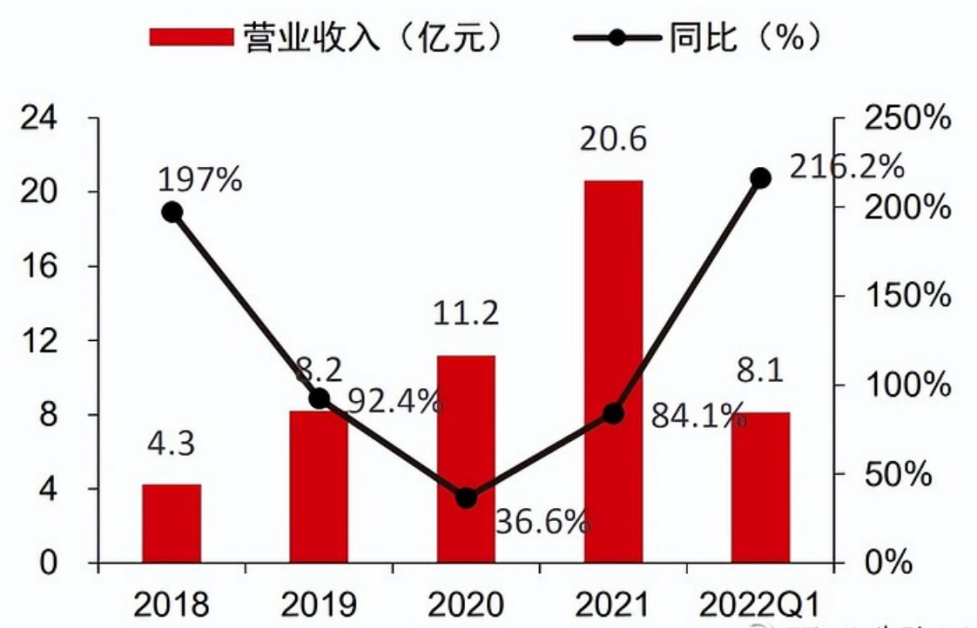

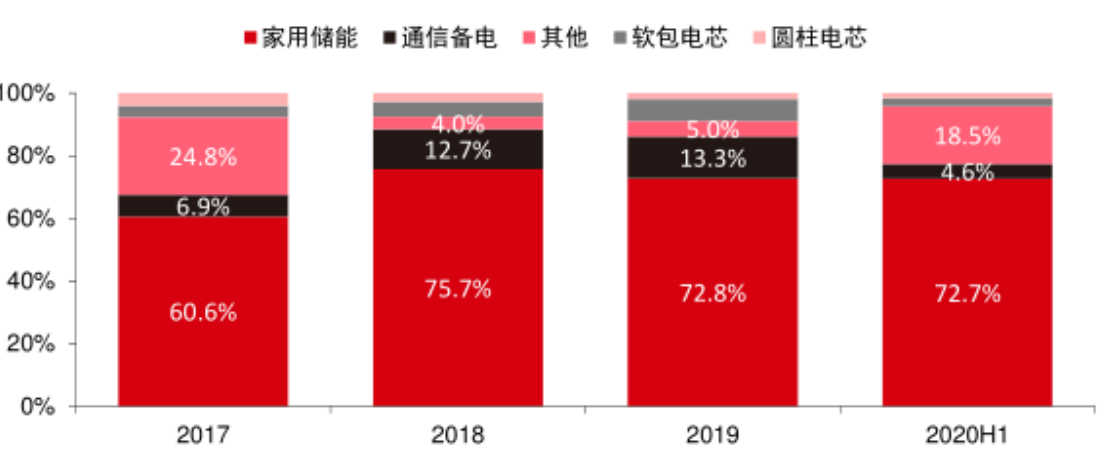

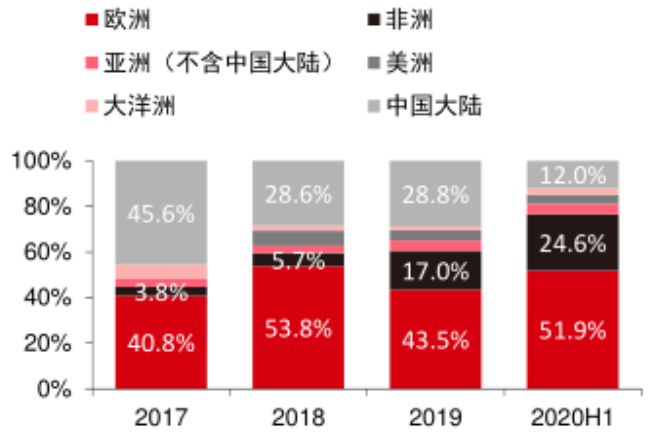

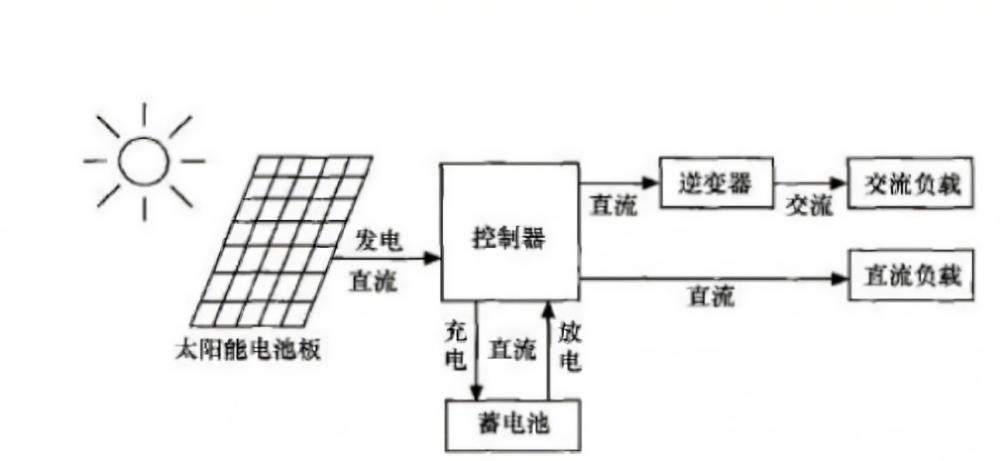

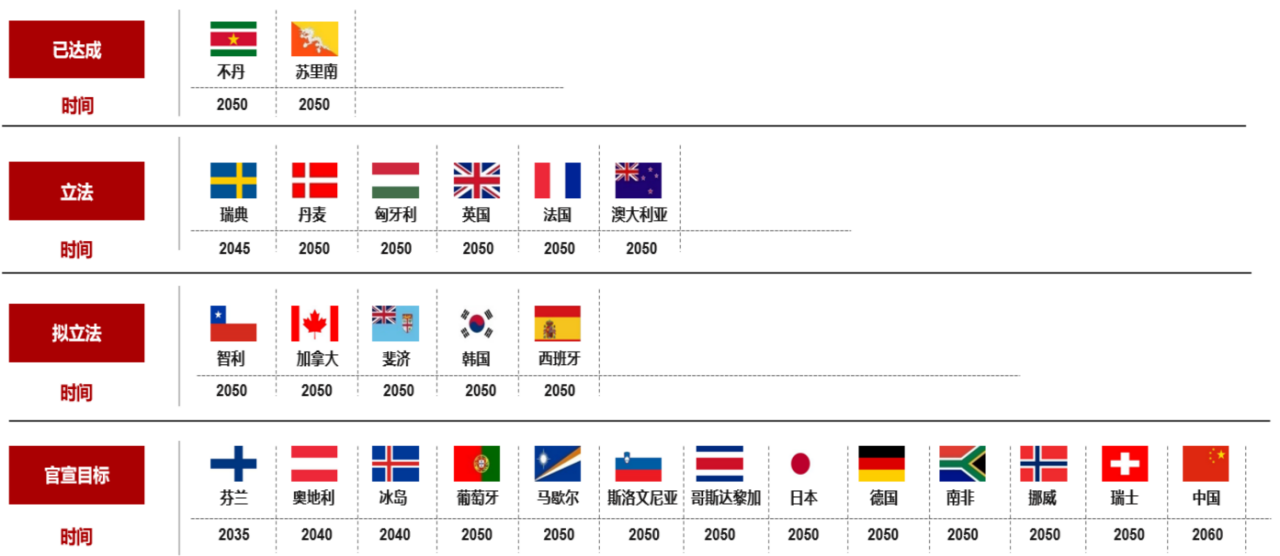

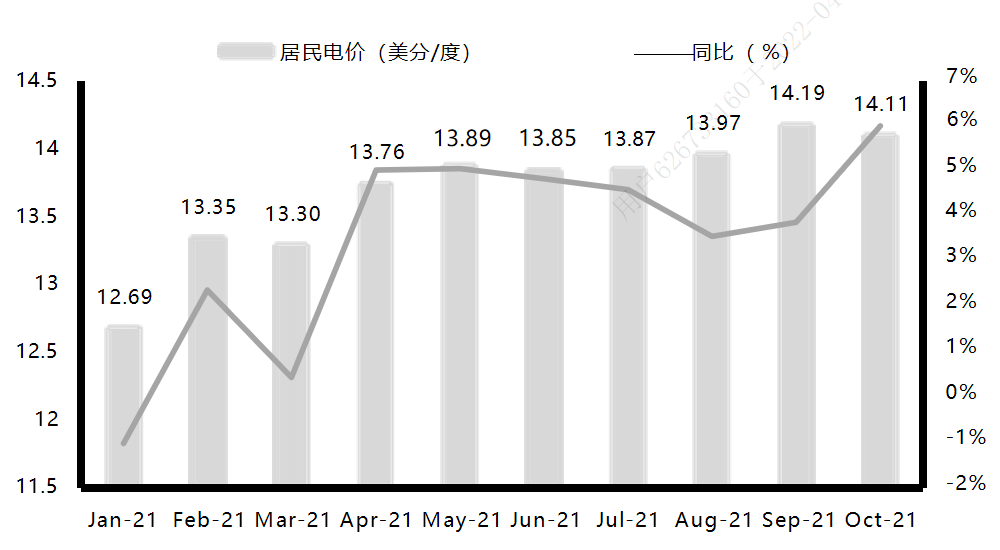

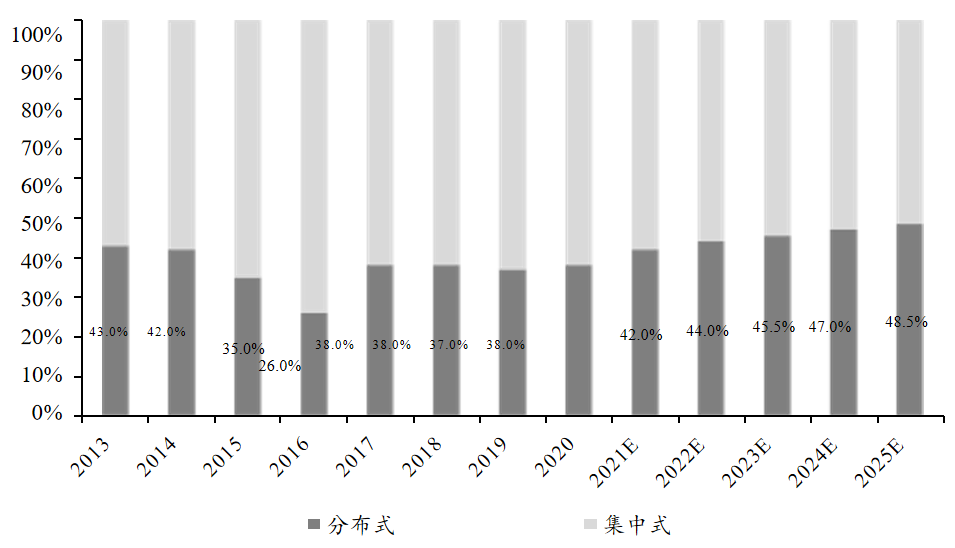

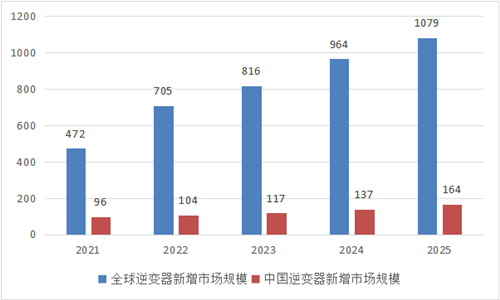

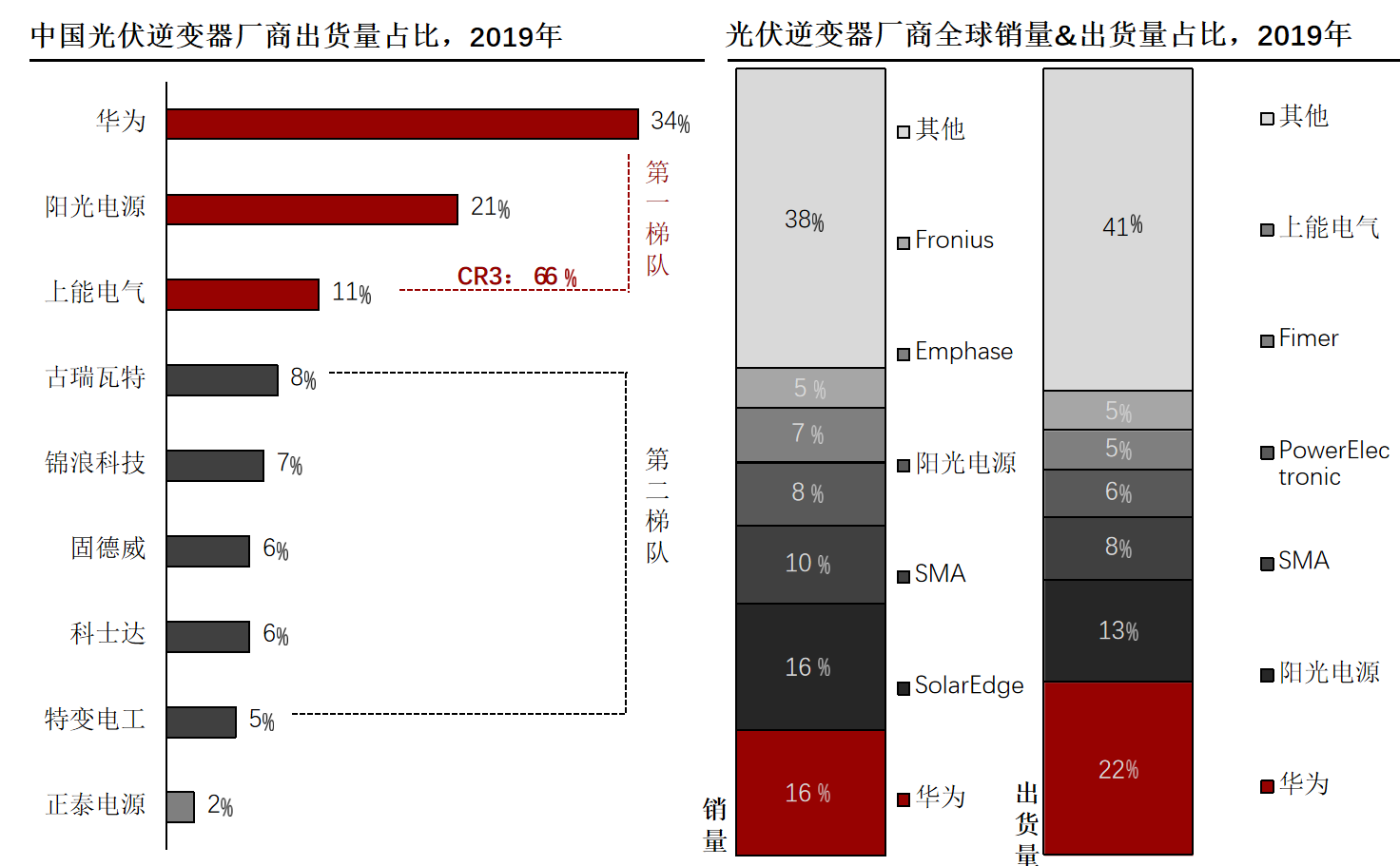

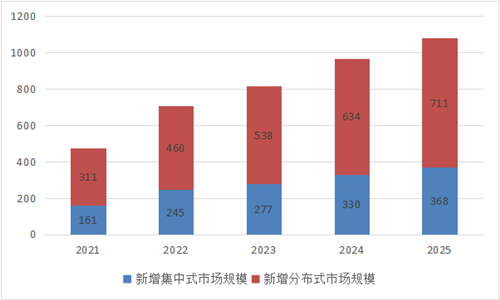

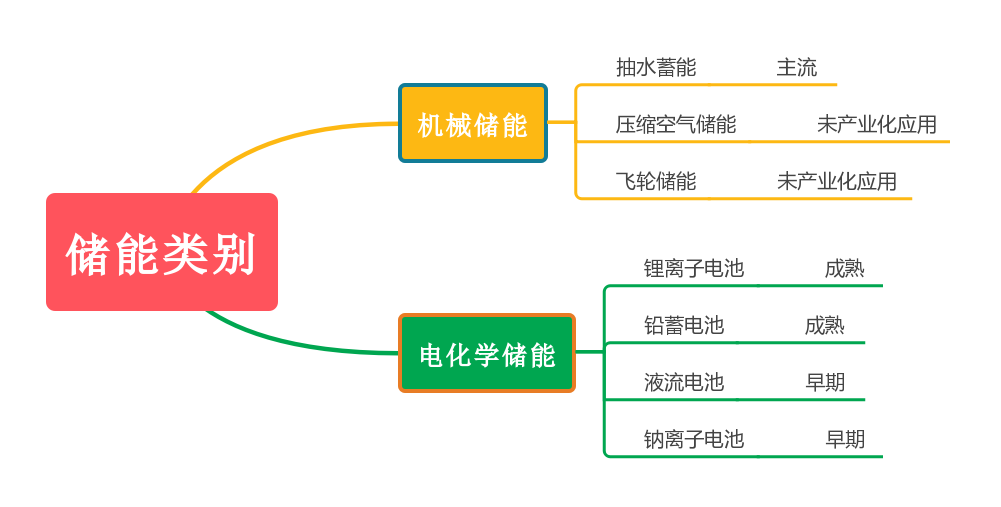

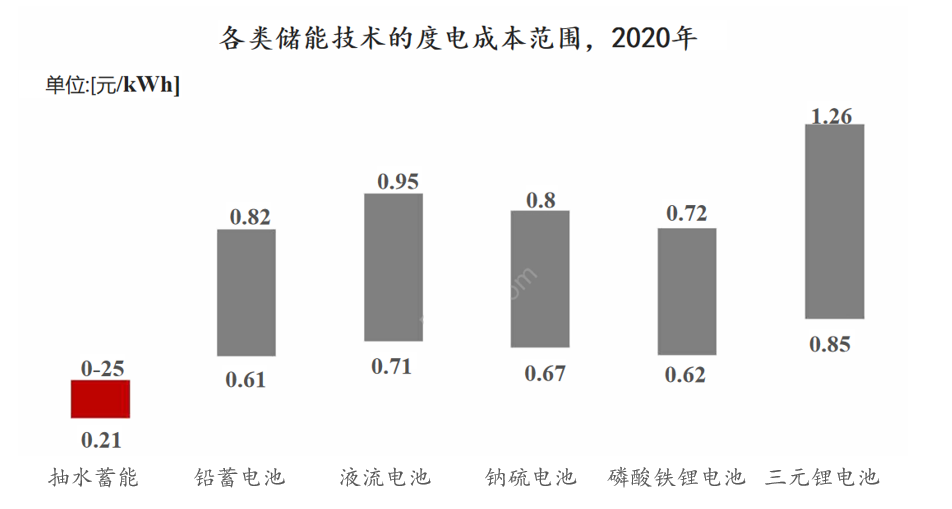

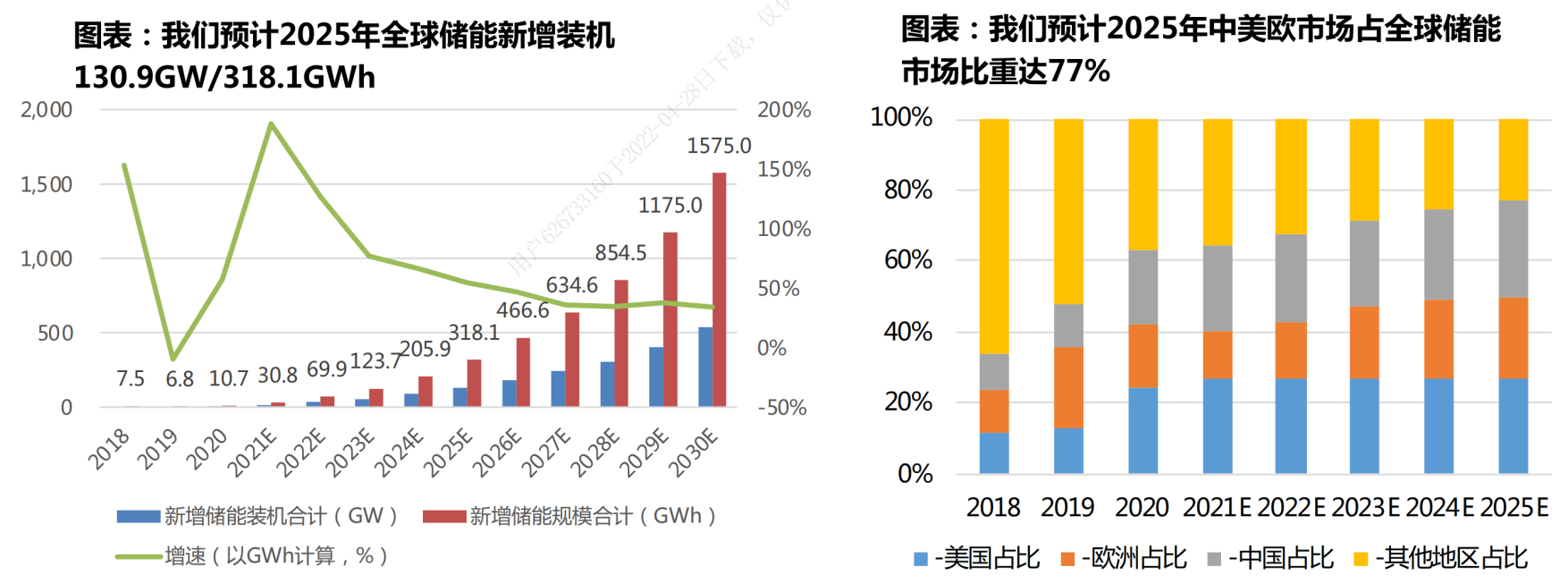

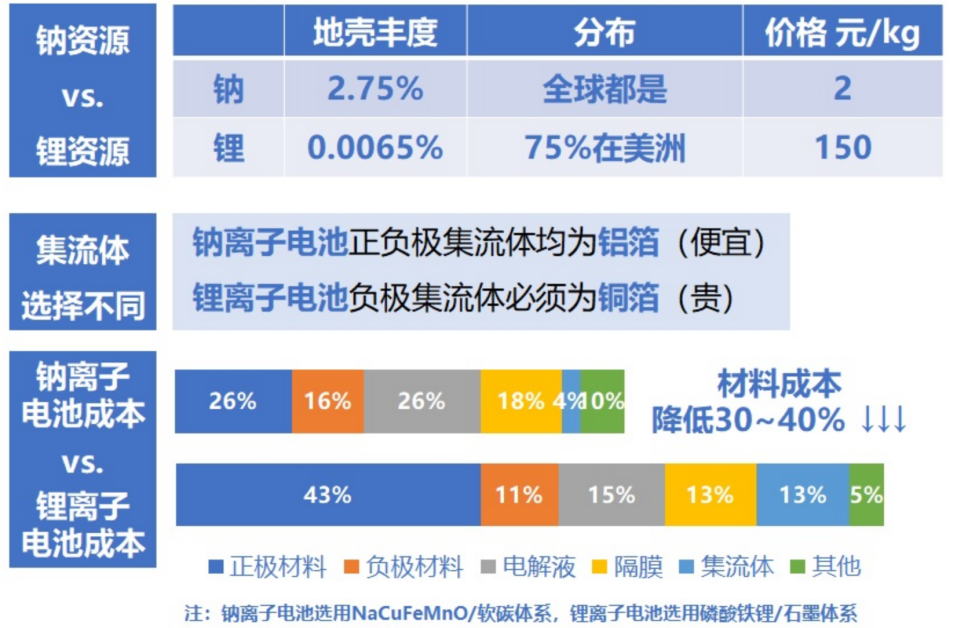

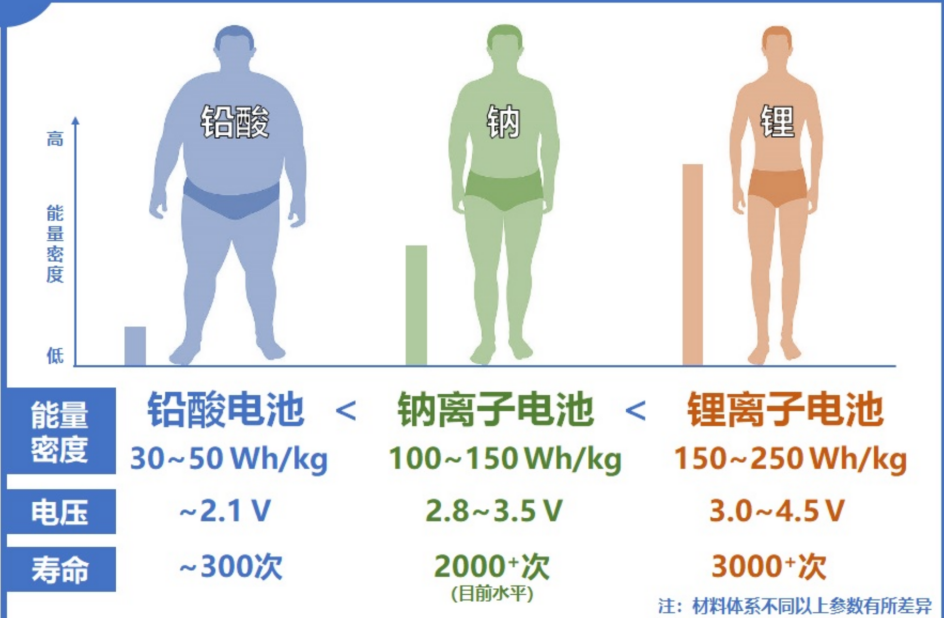

According to whether it is connected to the grid, photovoltaic power stations can be divided into independent photovoltaic power stations and grid-connected photovoltaic power stations. Independent photovoltaic power station Grid-connected photovoltaic power station definition Also known as off-grid photovoltaic power generation system, refers to a solar photovoltaic power generation system that is not connected to the public Refers to the solar photovoltaic power generation system connected to the public grid. Has now entered the stage of large-scale commercial power generation main component Solar panels, energy storage batteries, charge and discharge controllers, inverters, etc. Solar Panels and Inverters advantage No geographical restrictions. Widely used (as long as there is sunlight, it can be installed and used) No battery is required. Mainstream way shortcoming The cost is high, and it needs to be equipped with a battery, which occupies 30%-50% of the cost of the power generation system. The battery has a short lifespan (3-5 years) and needs to be replaced frequently When the public grid loses power, photovoltaic power generation stops running. If a grid-connected and off-grid hybrid inverter is used, the power station can operate normally 1. Short- and medium-term photovoltaic power generation grid parity performance broke out China's photovoltaic power generation industry has gradually matured after a round of cycles, its dependence on subsidies has decreased, and it has entered a period of explosive performance of grid parity . In 2019, the average annual utilization hours of photovoltaics nationwide was 1,169 hours, and the construction cost of photovoltaic power plants was 4.5 yuan/W, and the cost of electricity at this time was 0.44 yuan/kWh. Based on the current cost reduction trend, the average construction cost of photovoltaic power plants by the end of 2020 will be around 3.2 yuan/W-3.5 yuan/W. At this time, the cost of electricity is 0.36 yuan/kWh. In 2019, the national average price of desulfurized coal-fired electricity was 0.36 yuan/kWh. As the photovoltaic power generation industry continues to reduce costs and increase efficiency, the economic benefits of photovoltaic power generation are obvious, which has promoted the grid parity projects in China's photovoltaic power generation industry. As of August 2020, photovoltaic parity projects have covered 18 provinces across the country, and the parity projects in 2020 are expected to become The main source of PV installations in 2021. Note: The notice announced that the photovoltaic parity project in 2020 is 33.05GW and the project should be connected to the grid before the end of 2021. In addition, 7.54GW of PV projects not included in the 2020 bidding subsidy can be voluntarily converted to parity. 2. The long-term carbon neutrality trend is accelerating, and the growth logic is clear Global warming has led to increased attention to environmental issues around the world, and the emission of "carbon dioxide" brought about by "carbon" consumption is the main cause of global warming. In order to reduce further global warming and the frequent occurrence of natural disasters, the concept of "carbon neutrality" has been advocated around the world, with the purpose of reducing carbon emissions and achieving green development. Countries and regions around the world have issued corresponding "carbon neutrality" goals. The EU plans to reduce carbon emissions by 55% in 2030 and achieve carbon neutrality in 2050. The 750 billion euro recovery fund ensures the smooth implementation of the emission reduction target. The United States proposes to reduce emissions by 50-52% in 2030 and achieve carbon neutrality in 2050. Biden has launched a $2 trillion investment plan aimed at promoting the development of new energy. China plans to reach the peak by 2030 and achieve carbon neutrality by 2060. The proportion of non-fossil energy consumption will reach 20%, 25% and 80% in 2025, 2030 and 