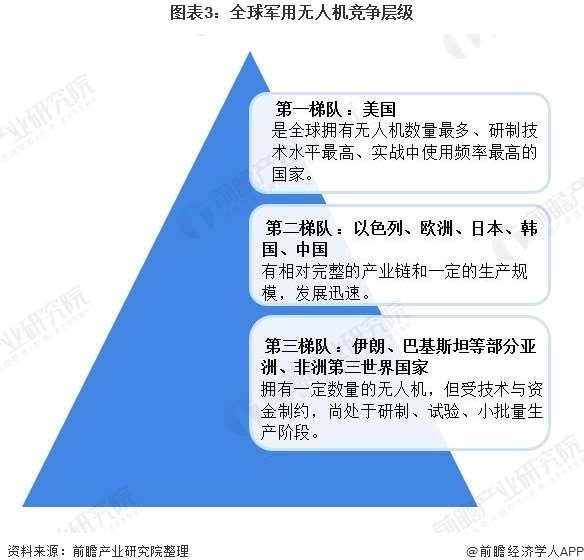

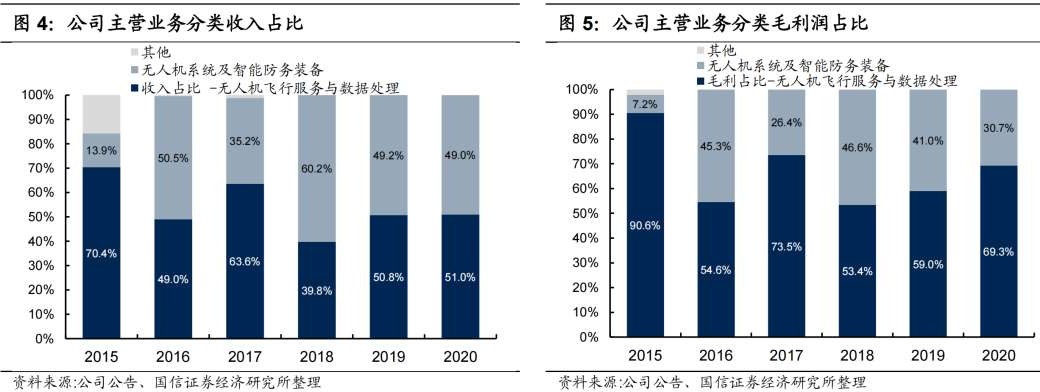

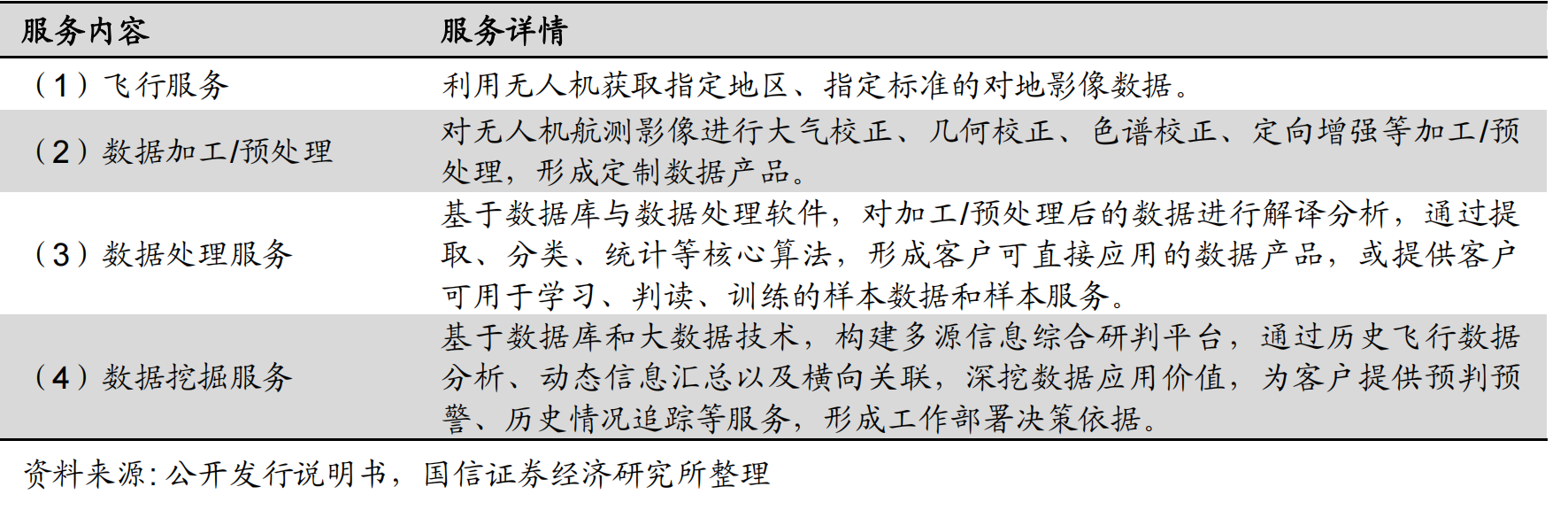

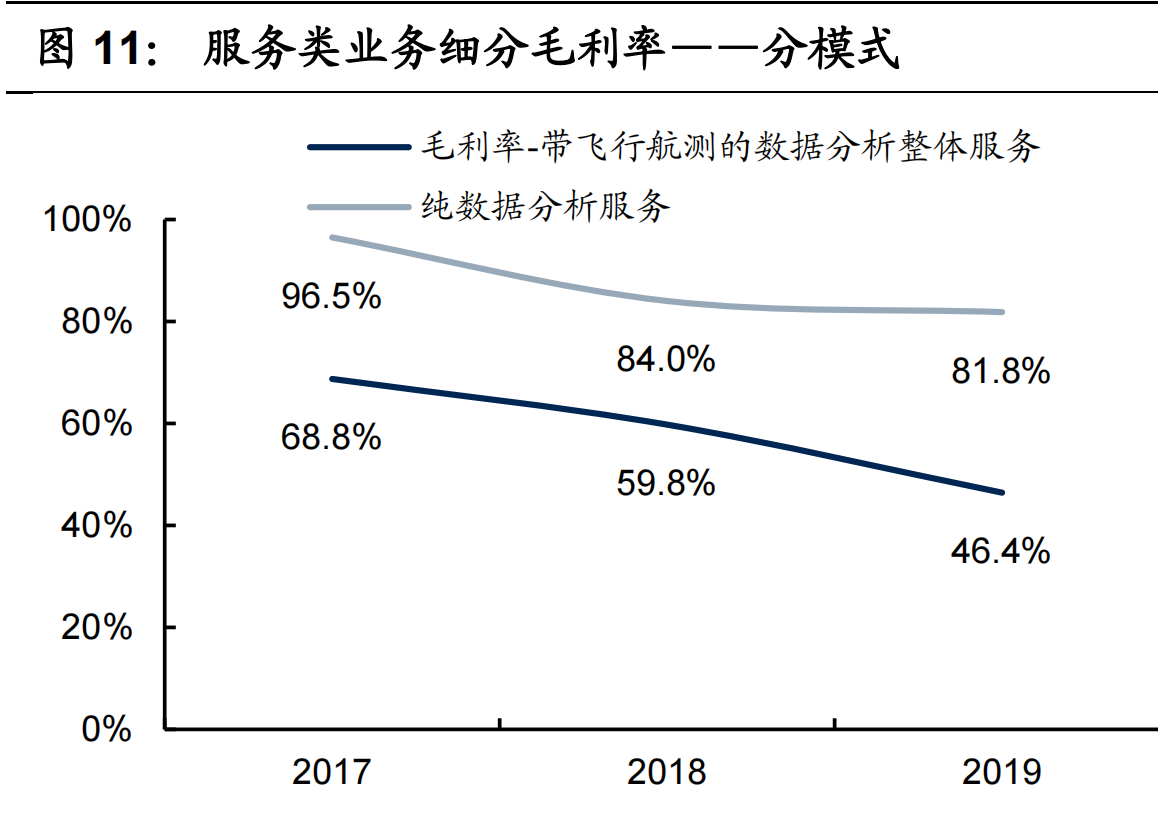

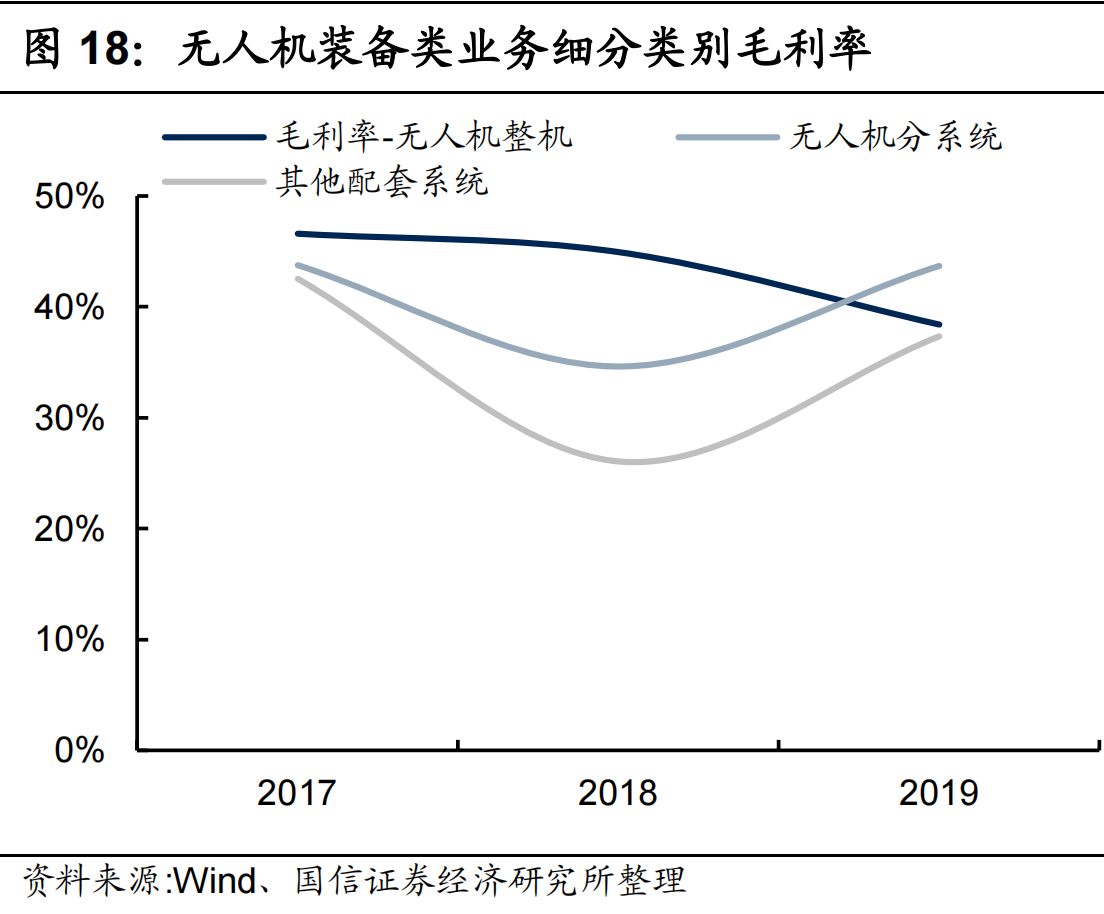

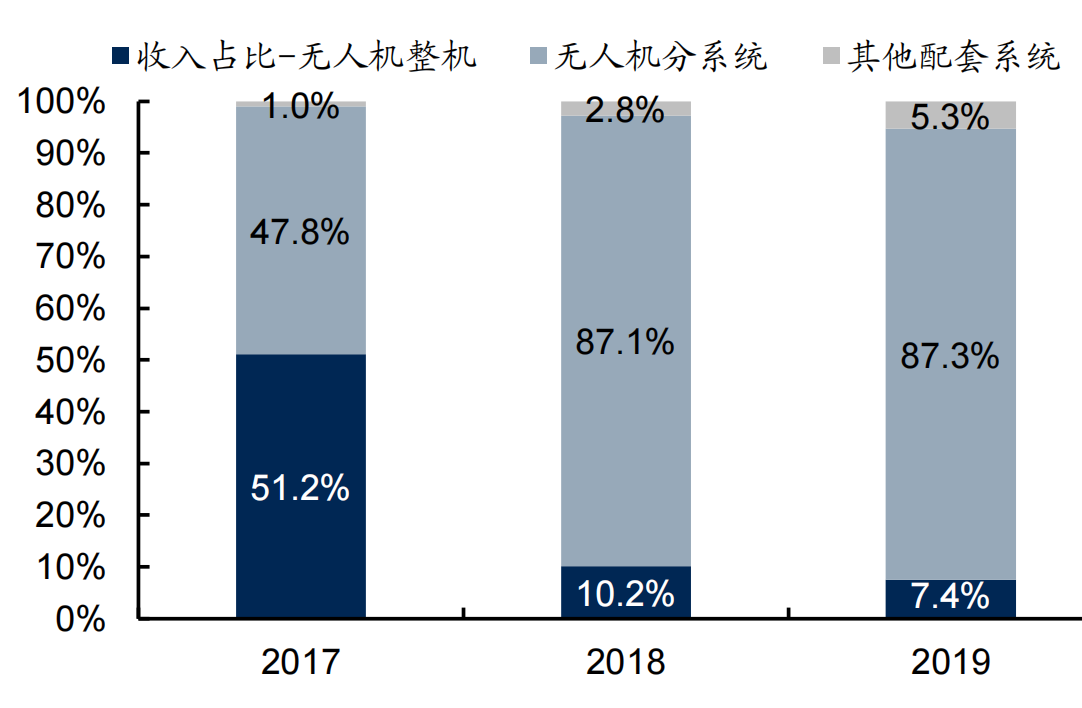

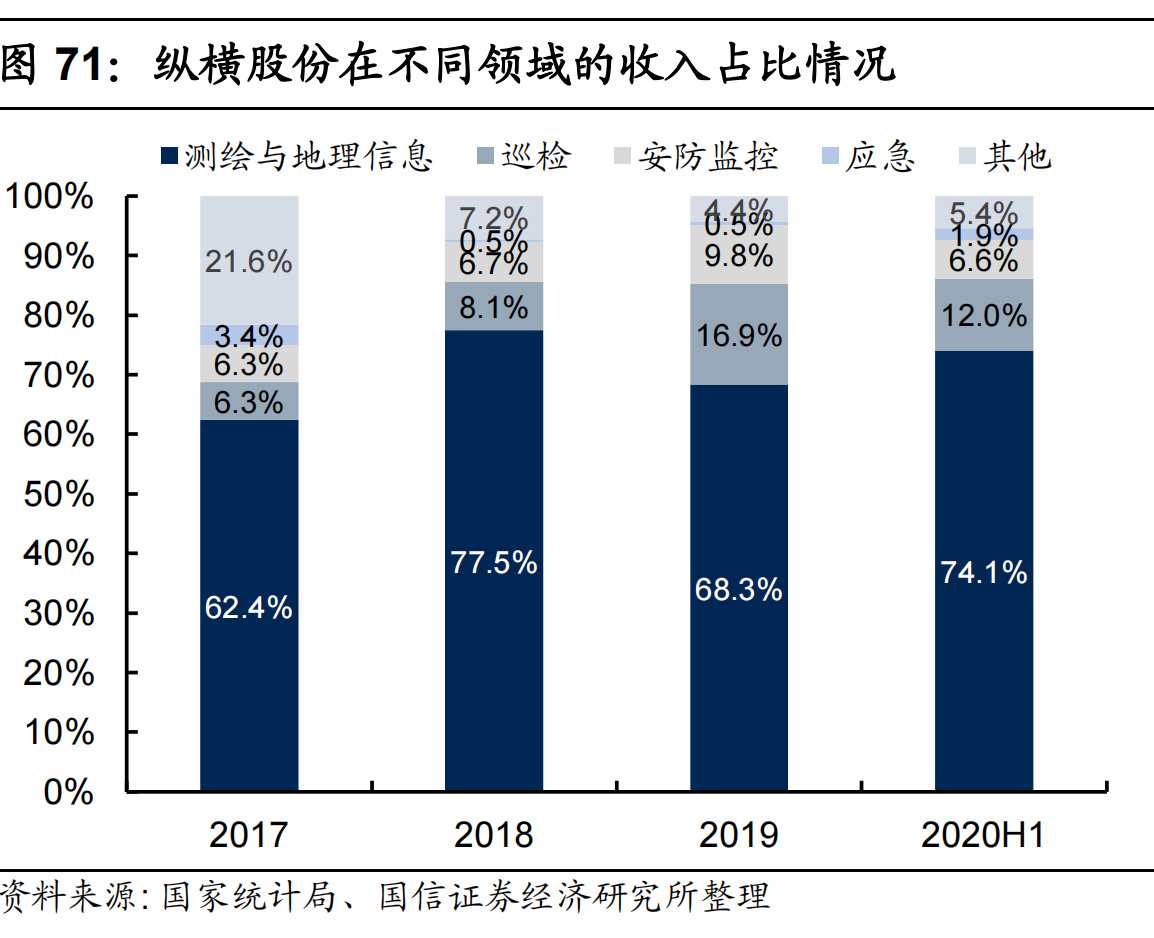

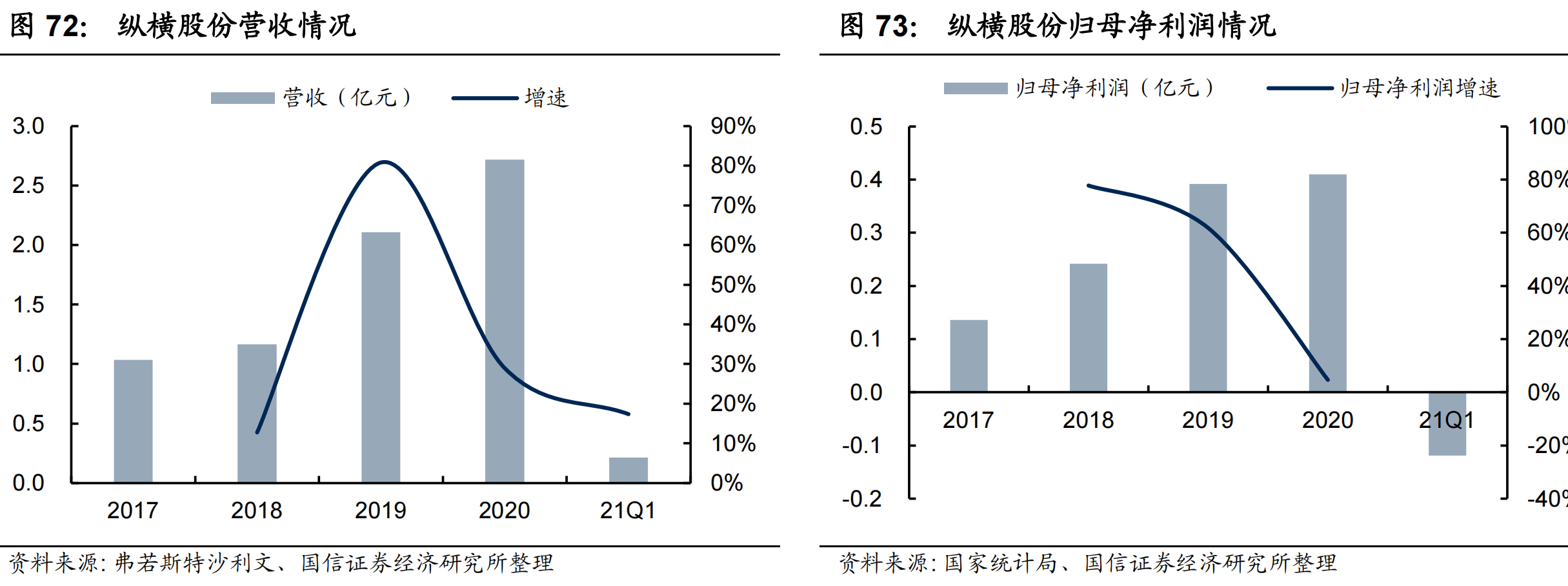

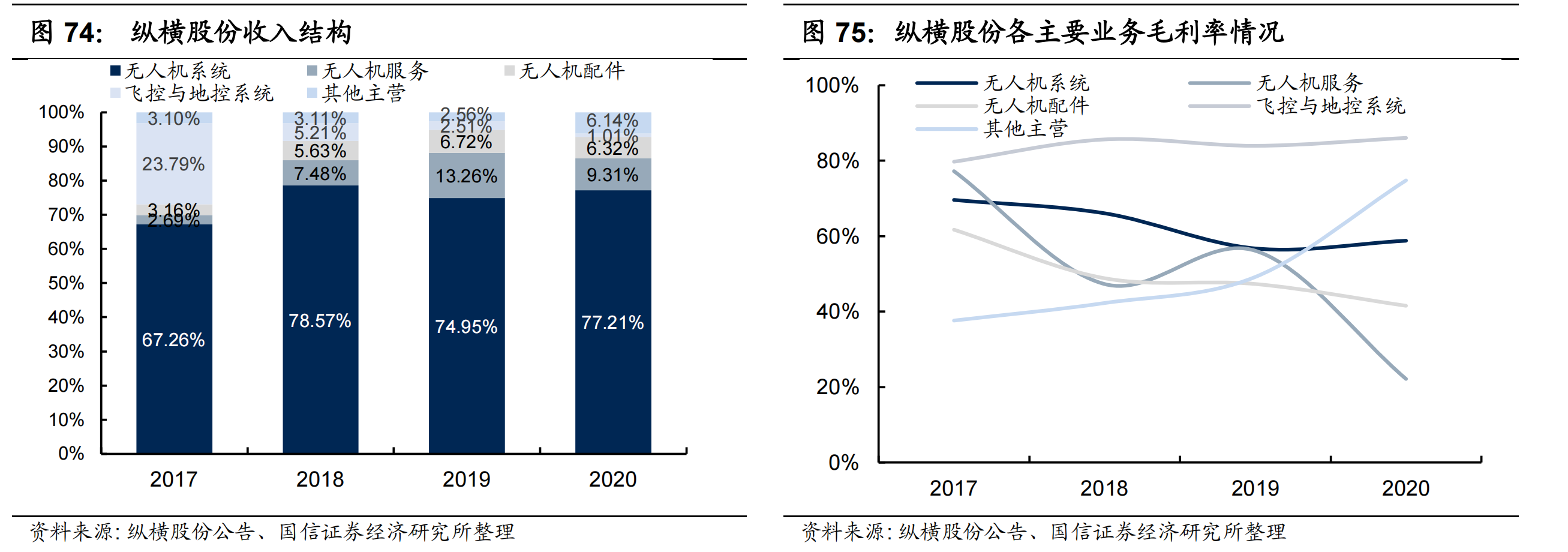

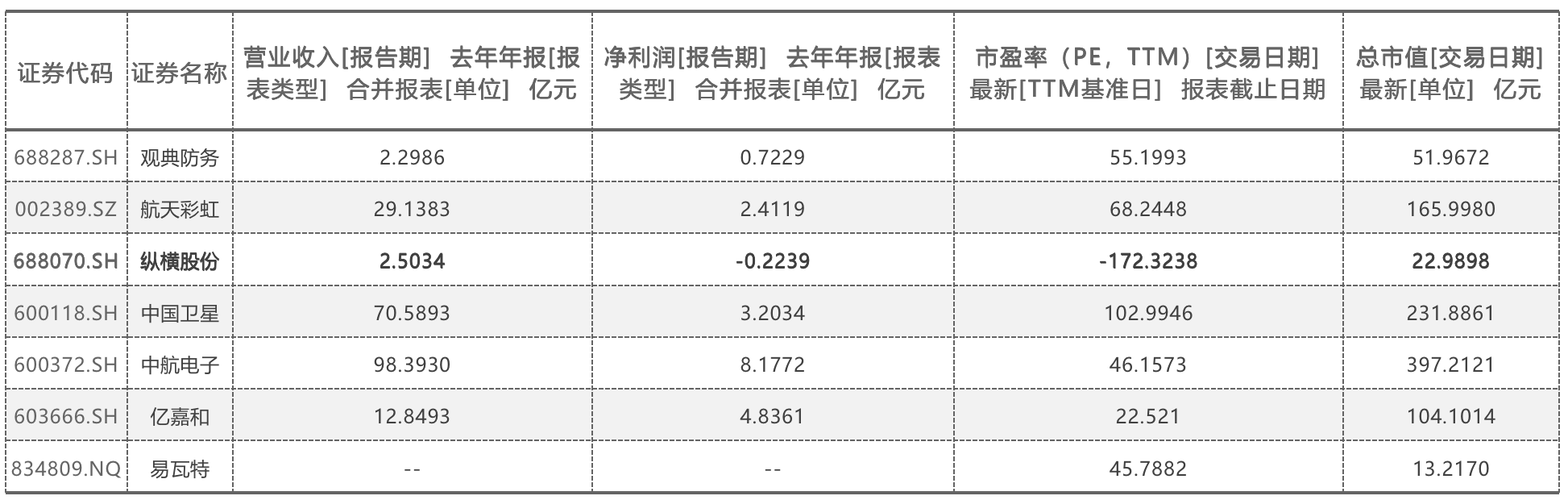

|Competitive Analysis The competitive landscape of the UAV market mainly has the following characteristics: First, the international drone market is large in scale but fiercely competitive. Based on domestic and foreign research, in the next two decades, the global civilian drone market will reach 90 billion US dollars, and China will account for at least half of it, reaching a scale of 100 billion. However, the current size of my country's drone market is only about 3 billion yuan. Second, my country's technology is independently owned and internationally leading. Compared with international companies in the same industry, the growth rate of the total R&D expenditure of domestic drone companies is far ahead of the global level, and the number of patent applications ranks first in the world, and a group of companies quickly seized the industry system. High Point. The third is that enterprises get together along the coast and gather together