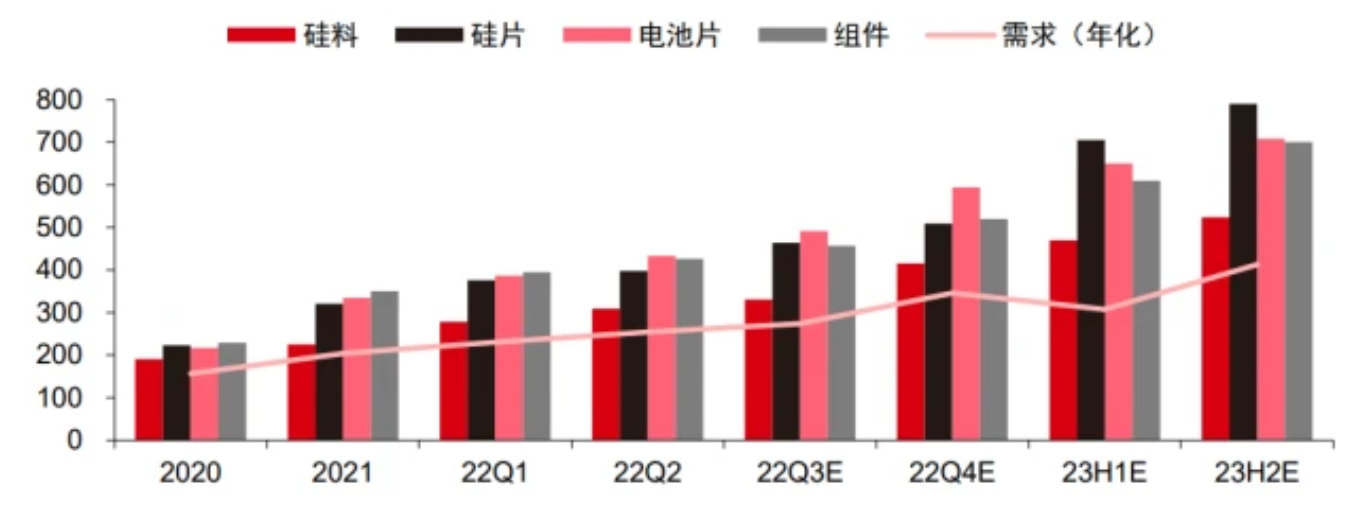

In 2021, the price of silicon material is already on the rise, from 85,000 yuan/ton at the beginning of the year to the highest at the end of the year, about 270,000 yuan/ton. Recently, the news that the price of silicon material has exceeded 300,000 yuan/ton has caused an uproar in the market. Compared with last year, the price has increased by more than 242%. So far, the "pause button" has not been pressed, becoming the biggest bottleneck in the photovoltaic industry chain. In response, driven by the huge profits brought about by the tight market supply, the former silicon material companies have sprung up like mushrooms after a rain, returning to the silicon material track with more aggressive expansion enthusiasm. |In July, the price of polysilicon material continued to rise As the demand for photovoltaics exceeds expectations, the price of silicon material as the upstream raw material of the photovoltaic industry is also high. On July 6, the Silicon Branch of China Nonferrous Metals Industry Association announced the latest polysilicon prices. This week, the domestic single crystal re-feeding price range is 288,000-300,000 yuan/ton, the average transaction price is 291,600 yuan/ton, a week-on-week increase of 1.85%; the price range of single crystal dense material is 286,000-298,000 yuan/ton , the average transaction price was 289,600 yuan / ton, a week-on-week increase of 1.9%. The price increase of silicon material continues to transmit pressure to the downstream, driving the price of the entire photovoltaic industry chain such as silicon wafers and modules to rise. The skyrocketing price of photovoltaic modules has directly affected the investment and construction progress of photovoltaic projects. High-purity polysilicon (silicon material), known as "black gold", is the basic raw material in the upstream link of the photovoltaic industry chain. After polysilicon is melted and casted or pulled into slices, it can be made into polycrystalline silicon wafers and monocrystalline silicon wafers, and then use for the manufacture of photovoltaic cells. Among them, the average transaction price of single crystal re-feeding, single crystal dense material and single crystal cauliflower material increased by about 1.6%. The price increase was partly because the total domestic polysilicon supply was lower than expected due to power cuts or unplanned shutdowns of individual companies in June, and the lack of supply caused by temporary production cuts led to an increase in urgent orders and bulk orders in the short term. To produce polysilicon, trichlorosilane is required as a raw material. At present, the common process for producing polysilicon is the modified Siemens method. This method uses hydrogen chloride and industrial silicon powder to synthesize trichlorosilane at a certain temperature, and then purifies the trichlorosilane, and the purified trichlorosilane is reacted in a hydrogen reduction furnace to generate high-purity polysilicon. The price of trichlorosilane has also risen since last year. Sanfu Co., Ltd. produced about 60,000 tons of trichlorosilane last year, and is currently building a new production capacity of 50,000 tons. It is expected to be completed in the third quarter and output in the fourth quarter. As of June, the average domestic market price of photovoltaic grade trichlorosilane was 26,000 yuan per ton, and the quotations of