(1) Industry overview and industry chain

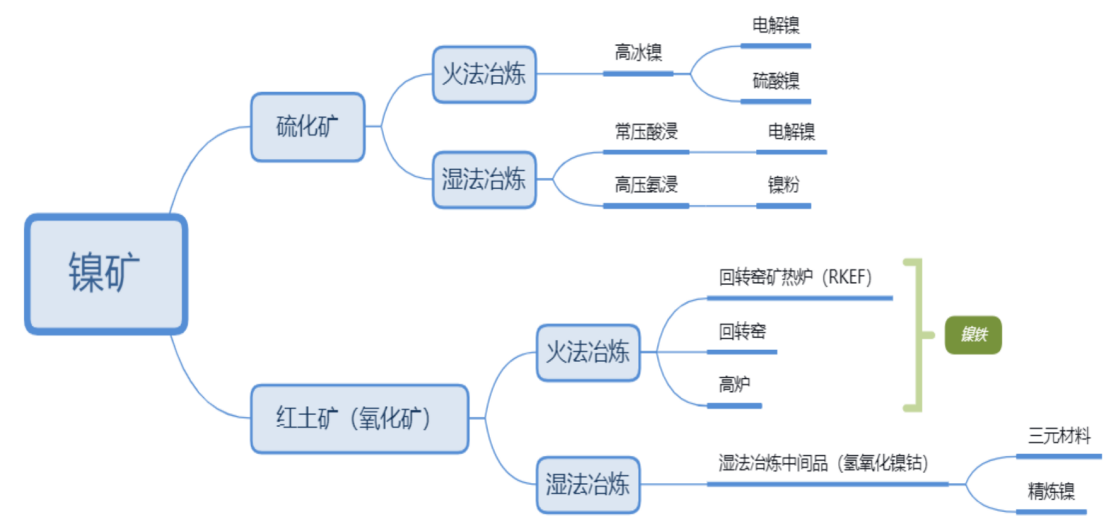

The global nickel ore is mainly distributed in laterite nickel ore (accounting for 55%), sulfide ore (accounting for 28%), and seafloor manganese nodules (accounting for 17%). However, due to the difficulty of mining seabed nickel resources, only sulfide ores and laterite ore can be used by humans.

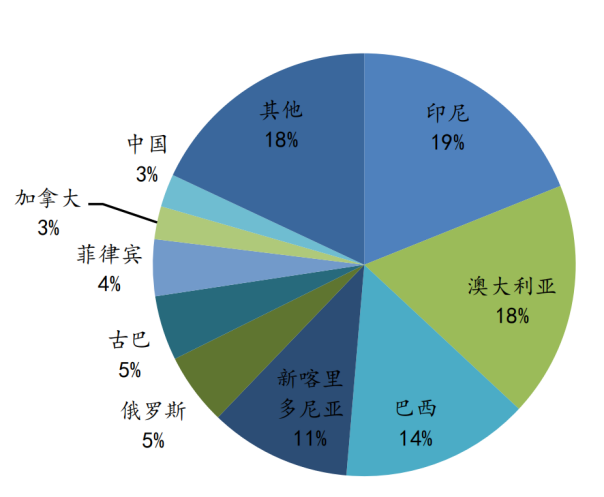

Laterite nickel ore is mainly distributed in Brazil, New Caledonia, Cuba, Indonesia, the Philippines, Colombia and other countries near the equator. Sulfide ores are mainly distributed in Australia, Russia, Canada, China and South Africa.