into a trend. Developed areas such as "Beijing, Shanghai, Guangzhou and Shenzhen" are the first choice for drone companies to invest and register due to their strong industrial foundation, complete supporting facilities, and concentration of universities. Fourth, the industry appears to be differentiated and subdivided. At present, most drone companies mainly rely on products to make profits, but some companies have gradually turned to service profits and data profits. Fifth, bottlenecks are being broken faster and competition is intensifying. At present, problems such as the lack of sales channels restricting the development of the UAV industry, the incomplete opening of low-altitude airspace, and the short battery life of power lithium batteries are being solved rapidly . The approach of lithium batteries has achieved good results. |Competitive Landscape From a global perspective, the U.S. and Israel are relatively advanced in UAV technology, especially the U.S., which has advanced UAV technology and a wide variety of UAVs. There are not only unmanned reconnaissance aircraft at all levels of strategy, campaign, and tactics, but also those that can realize the integration of inspection and attack. of attack drones and drones for transport. At present, the world's mid-to-high-end military drones are mainly developed by large aircraft professional companies. The two major manufacturers of Grumman and General Atomics in the United States firmly hold the top two positions in the market share, occupying more than half of the world's military drones. Market share; other competitive manufacturers are mainly located in the UK, Israel, China and Russia. Compared with developed countries, my country started relatively late in the field of industrial drones. Although the development is relatively rapid, the overall scale is still small. The scale of China's industrial drone market is 27.3 billion yuan in 2020 , and the CR3 of the industrial drone industry in 2020 will drop by 1.95% year-on-year to 4.43% . The specific distribution of industrial drone enterprises is relatively concentrated, and the top five provinces with the largest number are Guangdong, Jiangsu, Zhejiang, Shanghai and Shandong. |International representative company universal atom General Atomics was established in 1955 and is headquartered in California, USA. It is mainly engaged in the research and development, production and sales of UAV reconnaissance aircraft, Predator series UAV systems and airborne sensors. Its UAV products mainly include MQ-9A, MQ-9B, Avenger, GrayEagleER UAV system, etc. Northrop Grumman Headquartered in Virginia, United States, Northrop Grumman is a global aerospace, defense and security company that provides