In mid-July 2022, eMedClubNews reported that there are currently 14 drugs approved for marketing worldwide, involving 11 targets, with indications covering solid tumors and hematological tumors, and the market sales in 2021 will exceed 5 billion US dollars.

The ADC market is still growing. According to public information, the global ADC drug market is expected to reach $10.4 billion in 2024 and $20.7 billion in 2030.

| "Bio-missile" that precisely blasts cancer cells

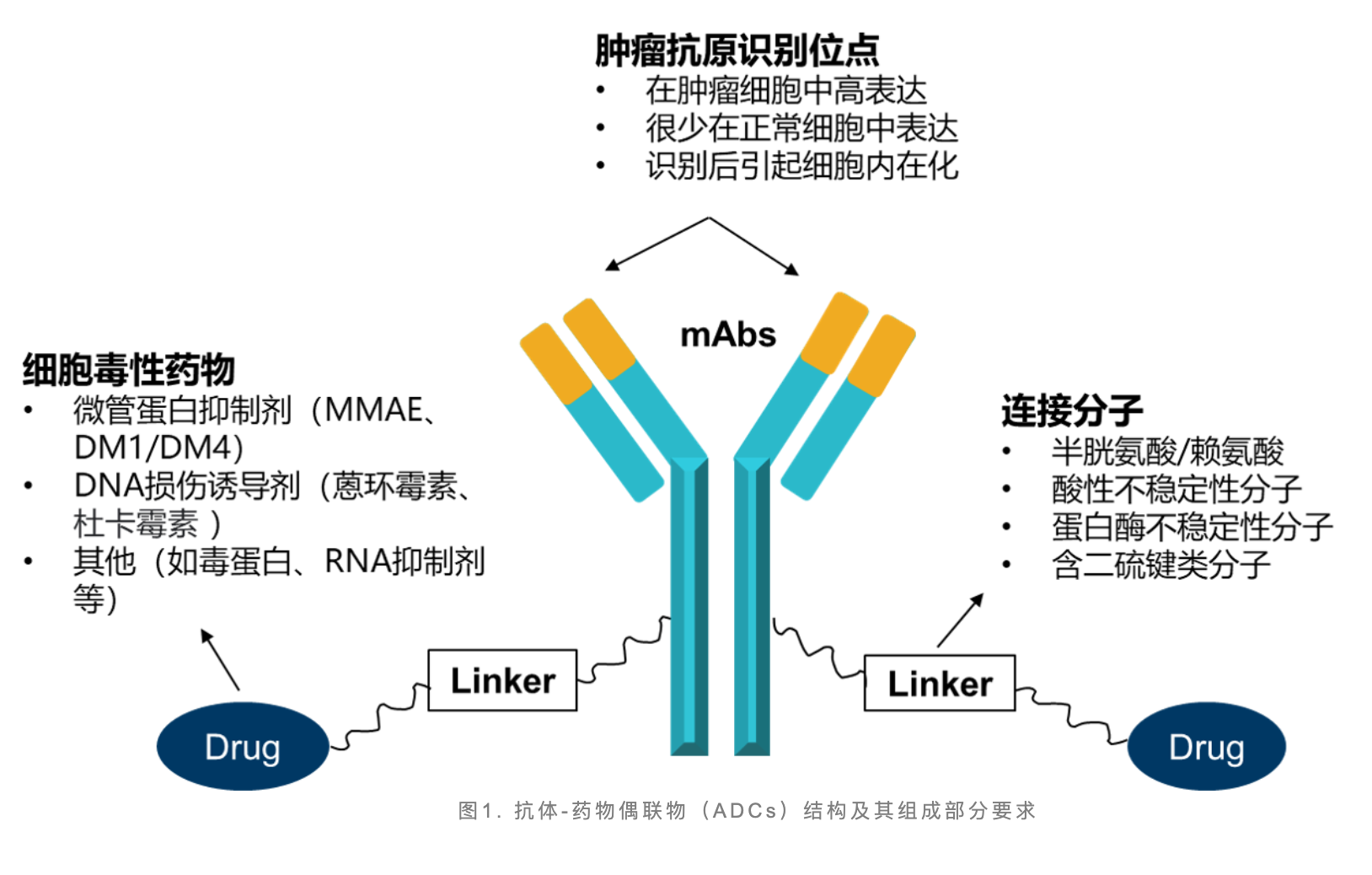

Antibody-drug conjugates (ADC) are composed of three parts: monoclonal antibody, linker and drug loading. ADC specifically binds target antigens highly expressed on the surface of tumor cells through monoclonal antibodies to form ADC-antigen complexes. Then enter the cell through clathrin-mediated endocytosis, so that the drug-loaded drug enters the tumor cell and kills the tumor cell.