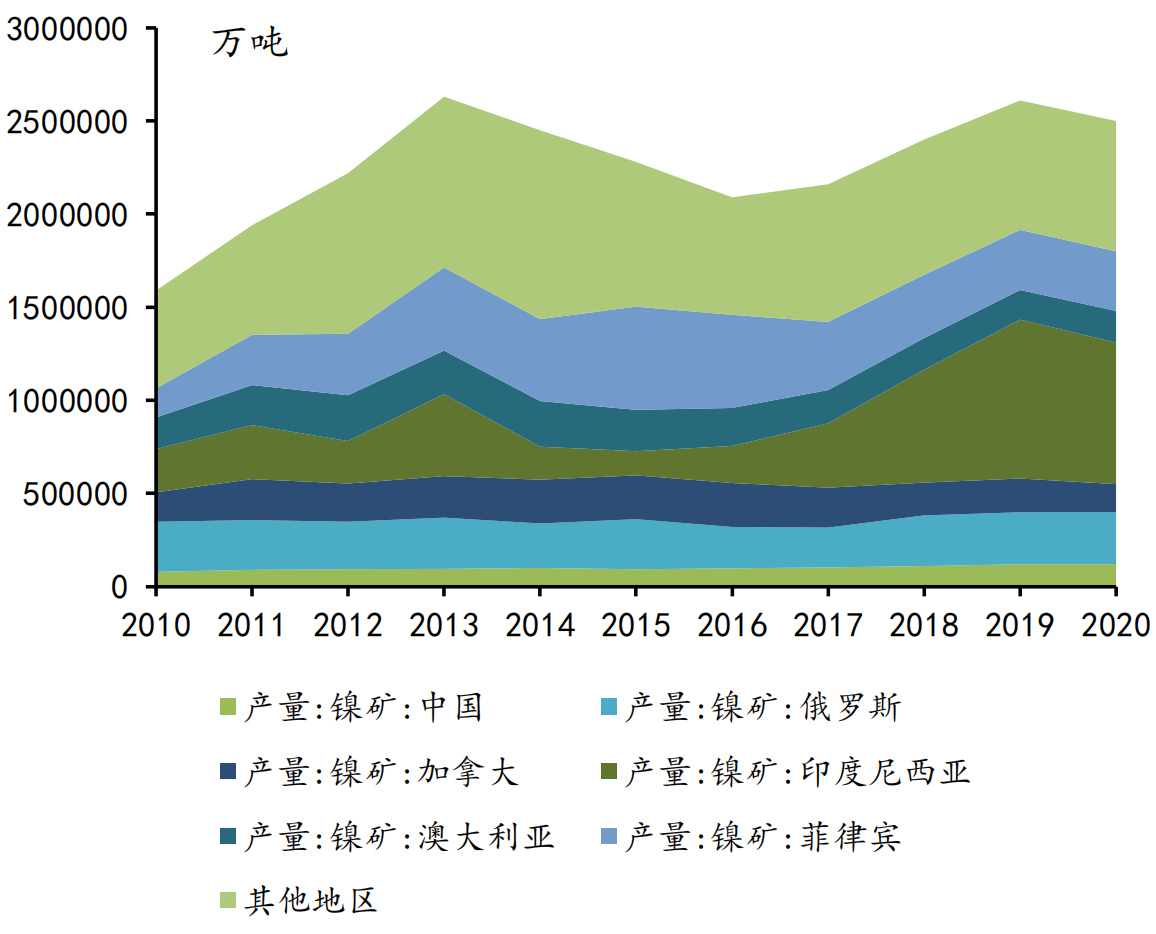

From the perspective of reserves, Australia, New Caledonia and Brazil occupy more nickel resource reserves. However, the Philippines and Indonesia, which are located near the equator , are the two countries with the highest output due to the low mining cost of laterite nickel ore and the advantages of transportation costs, and are the main suppliers of nickel ore to China.

Global nickel ore reserves distribution

Global nickel mine production distribution

There are four paths for the formation of nickel sulfate:

1) Nickel sulfide ore is first made into high nickel matte through pyrometallurgy (reduction sulfide smelting nickel sulfur process), and then further refined to obtain nickel sulfate.

2) Another route is to process into electrolytic nickel, such as nickel beans and nickel powder, on the basis of high nickel matte obtained by pyrometallurgical smelting of nickel sulfide ore, and finally make nickel bean or nickel powder into nickel sulfate. The global reserves of laterite nickel ore are much higher than that of nickel sulfide ore, so in recent years, the importance of laterite nickel smelting process development has gradually increased. The smelting of laterite nickel ore can also be divided into two categories: pyrometallurgy and hydrometallurgy.

3) There are two processes in hydrometallurgy, ammonia leaching process and high-pressure acid leaching process. The ammonia leaching process is generally only suitable for the treatment of surface laterite ore, and the production cost is high, and the recovery rate of nickel in the whole process is only 75%-80%, and cobalt is about 40%. %-50%.

