Entering the 14th Five Year Plan, China has accelerated the construction of military equipment, rapidly assembled new models of military aircraft, and increased the construction of missiles, all of which have formed strong demand for upstream materials.

With the addition of independent and controllable increments and an increase in the proportion of high-end high-performance materials used in new types of equipment, the upstream materials in the military industry chain are showing a strong "supply shortage", while also showing a higher performance increase elasticity compared to downstream.

| Industry background

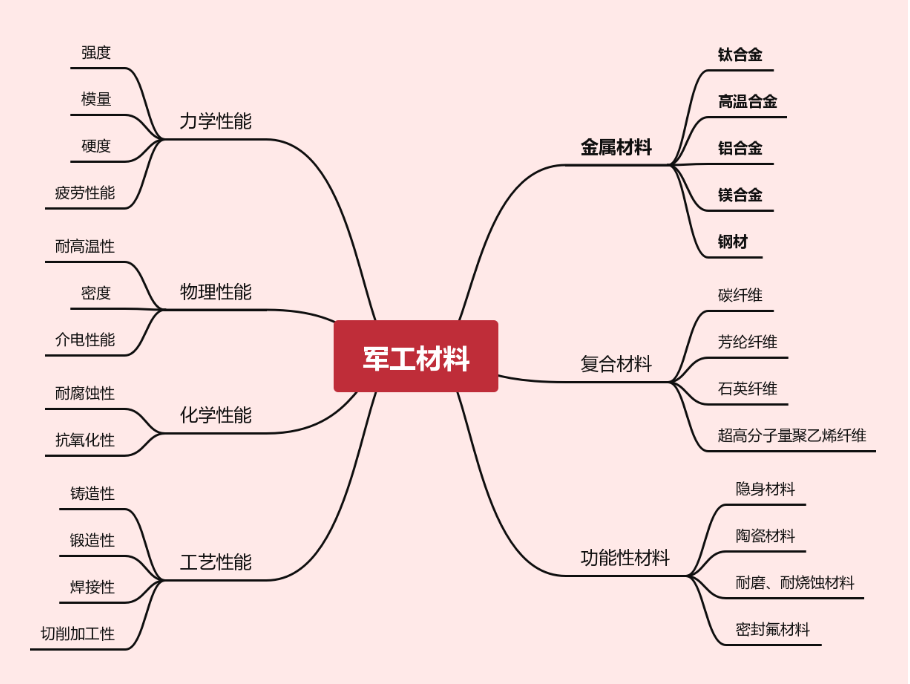

One generation of materials, one generation of equipment

Military materials are the material foundation for the development of weapons and equipment. Military materials are developing towards directions such as lightweight, high-performance, multifunctional, composite, low-cost, and intelligent. During the 14th Five Year Plan period, market demand for titanium alloys, high-temperature alloys, and carbon fibers is expected to maintain stable and high-speed growth, and market space is gradually opening up. It is expected that the composite growth rate of market demand for high-end titanium alloy, carbon fiber, and high-temperature alloy during the 14th Five Year Plan period will be 20%, 25%, and 16%, respectively. Assuming prices of 350000 yuan/ton, 150000 yuan/ton, and 300000 yuan/ton, it is estimated that the market size of the three materials will exceed 10 billion yuan, 20 billion yuan, and 30 billion yuan respectively by 2025.

Preliminary Improvement of the Military Materials Industry Chain

| Titanium alloy

Material characteristics: excellent performance, widely used in military industry

Titanium (Ti) is a silver white metal located in the IVB group of the periodic table. Titanium alloy is an alloy composed of aluminum, tin, vanadium, molybdenum, niobium and other elements added to titanium as the basis. Due to its excellent physical properties, it is widely used in high-end industrial manufacturing such as aerospace, shipbuilding, marine engineering, weapons, automobiles, medical, chemical, metallurgical, sports and leisure industries. It has the advantages of being a "third metal" and "aerial metal" Reputation such as "ocean metal".

Industrial chain: The chain is long and complex

Titanium has abundant reserves on Earth, with a crustal abundance of 0.61%. On the titanium industry chain, the main raw materials for industrial applications are ilmenite and rutile, and intermediate processing products are sponge titanium and titanium dioxide. Among them, sponge titanium is used to manufacture titanium materials and is used in military industries such as aerospace, ships and weapons; Titanium dioxide is mainly used in industries such as coatings, plastics, and papermaking. Due to the complexity and difficulty of titanium smelting technology, currently only the United States, Russia, Japan, and China have mastered complete titanium industry production technology.