ADC has unparalleled advantages and stimulates development enthusiasm around the world. Traditional oncology therapies, such as antibody drugs and chemotherapy, have their own limitations. The safety and efficacy profile of antibody drugs is affected by issues such as batch variability, background signal interference, and side effects, while chemotherapy exhibits high off-target toxicity, leading to risks such as infection, hair loss, and nausea due to the inability to effectively distinguish healthy cells from tumor cells increase.

In contrast, ADCs combine the main advantages of antibody therapy, chemotherapy and small molecule inhibitor therapy, have unique targeting capabilities, and show better clinical trial results, providing better treatment options for cancer patients , showing a great advantage.

With the iteration and maturity of ADC technology, the ADC treatment window has become larger, and more and more ADC drugs that have been marketed or are under development show excellent clinical data, especially in the past in refractory tumors or end-line treatment of tumors. Efficacy; markers overexpressed on the tumor surface or widely distributed in the tumor microenvironment can be potential ADC targets, and more and more new targets will be used for ADC development in the future.

|Funding fever continues to rise

As of 2022, there are more than 400 ADC drugs under research in the world, of which more than 200 have entered the clinical stage, and nearly 60 candidate products have entered the clinical stage in China. Most of the projects are in the pre-clinical test stage or the early stage test stage, and the overall situation has shown a trend of "thousands of sails competing for development and hundreds of boats competing for flow".

At present, ADC has gradually entered a mature stage. In 2021, the global sales will exceed 5 billion US dollars, and the market is still gradually cultivated. According to the prospectus of Lepu Bio, the global market is expected to reach 20.7 billion US dollars in 2030. As one of the hot research directions in the field of tumor treatment, the global ADC-related transactions and financing continue to rise.

Due to the complex pharmacokinetic characteristics, unavoidable side effects, aggregation, tumor targeting and payload release, immunogenicity and drug resistance of the current ADC research and development facing many unsolved challenges, both global and The development of ADCs in China shows a trend of clustering of targets and indications.

According to Yaozhi data, there are a total of 471 ADC clinical development projects in the world, and the targets are mainly concentrated in HER2 (38.4%), EGFR (11.9%), TROP-2 (9.9%), Claudin18.2 (9.9%) a few on a popular target.

In terms of indications for the layout, 95.17% of the indications for the pipeline layout are tumors, followed by autoimmune diseases (1.75%), bacterial infections (0.66%), wet age-related macular degeneration (0.66%), etc.

From the perspective of research and development progress, most of the current research and development projects are in the early stage. Among them, preclinical stage accounted for 46.78%, clinical stage I accounted for 29.93%, clinical stage I/II accounted for 7%, and clinical stage II accounted for 7.54%.

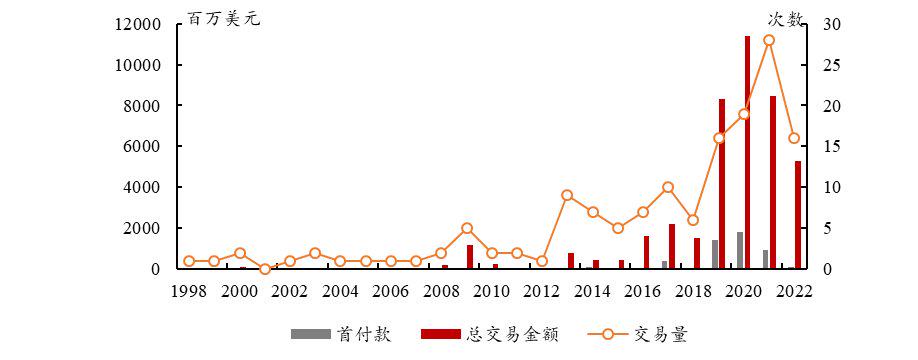

From the perspective of the capital market, ADC has unparalleled advantages compared to traditional therapies, which has stimulated global enthusiasm for development. In order to enter the field, ADC-related BD transactions have skyrocketed in both volume and value.

