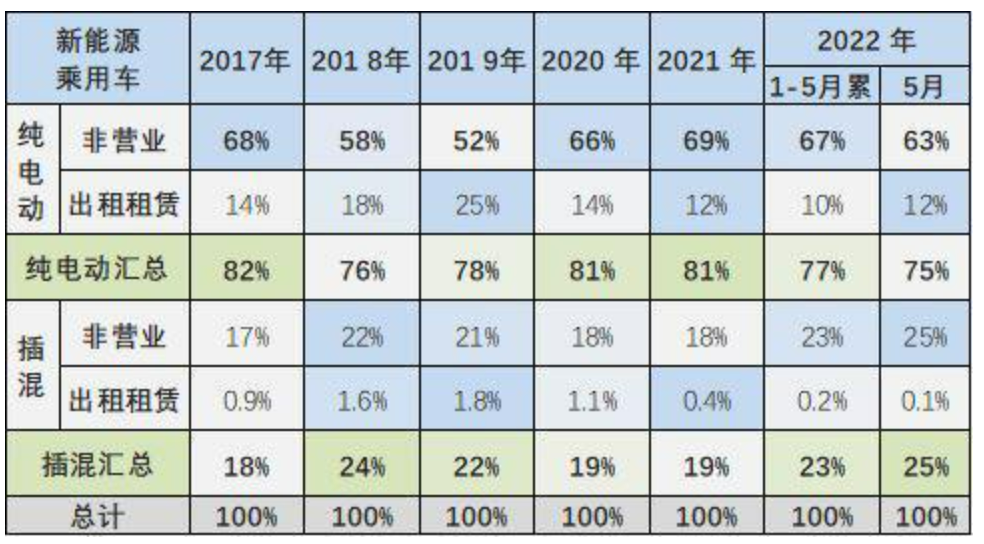

From the perspective of sales structure, the proportion of new energy passenger car leasing (excluding self-purchase for travel solutions) increased from 2017 to 2019, and began to decline after 2019, accounting for about 10% in the first five months of 2022, and private The market has become the main driving force and the proportion is continuously increasing.

|Domestic: The recognition of new energy vehicles has been significantly improved, and the structure has also been optimized

From the perspective of sales area, the demand for new energy passenger vehicles was mainly strong in mega cities with purchase restrictions in the past few years, and has continued to decline recently. Obviously, it also shows that new energy vehicles are now more driven by the market rather than by the purchase restriction policy.

The growth of new energy vehicles in May was mainly in non-restricted cities such as Chengdu, Chongqing and Foshan, while Shenzhen, Guangzhou, Hangzhou and other restricted purchases still performed strongly. However, sales in Shanghai both declined and the losses were huge. The current market increment is in Chengdu, Chongqing and other big cities, especially the increment of Chengdu has reached the scale of 36,000 units, forming the core driving force of the increment.

|Europe: High subsidies continue, supply chain test does not change long-term growth momentum

