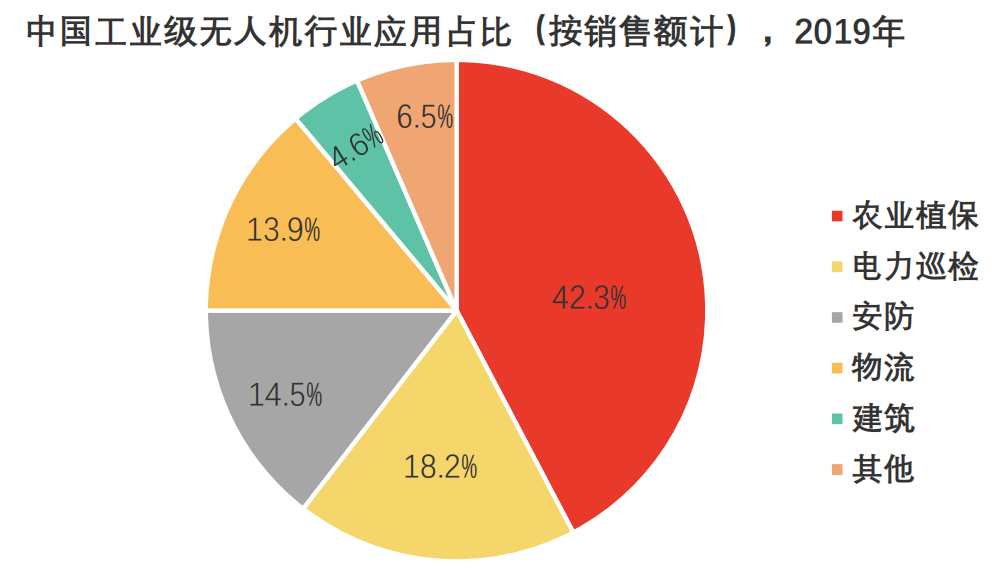

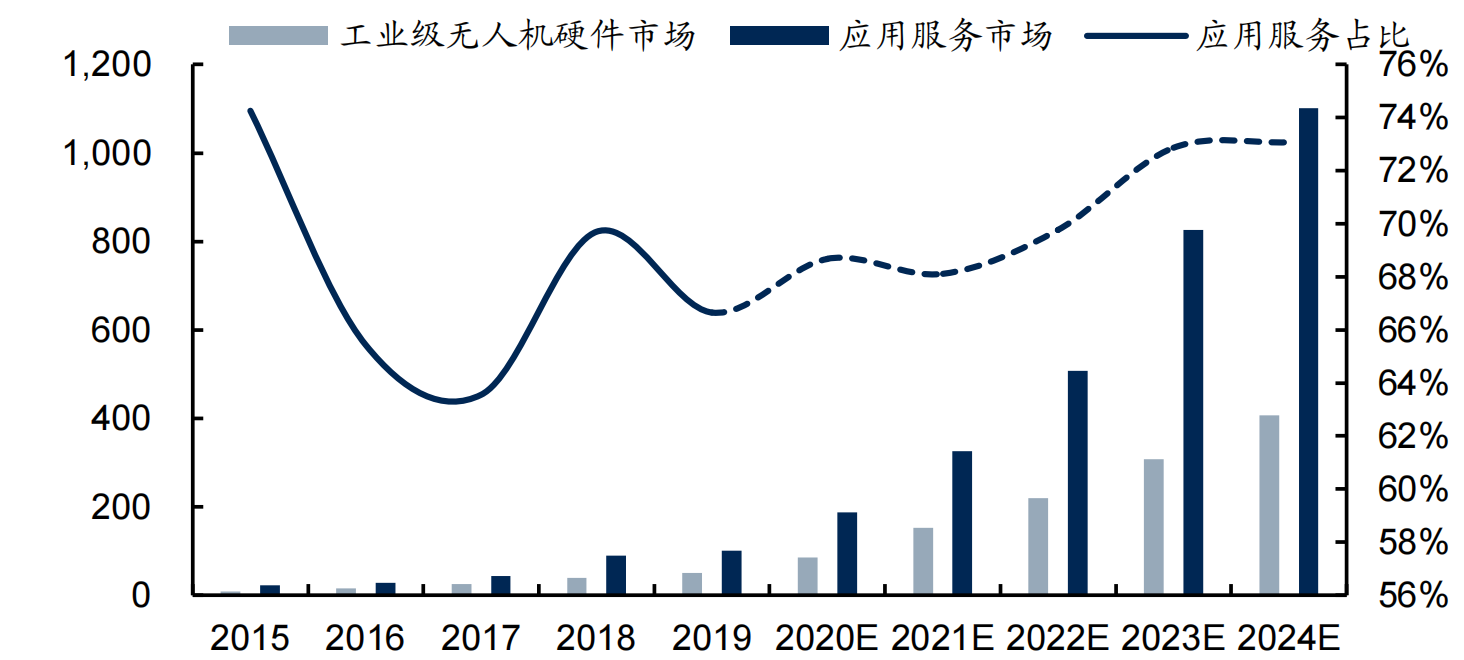

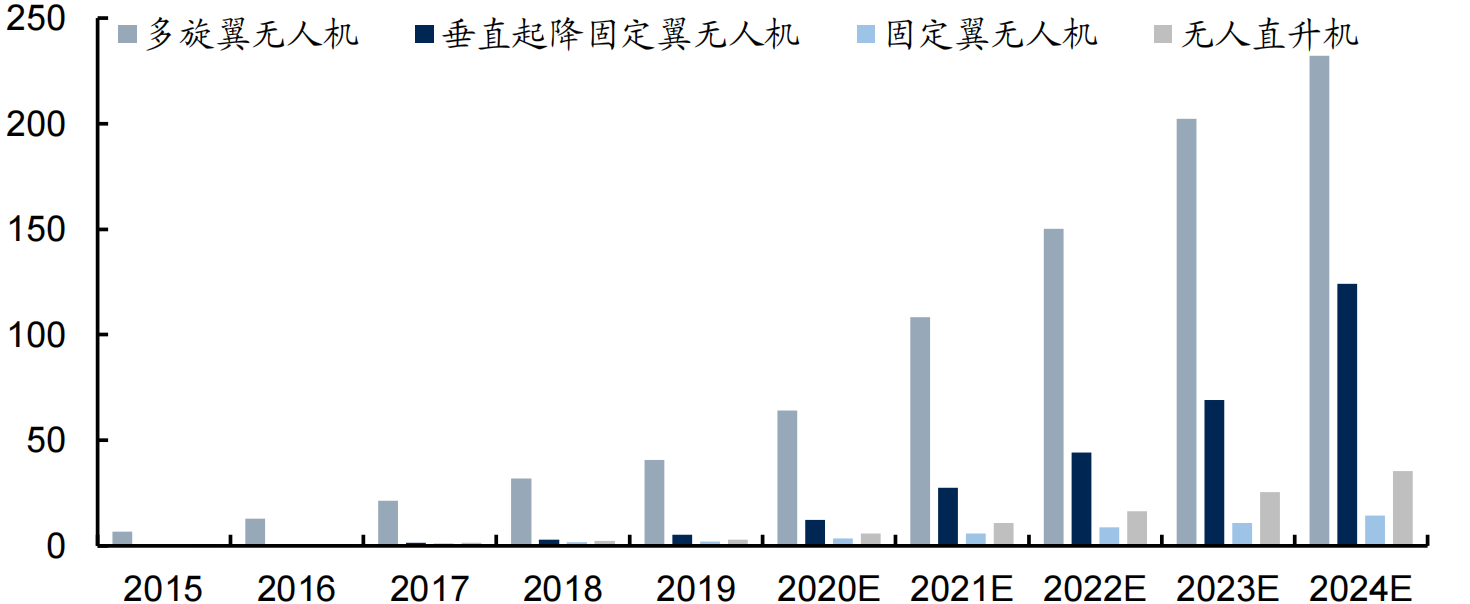

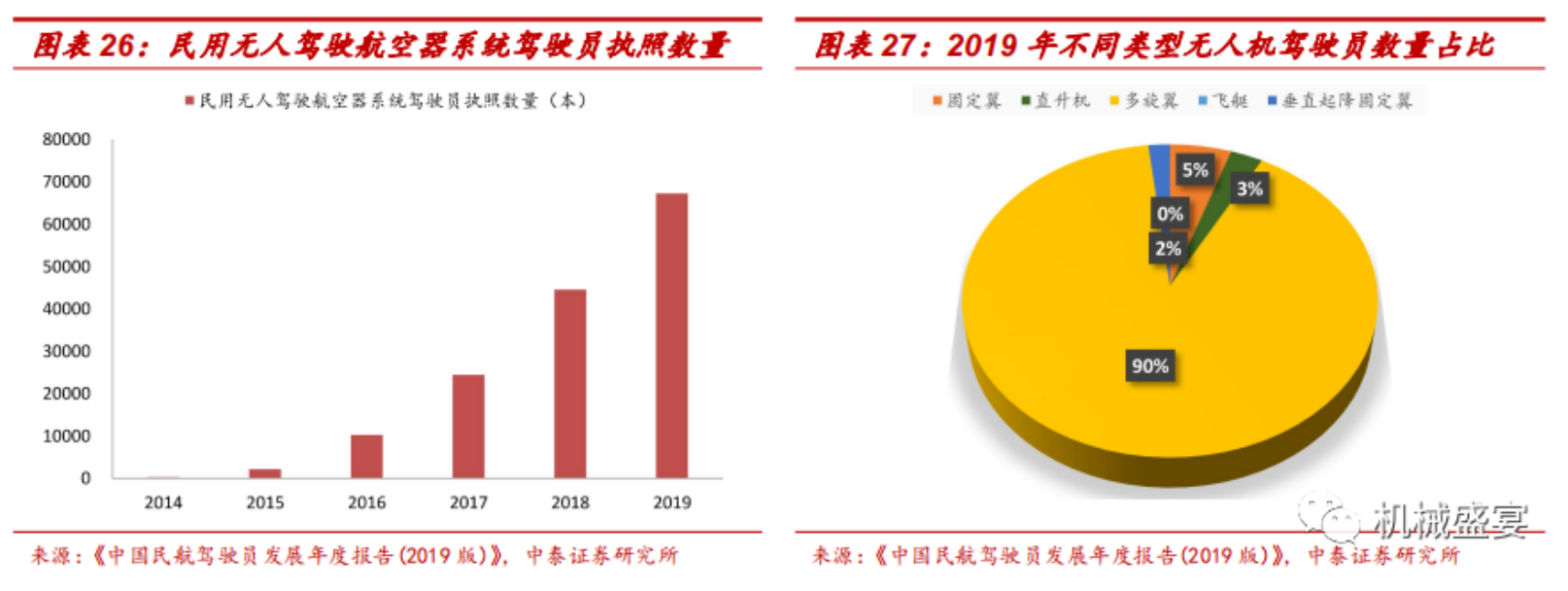

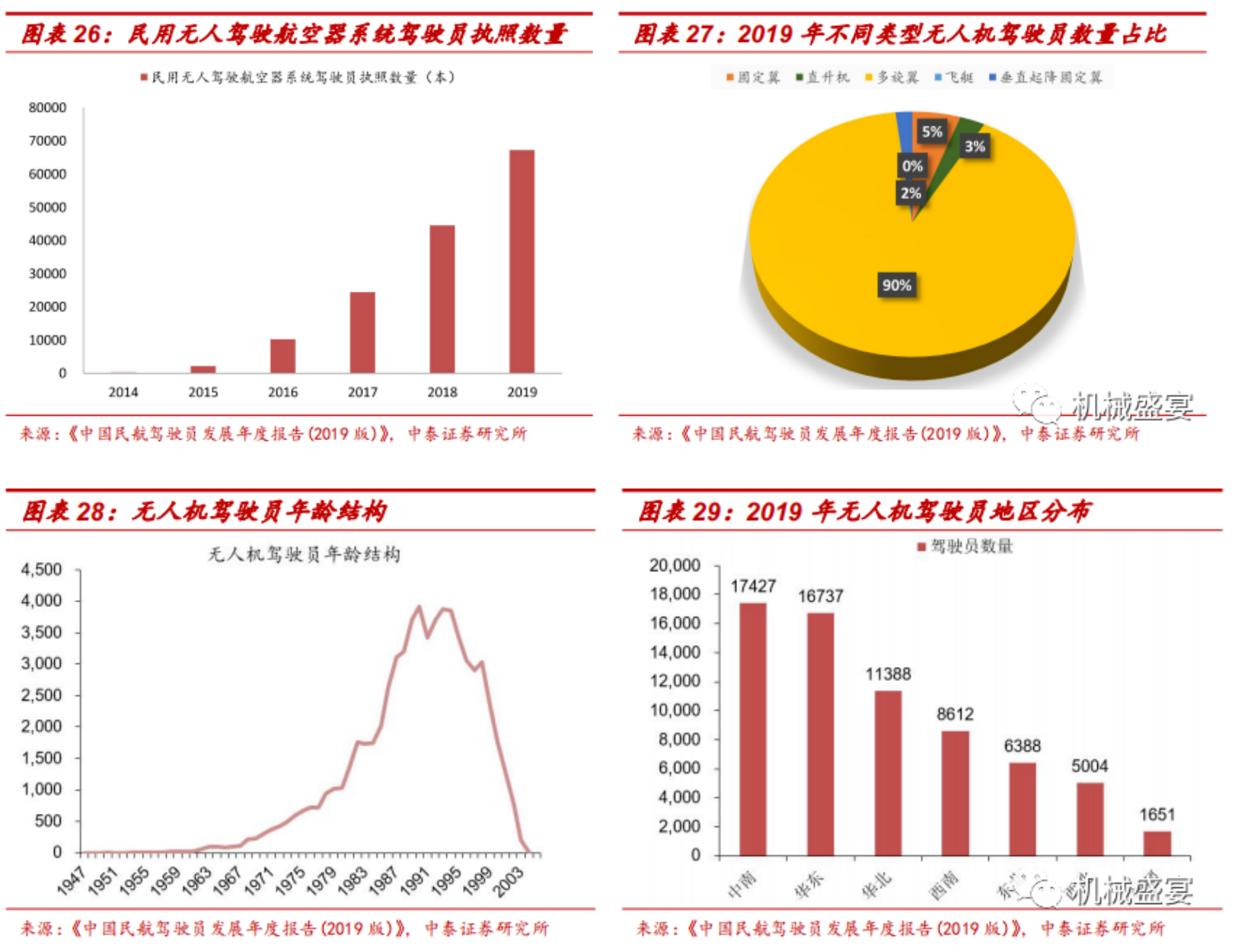

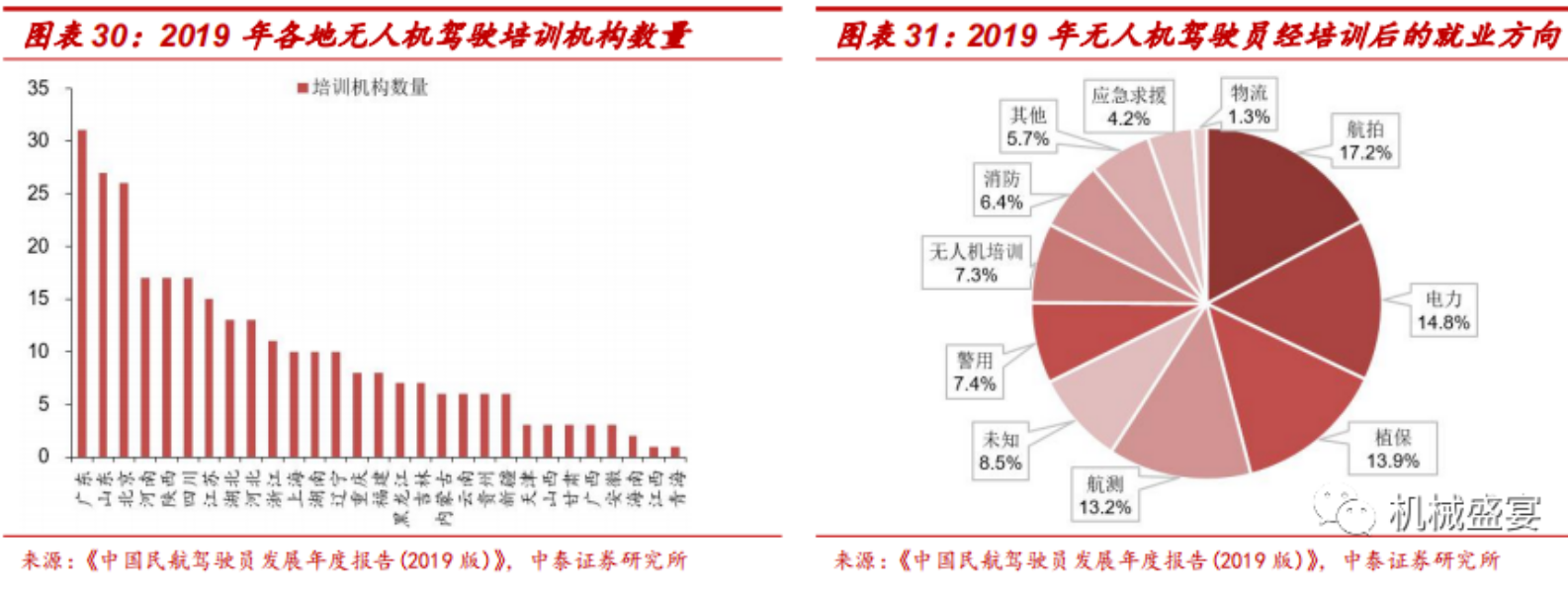

UAV system integrators dominate the industry chain. The upstream of the UAV industry chain is UAV component manufacturers and sub-system developers; the midstream is UAV system integration and service providers, some of which can provide UAV flight services, flight training services, etc. Dominant in the middle; downstream is mainly divided into military and civilian. By the end of 2019, the application of drones in the field of agricultural plant protection in my country accounted for 42.3%, and the application of drones in the fields of power inspection and security also accounted for more than 10%. The UAV industrial application service market has brought changes in business models. Currently, multi-rotor UAVs occupy a dominant position in the industrial level. |UAV industry chain UAV system integrators dominate the industry chain. The upstream of the UAV industry chain is UAV component manufacturers and sub-system developers; the midstream is UAV system integration and service providers, some of which can provide UAV flight services, flight training services, etc. Dominant