Minerals with low magnesium and aluminum content and high iron content are suitable for high-pressure acid leaching process. The biggest advantage of this process is that the recovery rate of nickel and cobalt can reach more than 90%. Nickel-cobalt hydroxide (MHP) or nickel-cobalt sulfide (MSP), the intermediate nickel product obtained above, can be further processed to obtain nickel sulfate.

4) Nickel-sulfur is obtained from laterite nickel ore through the pyrometallurgical smelting process (reduction sulfidation smelting nickel-sulfur process), and high-grade nickel matte is obtained by converter blowing, and finally nickel sulfate is produced.

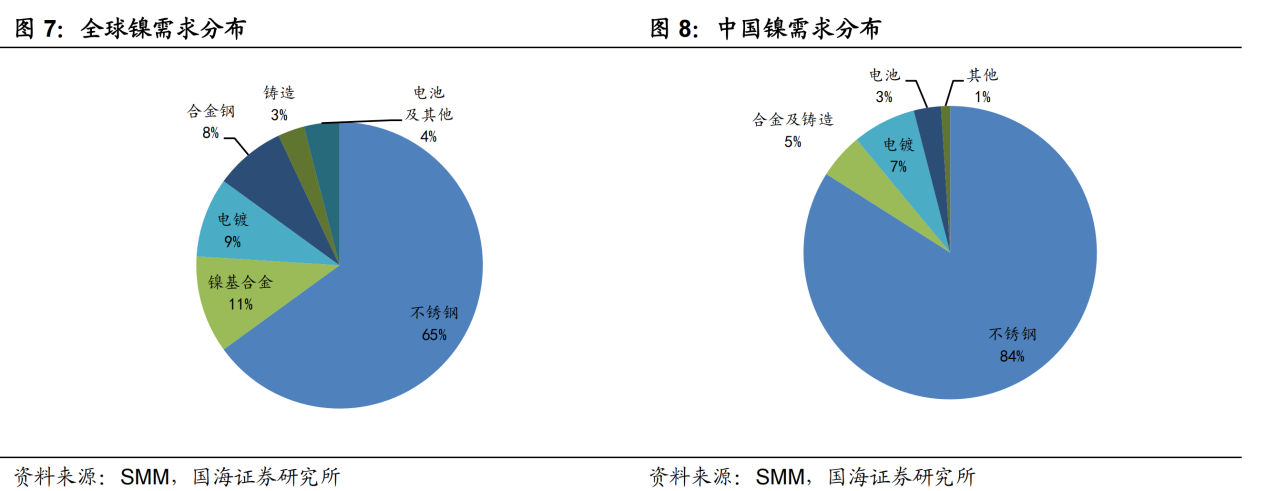

The downstream demand for nickel is still mainly concentrated in stainless steel , and batteries only account for a very small proportion. According to SMM data, in 2019, the global nickel used for stainless steel production accounted for 65% of nickel consumption, and the domestic nickel consumption for stainless steel production accounted for as high as 84%. In order to facilitate production, the stainless steel industry chain often uses nickel pig iron as nickel raw material, plus some pure nickel to prepare the nickel content of stainless steel.

Because laterite ore itself has nickel and iron elements, nickel and iron are directly used in stainless steel production as an intermediate product, which not only reduces the steps of nickel purification, but also can use the iron element of laterite ore.

(2) Market environment analysis

Driven by the demand of the new energy industry chain, the production and demand of nickel beans/wet process intermediates-nickel sulfate-ternary precursors have increased together . Domestically, imported nickel hydrometallurgical intermediates will be used to produce nickel sulfate, and if there is profit, it will also be converted to produce refined nickel. The direct production of nickel sulfate is highly economical, but the shortage of domestic raw materials restricts the production of nickel sulfate.

Domestic nickel hydrometallurgical intermediates are mainly imported from Papua New Guinea, Finland and other countries. In 2020, due to the epidemic, the supply of these two places will be negatively affected to a certain extent.

In addition, First Quantum's Ravensthorp project in Australia also produces nickel hydrometallurgical intermediates. Since the resumption of production in March 2020, there has been a large increase in shipments to China. It is expected that from 2021, as the epidemic situation improves in Papua New Guinea and Finland, the supply will be replenished, and the domestic imported nickel hydrometallurgical intermediate products will increase by 29,000 tons, which is equivalent to about 12,000 tons of nickel metal.