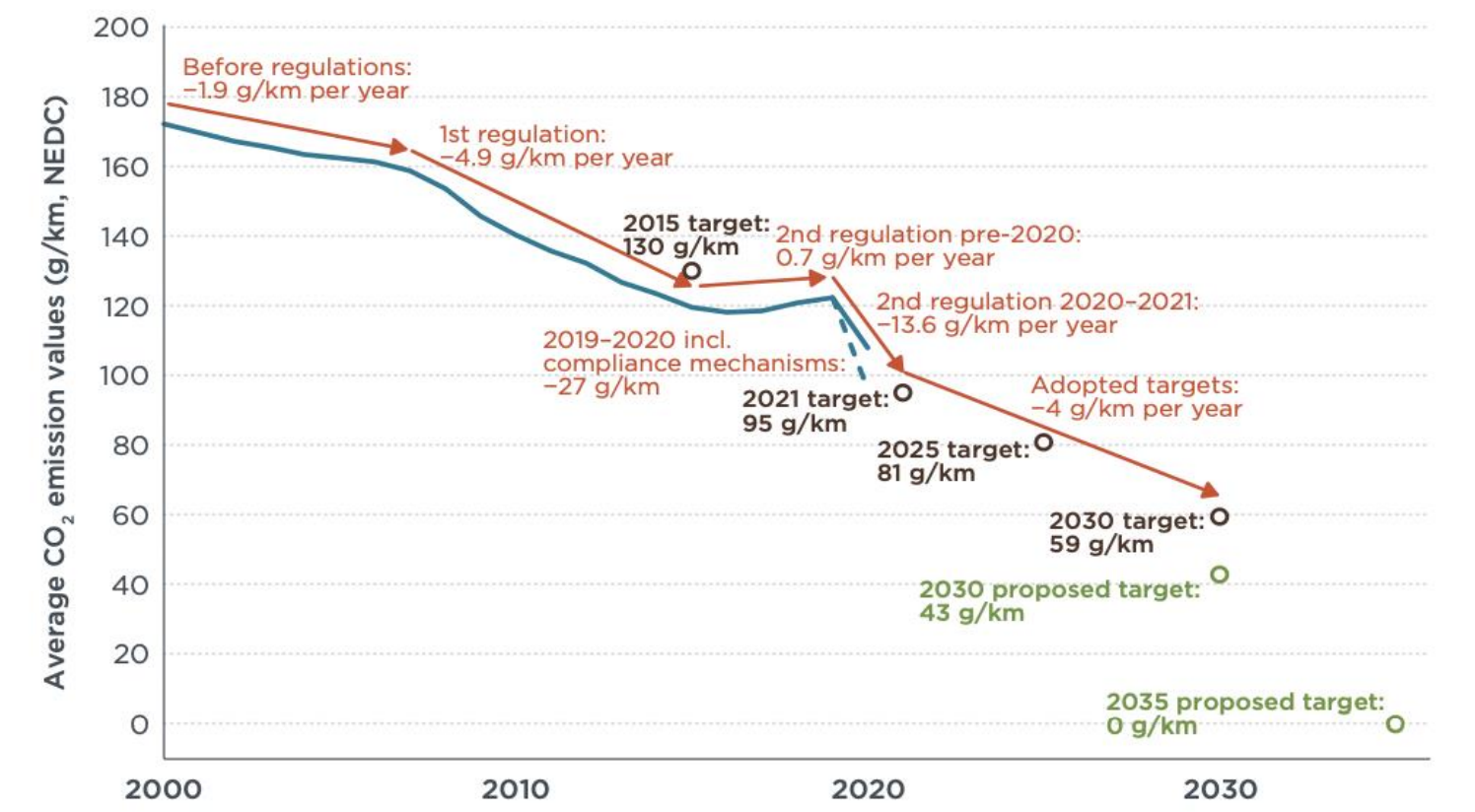

Steady growth under the pressure of carbon neutrality, and a complete ban on fuel vehicles in 2035. Since 2021, the EU will continue to increase the restrictions on new carbon emission standards for OEMs, requiring OEMs to reduce the average carbon emission per vehicle of 100% of new cars to 95g/km. OEMs that exceed the standard will face 95 per vehicle. €/g fine, and plans to further tighten the standard to 81g/km in 2025.

According to the latest proposal of the European Commission, carbon emissions in 2030 are required to be reduced by another 55% compared with the average value in 2021, which is far greater than the current reduction target of 37.5%, and it is planned to completely end the era of internal combustion engines in 2035.

|United States: Entering the new model cycle, the era of large subsidies is about to begin