in the middle; downstream is mainly divided into military and civilian. |The application status of UAV industry As of the end of 2019, the application of drones in the field of agricultural plant protection accounted for 42.3%, and the application of drones in the fields of power inspection and security also accounted for more than 10%. UAVs can perform tasks that cannot be performed by manual operations, and adapt to difficult and dangerous operating environments, such as logistics and transportation, disaster prevention and mitigation, search and rescue, nuclear radiation detection, traffic supervision, resource exploration, border patrol, forest fire prevention, meteorological detection, crops The use of drones in production estimation, pipeline inspection and other fields has obvious advantages. Considering market demand and technological maturity, logistics distribution and environmental protection testing have huge application potential in the future. |Industrial application service market brings changes in business model An important difference between the industrial drone market and the consumer market is that the proportion of related application services is much higher than that of hardware devices. The consumer market basically exists in the form of selling products to the terminal, while the industrial drone itself is a basic tool for the industry, and the various application services provided for the industrial, commercial, government and enterprise departments are the core, so the final demand side is not necessary. Procurement of drones and master related operating technologies; they can be obtained through leasing, outsourcing and other methods. Therefore, from the perspective of hardware alone, the market size may not reach the consumer level in the short term, but the application service market is quite broad and is expected to maintain a proportion of about 70%. |Multi-rotor UAVs occupy a dominant position in the industrial level At present, multi-rotor UAVs still occupy the vast majority of industrial-grade UAVs, and will maintain a high proportion for a period of time in the future, but the vertical take-off and landing fixed-wing with good comprehensive application is expected to usher in rapid development. |UAV training market Drone pilots are still scarce, and the training market is promising. At present, most of the drone training in China remains at the primary level of drone driving technology, resulting in many people unable to become real industry pilots after obtaining a driver's license. The number of civilian drone pilot licenses has grown rapidly in recent years. According to the "Annual