individual manufacturers reached 28,000 to 30,000 tons per ton. In contrast, the market price of photovoltaic-grade trichlorosilane at the beginning of this year was between 16,000 and 17,000 yuan per ton. In July, the domestic supply of about 65,000 tons of silicon materials (including imports) can only meet the output of about 24.5GW of silicon wafers. Compared with the demand for silicon materials corresponding to the current production capacity of silicon wafers, there is a large gap. 7 The price of polysilicon will continue to maintain the upward trend in the month. |Silicon material shortage will continue in the short term Tight supply pushes the price of silicon material to continue to rise. Due to the tight supply of silicon materials, it is difficult to effectively release new production capacity in the short term. Looking forward to the fourth quarter of 2022, although silicon materials may usher in a small peak in phased production expansion, as photovoltaics enter the peak season of installations and the potential start-up of domestic ground power stations, the actual supply and demand of silicon materials may still be relatively tight, and the expected price of silicon materials is expected. The decline is relatively limited. At present, silicon material will still be the link in the main photovoltaic industry chain with the tightest supply and the least flexibility in production capacity. According to the latest production scheduling plans of various enterprises , the domestic polysilicon production in July was about 58,000 tons, a net decrease of about 3,200 tons from the previous month. Enterprises with reduced output include Xinjiang GCL, Dongfang Hope, Tianhong Ruike, etc., with a total reduction of about 6,700 tons. In the same period, four domestic enterprises expanded their production capacity and released a small amount of capacity, including GCL Technology, Baotou Xinte, Yunnan Tongwei, and Asia Silicon Industry. In addition, the output of individual enterprises fluctuated normally, and the increment totaled about 3,500 tons. In the short term, in the stage of tight supply and demand in the industry, high-quality enterprises will reap significant excess profits, and profit growth will be highly elastic; in the long run, leading enterprises will lead the expansion of production capacity, and the advantages in quality, cost and scale are expected to continue to be consolidated. In the next two years, silicon materials may still be the link with the least supply flexibility in the main industrial chain. In 2022Q4, silicon materials may usher in a small peak of phased expansion, but as photovoltaic installations enter the peak season, it is expected that the actual supply of silicon materials will still be relatively tight, and the price drop of silicon materials is expected to be relatively limited. In 2023, silicon materials will enter the stage of concentrated release of production capacity. However, considering the release of nearly 200GW of new production capacity in the silicon wafer segment, the increase in the capacity ratio of terminal power stations, and the procurement of inventory and other factors, the downstream capacity of silicon materials is expected to be digested. enhanced. At present, in the next two years, silicon materials will still be the link with the most limited supply and the least flexibility in production capacity in the main photovoltaic industry chain.