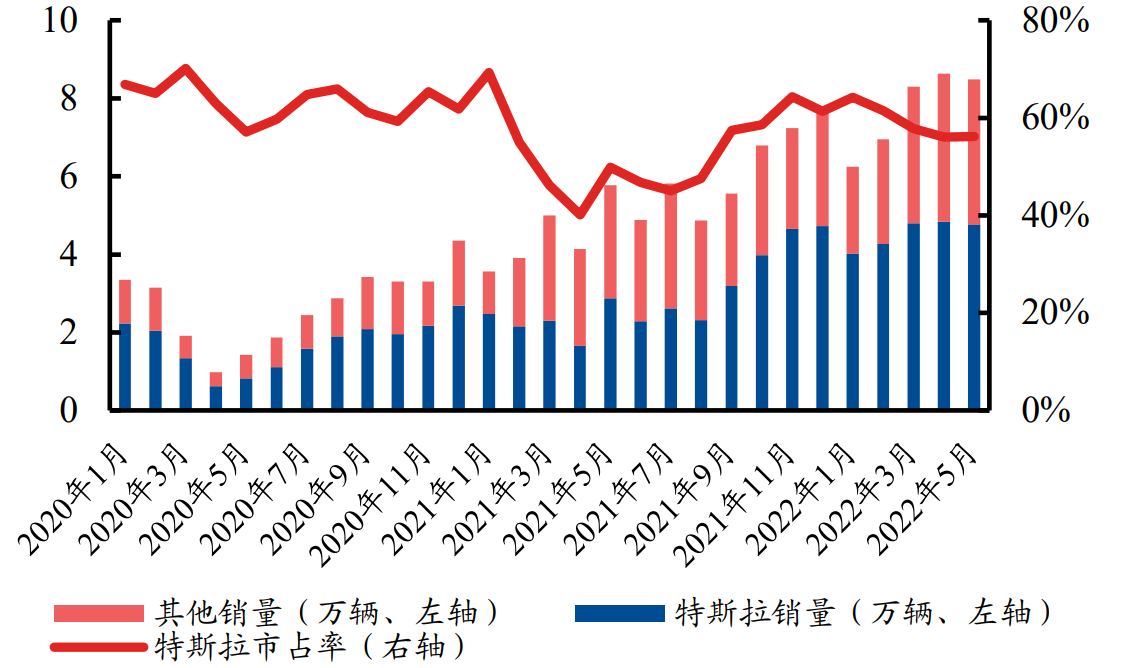

The new US bill increases the amount of subsidies and support. Under the current policy, state subsidies are lower than that of the federal government, and the cumulative sales volume of 200,000 vehicles triggers the rollback mechanism. At present, Tesla and GM have triggered the withdrawal clause, and will no longer enjoy subsidies from January and April 2020, respectively. In the Building Back Better Act passed by the House of Representatives, the subsidy is expected to be raised to $12,500, while the subsidy cap of 200,000 vehicles is removed. In terms of new energy vehicle procurement and infrastructure construction, on the basis of tax credits, the Build It Back Act also involves $12 billion in purchasing new energy vehicles for the government, postal services, and more than $16.5 billion in charging infrastructure.