2060, respectively . Carbon neutrality goals and work routes, and build a carbon peak, carbon neutral "1+N" policy system. "1" 3060 Peak by 2030, carbon neutrality by 2060, and the proportion of non-fossil energy consumption will reach 20%, 25%, and 80% in 2025, 2030, and 2060, respectively "N" Scenery Base Accelerate the planning and construction of a large-scale wind power photovoltaic base project in the desert Gobi area. The first phase of 100GW has started, and the second phase is under application. By 2023, it will land about 200GW county-wide Since the whole county promotion was proposed at the end of June 2021, as of the end of September 2021, a total of 676 counties in 31 provinces have finally entered the national whole county promotion pilot list. Assuming that each county is 200MW, the scale of 676 counties will exceed 130GW. There are a large number of undeclared counties with strong will to promote the development of distributed photovoltaic energy storage new energy storage In 2025, realize the transformation of new energy storage from the initial stage of commercialization to large-scale development, with an installed capacity of 30GW+, and realize the comprehensive market development of new energy storage by 2030 green finance The interest rate of carbon emission reduction loans for financial institutions is 1.75%, and new energy companies benchmark LPR to support clean energy construction Energy consumption dual control If the energy consumption intensity decreases and reaches the incentive target, the total energy consumption assessment can be exempted; at the same time, for regions that exceed the weight of incentive consumption responsibility, the part exceeding the minimum consumption will not be included in the total energy consumption assessment. Build or conduct green electricity transactions to ensure energy supply Green electricity transaction The transaction price of Jiangsu green power is 7 cents/kWh higher than the benchmark price of coal power, and 0.4 cents/kWh lower than the average transaction price of thermal power; the average transaction price of Guangdong green power is 6 cents/kWh higher than the benchmark price of coal power, which is lower than the average transaction price of thermal power The average price is higher by 1.7 cents/kWh, and the premium for green electricity is obvious Consumption indicator The policy clarifies that by 2030, the proportion of renewable and non-water renewable energy power consumption must reach 40% and 25.9%. At the same time, it also clarifies the annual consumption quota indicators of each province from 2021 to 2030. The target is broken down into each province and year. Strong landing Electricity Price Policy In April 2021, the wind and solar construction consultation draft proposed that the guiding electricity price should be about 3% lower than the benchmark electricity price. In the informal consultation draft in early 2021, it was proposed to bid on the basis of the benchmark coal-fired electricity price. Electricity prices are better than market expectations, and new projects can be voluntarily market-based transactions to form on-grid electricity prices to promote profit recovery in the industry chain 3. The high demand for household and industrial and commercial use promotes the popularity of the distributed photovoltaic + energy storage model The domestic household market is in the ascendant: 1) Household photovoltaics have a high yield, and household photovoltaics will still have a kWh subsidy of 0.03 yuan in 2021. If the loan is based on 70%, the loan period is 10 years with equal principal and interest, and the loan interest rate is 4%. If the component cost is 1.8 yuan /W, the IRR of the total investment can reach 9.1%, and the household subsidy will decline from 2022, but the unsubsidized yield can still reach 7.9%, which is about 2pct higher than that of the ground power station, and has a strong economic estimate of 7.9%. %-9.1%, about 2pct higher than the ground power station; 2) The whole county promotes the development of distributed space. As of the end of September 2021, 676 counties have entered the national whole county promotion pilot list, which is close to 1/4 of the country. Assuming that each county is 200MW, the scale of 676 counties will exceed 130GW. The counties and cities that have not reported the report are also actively carrying out household photovoltaic construction, opening up long-term growth space. It is expected that in 2021 and 2022, the newly installed capacity of households will reach 21 and 30GW, with an increase of 100% and 50%. The industrial and commercial