Development prospects and investment hotspots of semiconductors in 2022

As the Pearl of the high-tech crown, the semiconductor industry is the national basic industry, and the chip is the focus of the game among big countries. The development of the semiconductor industry has a high strategic significance.

According to the latest data released by SIA, from January to November 2021, the cumulative annual sales volume of global semiconductors reached 1.05 trillion, setting an all-time record. Regionally, sales increased year-on-year in the Americas (28.7%), Europe (26.3%), Asia Pacific / all other regions (22.2%), China (21.4%) and Japan (19.5%).

At present, China is the largest semiconductor consumer in the world, accounting for more than 60% of the demand, but the self-sufficiency rate is still not high, and domestic substitution is imperative. With the support of national policies and strong market demand, the capacity expansion and project construction of the domestic semiconductor industry are in full swing. The next few years may be the golden investment period of the semiconductor industry.

01 IC Insights

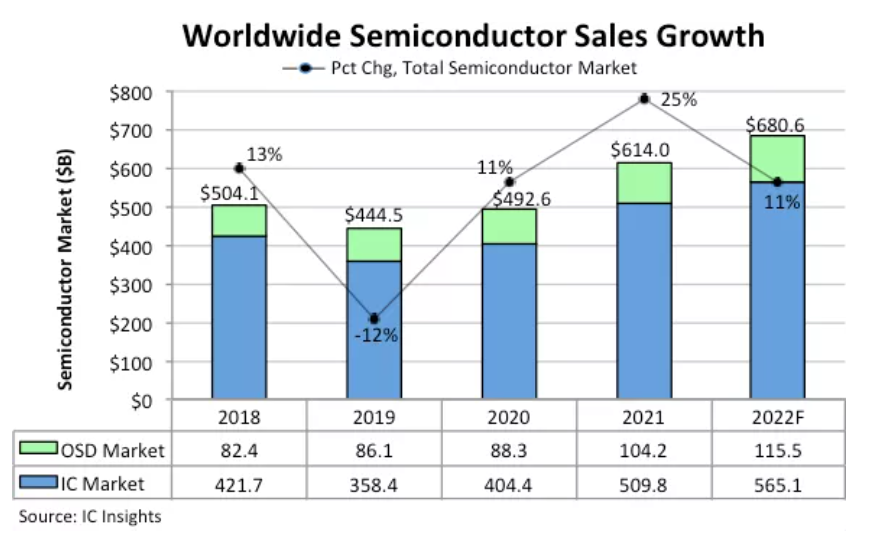

Global semiconductor sales increased by 11% in 2022

According to IC Insights's January semiconductor industry express report, the global semiconductor revenue increased by 25% in 2021 after the rebound from the COVID-19 crisis in 2021. The total semiconductor sales in 2022 will increase by 11% and reach a record $680 billion 600 million.

The semiconductor industry express shows that the whole semiconductor market will grow at a low double-digit rate in 2022 (as shown in the figure below). Sales growth in all major semiconductor product categories is expected to slow, but still above average.

▲ global semiconductor sales growth chart, source: IC insights

02 Development prospect

What is the development prospect of domestic semiconductors in 2022?

Semiconductor industry is a national strategic industry, which is highly supported by the state

Due to the late start of China's semiconductor industry, the development of China's semiconductor industry can not meet domestic demand at this stage, and a large number of semiconductors still rely on imports. In order to encourage and promote the development of integrated circuit industry, the state has issued a series of fiscal, tax and intellectual property protection policies. In August 2020, the State Council issued the notice on several policies to promote the high-quality development of integrated circuit industry and software industry in the new era, which strongly supported the integrated circuit industry.

Domestic substitution brings development opportunities for semiconductor industry.

China is in the process of changing from manufacturing industry to cutting-edge industrialization. Industrial intelligence and informatization have become an important direction of national development. As the "granary" of electronic system and the carrier of data information, chips play a key role in ensuring the reliability and security of important information storage. However, at present, China's chip self-sufficiency rate is low, and medium and high-end chips are obtained through import, With the frequent trade frictions between China and the United States, the importance of mastering independent and controllable storage technology is gradually highlighted. In the future, the gradual promotion of domestic substitution and the improvement of IC self-sufficiency rate will bring new development opportunities for China's semiconductor industry.

Domestic industrial chain supporting facilities will be gradually improved

At present, China has become the largest consumer electronics market in the world. Its huge consumer group and strong consumer demand have attracted the global integrated circuit industry to gradually transfer to the Chinese market. Not only well-known wafer foundry and packaging and testing manufacturers at home and abroad have established production lines in China, which has improved and enriched the integrated circuit industry chain, It provides sufficient capacity support for domestic IC design enterprises.

The terminal application market is developing rapidly, and the demand for chips continues to grow.

With the increasingly complex functions of downstream products and the continuous expansion of application fields, their performance requirements continue to improve, bringing new market demand to the integrated circuit industry. Chips have been gradually used in emerging fields such as automotive electronics, 5g communication and intelligent terminals, especially in terminal products such as ADAS system, 5g base station and smart home. The rapid development of the above application fields and terminal products will further drive the increasing demand for memory chips, and the broad emerging market will bring new development opportunities for industry companies.

03 Investment hotspot

Where are the investment hotspots of the semiconductor industry in 2022?

In 2021, the main semiconductor segments pursued by the capital market include: GPU, DPU and other high-performance special processors strongly combined with the data center scene, vehicle specification MCU, ADAS, laser / millimeter wave radar and other key chips concerned by the capital market due to the global lack of core, SiC brought by new energy vehicles and carbon neutralization concept Gan and other power semiconductors are the whole industrial chain from substrate materials to device manufacturing, as well as WiFi 6, saw filter and other products that meet the localization needs of the new generation of communication. It focuses on the terminals and infrastructure of new energy intelligent vehicles, AR / XR and other meta universe concepts, as well as key chips related to applications such as carbon neutralization.

In 2022, there is no doubt that semiconductors will still be the most representative mainstream of investment in hard technology in China, but the main logic of investment will be adjusted: from comprehensive coverage to in-depth layout, from product driven to factor driven such as production capacity and talents, from catch-up and substitution to both catch-up and leading, from pursuing value hotspots to looking for value depressions.

To sum up, China's semiconductor industry will still ride the wind and waves in 2022, but only by strengthening the foundation in a good direction can it be stable and far-reaching. Friends with different views are welcome to leave a message in the comment area for discussion.

— END —

Article data source: China business intelligence network, IC insights

The trends described in this article are for readers' reference only and do not constitute investment suggestions