In the long run, there are not many new projects for supplying nickel sulfate from laterite mines in other regions, and the source of domestic nickel sulfate raw materials will be aimed at Indonesia, which is rich in laterite nickel ore.

China's import volume of hydrometallurgical intermediate products (tons)

Import source | 2019 | 2020 | year-on-year | Source ratio |

Papua New Guinea | 233688 | 181106 | -twenty two% | 49.89% |

Finland | 44023 | 31104 | -29% | 8.57% |

Turkey | 11577 | 25930 | 124% | 7.14% |

Xinka | 25205 | 82333 | 226% | 22.68% |

Australia | 0 | 34665 | 9.55% | |

total | 303675.7 | 363002.5 | 19% |

Data source: General Administration of Customs

Indonesia's wet process production capacity construction is relatively concentrated, in response to the increase in domestic demand for nickel sulfate. Since 2018, the traditional production route of nickel sulfate (sulfide ore-nickel sulfate) can no longer continue to meet the demand for nickel sulfate in ternary batteries due to the limited increase in sulfide ore resources.

Domestic enterprises are further targeting Indonesia, which is rich in laterite nickel ore, to build HPAL wet process and fire process-high matte nickel-nickel sulfate production capacity, and strengthen the utilization of laterite nickel ore.

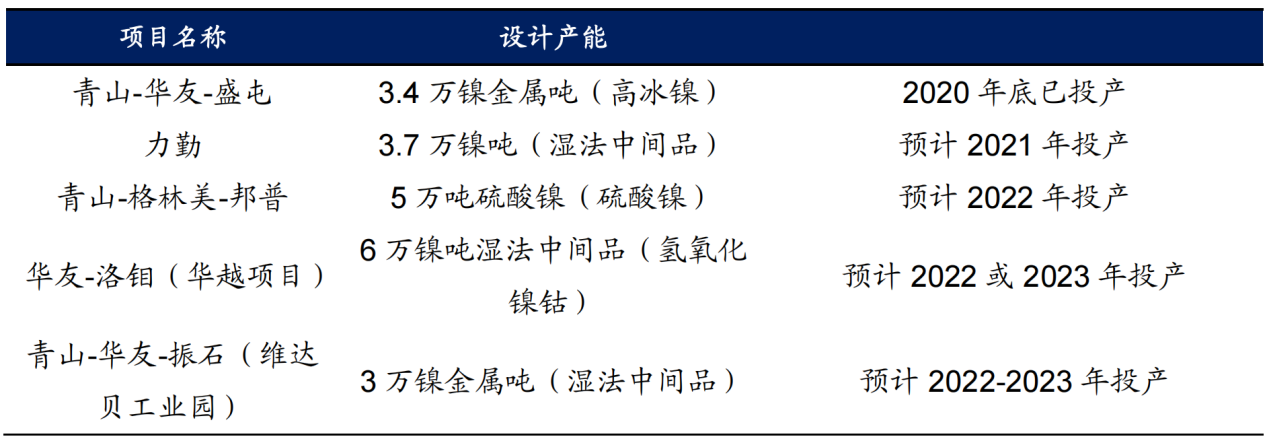

In Indonesia, the 34,000-ton high matte nickel project of China Shengtun/Huayou/Qingshan (wet process) has been put into operation at the end of 2020, and the 50,000-ton nickel sulfate project of China GEM/Bangpu/Qingshan (wet process), China Liqin /Indonesia Khalida (wet process) 37,000 tons of nickel-cobalt intermediate products, and Qingshan-Huayou-Zhenshi (Vidabe Industrial Park) will be put into operation in the past three years. It is expected that the domestic supply of nickel sulfate raw materials will be in the next three years. Enhanced security capabilities.

Production progress of Indonesia wet process project

Source: Mysteel

The incremental supply of nickel sulfate has steadily expanded capacity. In recent years, the new expansion projects of nickel sulfate in the world mainly include domestic Jinchuan, Jien Nickel, Huayou, Yinyi, etc., and overseas projects include Finland's Terrafame and BHP.

