While the production capacity crisis caused by the "lack of cores" in the world continues, another effect of the imbalance between supply and demand in the market is also emerging. Due to the sharp drop in shipments of smart terminals, the risk of "cutting orders" for some types of chips is on the rise. According to data released by Canalys, a market research institute, in the first quarter of 2022, global smartphone shipments reached 311.2 million units, a year-on-year decrease of 11%. At the same time, the shipments of Xiaomi, OPPO, and vivo, which occupy the top three domestic mobile phone sales, all experienced a year-on-year decline of more than 20%.

The decline of nearly 30% was soon transmitted to the upstream chip industry. The Android phone market in mainland China will continue to decline, and 270 million orders have been cut this year. Among them, about 170 million smartphone orders have been cut in March, and another 100 million orders have been cut by now.

Take MediaTek, which is currently No. 1 in the mobile phone chip market, as an example, 5G chip orders in the second half of this year. Among them, MediaTek's orders for mid- and low-end products in the fourth quarter were adjusted by 30% to 35%; Qualcomm lowered orders for high-end Snapdragon 8 series by about 10% to 15%.

|Competition has come to self-developed chips

At present, the vast majority of domestic mobile phones use Qualcomm chips. Except for Huawei's self-research and MediaTek processors, which mainly focus on low-end mobile phones, Qualcomm is still the mainstream of the market.

But for domestic manufacturers, if they want to stand up, they must develop their own chips. Having a brand's own chip is equivalent to mastering the direction of your own path.

If foreign chips are used all the time, it is equivalent to directly strangling the throat of the company . This monomial containment is extremely detrimental to the development of the brand.

From the perspective of chip production models in the mobile phone industry, there are currently two types. One is Apple: self-developed chips and then handed over to TSMC and other international chip foundries for production. The other type is the current model commonly used by major domestic mobile phone manufacturers: purchasing the most cutting-edge chips in the market from professional chip manufacturers such as Qualcomm and MediaTek.

Behind the battle of mobile phone manufacturers to make cores, from the perspective of experience, on the one hand, it is to enhance the competitiveness of mobile phones. But more importantly, manufacturers must break the stereotype of "assembly factory" and establish the image of technology-based manufacturers.

|Mobile phone manufacturers have created "Chinese cores", highlighting the encirclement

As the competition in the smartphone market gradually turns to the high-end, manufacturers have basically chosen a breakthrough direction that is roughly close, that is, self-research of chip products. At present, well-known manufacturers in the market have basically brought their own chip products.

Xiaomi: At the second spring conference last year, it was announced that the Surging chip will return again, but this time it is not in the form of an SoC, but an ISP (image signal processing) chip called "The Paper C1". The Surging C1 has a dual filter configuration, which can realize parallel processing of high and low frequency signals, and the signal processing efficiency is improved by 100%. With the self-developed algorithm, the performance of the most basic and important 3A of images (ie better auto focus (AF), more accurate white balance (AWB), and more accurate auto exposure (AE)) can be greatly improved. At the end of last year, Xiaomi announced the launch of the charging chip Surging P1, which is used in the Xiaomi Mi 12Pro.

As we all know, the current 100W fast charge is basically composed of dual cells, and after the built-in Surging P1, Xiaomi Mi 12Pro has realized a 120W single cell. According to the battery energy, the single cell is higher than the dual cell, and the same volume is maintained. Larger battery capacity.

That is to say, Xiaomi's Pengpai P1 charging chip has been distributed to the Redmi brand, and it may be carried by more Xiaomi models in the future.

OPPO: At the "OPPO Future Technology Conference" meeting, OPPO officially released its first self-developed chip, the Mariana MariSiliconX based on the 6nm process. This chip consists of a self-developed image processing unit MariLumi, a self-developed AI computing unit MariNeuro, and on-chip memory subsystems and other core components. According to reports, MariSiliconX is the world's first dedicated NPU chip designed for imaging. Its AI computing power is as high as 18TOPs, surpassing Apple's A15, and its energy efficiency ratio has reached 11.6TOPs/W. At the same time, it also supports up to 20bitUltra HDR and real-time RAW calculation, which can maximize the capabilities of OPPO's customized RGBW sensor and solve many problems in traditional mobile phone imaging.

The OPPO Find X5 Pro released this year is equipped with OPPO's first self-developed image-specific NPU chip - Mariana MariSiliconX. Through DSA's new golden architecture concept, 6nm advanced process and self-developed IP design, it brings customization of vertical links for images. Integration breaks the long-standing synergy problem between algorithms, chips and sensors, and elevates computational photography to new heights.