Report on the Development of Chinese Civil Aviation Pilots (2019 Edition)" issued by the Flight Standards Department of the Civil Aviation Administration, as of December 31, 2019, the total number of pilot licenses for civil unmanned aircraft systems was 67,218, mainly distributed in various civil aviation systems. UAV production and research and development enterprises, related application units and colleges and universities. The number of civilian drone pilot licenses in 2019 increased by 274 times compared to 2014. According to the types of drones, as of the end of 2019, the number of multi-rotor drone pilot licenses reached 60,614, accounting for 90.2%; the number of fixed-wing licenses reached 3,524, accounting for 5.2%. The age of drone pilots is mainly between 21-35 years old, and there are more in Central and South China, East China and North China. The age of drone pilots is mainly in the age group of 1947-2003, and the majority of them are young people from 1985-1999. In terms of geographical distribution, there are more drone pilot licenses issued in Central South, East and North China, with Guangdong, Shandong, Henan, Sichuan and Jiangsu ranking the top five. Drone training institutions are developing rapidly. At present, there are already some driving training institutions in the society: One is social educational institutions , such as science and technology training colleges, flight schools, aerospace universities, etc. They rely on the college's advantageous teaching resources to train low-altitude micro and small UAV operators. The other category is civil drone professional aviation operation enterprises or units, drone production and research and development enterprises , using their rich drone industry application experience and equipment advantages to open drone training courses to provide students with market-oriented operations. On-demand drone flight guidance. The third category is the drone operator training course jointly offered by schools and enterprises . According to the data of the "Regulations on the Qualification of Civil Drone Pilot Training Institutions", as of December 31, 2019, a total of 422 drone pilot training institutions have been certified by China's AOPA and have obtained training qualifications. 132 have been cancelled, and the remaining 290 training institutions now have training qualifications. The number of training institutions in Guangdong, Shandong and Beijing ranks high in the country. In 2019, the pass rate of the multi-rotor UAV practical exam was only 60.0%, a year-on-year decrease of 12.7%; the fixed-wing UAV practical exam pass rate was 63.7%, a year-on-year decrease of 14.8%.