Among them, the nickel sulfate raw materials of Jinchuan and Jien Nickel come from their own sulfide ore, which is produced through the sulfide ore-high nickel matte-nickel sulfate route, while other production capacity relies more on imported wet intermediate products as raw materials.

In 2021, the domestic nickel sulfate production capacity is expected to increase by 166,000 physical tons, while the overseas BHP+Terrafame is expected to increase the total production capacity by 270,000 physical tons.

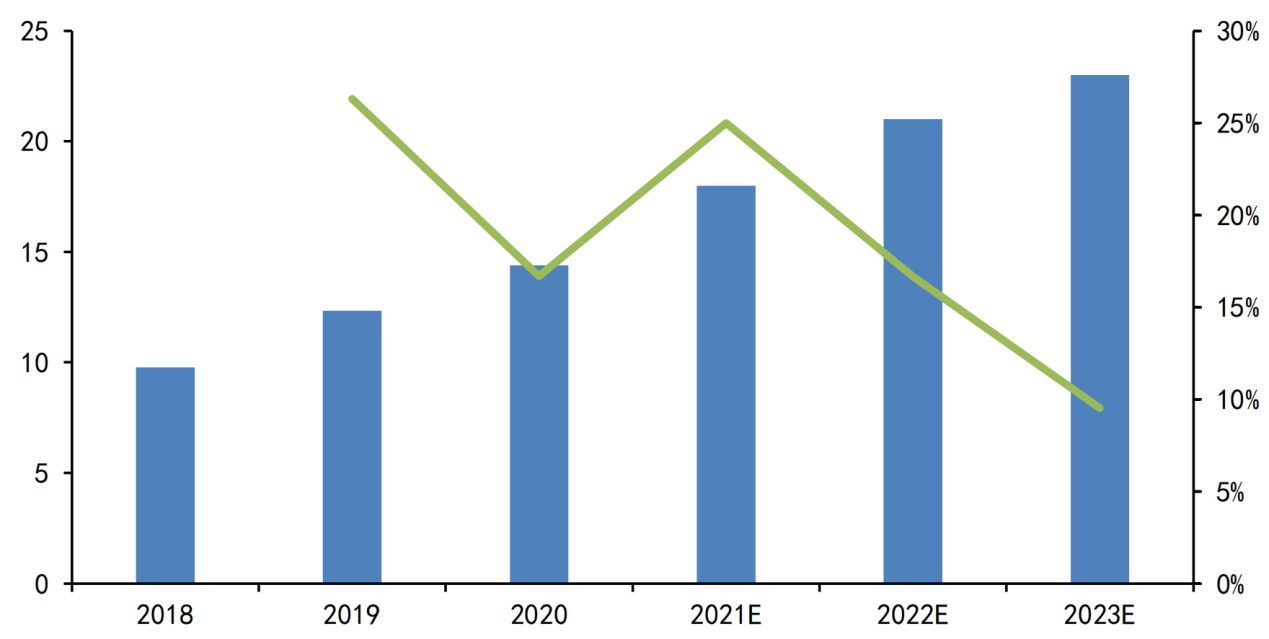

In 2019, the global nickel sulfate production was about 206,800 nickel metal tons, and the domestic production was 123,400 nickel metal tons, accounting for 60%. By 2020, domestic production will increase to 144,000 tons of nickel metal, a year-on-year increase of 16%. With the further growth of demand for nickel consumption in lithium batteries and the further expansion of nickel sulfate production capacity, domestic nickel sulfate production will maintain a steady growth. It is expected to increase to 230,000 nickel metal tons in 2023, with a 3-year CAGR of 16.8%.

China's nickel sulfate production (ten thousand nickel metal tons)

