In recent years, the first generation of semiconductor, silicon, has profoundly and comprehensively affected our lives. Up to now, it is still the mainstream material in the field of electronics and electricity. However, although silicon materials are excellent in every way, their performance at high frequencies and pressures is average. With the growth of technological level and downstream demand, there is an urgent need for new materials in the high-frequency and high-voltage fields.

The second and third generation semiconductor materials emerged as the times require. The popularity of wide band gap compound semiconductor technology represented by silicon carbide (SiC) and gallium nitride (GaN) has ignited the entire power semiconductor market.

The third generation semiconductor materials have a large band gap, which has advantages such as high breakdown electric field, high thermal conductivity, high electron saturation rate, and strong radiation resistance. Therefore, semiconductor devices fabricated using third generation semiconductor materials can operate stably at higher temperatures and are suitable for high voltage and high frequency scenarios. In addition, it can achieve higher operating capacity with less power consumption, making it more suitable for making high-temperature, high-frequency, radiation resistant, and high-power devices.

What is gallium nitride?

Gallium nitride, as a representative of a new generation of wide band gap compound semiconductors, is an extremely stable compound. Under atmospheric pressure, GaN crystals generally have a hexagonal wurtzite structure, which is a hard high melting point material with a melting point of about 1700 ℃.

From the material level alone, compared to the first generation of Si and the second generation of GaAs, GaN has many outstanding characteristics: it has a larger band gap width and excellent breakdown field strength, can carry higher energy density (withstand voltage), and has higher reliability; With higher electron density and electron mobility, it has the advantages of low conduction loss and high current density, which is conducive to improving the overall energy efficiency of the device; The wide band gap and high thermal conductivity make GaN devices more resistant to high temperatures. GaN devices can operate at temperatures above 200 ℃.

Gallium nitride is used in the production of radio frequency, power, and photoelectric devices. The substrates used mainly include silicon carbide substrate, silicon substrate, sapphire substrate, and gallium nitride substrate.

GaN-on-SiC epitaxial wafers fabricated by growing gallium nitride epitaxial layers on silicon carbide substrates can be made into radio frequency devices. Silicon carbide based gallium nitride radio frequency devices have advantages such as higher efficiency, greater bandwidth, and higher power, which can better meet the high requirements for radio frequency devices in military/civil fields such as 5G macro stations, satellite communications, microwave radar, and aerospace.

GaN-on-Si epitaxial wafers fabricated by growing gallium nitride epitaxial layers on silicon substrates can produce success rate devices. Silicon based gallium nitride power devices have characteristics such as high conversion efficiency, low conduction loss, and high work efficiency, and can achieve rapid penetration in areas such as high-power fast charging chargers, new energy vehicles, and data centers.

GaN-on Appeire/GaN-on GaN epitaxial wafers fabricated by growing gallium nitride epitaxial layers on sapphire/gallium nitride substrates can be used as optoelectronic devices. Gallium nitride optoelectronic devices have characteristics such as large baseband width, high breakdown electric field, and fast electron saturation drift speed. They have outstanding application advantages in the fields of Mini LED, Micro LED, and traditional LED lighting

In the field of electronics and electronics, gallium nitride is actually an old competitor. Gallium nitride materials have a wide band gap, good physical and chemical properties, and thermal stability, which can better meet the demand for high-power high-temperature and high-frequency high-voltage devices in fields such as 5G technology, new energy vehicles, and military detection, and have a good market prospect.