Industry chain: upstream raw materials

Rutile is a high-quality raw material for titanium series products, but its natural reserves are relatively small. In terms of reserves, according to USGS, the global ilmenite reserves in 2021 were 700 million tons and the rutile reserves were 49 million tons. The TiO2 content of rutile concentrate is generally above 93% -95%, with high grade and low impurity content. Therefore, rutile is a high-quality raw material for producing titanium series products such as titanium dioxide, sponge titanium, and titanium tetrachloride.

From a national perspective, the distribution of titanium ore is concentrated, and although China has a large reserve, there are few high-quality ores. Looking at different countries, global rutile is mainly concentrated in Australia, India, and South Africa, with Australia ranking first with a reserve of 31 million tons, accounting for 63%; The global concentration of ilmenite is mainly in China, Australia, and India, with China ranking first with a reserve of 230 million tons, accounting for 33%. Although China has abundant titanium resources, it is mainly composed of ilmenite with low TiO2 content and high content of calcium and magnesium impurities, making it difficult to select and smelt.

Industrial chain: Structural supply-demand imbalance of mid stream sponge titanium

The basic raw materials for high-end titanium materials are mainly grade 0 sponge titanium. The basic raw material of titanium material is sponge titanium. According to the unified national standard for sponge titanium, sponge titanium can be divided into 0A level, 0 level, 1 level, 2 level, 3 level, 4 level, and 5 level, mainly related to chemical composition and Brinell hardness. High end titanium alloy production raw materials are mainly grade 0 sponge titanium, while civilian titanium alloy production raw materials are mainly grade 1 sponge titanium.

Global sponge titanium production capacity is surplus, while China's high-end sponge titanium production capacity is insufficient. Currently, only eight countries, including the United States, Russia, China, Japan, Ukraine, Kazakhstan, Saudi Arabia, and India, have the production capacity for sponge titanium. According to USGS, the global sponge titanium production capacity in 2021 was 350000 tons, but the capacity utilization rate was only 60.0%. Among them, China's production capacity is about 177000 tons, with a capacity utilization rate of 67.8%. The overall supply of sponge titanium in China is sufficient, but there is a significant gap in high-quality and small particle sponge titanium. In 2021, China imported 13800 tons of sponge titanium, reaching a historic high, mainly to meet the demand of downstream enterprises for high-quality sponge titanium. The high-end sponge titanium process is complex, with low yield and high production costs. Only a few companies in China, such as Zunyi Titanium Industry, Baoti Huashen, and Chaoyang Jinda, can provide stable supply. Currently, the growth rate of high-quality sponge titanium production in China cannot meet the explosive growth of downstream demand, and the supply-demand gap is increasing year by year, mainly filled by imports from Ukraine and Kazakhstan.

Industry chain: Insufficient production capacity of downstream high-end titanium materials (difficult to melt and cast)

Porous sponge titanium needs to be melted and cast into dense titanium ingots before it can be used to manufacture titanium materials. Titanium has high chemical activity and must be melted and cast under vacuum or inert atmosphere. At present, there are two mainstream casting processes worldwide: vacuum consumable arc melting (VAR) and cold bed furnace melting (CHM). At present, the most widely used method in China is the VAR method (which is adopted by Western Superconducting). Its advantages are mature technology, fast melting speed, but its disadvantages are easy segregation, poor composition uniformity, and easy defect generation. Therefore, for titanium alloy ingots with high quality requirements, they are generally subjected to three rounds of VAR melting to reduce defects. The CHM method better solves the problems of low and high-density inclusions and composition uniformity. In recent years, some titanium companies in China have introduced electron beam cold furnace bed melting furnaces and plasma cold furnace bed melting furnaces from the United States and Germany, and the CHM method is also developing rapidly.

Industry chain: Insufficient production capacity of downstream high-end titanium materials (difficult processing)

The difficulty of titanium alloy processing technology is significant. The thermal conductivity and specific heat of titanium alloy are small, making it difficult for the heat generated during processing to be released through the workpiece. Local temperatures rise rapidly, and under high temperatures, on the one hand, it causes sharp tool wear, and on the other hand, it can damage the surface integrity of the parts, leading to a decrease in geometric accuracy and the occurrence of processing hardening. In addition, titanium alloy has a low elastic modulus, which makes the processed surface prone to springback, especially for thin-walled parts, which can cause strong friction between the rear cutting surface and the processed surface, leading to tool wear and blade breakage. Therefore, titanium alloy processing is very difficult, and currently only six countries in the world, including the United States, Russia, Japan, China, Ukraine, and Kazakhstan, have complete titanium material processing and manufacturing processes. The supply of high-end titanium materials is concentrated in foreign countries, while China has a large production but mainly focuses on the middle and low-end. High end titanium material suppliers are mainly concentrated in three countries: Russia, the United States, and Japan.