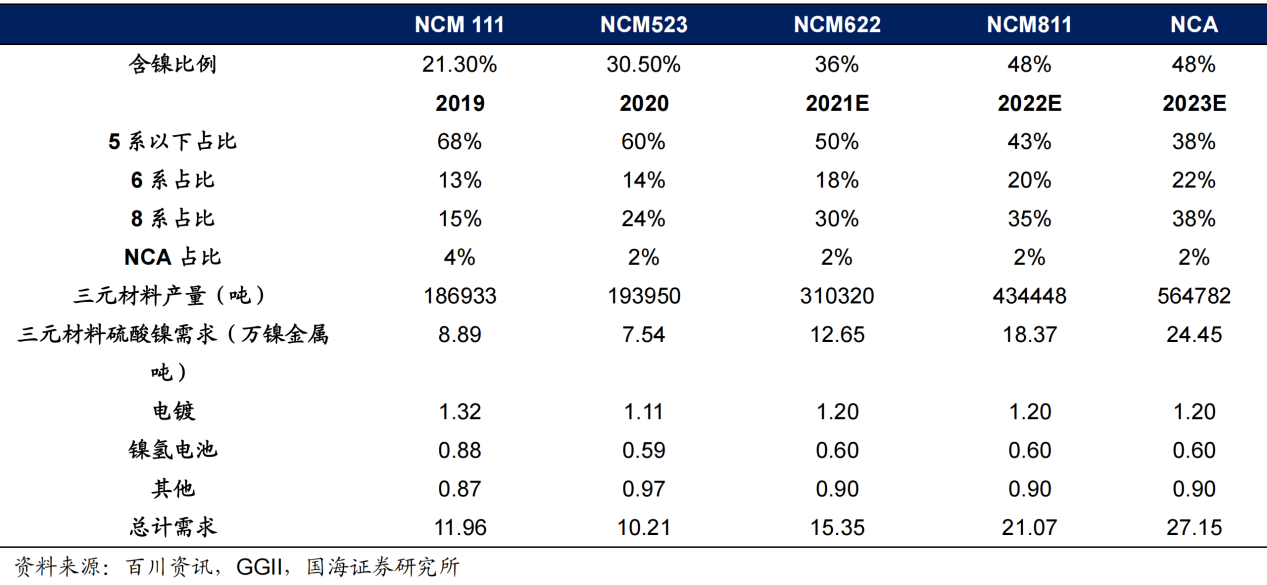

Demand pull factors: electrification and high nickel.

The steady growth of global new energy vehicle production and sales is highly certain. It is tentatively estimated that global new energy vehicle sales will be 4.65 million, 6.98 million and 10.48 million in 2021, 2022 and 2023, respectively, with an annual compound growth rate of 50%. The domestic production of new energy vehicles in 2021, 2021 and 2023 will be 2.10 million, 2.94 million and 3.82 million, respectively, with an annual compound growth rate of 42.9%.

High-nickel ternary (NCM) is a long-term trend in the development of lithium batteries. From the perspective of cost, the cost of raw materials can account for as high as 90%, and there is still room for cost reduction of raw materials. Due to the shortage of global cobalt resources and the great influence of international trade, the price of cobalt fluctuates greatly and the price center is at a high level all the year round.

The current cobalt price exceeds 300,000 yuan/ton, while the current nickel price is 130,000 yuan/ton. The cost advantage of nickel metal is relatively significant. High nickel ternary battery is a more effective way to reduce the amount of cobalt, so the future development of ternary battery to high nickel is a certain direction.