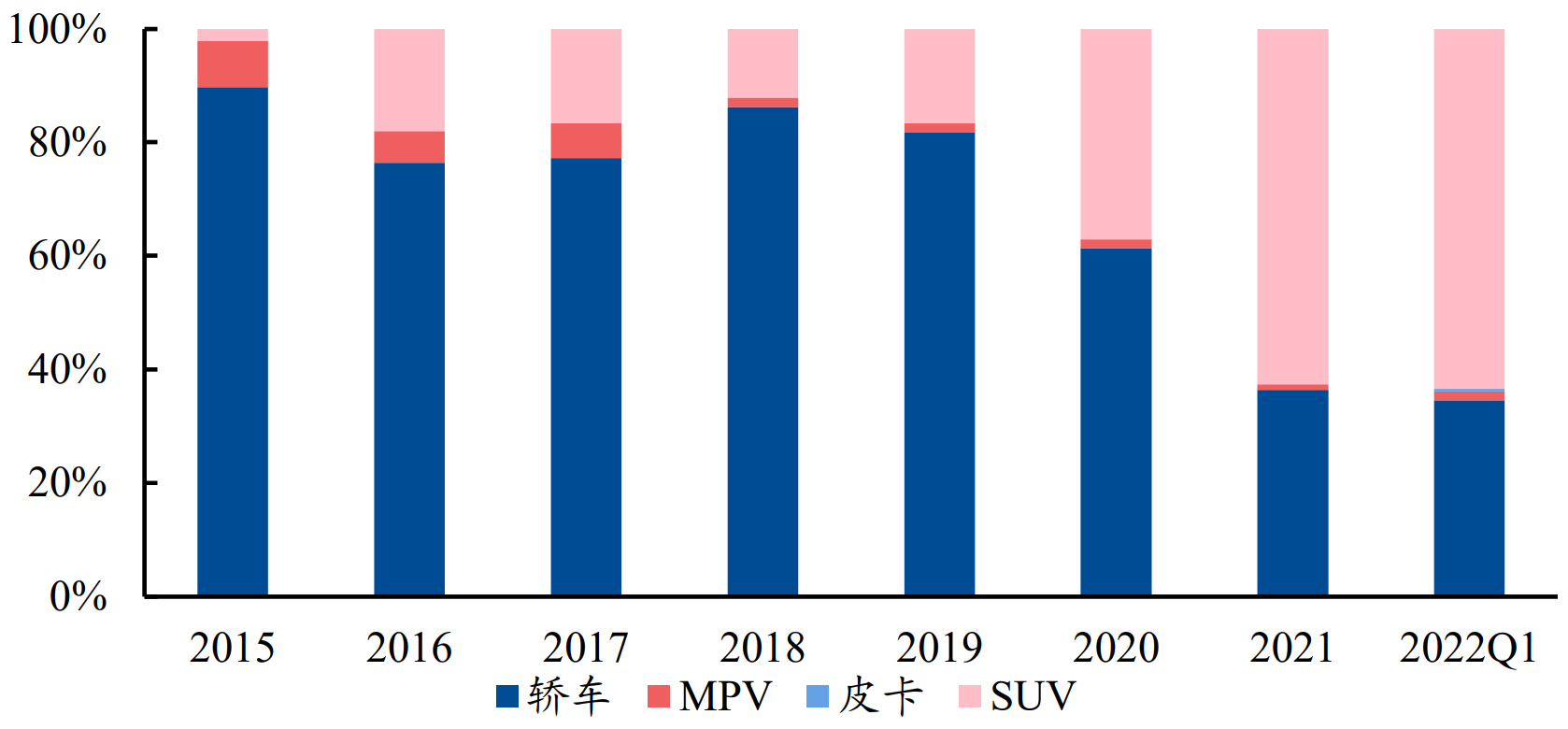

The trend of electrification of SUVs and pickups is obvious, and the industry boom continues to improve. Since 2022, the sales of new energy vehicles have achieved high growth, with the cumulative sales from January to May reaching 386,000.

