"Semiconductor business model I DM"

At present, the main business models of chips can be divided into two categories: IDM (vertical integrated manufacturing) model and vertical division of labor model.

IDM (integrated device manufacturing) mode: a semiconductor company that does everything from design to manufacturing, package testing and sales of its own brand IC, which is called IDM company. Foreign IDM representatives include Intel, SK Hynix, micron, NXP, Infineon, Sony, Ti, Samsung, Toshiba, St, etc.

IDM manufacturers in mainland China mainly include: China Resources Microelectronics, Shilan micro, Yangjie technology, Suzhou solid technetium, Shanghai Beiling, etc.

Vertical division mode: some semiconductor companies only do IC design without fab, which is usually called fabless, such as Huawei, arm, NVIDIA and Qualcomm. In addition, some companies only do OEM, not design, which is called foundry. The representative enterprises include TSMC, grofangde, SMIC international, Taiwan union power, etc.

According to the above two business models, the existing semiconductor enterprises can be divided into IDM, foundry, fabless and Fab Lite (between IDM and fabless).

The investment in semiconductor manufacturing is huge and the sunk cost is high. Especially with the evolution of the manufacturing process (referring to the minimum linewidth of the transistor gate), the investment cost is higher and higher. In order to achieve profit and loss balance, the sales volume is higher and higher, and the operation risk is greater and greater.

The investment of a 28nm process integrated circuit production line is about US $5 billion, the 20nm process production line is as high as US $10 billion, and the investment of 7Nm process is more than US $10 billion. Once the process and wafer size of the wafer manufacturing line are determined, they can not be changed, because if it is to be rebuilt, the investment scale is equivalent to building a new production line.

Moreover, the annual expenditure on equipment maintenance, repair and renewal and new technology R & D investment account for 20% of the total investment. This means that except a few powerful IDM manufacturers have the ability to expand, other manufacturers are simply unable to expand.

In contrast, according to the development ideas and policy suggestions of integrated circuit design industry, generally, the R & D investment of a 28nm chip design is about 100 million yuan to 200 million yuan, and that of a 14nm chip is about 200 million yuan to 300 million yuan. From the perspective of investment scale, the risk and access threshold of design link are far lower than that of manufacturing link.

Because the vertical division of labor mode is more flexible and the threshold is lower, it is convenient to diversify investment risks and better adapt to the rapidly changing market demand, so it has been recognized and selected by more and more semiconductor practitioners. This is why the original IDM enterprise divested the semiconductor business.

For example, amd divested its manufacturing business to establish grofangde, Thomson of France divested its semiconductor business and merged with Italian semiconductor company to establish st, Siemens divested its semiconductor business to establish Infineon, IBM divested its commercial semiconductor business to grofangde, etc.

The competition between fabless and IDM is fierce, because fabless and IDM manufacturers need to fight for end customers or end integrators. They are at the same level of competition, and the competition between them is fierce. Relatively speaking, IDM's brand advantage is more obvious. Obviously, a few fabless with strong technical strength have become the leader of the fine molecule industry. However, from the perspective of market share, IDM enterprises still occupy the leading position in the market. Although IDM mode is not easy to do, it is the best choice in resisting external risks and meeting industry opportunities. Whether in traditional application scenarios such as automobile, aerospace, transportation, household appliances and agriculture, IDM has absolute advantages of mature supply chain. The recent development of 5g and the Internet of things has given IDM a development opportunity. 10 years ago, the sensor enterprises in IDM mode only involved the design, manufacturing, packaging, testing and other industrial chain links of sensor chips. However, now, IOT provides these IDM manufacturers with a richer product and business imagination space. Under the influence of IOT, the price, performance and cost performance of sensor chips may not be the absolute standard to measure the market feedback of a sensor enterprise. The Internet of things project based on terminal matching ability and solution universality will be one of the standards for IDM sensor enterprises. In the IOT era, the "new IDM mode" of sensor manufacturers came into being, from chip materials, modules, terminals, platforms, sensor networks, solutions and scene projects.

