The global FPGA chip market size has grown from US$4.34 billion in 2016 to US$6.08 billion in 2020, with a compound annual growth rate of 8.8%. The scale of the FPGA market, which is widely used in downstream applications, will continue to expand with the development of AI, 5G, and data center markets.

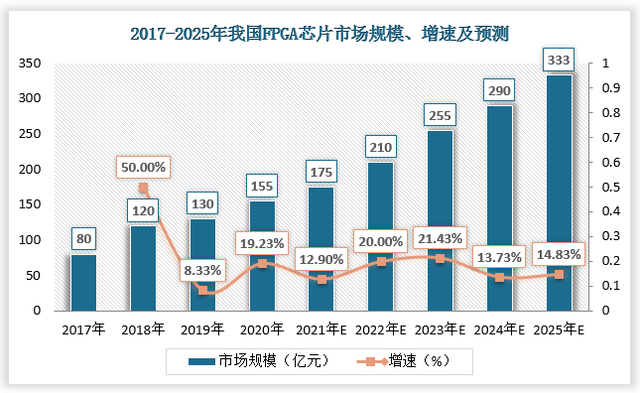

The growth rate of the Chinese market is faster than the global market, and the compound annual growth rate is expected to be 23.1% in the next five years. With the further acceleration of the domestic substitution process, the size of China's FPGA market will reach about 33.22 billion yuan by 2025.

|1. What is an FPGA chip? Why is it hot?

FPGA chips can be called "programmable chips", "semi-customized chips" and "universal chips". Traditional chips are fully customized. Once the finished product is designed, these functions are dead and cannot be changed. If you want to change, you have to redesign and produce. However, the biggest feature of FPGA chips is that the specific functions of the chip are After the manufacturing is completed, it is determined by the user's configuration, so it is called "programmable chip".

Compared with other chips, FPGA chips have powerful advantages:

First, the FPGA chip can be turned into any chip you want, so it is called a universal chip.

Second, it is hardware programmable, such as sound card programming can be turned into graphics card use.

Third, each hardware logic can work at the same time without interference, greatly improving data processing efficiency and delay rate, which has obvious advantages in 5G, artificial intelligence, unmanned driving and cloud computing. Bitcoin mining machines all use FPGA chips.

Fourth, one chip can control many units, such as the key operations of the robot's arm, all of which can be controlled through the FPGA chip. This is a special chip for the AI era.

The biggest selling point of FPGAs is that FPGAs can be prefabricated and programmed by customers in the lab or in the field. They require no one-time engineering expense (NRE) and can help innovators get to market extremely quickly. This makes FPGAs an excellent choice for differentiation in a rapidly changing environment.

|Application scenarios of FPGA chips

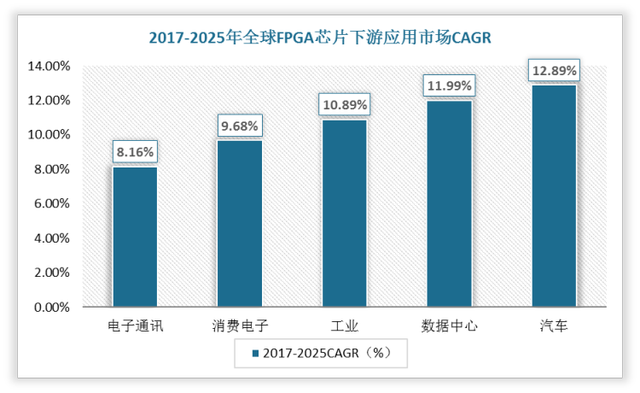

The demand for FPGA chips in the three major fields of automobile, industry and data center is clearly growing. At present, the global FPGA chip demand is mainly concentrated in the two downstream fields of electronic communication and consumer electronics, accounting for more than 60% of the total .

With the improvement of 5G technology, the advancement of AI and the evolution of the trend of automotive automation, the demand for FPGA chips in the three major fields of the global automobile, data center and industry has clearly increased. .