market ushered in rapid growth: 1) Electricity prices are rising, and industrial and commercial photovoltaics are highly economical for self-generation and self-consumption. In 2021, policies will be introduced to require marketization of electricity prices to increase by 20%, and the market electricity prices of high-energy-consuming enterprises will fluctuate higher. The cost of electricity for industrial and commercial use is rising, and the economy of electricity is prominent; 2) Under the influence of power and production restrictions, the demand for green electricity is high, and the power shortage and energy consumption control are becoming more and more strict or become the norm. Only by using a higher proportion of green electricity can normal production be ensured, and the penetration rate of industrial and commercial distributed photovoltaics will increase rapidly. . It is estimated that in 2021 and 2022, the newly installed industrial and commercial capacity in China will reach 9 and 15GW, an increase of 80% and 67% year-on-year. In this context, the installed capacity of distributed photovoltaics will exceed the installed capacity of centralized photovoltaics for the first time in 2021. Data source: solarzoom, Energy Bureau, National Development and Reform Commission The overseas distributed photovoltaic + energy storage mode has a better application environment and greater potential: 1) Electricity prices have risen, and the market-based electricity price difference is large. As of July 2021, the electricity prices in Italy, Spain, Germany, and France have reached 10.5, 9.2, 8.1, and 7.8 euro cents/kWh, respectively, and the U.S. residential electricity price in August reached 13.97 cents /kWh, and overseas are mostly market-based electricity prices, the peak-to-valley price difference has widened, and the electricity consumption of residents and industries has surged, which has greatly stimulated the development of overseas distributed photovoltaic installations + energy storage; 2) Unstable power grid supply, weak peak shaving capability of overseas power grids, weak inter-state and inter-regional connections, aging circuits and other serious problems, frequent large-scale power outages in extreme weather, and increasing demand for self-sufficiency of electricity by users or factories; 3) To save land space, some overseas countries have limited large-scale land use area, and actively promote the development of photovoltaic roofs to increase the proportion of renewable energy. We believe that distributed photovoltaics are developing rapidly, and by 2025, the proportion of distributed photovoltaics in the installed capacity of photovoltaic shares will exceed that of ground-based power plants. U.S. Residential Electricity Rate Data Tracking Proportion and forecast of global distributed installed capacity Source: GlobalPetrolPrice, IHS, CPIA 4. The growth of photovoltaics is prominent, and it is expected to grow into the main energy source Due to the excellent endowment of photovoltaic resources and the arrival of global photovoltaic parity, the cost is still falling rapidly, and matching the development of energy storage and the realization of carbon emission reduction and carbon neutrality, photovoltaic is expected to grow from auxiliary energy to the main energy source, bringing broad growth potential for the industry. . It is estimated that my country's newly installed photovoltaic capacity will reach about 170GW in 2025, and the market growth rate will remain at about 20%. Globally, it is estimated that the newly installed photovoltaic capacity will reach about 450GW in 2025 (hundreds of billions of market), and the newly installed photovoltaic capacity will reach about 1300GW (trillion market) in 2030, and the market growth rate will remain at about 25%. Source: National Energy Administration (1) Optimization of supply and demand of silicon raw materials + technological innovation and upgrading promote industrial price reduction, expansion of profit space downstream of the industrial chain, and acceleration of commercialization. 