With the recent wave of core shortage and the pressure of the United States on Chinese Huawei and other enterprises, IDM model has become a necessary business model for powerful enterprises. Due to the huge investment cost, these mature enterprises have a strong moat and opportunities for domestic chip enterprises to break through. Asia Pacific Huijin Investment Research Department focuses on several potential semiconductor companies:

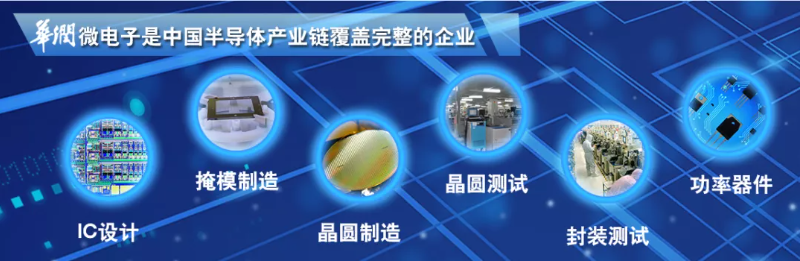

1. Hua runwei

China Resources micro is one of the largest IDM mode semiconductor enterprises in China. It has leading integrated operation capabilities in the industrial chain such as chip design, wafer manufacturing and packaging testing. It is a leading enterprise in the whole chip industry chain in China. Its MOSFET revenue ranks ninth in the world and first in China's local enterprise market. It has complete R & D and manufacturing capabilities of mainstream MOSFET device structure, It is the MOSFET manufacturer with the largest operating revenue and the most complete product series in China.

In the short term, in the current situation of tight production capacity of power semiconductors, the pricing power is in the hands of a few enterprises with production capacity. As a scarce company with IDM mode in China, China Resources micro has a significantly enhanced voice in the industry. Secondly, from the perspective of global power semiconductor leading enterprises, IDM mode is more conducive to the coordinated development of product iteration, process control and customer channels.

Therefore, as the leader of domestic power semiconductor IDM mode, China Resources micro ranks among the leaders in the industry in terms of product category, process platform and capacity scale. After the fund-raising in 2020, it has nearly 10 billion funds. The medium and long-term competitive strength and growth logic are very clear, and the development prospect is worth looking forward to.

Wang Xiangming, chairman of China Resources Group, made it clear that this year, we will increase efforts to improve production capacity and increase investment in 12 inch wafer factories and packaging testing. He revealed that this year, China Resources Group established a science and technology innovation department to improve the overall R & D investment intensity of the group, focusing on microelectronics, semiconductors and other aspects.

In 2020, the operating revenue and profit of China Resources micro increased, of which the operating revenue was 6.977 billion yuan, an increase of 21.50% over the same period of last year; The net profit attributable to the parent company was 964 million yuan, a year-on-year increase of 140.46%, and the year-on-year increase of deducting non net profit was as high as 313.52%, which fully demonstrated the development and growth power of the company. In 2021, the company continued the rising momentum in 2020, and its performance was equally bright. China Resources micro achieved a revenue of 2.045 billion yuan in the first quarter, a year-on-year increase of 47.92%; The net profit attributable to the parent company was 400 million yuan, a year-on-year increase of 251.85%.

2. Shi Lanwei

In the early stage, the company announced that it would issue 82.35 million shares to the large fund to purchase the equity of Jihua investment and Shilan Jixin. At the same time, it also plans to raise supporting funds of no more than 1.122 billion yuan for the phase II project of 8-inch integrated circuit chip production line and repay the bank loans of listed companies. At present, it has been approved by the CSRC. If the transaction is completed, the shares of Shilan Jixin held by Shilan micro will increase from 34.13% to 63.73%, and the large fund will account for 5.91% of the total share capital of Shilan micro.