military equipment to the U.S. government. Northrop Grumman's UAV products are mainly large fixed-wing reconnaissance UAV MQ-4C and Global Hawk UAV system. Israel Aerospace Industries Ltd. Israel Aviation Industry Corporation is an Israeli state-owned enterprise mainly responsible for the production of Israel's defense systems and export products. Its main UAV products are the large-scale high-altitude long-endurance unmanned reconnaissance aircraft Heron TP UAV and the medium-altitude long-endurance UAV system Heron UAV. Turkish Aerospace Industries Turkish Aviation Industry Group is a state-owned enterprise in Turkey, mainly responsible for the development and production of aircraft, helicopters, unmanned aerial vehicles and aerospace systems. Its main UAV products are the ANKA medium-altitude long-endurance reconnaissance UAV and the ANKA -AKSUNGUR reconnaissance and strike integrated medium-altitude long-endurance UAV system. Baykar Makina Corporation Baykar Makina is a private UAV manufacturer in Turkey. Its main UAV products include BayraktarTB-2 medium-sized inspection and attack UAV and BayraktarAKINCI System large inspection and attack UAV, etc. |Guandian Defense: UAV anti-drug leader, complete military qualifications The company is an industrial-grade UAV R&D, manufacturing and application service provider with strong comprehensive strength. On