2021 is the first year of photovoltaic parity, but it has encountered the rising prices of upstream raw materials such as industrial silicon, silicon materials, EVA particles, IGBTs, etc. The prices of components and EPC systems have remained high, and the industry chain has a strong game atmosphere, resulting in large fluctuations in production scheduling. . However, the demand in 2021 will greatly exceed expectations, and under the market expectations of superimposed electricity price increases, the industry's medium and long-term growth space will be further opened. In 2022, H1 will release more than 150,000 tons of new silicon material production capacity, opening the industry chain to truly reduce prices. supply and demand Competitive Landscape Technology Trends Silicon New production capacity will be released in the first half of 2022. With the advancement of thinning, it is expected that silicon consumption per watt will continue to decline, corresponding to a total supply of 280GW+ of silicon materials, driving prices to fall rationally Affected by the epidemic, a large number of small manufacturers have been eliminated, and the industry has formed an oligopoly structure of five companies, namely GCL-Poly, Tongwei, Xinte, Daqingxin Energy, and Dongfang Hope, of which Tongwei has a market share of about 30%. The energy consumption of granular silicon production has dropped significantly, the unit investment has decreased, and it has been gradually verified by the downstream, and mass production has begun. silicon wafer Affected by the double impact of firm prices and falling costs, the profitability of silicon wafers has gradually increased, driving the industry to expand production significantly. From 2022, the expansion of the silicon material industry will be sufficient, and the problem of overcapacity of silicon wafers will appear, entering a stage of fierce competition. LONGi (40%) and Zhonghuan (20%) have a double-leading pattern. With the gradual maturity of single crystal pulling technology, integrated component factories such as Jinko and JA Solar have begun to expand their production upstream. Beijing Express and others also entered the industry The trend of large size is clear, and the new production capacity of silicon wafer faucet is compatible with 182 and 210; each company actively promotes thinning, and the mainstream thickness is switched from 170um to 165um. Cell PERC capacity is expanding rapidly, exceeding 390GW by the end of 2022, of which 182&210 large-size capacity accounts for about 70%, which is in a state of tight balance, and the profitability of 166 and below batteries is significantly different In 2021, the CR6 concentration will exceed 80%. Among the top 6, Tongwei and Aixu are professional battery factories, leading second- and third-tier manufacturers in terms of efficiency and cost; the remaining four are JA Solar, Jinko, TRW, and LONGi. Manufacturers, expand the production of cells to complement the integrated production capacity. At present, the cells are basically monocrystalline PERC. The technology spillover has led to lower barriers, and the efficiency of PERC has reached its peak. The emergence of new high-efficiency cell technologies has brought new industrial opportunities. TOPCon will take the lead in 2022. (2) Components: Concentration of faucets continued to increase, and both volume and profit were fully benefited. In the component segment, due to low investment per unit capacity, slow technological changes and mainly physical packaging, the industry's total production capacity is relatively excess. However, modules have three major barriers of brand, channel and innovation ability. From the perspective of shipment pattern, the concentration rate has increased rapidly, and CR4 will increase from 31% in 2018 to 88% in 2021. The component faucets are all integrated faucets (Tianhe achieves cooperation and integration by binding Tongwei), because integration can significantly reduce production costs, and the proportion of external procurement in the industry has dropped rapidly. In 2022, the electricity price policy exceeds market expectations + some projects are postponed in 2021. It is estimated that the global installed capacity demand in 2022 will be 220-230GW, an increase of 41%. The annual cost benefited from the decline in the price of silicon materials, and the module profit was significantly repaired year-on-year. In 2022, the module volume and profit will double. (3) Inverter: The market potential is huge and the competition pattern is stable. Distributed photovoltaic inverters are the main focus. China's photovoltaic inverter industry has the characteristics of being strongly influenced by policies and high barriers to technical access; based on the growth of photovoltaic installed capacity and the introduction of favorable policies, the global photovoltaic inverter market is expected to exceed 100 billion yuan in 2025. 