| Rich downstream fields of GaN

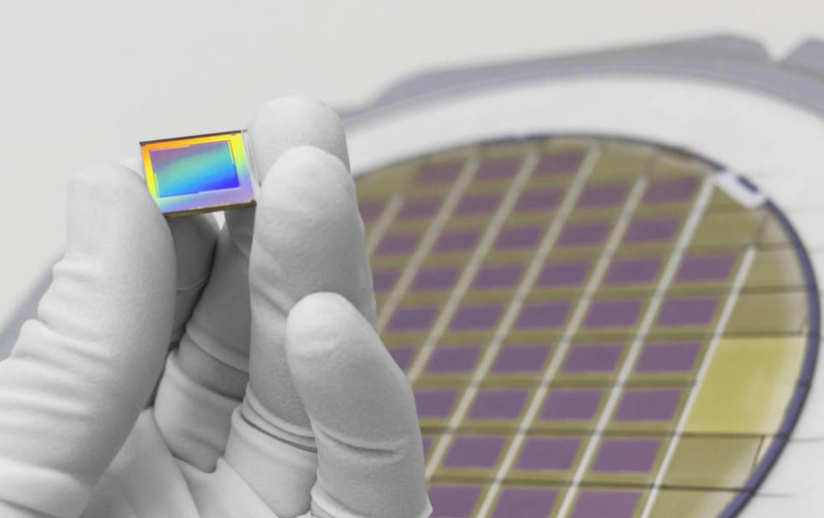

The gallium nitride industry chain can be mainly divided into six links: substrate manufacturing, epitaxial growth, device design, device manufacturing, packaging testing, and downstream applications.

IDM manufacturers (i.e., responsible for both design and manufacturing) generally cover epitaxial growth, device design, and device manufacturing simultaneously. The most critical part is epitaxial growth, which accounts for 40% to 50% of the final device cost. Currently, the main industrial chain structure is as follows:

The middle reaches of the industrial chain are gallium nitride device manufacturers, with business models divided into design and manufacturing integration (IDM mode), design (Fabless mode), and foundry (Foundry mode). Enterprises with IDM mode can fully explore the technological potential and have the conditions to take the lead in experimenting and promoting new technologies. Currently, 80% of GaN enterprises in China are in IDM mode.

The Fabless model has relatively light assets, small initial investment scale, relatively small entrepreneurial difficulty, and low operating costs, accounting for 5%. Foundry mode enterprises do not have to bear decision-making risks due to inaccurate market research, product design defects, and other factors, accounting for 15%.

| The global market size of GaN will reach 1.1 billion US dollars

According to the latest market report released by Yole in 2021, the global market size of GaN power electronics reached $46 million in 2020, with a growth rate of 122% compared to 2019 ($20.7 million). Meanwhile, it is expected to maintain rapid growth in the next five years. It is expected that the global market size will reach $1.1 billion by 2026, with a compound annual growth rate of 70%.

From the perspective of market segments, consumer grade applications represented by fast charging will continue to be the main growth driver of the market. It is expected that the market size will increase from $28.7 million in 2020 to $672 million in 2026, with a compound annual growth rate of 69%. Next, it is worth looking forward to data center applications and automotive applications.

Overall, gallium nitride is expected to replace the market for Si MOSFETs. According to statistics, the global Si MOSFET market size will reach US $8.067 billion in 2020. However, due to the fact that the cost of gallium nitride devices is still significantly higher than that of Si MOSFETs (the price is about 1.5-2 times), they can only be more competitive in some high-frequency switching applications and cannot form a comprehensive replacement for Si MOSFETs.

It is expected that the market of gallium nitride power electronic devices in the next five years will be mainly driven by the following five major applications: current (small) power supply devices and wireless power supplies with high penetration rates, data centers with medium penetration rates, new energy vehicles and laser radars that may have a large market in the future.

| Panorama of domestic gallium nitride enterprises

Enterprises related to the gallium nitride industry in China are mainly concentrated in the eastern and southeast coastal areas. The gallium nitride industry is a high-tech industry with high R&D investment and advanced technology. Most of the relevant enterprises are located in economically developed provinces, with the gallium nitride industry in Jiangsu Province developing best.

Currently, only InnoSecco in China has achieved mass production and shipment on a large scale, while other startup companies are still basically at the stage of small batch production, which has formed a significant gap of 1-2 years. In the consumer level fast charging market, products can only have market competitiveness if they are shipped and iterated quickly.

With the production of subsequent manufacturers, fast charging will likely become a difficult market to "make money", and potential market opportunities will be more prevalent in markets that are less price sensitive, such as automobiles, laser radars, and data centers. However, this will inevitably require higher technical capabilities, supply chain reliability, and stability for device manufacturers.