Aviation sector: measuring the advanced level of aircraft

Due to its low density, high specific strength, good corrosion resistance, and low thermal conductivity, titanium alloy is widely used in aircraft structural components (such as skin, pipe parts, fasteners, various sheet metal parts, and load-bearing components) and engines (such as compressor discs, stationary blades, moving blades, casings, combustion chamber casings, exhaust mechanism casings, center bodies, jet pipes, compressor blades, wheel discs, and casings).

At present, the maximum speed of the new generation of aircraft is more than three times the speed of sound, which will generate a large amount of heat due to friction between the aircraft and the air. Generally, aluminum alloy can be used for the fuselage when the speed of sound is less than two times. When the flight speed reaches more than two times the speed of sound, titanium alloy with high temperature resistance and better performance must be used. When the flight speed exceeds three times the speed of sound, more titanium alloy needs to be used for the fuselage.

Aerospace field: major projects and missile reserves

Replacing traditional steel materials with titanium alloy materials can significantly reduce the structural weight of aerospace vehicles while improving their corrosion resistance. It is of great significance for increasing the range of aerospace vehicles, reducing fuel consumption, extending service life, and improving service reliabilit

Naval field: innate adaptability

Due to its high specific strength and excellent corrosion resistance in seawater and marine environments, titanium alloys have also been widely used in the field of shipbuilding. Mainly used in pressure resistant hull, structural components, buoyancy system spheres, pump bodies, pipelines, and deck accessories of waterborne vessels, speedboat propellers, propulsion shafts, hydrofoils, whip antennas, etc. At present, the application of titanium alloys in ships is mainly concentrated in some key parts. However, with the continuous maturity of the titanium alloy industry and the decrease in costs, the proportion of titanium alloy applications in ships will continue to increase in the future.

Market size: There is great growth potential for high-end titanium materials, and the market size is expected to reach billions of yuan

China's consumption is mainly in the chemical industry, with a vast space for high-end titanium materials. The consumption of titanium materials in China in 2021 was 127000 tons, a year-on-year increase of 35.7%, indicating a rapid increase in titanium consumption.

Compared to the demand structure of titanium materials, China mainly focuses on the chemical industry, while the aerospace industry has the largest demand for titanium materials globally, reflecting the problem of low usage of high-end titanium materials in China. The future growth space for high-end titanium materials such as aerospace is still vast.

It is expected that the total demand for titanium alloy for military aircraft in China from 2022 to 2026 will be 27234 tons, with an average annual output of 5447 tons. The total demand for titanium alloy in civil aircraft is 197097 tons, with an average annual output of 39419 tons. According to the calculation of 350000 tons of high-end titanium materials, the annual market size of military aircraft and engines is about 2 billion, and the annual market size of military aircraft and engines is about 10 billion.

Competitive landscape: "department stores" and "specialty stores"

Military high-end titanium alloys do not directly compete with foreign countries, but there is still a certain gap, such as titanium alloy extruded profiles, die forgings, large titanium alloy wide and thick plates, large titanium alloy castings, titanium alloy rods and wires for aviation fasteners, etc. It is urgent for China's titanium industry to improve product quality to fully meet the development needs of national defense and military industry for titanium alloys. At present, the main foreign manufacturers include Japan's Toho Titanium Company, the United States Titanium Metal Company, Russia's VSMPO-AVISMA, and so on. At present, the domestic high-end titanium alloy military industry market basically does not face competition from foreign companies. However, in the future, with the landing and mass production of China's civil aviation large aircraft, on the one hand, it has opened up market space, and on the other hand, it will also compete with international titanium alloy leading enterprises in the field of civil aviation titanium alloys.

From the current perspective, due to its historical status, Baotai is the longest industrialized, largest, and most diverse titanium alloy production enterprise, which can be seen as a "department store" of titanium alloys. Both Western Materials and Western Superconducting are controlled by the Northwest Nonferrous Metals Research Institute, resulting in industry competition restrictions. As a result, Western Materials mainly consists of titanium alloy plates and pipes, while Western Superconducting mainly consists of titanium alloy rods and wires. Both companies have strong competitiveness in their respective fields and can be seen as specialty stores for a certain type of titanium alloy.

| High temperature alloy

Material properties: still exhibits good properties at high temperatures

High temperature alloys are a class of advanced structural materials based on metal elements such as nickel, iron, and cobalt, which can withstand certain stresses for long-term operation at high temperatures above 600 ℃, and have excellent oxidation and corrosion resistance. Compared to ordinary metals, high-temperature alloys exhibit excellent performance in complex working environments: ① high-temperature strength; ② Antioxidant activity; ③ Resistance to thermal corrosion; ④ Fatigue resistance; ⑤ Fracture toughness; ⑥ Stable internal organization and reliable use. Although it has excellent performance, the preparation of high-temperature alloys is difficult, and they are also known as superalloys in Europe and America.

