" The development of the situation of the Russian-Ukrainian war has affected the nerves of the international market, and the Russian-Ukrainian war has become an uncertain factor that once again triggered a major turbulence in the international market after the outbreak of the new crown pneumonia epidemic.

Following the outbreak of the conflict, European and American countries quickly imposed a series of sanctions on Russia in terms of energy, finance, economy, etc., including freezing Russia’s assets in the West (about 170 billion yuan in USD assets and 154 billion yuan in sterling assets), and prohibiting Russia from importing high Tech products, removing Russia from the international payment system SWFIT, banning settlements in U.S. dollars, cutting off its international energy transactions, etc.

The global market earthquake caused by the Russian-Ukrainian war also has a huge impact on investment! "

Oil and gas: prices up 50-150%

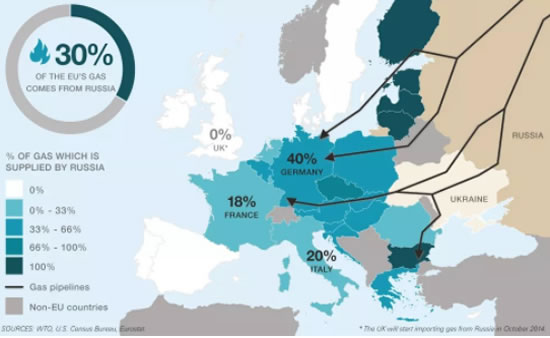

Affected by the conflict between Russia and Ukraine, international crude oil futures prices continue to fluctuate. Russia supplies about 30% of Europe's oil and 35% of natural gas. In the event of a conflict, these resources will be cut off. At the same time, European natural gas futures prices also continued to fluctuate.

Why did the Russian-Ukrainian conflict have such a big impact on the crude oil and natural gas markets?

According to Russian Energy Minister Nikolai Shulginov, Russian oil production will reach 517 million tons in 2021. Global oil production is about 4.423 billion tons, and Russia's crude oil production accounts for about 11.69% of the world's.

In 2021, Russia's natural gas production will be about 639 billion cubic meters, the global natural gas production will be about 3.854 trillion cubic meters, and Russia's natural gas production will account for about 16.58% of the world's.

While countries such as Saudi Arabia can step in to help address Russia's supply shortage, the delivery infrastructure is incomplete. But if longer-term, tougher sanctions are imposed, the potential price impact would be huge.

Investors face significant stagflation risk from rising energy

Soaring energy prices, as well as the cost of raw materials, will further push up inflation and could lead to sharp cuts in industrial production and household spending.

Such stagflation could lead markets and central banks to be less hawkish in tightening policy if global growth comes under severe pressure. If the risk of a recession is on the radar, excessive wage inflation will eventually collapse and policymakers around the world may be forced to introduce more stimulus.

Temporary experiments are blocked but have less impact on the pharmaceutical industry

According to Fierce Biotech, the conflict between Russia and Ukraine may cause more than 200 biomedical-related clinical trials to be affected, and some trials may be delayed or suspended.

According to the Pharma Go global clinical trial database, a total of 227 multi-center clinical trials initiated by Chinese companies or researchers have selected Ukraine as a clinical trial site. The impact of the war on the clinical trials of Chinese companies has yet to be determined.

Domestic pharmaceutical companies have less business in Ukraine, so the conflict between Russia and Ukraine has less impact on business. The following is the response of some domestic pharmaceutical companies to whether the conflict between Russia and Ukraine has affected their business:

● Most of Tigermed's business is carried out in China, and the overall proportion of European business is very small.

● Lianhua Qingwen Capsules produced by Yiling Pharmaceutical Co., Ltd. are not available for sale, but the sales volume is relatively small, which has no impact on the company.

● Meikang Bio's business in Ukraine accounts for a very low proportion of its operating income and has little impact on the business.