At present, the company's capacity scale is leading in China, and the integrated 5 / 6-inch chip of its subsidiary Shilan can reach 210000 pieces / month; Subsidiary Shilan Jixin 8-inch 60000 pieces / month; Moreover, the holding company Shilan Jike 12 inch phase I 40000 piece production line was put into operation in December 20, and is expected to be close to full production by the end of 21. In the short term, the prosperity of the industry continues to be high, and the price of out of stock continues to rise. As a power IDM, the company has significantly benefited from both price rise and capacity utilization. In the long run, the growing capacity and manufacturing capacity will enhance the company's market competitive advantage and lay the foundation for rapid growth.

In recent years, the company's products have been developing towards high-end. In terms of IGBT, IPM module has been used by domestic mainstream white power manufacturers, IGBT module for industrial control has entered Huichuan, GE and Shanghai Stock connect, IGBT module for new energy vehicles has begun to enter batch supply, and major domestic vehicle manufacturers have increased evaluation. At present, IGBT is promoted to transfer the lifting capacity on 12 inches, which will further enhance the cost advantage; In terms of MEMS, the company has worked in the field of MEMS sensors for more than ten years, with rich product types and outstanding competitive advantages of three-axis acceleration sensors, and has entered hmov and other head customers; In addition, the company also continued to increase investment in compound semiconductors. In 2017, a 6-inch silicon-based gallium nitride integrated circuit chip pilot line was built, and in 2020, a pilot line of SiC power devices was started to speed up the research and development of SiC devices, and strive to achieve a breakthrough in vehicle silicon carbide.

We expect the company's net profit attributable to the parent company from 2021 to 2023 to be 924 million / 1251 million / 1548 million respectively, and the PE valuation corresponding to the closing price on June 29 is 80.01/59.09/47.76 times. As one of the leading power IDM companies in China, Shilan micro is currently benefiting most from the trend of tight production capacity. With continuous and vigorous R & D investment and the technical advantages accumulated by adhering to the IDM model, the company's products are highly competitive. Driven by the high prospect of the downstream market, it has sufficient growth momentum in the future.

3. Yang Jie Technology

The company is one of the leading power semiconductor enterprises. Based on the high business cycle of power semiconductor, the company continues to increase R & D investment, fully promote the R & D and industrialization of high-end power MOS, IGBT and other new products, further optimize the company's product structure and promote the improvement of the company's overall benefits. At the same time, the company will raise 1.5 billion yuan for the sealing and testing project of ultra-thin micro power semiconductor chips for intelligent terminals. After completion and operation, the monthly production capacity will reach 2000kk / month, providing growth impetus for the further development of the company in the future. At the industry level, benefiting from the demand growth of new energy and domestic economy, the power semiconductor industry presents a pattern of strong demand - full production capacity - full orders - low inventory - product price rise. Domestic and foreign power semiconductor enterprises have successively raised prices and extended delivery dates since the second half of 20 years. Recently, some enterprises have raised prices again. We expect that under the background of tight supply and demand, the high prosperity trend of the industry will continue in the future.

According to the announcement of the company, the net profit attributable to the parent company is expected to reach 320-360 million yuan in the first half of 2021, with a same increase of 120-150%. Calculated according to the median value of the interval, the net profit attributable to the parent company is expected to reach 190 million yuan in the single quarter of 21q2, with a same increase of 108% and a ring increase of 19%; After excluding non recurring gains and losses, it is estimated that the net profit deducted from non return to parent in the single quarter of 21q2 will be 170 million yuan, with a simultaneous increase of 102% and a ring increase of 12%. Mainly due to the growth of downstream demand, the acceleration of domestic substitution, the improvement of the company's capacity utilization and market share, the company achieved full production and full sales, and the sales revenue increased by more than 70% at the same time; At the same time, the performance of new products is outstanding, and the year-on-year growth rate of MOS, small signal, IGBT and module products is more than 100%.