Industrial chain: A basic and complete industrial chain has been formed

At present, there are more than ten enterprises and research institutes engaged in the research and preparation of high-temperature alloys in China, and a relatively complete high-temperature alloy production system has been formed. The high-temperature alloy industry chain consists of upstream raw material and equipment suppliers, midstream high-temperature alloy material and product manufacturers, and downstream application terminals.

Aerospace: The largest application field

At present, high-temperature alloys are mainly used in the field of engines, including aviation engines, aerospace rocket engines, and various industrial gas turbine engines. According to Roskill's statistical data, in the downstream applications of high-temperature alloys, by value, aerospace applications account for 55%, followed by the power sector with a proportion of applications20%.High temperature alloys are important materials for aircraft engines and provide performance assurance for multiple core components. According to the Development of Materials and Structures in Aviation Engines, high-temperature alloys account for over 40% to 60% of the total weight of new aviation engines. They are mainly used for hot end components such as combustion chambers, turbine guide vanes (also known as guides), turbine working blades, and turbine discs. In addition, they are also used for components such as casings, rings, and exhaust nozzles.

Ships and warships: concentrated application in the power equipment of ships

The application of high-temperature alloys in ships and warships is mainly focused on the structural components of power equipment and a large number of high-temperature bolts used in power equipment. The power equipment of ships around the world is divided into main power (mainly large diesel engines or nuclear reactors) and auxiliary power (mainly gas turbines), both of which require a large amount of high-temperature alloys. Diesel engines have advantages such as high thermal efficiency and wide power range, and occupy a large share in ship power equipment. High temperature alloys are mainly used in the pre combustion chamber nozzles of large diesel engines, high-temperature corrosion-resistant elastic parts and fasteners, valve and seat alloys, turbocharged turbochargers, turbochargers, and exhaust systems. The parts that require high-temperature alloys in gas turbines include air compressors, combustion chambers, impeller systems, and gear reducers. The temperature of the gas sprayed onto the impeller can reach up to 1300 ℃, so the impeller system needs to use high-temperature alloy materials.

Market size: Annual market size exceeding 10 billion yuan

The domestic high-temperature alloy production capacity supply is limited, and there is a significant supply-demand gap for a long time. According to statistics, the size of China's high-temperature alloy gold market reached 16.98 billion yuan in 2019, with a production volume of about 27600 tons. However, the overall market demand for high-temperature alloys was about 48200 tons, with a supply-demand gap of 20600 tons.

It is expected that China's annual demand for high-temperature alloys will be about 58200 tons in the future, with a broad market space.

Competitive landscape: Global oligopoly characteristics presentDue to high technical difficulty, long process accumulation time, long product validation cycle, and large initial investment, only less than 50 companies worldwide have the ability to produce high-temperature alloys for aerospace, mainly concentrated in countries such as the United States, the United Kingdom, France, and Germany, and the industry presents an oligopoly characteristic

| Aluminum alloy

Low cost, high modulus: the most widely used structural material

Aluminum is the most abundant metallic element in the Earth's crust, second only to steel in production and usage as a non-ferrous metal in the world. Its density is only 2.7g/cm, about one-third of that of steel. Due to the softness and low strength of pure aluminum, aluminum alloys with better performance are made by adding small amounts of elements (such as magnesium, copper, zinc, silicon, lithium, etc.) to aluminum. Due to its excellent mechanical and corrosion resistance properties, aluminum alloy is the most widely used non-ferrous metal structural material in industry, and has been widely used in construction, aerospace, automotive, mechanical manufacturing, shipbuilding, and chemical industries. The aluminum alloys used in military industry mainly include aluminum lithium alloys, 2XXX (A1 Cu Mg) series, and 7XXX series aluminum alloys.

Industry chain: developing towards high-end aluminum materials

The upstream of the aluminum alloy industry chain is the metal mining and smelting industry, mainly composed of three links: bauxite mining, alumina refining, and electrolytic aluminum production. After processing electrolytic aluminum (mainly casting and rolling), aluminum alloy castings, aluminum plates and strips, and aluminum profiles are obtained; Downstream enterprises in the industrial chain widely apply aluminum processing materials in construction, automotive, aerospace, and aviation by purchasing them