the one hand, the company provides anti-drug aerial survey data services for government departments at all levels all the year round. It has a very high accuracy in the investigation of drug original plant planting and field processing. It has established deep technical and service barriers, and is unique in the field of drone application services. There is a large space for business development, and related capabilities can also be expanded to other fields with a broad market. On the other hand, the company has industry-leading UAV design and development capabilities, and the UAV products produced have excellent performance such as long endurance, large load, multi-function, and easy deployment. It has undertaken several aerospace state-owned enterprises and scientific research institutes. The company's customized development projects, and the company's military qualifications are complete, and special technical products are expected to form a larger order breakthrough in the future. It is estimated that the company's 2021-2023 revenue will be 2.26/3.31/447 million yuan, respectively, and the net profit attributable to the parent is 0.72/1.12/157 million yuan. |Main business 1: aerial survey and data services This type of business is mainly to process, process and analyze various images, spectra and other data information obtained through the flight of drones, obtain judgments or statistical data for specific purposes, and provide customers with the basis for decision-making and work. The basic form of providing anti-drug services for law enforcement agencies has gradually extended to anti-terrorism, resource surveys, environmental monitoring, oil pipeline inspections and other fields in recent years. |Main business 2: UAV hardware products and equipment This business is mainly to provide customers with UAV system equipment and related equipment products independently developed and produced by the company. At present, most of the cases are customized according to customer needs, and are further subdivided into 1) UAV complete machine, 2) UAV subdivision system and, 3) related intelligent defense equipment systems. In terms of revenue, since 2015, the hardware equipment business has developed relatively rapidly. In 2020 , the revenue was 88.03 million yuan, an increase of 22.55% , and the five -year CAGR reached 60.31% , with fluctuations between years. From the perspective of sub-categories, the business is currently dominated by the customized development of subsystems, especially since 2018, the proportion of revenue is close to 90%, which is also the main reason for the growth of revenue. It mainly undertakes aerospace state-owned enterprises and scientific research institutes. As the number