In 2020, Gilead acquired the ADC company Immunomedics at a high price of US$21 billion, setting a record for the highest transaction of the year. Rongchang Bio, a domestic innovative pharmaceutical company, sold the overseas rights and interests of Vidicitumumab to Seagen at a high price of US$2.6 billion, further proving the R&D strength of Chinese companies.

In February 2022, Johnson & Johnson and Eli Lilly and ADC companies Mersana and ImmunoGen reached a cooperation worth over US$1 billion respectively. The entry of giants has made the track even hotter.

|Competition is becoming a red sea

In addition to the R&D competition, the domestic commercialization competition of ADCs is also becoming increasingly fierce. Enhertu, which shines at the ASCO annual meeting and is known as the "ceiling" in the ADC field in the industry, also submitted a domestic listing application in March this year and was included in the priority review in May.

In June 2021, through the priority review and approval process, Aidixi was approved for listing with conditions. In December of the same year, Aidixi was included in the National Medical Insurance Catalogue. In 2021, the sales of Aidixi will be about 84 million yuan. Up to now, in addition to Aidixi, the ADCs approved for marketing in China include Seagen and Takeda's velbutuximab (Adcetris), Roche's trastuzumab (Kadcyla), and Pfizer's Ogaituo. Besponsa, and the recently approved Tuodawei.

According to the financial report, the 2021 sales of Adcetris, Kadcyla, Enhertu, and Besponsa will be $1.306 billion, $2.178 billion, $426 million, and $192 million, respectively.

According to the prediction of the scientific magazine Nature, the domestic ADC market will be launched in 2020. It is expected that the market size will reach 7.4 billion yuan and 29.2 billion yuan in 2024 and 2030, respectively, with a compound annual growth rate of 25.8% from 2024 to 2030.

In China, a pattern of innovation and differentiation has gradually formed from imitation and improvement to differentiated layout.

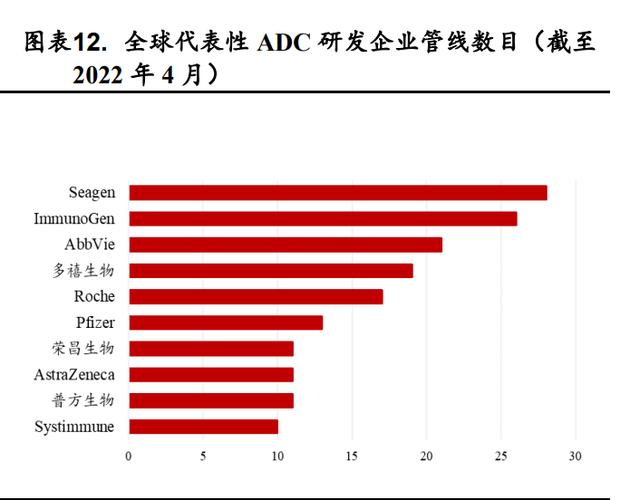

According to the disclosure of the Medicine Rubik's Cube database, as of April 2022, Duoxi Bio (19), Pufang Bio (11), Rongchang Bio (11), and Hengrui Medicine (600276) (8) are domestic layouts. The four companies with the most ADC pipelines. Among them, the HER2 ADC drug SHR-A1811 with the fastest research and development progress of Hengrui has carried out a number of Phase I and Phase II clinical trials, and several ADC drugs with undisclosed targets are in the Phase I clinical stage.

TAA013 from TOT BIOPHARM aims to be an affordable alternative to Kadcyla, and has been rapidly advanced to the pivotal Phase III clinical trial. If it is successfully launched, it will reduce the burden on patients and gain a share of the ADC market.

In general, it is not difficult to find that when domestic enterprises are making differentiated layouts, they are mainly innovating in three aspects: targets, clinical indications, and technology platforms; and in terms of R&D models, they have gradually shifted from cooperative R&D to independent R&D. transition.

At present, there are many dazzling antibody labeling technologies on the market, and only by choosing better ones can we save time and effort in early research and development, avoid uncertain risk factors, and set sail in a red sea.