According to the disclosure of the performance forecast, we raised the profit forecast. It is expected that the net profit attributable to the parent company will be RMB 720 / 9.3 / 1.11 billion in 2021 / 2022 / 2023, corresponding to 43 / 33 / 28 times of PE. At present, Shenwan Semiconductor Index PE is 87 times. Considering the high prosperity of power semiconductor, as well as the company's future capacity expansion and product structure optimization, Yangjie technology is an underestimated variety.

4. Suzhou solid technetium

In 2021, the production and sales of the company were booming, and the capacity utilization rate was improved; The market share of automotive electronic products strategically deployed by the company in previous years has been increasing. Integrated circuits, ppak packaging and MEMS packaging and testing grew rapidly, and the sales volume and sales volume reached a new high.

"From the perspective of many foreign investment projects, Suzhou solid technetium aims to continue to strengthen innovation and expansion in the fields of new electronic materials and semiconductors." A brokerage analyst told the reporter of Securities Daily: "In recent years, the company has made full use of the capital market platform to fully integrate the resource advantages in the fields of semiconductors and photovoltaic electronic pastes, expand and strengthen the field of new energy and new materials, peel off Suzhou jingxun, which is in a state of loss and low profit, and improve the company's asset structure. These capital operations show that the company is concentrating resources to develop its main business."

"In terms of business, Suzhou Mingfu sensor is mainly used in consumer electronic products. The addition of Xiaomi has enhanced the synergy between Suzhou Mingfu and downstream customers and expanded customer resources. In the automotive field, Suzhou gutechnetium automotive products mainly include rectifier diode, Schottky, TVs and other products, and have entered world-famous automotive brands. At the same time, its products are used at home Electrical appliances, digital communication and other aspects are also widely used. " The analyst said.

"The semiconductor, new materials, intelligent manufacturing and other fields invested by Suzhou solid technetium are all hot fields, which are strategic industries encouraged by the state." Executive dean of Digital Economy Research Institute of Central South University of economics and law Professor Pan Helin told the Securities Daily: "judging from the layout of the company's MEMS sensing field, China Academy of Commerce and industry predicts that China's micro electromechanical (MEMS) will be in 2021 The market scale of the industry may reach 81 billion yuan. The MEMS industry has broad prospects for development, and the miniaturization of mechanical systems is the general trend. In particular, the vigorous development of the consumer electronics industry has led to the explosion of demand for MEMS sensors. In the case of more and more extensive application ways in the future, the market is a blue ocean, there are certain technical barriers, and the industry competitors are generally limited, which is more conducive to the development and growth of enterprises. "

In the first quarter of 2021, Suzhou solid technetium achieved a revenue of 561 million yuan, a year-on-year increase of 71.85%; The net profit was 50.41 million yuan, a year-on-year increase of 289.74%. It is estimated that in the first half of 2021, the net profit attributable to the shareholders of the listed company will reach 93 million yuan to 121 million yuan, with a year-on-year increase of 100.00% to 160.00%.

5. Shanghai Beiling

High precision ADC is one of the fields with the highest technical content in analog circuit. It is known as the Pearl on the crown of analog circuit and the global leader. The localization rate has been difficult to break through. ADC of the company has been deeply cultivated for many years. At present, the first and second generation products have achieved small batch sales in Beidou navigation, signal receiving, medical imaging and other fields, and have sent samples and designed and imported for many customers. The research and development of the third generation RF sampling high-speed ADC is smooth. In the first half of this year, the company's ADC chip bl1081 was put into trial operation in Hubei power grid for the first set of "domestic core" relay protection installation and hanging network, which is the first pilot application of this kind of installation in Hubei 220 kV power grid.

According to the company's annual report, in 2020, the company's sales of power management products amounted to 467 million yuan (after merging with Nanjing Weimeng), with a year-on-year increase of 23.66%, accounting for 35.07% of the total revenue from 18.40%, becoming the largest business, and ACDC products continued to increase in the fast charging market share.