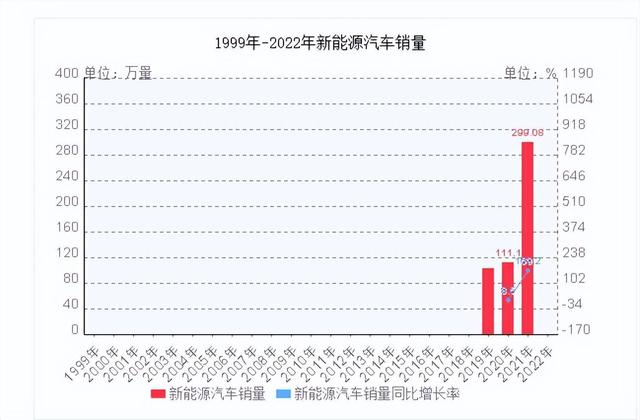

With the rapid development of the new energy industry, the industry chain of charging piles surrounding the development of new energy vehicles is also rapidly expanding. However, with the surge in the number of new energy vehicles, the "one is difficult to find" ridicule one after another. Many owners are either charging or on their way to find charging points. Can the hot new energy vehicle market drive the development of downstream charging pile industry? What kind of market opportunities will charging pile industry usher in?

| charging infrastructure of tuyere trillion-dollar markets

According to relevant statistics, by the end of June this year, the number of new energy vehicles has exceeded 10 million, reaching 10.01 million, accounting for 3.23% of the total number of vehicles. Among them, the number of pure electric vehicles is 8104,000, accounting for 80.93% of the total number of new energy vehicles. With the gradual increase in the production and sales of new energy vehicles, The demand for charging piles is also increasing.

As of June, the country had 3.918 million charging infrastructure units, up 101.2 percent year on year, according to the China Charging Alliance. Among them, public charging piles have 1,528,000 units, with a year-on-year growth of 65.5%. However, the pile ratio of electric vehicles is only 2.1:1 at present, which also shows that the overall scale of the charging pile market lags behind.

In the case of high demand of charging pile market, the charging pile market lagging behind the new energy vehicle has a huge market potential and a great tuyere.

Pile ratio is an important index to measure whether the charging pile can meet the charging demand of new energy vehicles.

Data from the Alliance for the Promotion of Charging Infrastructure for Electric Vehicles showed that 1,301,000 new charging piles were added in the first half of 2022, among which the increment of public charging piles increased by 228.4% year on year; The increment of private charging piles built with vehicles continued to rise, up to 511.3% year-on-year. By the end of 2021, China had 7.84 million new-energy vehicles and 2.617 million charging piles, with a ratio of 3:1, a large gap. The number of new energy vehicles in China is expected to reach 64.2 million by 2030. According to the construction target of 1:1 pile ratio, there will still be a gap of about 63 million yuan in China's charging pile construction in the next 10 years, which will form a 1,025.3 billion yuan charging pile infrastructure construction market.

According to the data of China Electric Vehicle Charging Infrastructure Promotion Alliance, the market scale of charging piles in China was only 7.2 billion yuan in 2017, and reached 41.9 billion yuan in 2021, driven by both market and policy factors, with a CAGR of 55% from 2017 to 2021. In 2025, the number of newly added charging piles in the world is expected to reach 13.99 million, with a corresponding market space of 196.3 billion yuan and a CAGR of 65% from 2021 to 2025.

It is expected that by 2030 the vehicle-pile ratio will be close to the reasonable value of 1:1, when the number of new energy vehicles in our country will reach 52 million. The incremental space of charging piles in 10 years will be about 50 million, the incremental space of 5-9 times in 5 years, and the construction scale will exceed 500 billion. In addition, in 2025, after the nearby operation model is improved and the industrial pattern is basically stable, the charging pile service fee will also grow rapidly, bringing new space, which can reach nearly one trillion market.

| opportunities and risks

In the case of high market demand, charging pile of charging infrastructure has also become a hot investment spot in the capital market.

1. Public charging piles with high power DC fast charging will become the major increment and inevitable choice in the future

Judging from the construction and operation of public charging facilities around the country, car owners, especially those of taxis and e-hailing cars, prefer short-term and fast charging, and DC charging piles are commonly referred to as "fast charging". The overall market situation shows that the growth rate and proportion of high-power DC charging piles will continue to increase in the future, and some enterprises are also taking high-power DC charging piles as one of the key research and development directions in the future.

2. "Charging pile + value-added service" will be an important profit point in the future

Now charging pile downstream some links regardless of the cost of competition is easy to evolve into low price vicious competition. Increasing revenue and profitability is the key to a healthy and sustainable industry. As the charging pile is an important entrance to the Internet of vehicles, it carries a large number of car owners' data. Data-based value-added services can provide higher business value for vehicle manufacturers or transportation companies.

3. In the future, the co-existence of self-built pile and cooperative pile construction mode of automobile enterprises has a broad prospect

Automobile enterprises need to consume a lot of capital to build piles by themselves. If they can cooperate with operators to build piles, they can effectively reduce the financial pressure, and the operators can also expand the business scope and increase the revenue.

Of course, you can't ignore the risks while looking at the opportunities.

With the continuous development of the new energy industry, charging piles have gradually entered the stage of fierce competition. However, from the current scale and distribution of charging stations, problems such as uneven distribution, poor operation and maintenance of the national charging infrastructure still need to be solved. Therefore, the charging pile industry is not very mature at present.