of projects increases, the other party generally takes the development of sub-systems as the main demand, while the complete machine is relatively small. The complete machine produced is used to meet its own business needs more, and it is also sold to some private enterprises. |Zongheng Co., Ltd.: the leader of domestic vertical take-off and landing fixed-wing Zongheng Co., Ltd. is a leading comprehensive integrator of domestic industrial-grade UAVs, focusing on the development of innovative vertical take-off and landing fixed-wing models. In 2019, the market share was as high as 50%, which is far ahead in this segment. Founded in 2010, the company initially started with the flight control and ground control sub-system business at the core of drones. At that time, the founder had nearly 20 years of related R&D operations. Since then, the company has turned to the complete machine business. In 2015, it released the first domestic vertical take-off and landing fixed-wing UAV, and later formed a comprehensive product system. At present, thousands of UAVs have been manufactured and applied in more than 1,300 companies. formed a wider influence. The company successfully landed on the Science and Technology Innovation Board in February 2021, and obtained all the qualifications to undertake military projects. |Zongheng Co., Ltd.: the leader of domestic vertical take-off and landing fixed-wing Business structure: take hardware products as the leading factor, create a standardized body pedigree, and have a high gross profit margin. From the perspective of business structure, the company not only sells UAV-related hardware products, but also provides UAV-related flight data and license training services, but hardware sales occupy an absolute dominant position. Among them, the sales of UAV systems in the past three years account for about 75% of the revenue, and accessories such as flight control and ground control systems and cameras account for 8-15%. The other main businesses are mainly maintenance and after-sales service, accounting for 2 -6%, actually also related to hardware sales. From the perspective of gross profit margin, the gross profit margin of Zongheng's hardware products is relatively high, and the core UAV system can also reach about 60% , which is expected to be related to the company's large-scale production model and comprehensive and mature product pedigree. The gross profit rate of drone service business fluctuates, and the overall relatively low is related to the specific service structure of the year. For example, the gross profit rate of some basic security flight services is relatively low. | Valuation The PE of domestic listed companies is about 40-60x Attachment: Unlisted companies