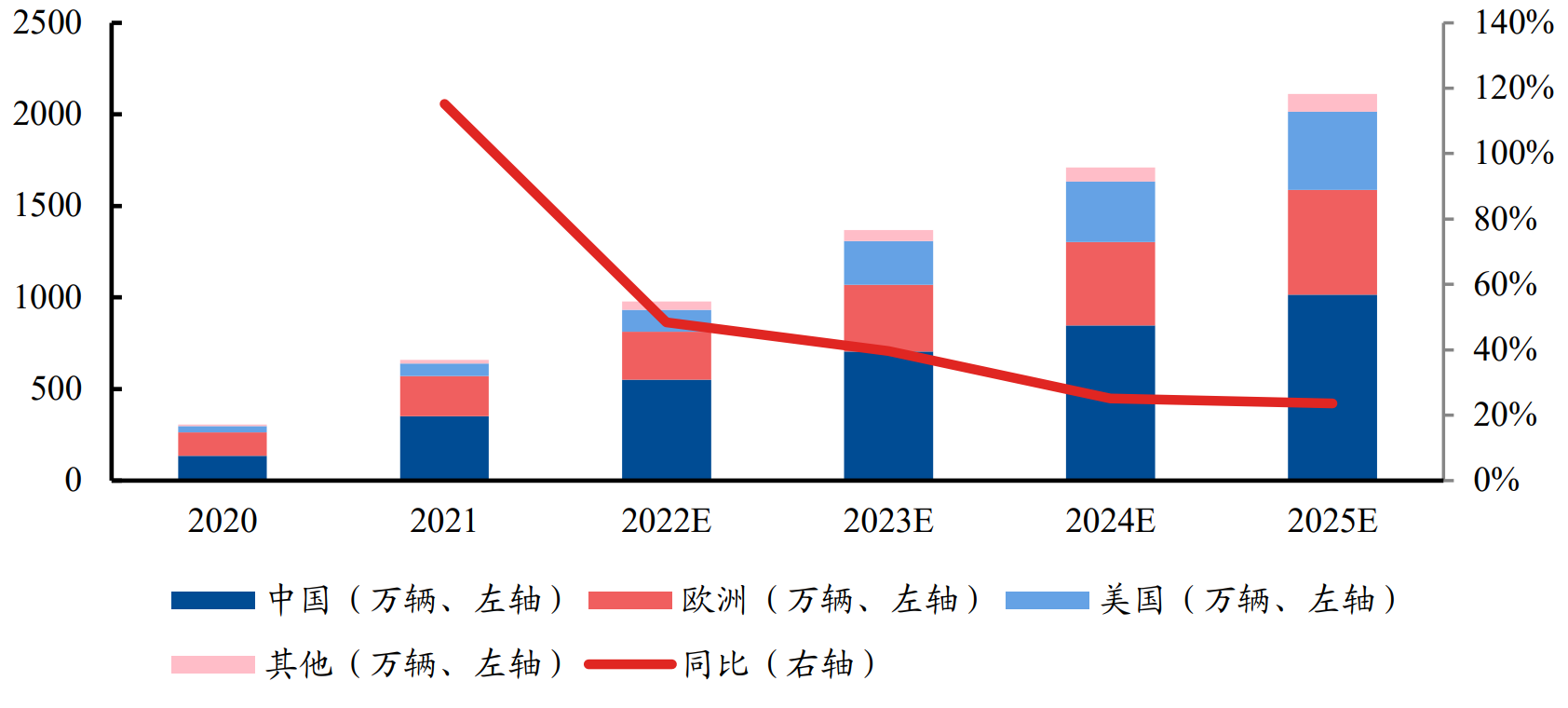

|Prediction: The high sales growth momentum is confirmed, and the demand accelerates towards the TWh era

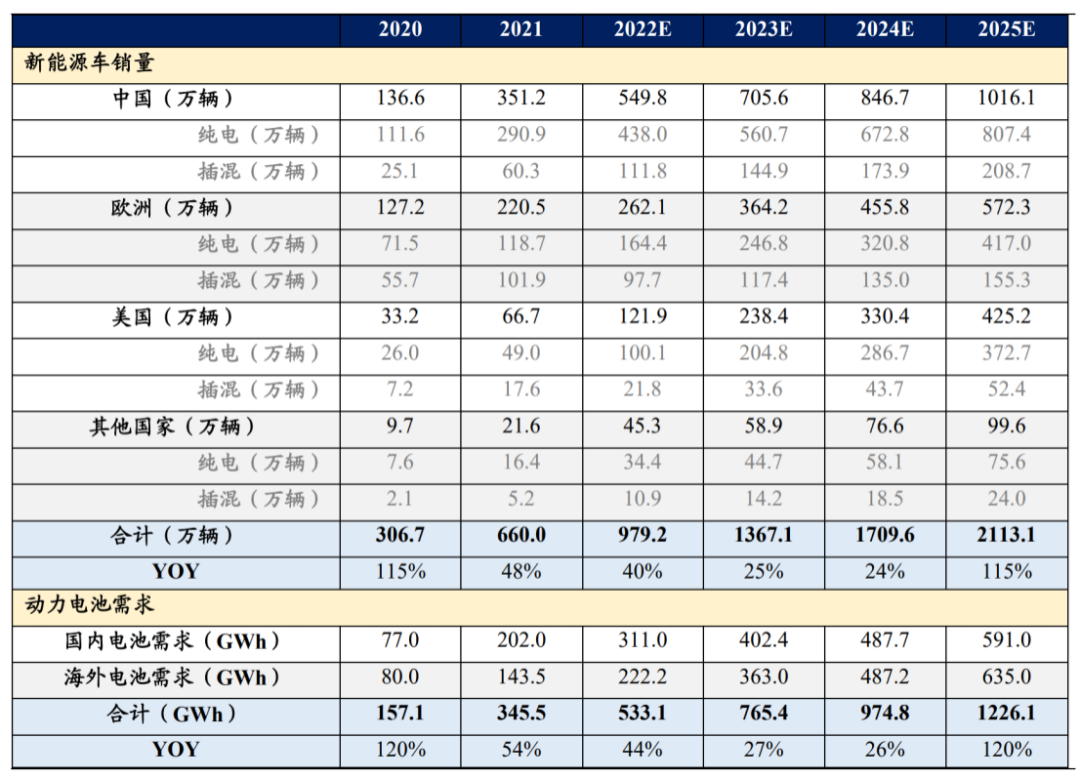

In the three major global markets, the high growth trend of new energy vehicles is confirmed. It is expected to sell nearly 9.8 million vehicles for the whole year and exceed 20 million vehicles in 2025.