1. Application of FPGA chips in network communication and 5G

The field of network communication is one of the main application markets for FPGA chips. Frost & Sullivan data shows that the sales of FPGA chips applied in this field will reach 6.21 billion yuan in 2020, accounting for 41.3% of China's FPGA chip market share. From 2021 to 2025 The average compound growth rate will reach 17.5%.

2. Application of FPGA chips in industrial and data centers

The industrial field is one of the main application markets for FPGA chips. FPGA chips are widely used in the industrial field, and are widely used in video processing, image processing, CNC machine tools and other fields to achieve signal control and computing acceleration functions. With the development of intelligence and automation technology, the industrial field is gradually shifting from human resources as the core element to intelligent unmanned factories with automation as the core element.

3. Application of FPGA in automotive intelligence and artificial intelligence

The FPGA chip can be used to realize functions such as signal bridging of multiple image sensors, 3D surround view video fusion, reversing auxiliary video, and assisted driving video. In the field of assisted driving and autonomous driving, FPGA chips can be used to implement various functions such as machine vision and object detection.

|Three, domestic leading manufacturers are struggling to catch up

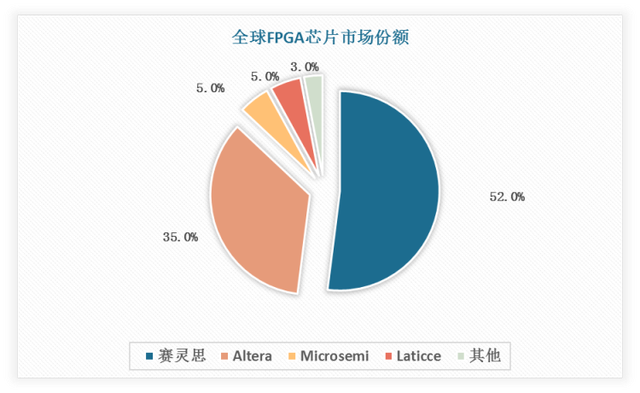

FPGA chips started early abroad, with profound technology accumulation and a high degree of market monopoly. According to statistics, more than 80% of China's FPGA chip market is occupied by foreign companies. At present, the global FPGA chip market is mainly concentrated in international large-scale enterprises such as Xilinx and Altera, with a market share of 52% and 35% respectively.

The compound annual growth rate of China's FPGA market in the past four years is about 23.1%. At present, domestic manufacturers of FPGAs include Ziguang Guowei, Fudan Microelectronics, Chengdu Huawei, Anlu Technology, Gowin Semiconductor, Yilingsi, etc.

Tsinghua Unigroup, a subsidiary of Tsinghua Unimicron, is specialized in programmable logic device business including FPGA. A variety of small and medium-sized FPGA products have gradually matured and shipped steadily, and have been applied in the fields of video image processing, industrial control and consumer markets. The company is also developing large-scale FPGAs.

Fudan Micro is the first manufacturer to launch 100 million gate FPGA products in China. In 2021, Fudan Micro FPGA annual revenue is 430 million yuan, a year-on-year increase of 109.49%, and the gross profit margin is as high as 85%. Fudan Micro is currently developing 14/16nm process technology 1 billion gate-level products.

Anlu Technology will be listed in 2021. It has established its cost-effective series, low-power series, and high-performance series of matrices. Its products cover the fields of network communication, industrial control, consumer electronics and data centers.

GOWIN Semiconductor's FPGAs have made certain breakthroughs in automotive-grade products. Several FPGAs have passed the automotive-grade certification and have been shipped in batches in dozens of cars from many well-known domestic and foreign car companies.

It can be seen that there are many domestic semiconductor manufacturers involved in FPGA, and the potential market also allows some manufacturers to get the help of the capital market. Compared with FPGA giants such as Xilinx and Altera, domestic FPGA research and development started late, but the gap is gradually narrowing, and the gap with leading manufacturers has been shortened from three generations to two generations.

With the current strong support of the country for the chip industry, and the wide application of FPGAs in 5G and AI fields, these status quo is a rare opportunity for domestic FPGA manufacturers. It is enough to see that the domestic semiconductor industry is also confident in the FPGA track.