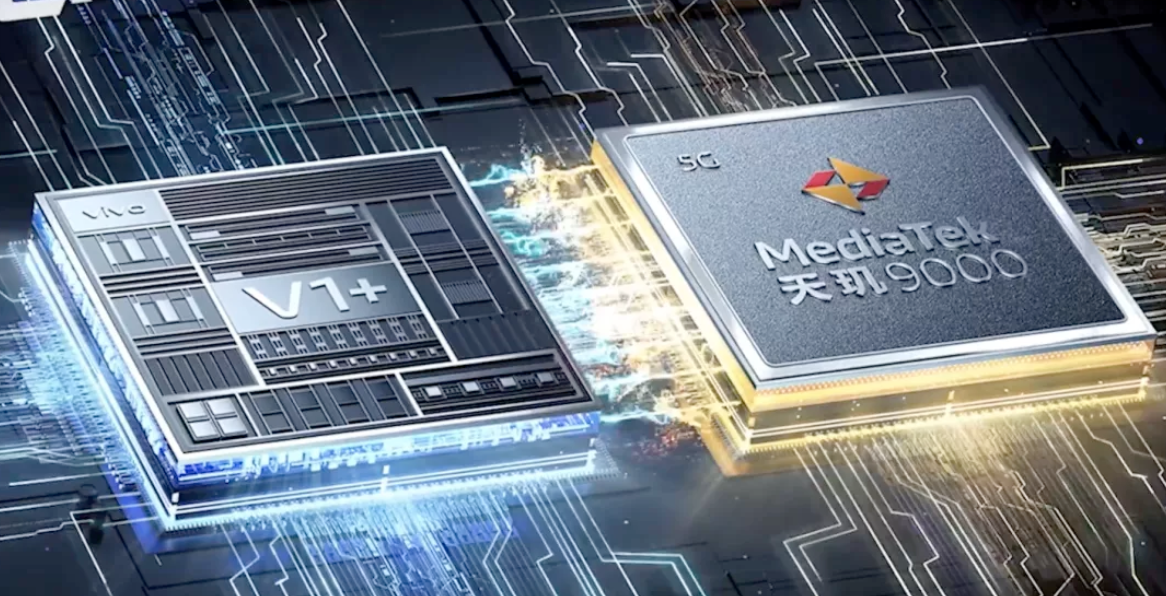

VIVO: In April this year, at the dual-core × imaging technology communication conference, vivo launched a new self-developed chip V1+, which will be applied to the flagship mobile phone X80 series. V1+ is the most performance-consuming algorithm for 3D real-time stereoscopic night scene noise reduction, MEMC frame insertion and AI super-resolution (AISR), which is hardware packaged into an ASIC chip in an integrated circuit.

Wai V1+ is also a highly compatible chip. Vivo said that the chip can be adapted on flagship chips of Qualcomm, MediaTek, Samsung and other platforms. Since then, vivo has become the only mobile terminal manufacturer in the industry that has achieved self-developed chips compatible with multiple flagship platforms.

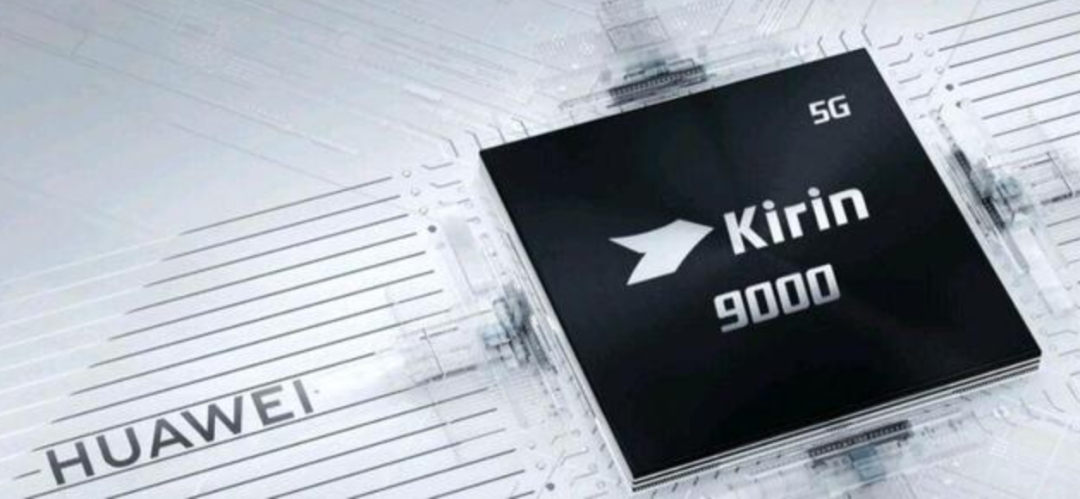

Huawei: Among them, the Kirin chip is a mobile phone SoC chip, which integrates an application processor and a baseband processor, and is widely used in Huawei series mobile phones. The mobile phone SoC (SystemonChip) chip consists of an application processor (AP) and a baseband processor (BP) . Specifically, the mobile phone SoC chip should include the following parts: Central Processing Unit ( CPU ), Graphics Processing Unit ( GPU ), AI Processor (APU) , Image Signal Processing (ISP) , Digital Signal Processor ( DSP ), Baseband / RF front-end, etc.

From a technical point of view, the difficulty of SoC chip development lies in the integration and coordination of various parts. At present, the main high-end flagship models of Huawei Kirin chips include Kirin 9000 , Kirin 9000E , Kirin 9000L , Kirin 9905G , Kirin 990 , etc.

|Self-developed chips are the future of domestic production

From single-function chips for use scenarios, to multi-functional chips, and finally self-developed SoC chips with the most difficulty. This "core making" is a difficult road, but it is also a road that must be taken!

Self-developed chips, on the surface, are problems of differentiated competition and supply chain security, but in fact, they are essentially to avoid being shuffled. Chen Mingyong, founder of OPPO, said, "A technology company cannot have a future without the underlying core technology. And high-end products without the underlying core technology are even more castles in the air."

Whether or not a good core can be built will determine whether a terminal enterprise can only be a component "assembly plant" that can only stand still, or can become a hard technology enterprise with independent core technical strength.

Chips are the core components that cannot be avoided in mobile phones, and they are also the only way for major mobile phone manufacturers to get rid of constraints and achieve development and growth in the future. Only by mastering the autonomy of chip research and development, can we participate in the formulation of future mobile phone market rules and have the right to speak in the industry chain. Therefore, self-developed chips will definitely become the development trend of mobile phone manufacturers.