16.4 billion yuan. The market structure of the photovoltaic inverter industry is stable and highly concentrated, with Sungrow (31.3%) and Huawei (23.1%) leading the way. Other domestic inverter manufacturers such as Jinlang, GoodWe, and Growatt have a small share. . Domestic inverter products have good prices and low prices. In 2020, domestic companies will account for about 70% of the global market share (based on shipments), and it may increase to more than 85% in the next 3-5 years. Distributed market has high growth rate, higher unit price, and better profitability: From the perspective of unit price, the unit price of household inverters is much higher than that of commercial and industrial inverters. The products of leading manufacturers are mainly string-type and household-type inverters, among which the competition of string-type inverters is fiercer than that of centralized and household-type inverters. Energy storage: the industry is in the ascendant, and the trillion-level blue ocean: The energy storage is mainly used on the power generation side (to absorb abandoned light and wind/smooth power output), the grid side (frequency modulation and peak regulation), and the user side (peak shaving and valley filling/spontaneous self-use). China's energy storage industry is in the stage of coexistence of various energy storage technology routes. Pumped hydro storage is currently the most mature, most installed and the lowest cost per kilowatt-hour of energy storage technology, accounting for 90.3% in 2020. Electrochemical energy storage accounts for about 7.5%, but it is the main growth point in the future. In 2021, the cost of the energy storage system will drop to about 1.5 yuan/Wh, which is the inflection point of energy storage economy. It is estimated that the newly installed energy storage capacity in the world will reach 131GW/318 (cumulative) GWh by 2025, and the compound growth rate from 2021 to 2025 will be 79%; The compound annual growth rate is 84%. China, the United States, and Europe will be the largest incremental markets, and overseas has greater potential for higher-value residential, industrial and commercial energy storage. Tesla's share in the US market is more than 50%, and the European pattern is more fragmented. Energy storage industry players can be divided into three categories: First, companies in the photovoltaic industry such as Sungrow; Second, battery companies such as CATL and BYD; The third is the power companies such as Zhongheng Electric. Sungrow's market share is 13%, and CR5 is about 37%. Photovoltaic companies have inherent channel and market advantages, and there are no obvious technical obstacles for battery companies to switch from automobile power batteries to energy storage batteries, and the industry competition is very fierce. Lithium batteries are the most widely used in energy storage batteries, accounting for 88.8%, followed by lead-acid batteries, accounting for 10.2%. electrochemical energy storage advantage disadvantage Lead storage battery Mature technology and low cost Short life and heavy pollution Lithium-ion battery (ternary) Long life and high energy density High price, poor security Lithium-ion battery (lithium iron phosphate) Long life and relatively safe low energy density Lithium-ion battery (lithium titanate) Long life and relatively safe high price sodium ion battery Long life, low cost, safe Fast decay, low energy density flow battery Long life and good safety low energy density Sodium-ion batteries are very suitable for energy storage batteries because of their superior performance, abundant reserves and low cost, and are widely optimistic. Performance advantages: sodium-ion batteries have good fast charging performance, excellent high and low temperature performance, good safety performance, and good equipment compatibility; cost advantages: sodium raw materials are abundant and widely distributed, cheap and easy to obtain, compared with lithium-ion batteries (lithium iron phosphate). ) is reduced by about 20%; Disadvantages: Single energy density and short cycle life are the main problems that limit its development, but it has great potential in the field of energy storage where energy density is not high but price-sensitive. From the perspective of research and development level, core technology and industrialization advancement, China is at the international leading level in sodium-ion batteries. In terms of core material systems, China's sodium-ion batteries have independent intellectual property rights, and some patents have also been authorized by the United States, Japan, and Europe and the United States. As of 2020, more than 20 companies across the country are committed to the research and development of sodium-ion batteries, including Faradion in the United Kingdom, Naiades in France, Kishida