Chip production and supply blocked

Global semiconductor supply is already in short supply, and the Russia-Ukraine war could exacerbate the problem. The war has sparked another round of fears for the entire chip industry, and memory chip makers in particular: a potential disruption to gas supplies from Ukraine, which is crucial to chip manufacturing, could drive up prices for semiconductor wafers and exacerbate chip shortages.

Ukrainian military action could disrupt supplies of neon, krypton and xenon, which are required for lasers used in chip production.

Memory makers are currently holding about 6 to 8 weeks of inventories of these key gases, above the normal level of 4 weeks. However, supplies of these gases are highly dependent on Ukraine, and any disruption to output caused by military action in the region could severely impact semiconductor production.

Partial demand spillovers from land and sea boost demand for air freight

On the one hand, the war caused some physical passages of sea and land transportation to be blocked. After the conflict between Russia and Ukraine, transportation companies have chosen to suspend or divert flights. For example, Maersk, MSC, CMA CGM, etc. announced the suspension of Ukrainian business. Flexport said it would no longer accept bookings for the Trans-Siberian railway between China and Europe.

On the other hand, it leads to a shortage of capacity and labor. Russian companies own 7.4% of the world's cruise fleet and 3.5% of the LNG carrier fleet.

Russian and Ukrainian seafarers account for 14.5% of the global shipping labor force. If the logistics channels are not smooth, the supply of transportation capacity and labor flow between the two countries will be blocked, which will have an impact on the global shipping and land transportation markets, aggravating traffic congestion and transportation disruption. Global trade tensions hit by the pandemic have been compounded. It may lead to the overflow of some high-value goods from sea and land transportation, increasing the demand for the international air logistics market.

Impact on global trade patterns

Exacerbating the risk of global economic inflation

Russia and Ukraine are the main product producers in the upstream of the industrial chain. The conflict between Russia and Ukraine and the new round of sanctions against Russia by Europe and the United States will push up the prices of raw materials and agricultural products, which will have an impact on the manufacturing industry in the middle reaches of the industrial chain of relevant Eurasian countries. If the conflict continues, events such as regional inflation and financial market volatility will be intertwined, which will bury cross-market risk contagion and resonance effects, increase the price of imported goods, adversely affect global trade, and further increase global inflation risks, thereby restricting air logistics demand. Steady growth.

Financial sanctions increase Sino-Russian bilateral trade

In recent years, Russia and China have maintained a good strategic cooperative relationship. China is Russia's largest import supplier, of which mobile phones, computers, telecommunications equipment, toys, textiles, clothing and electronic parts are the most important categories. On February 27, the United States, the United Kingdom, the European Union, and Canada jointly announced that Russia would be prohibited from using the SWIFT international settlement system, which would make it impossible for Russia to conduct cross-border transfers, "freeze" Russia's international trade and settlement, and its economic industry would be immediately and significantly affected.

However, at the Sino-Russian level, the proportion of RMB in Sino-Russian bilateral trade settlement has increased from 3.1% in 2014 to 17.5% in 2020. At present, Sino-Russian trade, logistics, transportation and settlement are not affected for the time being. The war may lead to Sino-Russian trade settlement. Bilateral trade further expanded.

impact on investment

The continuation of the Russo-Ukrainian war led to the biggest declines in Russian stocks due to the possible adverse impact of economic sanctions, followed by Ukraine, followed by Europe, which is dependent on Russia for energy supplies. U.S. and Asia-wide equities saw relatively modest losses as trade reliance fell. The decline in safe-haven bond yields was relatively small, and the risk of a global recession was low.

Perhaps the biggest worry and uncertainty for investors is what Russia will do next if it succeeds in annexing Ukraine. U.S. President Joe Biden has said that if a NATO member is attacked, U.S. troops will be deployed, which could lead to greater conflict across Europe.

The article is an analysis point of view of Jingtai and does not constitute investment advice. Please read it carefully.

Data sources: Refinitiv Datastream, Fierce Biotech