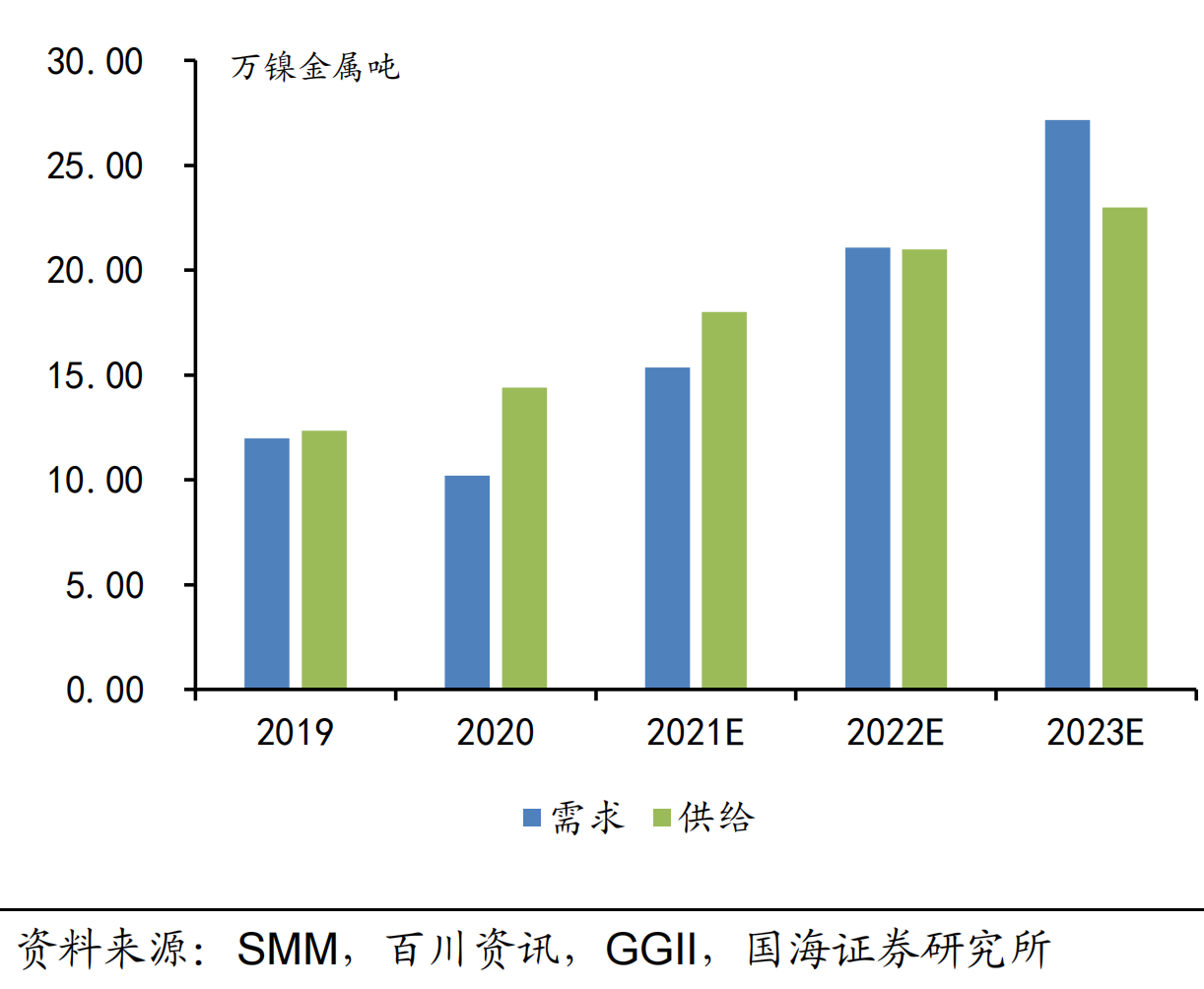

Ternary power batteries promote the growth of domestic demand for nickel sulfate. The total domestic demand for nickel sulfate in 2021, 2022, and 2023 will be 153,500, 21,07, and 271,500 tons of nickel metal, respectively. The three-year CAGR was 38.6%.

In this context, it is estimated that the domestic supply and demand balance of nickel sulfate from 2021 to 2023 will be 26,500 nickel tons/-0.07 million nickel tons/-41,500 nickel tons respectively. Starting from 2022, nickel sulfate will face a shortage of supply, and nickel sulfate will enjoy a higher premium relative to the benchmark price of pure nickel.

Domestic nickel sulfate may face shortage

(3) Competitive landscape and representative enterprises

The domestic nickel sulfate producer Jien Nickel has been delisted in 2018, Jinchuan Group, Tsingshan Holdings, etc. have not been listed, and nickel sulfate only accounts for a small proportion of the main business of Huayou Cobalt, China Molybdenum and other companies.

Because cobalt and molybdenum are both rare metals, Huayou Cobalt and Luoyang Molybdenum are comparable companies with a comprehensive PE of 20-30.

company | Company Profile | Operating income | net profit | PE |

Huayou Cobalt | Mainly engaged in the deep processing of cobalt new material products and the mining, selection and smelting of cobalt and copper non-ferrous metals | 353.17 | 40.24 | 29.20 |

CMOC | Engaged in mining, smelting, deep processing, trade and scientific research of rare and basic metals such as molybdenum, tungsten, copper and gold | 1738.63 | 54.28 | 18.48 |

average value | 1046 | 47.26 | 23.84 | |