Chemical in Japan, Natron Energy in the United States, and China's Ningde Times, Zhongke Haina, Nai Innovation Energy, Xingkong Sodium electricity, etc. 1. Sunshine Power Sungrow was established in 1997, focusing on independent research and development and manufacturing of inverters. In 2020, photovoltaic inverters will ship 35GW, with a global market share of 19%, ranking second. Relying on the advantages of inverter products and power electronic conversion technology, the company has gradually extended to the downstream application field. In 2013, it began to expand the power station business. At present, the market share has rapidly increased to the second in the world; in 2014, it started to build a joint venture with Samsung SDI. Entered into the energy storage battery and power supply business. Since 2016, the installed capacity of the energy storage system has ranked first in the country, and it has become the top five lithium battery energy storage manufacturers in the country. At the same time, the company is actively carrying out business innovation, looking for new growth points, and has a layout in the fields of new energy vehicle electronic control, charging piles and water surface photovoltaic systems. The company's operating income rose from 8.878 billion in 2017 to 24.137 billion in 2021, with a CAGR=28.4%. Among them, overseas business has expanded rapidly, rising from 1.02 billion yuan in 2017 to 9.177 billion yuan in 2021, and its proportion has rapidly increased from 11.5% to 38%, with a CAGR=73%. From the perspective of the company's overall gross profit margin, the overseas gross profit margin is about 40%, which is about 20% higher than the domestic one. The main reasons are: 1) Overseas friends are subject to cost factors such as labor and materials, and the price of inverter products is often several times higher than that of domestic ones. products, which provides a huge space for the pricing of export inverter products. 2) Overseas, the electricity price is high, and the price sensitivity of photovoltaic products is low. 3) In terms of product structure, the proportion of overseas centralized inverters is low, and the high unit price of string and household inverters is high. In the past, the focus of the company's sales channels was more inclined to direct sales-based ground power station customers, but this year, the company has started to change its strategy, carrying out channel reforms for overseas distribution and household users, strengthening cooperation with regional channel providers, and consolidating and expanding the market layout in Europe and America. efforts to seize more opportunities in emerging markets. At present, the company has established 20+ subsidiaries overseas, five global service areas, 110+ after-sales service outlets, and 80+ certified authorized service providers. In 2021Q1, the company's overseas revenue contribution reached 50.57% (mostly from photovoltaic inverters and energy storage systems), an increase of 34 percentage points compared to 2020, of which the revenue contribution from Europe and the Asia-Pacific region increased by 7.19 percentage points and 7.78 percentage points respectively. In May 2021, the company submitted the application draft of the fixed increase prospectus, raised about 500 million yuan to increase the global marketing service system, set up a global marketing service headquarters in Shanghai, and built new marketing outlets in Germany and the Netherlands. The six major regional marketing outlets in Asia Pacific, Southern Africa, the Middle East and China were upgraded. From the perspective of revenue structure, the company's current revenue is mainly supported by the two main business segments of power station system integration and solar photovoltaic inverters. The energy storage inverter business has developed rapidly in the past two years, and will contribute 3.138 billion revenue in 2021, accounting for The ratio reaches 13%, and the photovoltaic inverter and energy storage business will become the main increments for future development. 