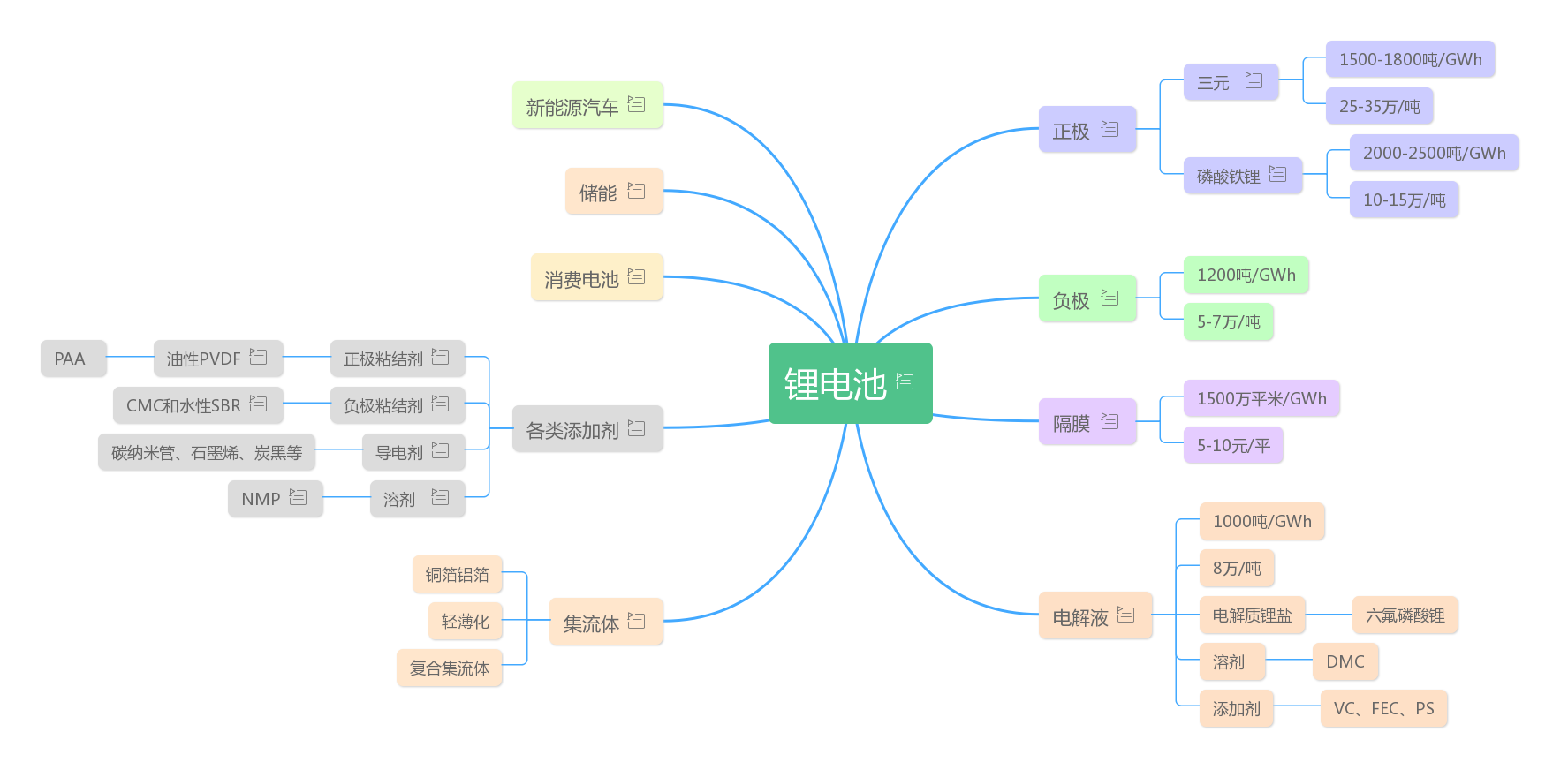

Under the background of the high prosperity of the new energy vehicle market, the demand for power battery installed capacity is rising simultaneously. It is estimated that the global power battery demand will reach 533GWh this year, and will exceed 1200GWh by 2025. During the "14th Five-Year Plan" period, the CAGR will reach 50.8%, officially entering the TWh era.