2. Goodway GoodWe Power Technology Co., Ltd. ("GoodWe") was established in November 1997 and is a provider of solar photovoltaic inverters and related products. GoodWe's business covers grid-connected inverters, photovoltaic inverters, and energy storage products used in household, commercial, ground and other scenarios. GoodWe's on-grid and off-grid seamless switching technology is a breakthrough technology in the inverter field, and inverter products have achieved microsecond-level indicators (other companies in the industry are second-level). As of 2019, GoodWe's household energy storage inverter sales ranked first in the world, with a market share of 15%. High technical barriers have been built in the energy storage inverter field. The total revenue of the first major product, photovoltaic inverter series, reached 940 million yuan in 2019, a year-on-year increase of 12%, and the export market share ranked fifth, accounting for 4.2%. Due to the price difference of photovoltaic inverter products in different regions, the gross profit margin of the Chinese market is generally lower than that of the European market, and GoodWe has a large profit margin in the European market. The second largest revenue came from energy storage inverters, whose revenue increased from RMB 37.452 million in 2017 to RMB 108.235 million in 2019, with a CAGR of 70%. The proportion of revenue increased from 3.57% in 2017 to 17.85% in 2021, and its shipments ranked first in the world in 2019, with a total sales of 2,150.1MW. Similar to Sungrow, GoodWe's overseas market has expanded rapidly. Since 2019, the overseas market has continued to account for more than 60%, contributing to the main business increment. 3. Paineng Technology The predecessor of the company, ZTE Paineng, was established in 2009. It is one of the early domestic manufacturers focusing on the commercial use of lithium battery energy storage systems, focusing on lithium iron phosphate cells, modules and energy storage battery systems. In 2010, the company launched the first communication backup power product and entered the market of three major domestic operators. In 2013, the first home energy storage battery system was successfully commercialized in Europe. In 2016, the containerized large-scale grid-level energy storage battery system was officially commercialized. A complete energy storage product line has been constructed. After more than ten years of development, the company was successfully listed on the Science and Technology Innovation Board in December 2020. The company's main products include energy storage battery systems and cells, which can be widely used in households, industry and commerce, power grids, communication base stations and data centers. Benefiting from the needs of the energy storage industry, the company's performance has maintained rapid growth in recent years. From 2018 to 2021, the company's sales revenue was 4.3/8.2/11.2/2.06 billion yuan respectively, a year-on-year increase of +197%/92.4%/36.6%/84.1%, and the average annual compound growth rate was 68.6%. The company's net profit attributable to the parent was 0.5/1.4/2.7/320 million yuan, +203%/217%/90.5%/15.2% year-on-year, with an average annual compound growth rate of 85.7%. In Q1 2022, the company's revenue and net profit attributable to the parent company will be 810/100 million yuan, respectively, +216.2%/70.5% year-on-year. Household energy storage accounts for more than 70% and is the company's main source of income. In 2021, the company's energy storage battery system and cell product revenue will be 1.988 billion yuan/0.65 billion yuan, accounting for 97%/5% of the main business revenue, respectively. Specifically, the sales of energy storage battery systems are mainly concentrated in the two fields of household energy storage and communication backup power. In 2020H1, household energy storage products accounted for 72.7%, which was the company's main source of income, and communication backup power accounted for 4.6%. Others account for about 18.5% (mainly industrial and commercial energy storage battery systems, etc.). The battery cell revenue accounts for a small proportion, mainly including soft pack and cylindrical lithium iron phosphate batteries, accounting for 2.6% and 1.6% respectively in 2020H1. The company's products are mainly sold overseas, and overseas sales account for more than 80%. The company's products are mainly exported, and the proportion of overseas revenue is on the rise. In 2021, the company's overseas and domestic main business revenue will account for 81.3% and 18.7% respectively. In terms of specific regions, the company's sales to Europe accounted for the highest proportion of revenue, reaching about 51.9% in 2020H1; the company's sales in Africa grew the fastest, and the company's sales in Africa accounted for 3.8%/5.7%/17.0%/24.6% respectively in 2017-2020H1 . While consolidating the existing market, the company is also actively expanding the domestic energy storage market in North America and Japan. It is expected that with the increase in overseas energy storage demand, the company's overseas sales will continue to increase.

|I. Industry Development Overview

Photovoltaic power generation is a technology that directly converts light energy into electrical energy by utilizing the photovoltaic effect of the semiconductor interface. It is mainly composed of solar panels (components), controllers and inverters, and the main components are composed of electronic components. After the solar cells are connected in series, they can be packaged and protected to form a large-area solar cell module, and then combined with power controllers and other components to form a photovoltaic power generation device.

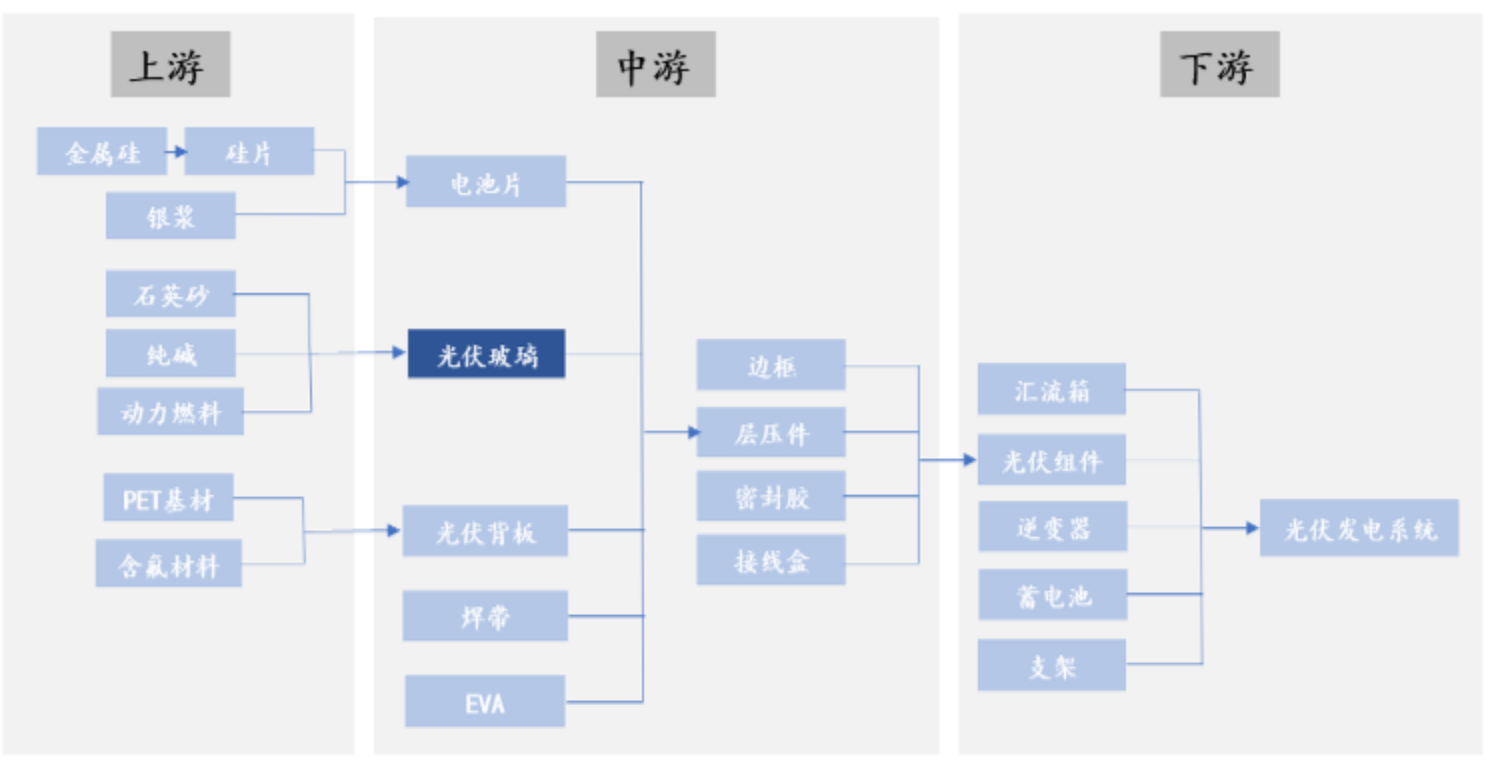

|Second, the industrial chain

The industrial chain of the photovoltaic industry includes silicon materials, silicon wafers, cells, modules, etc. The localization rate of each link in the industrial chain is generally high, and the export advantage is significant, showing a high degree of concentration. The industry chain has a high concentration of silicon materials/silicon wafers/cells/modules/inverters/photovoltaic glass/tracking brackets/films, with prominent leaders and a relatively stable competitive landscape. In addition to the foreign-dominated tracking brackets, domestic companies in other links of the industrial chain have a high right to speak. In 2019, the global production capacity of China's silicon wafers, cells and modules accounted for about 97%, 79%, and 71%, with a large number of products. exit.

|3. Representative enterprise