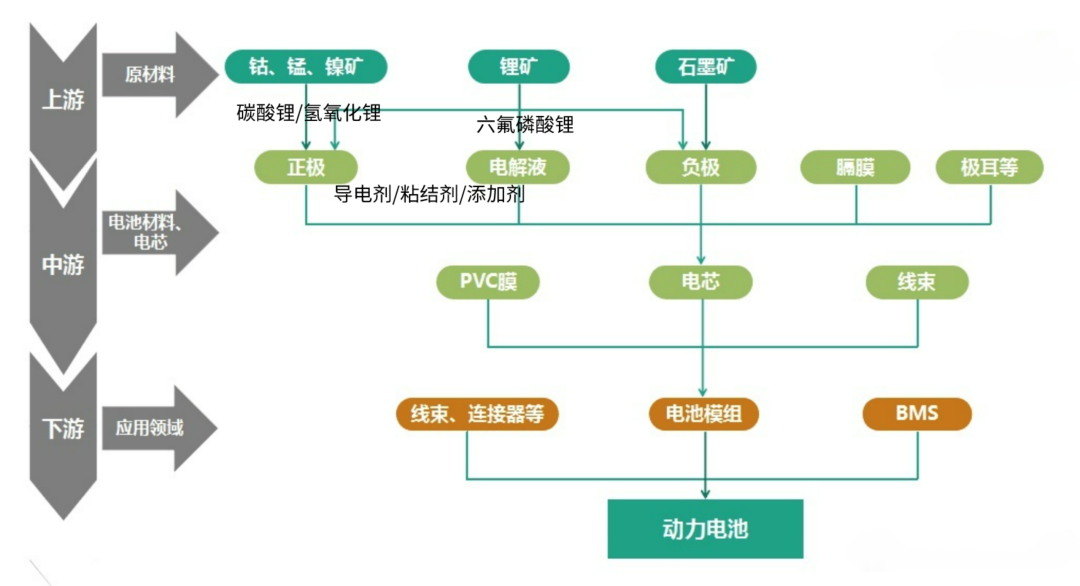

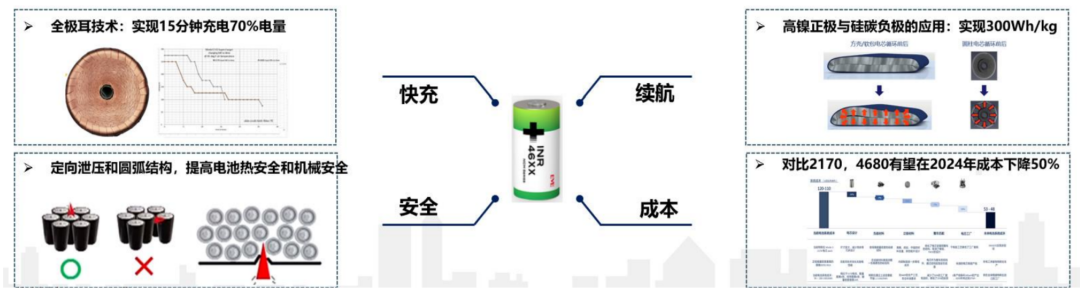

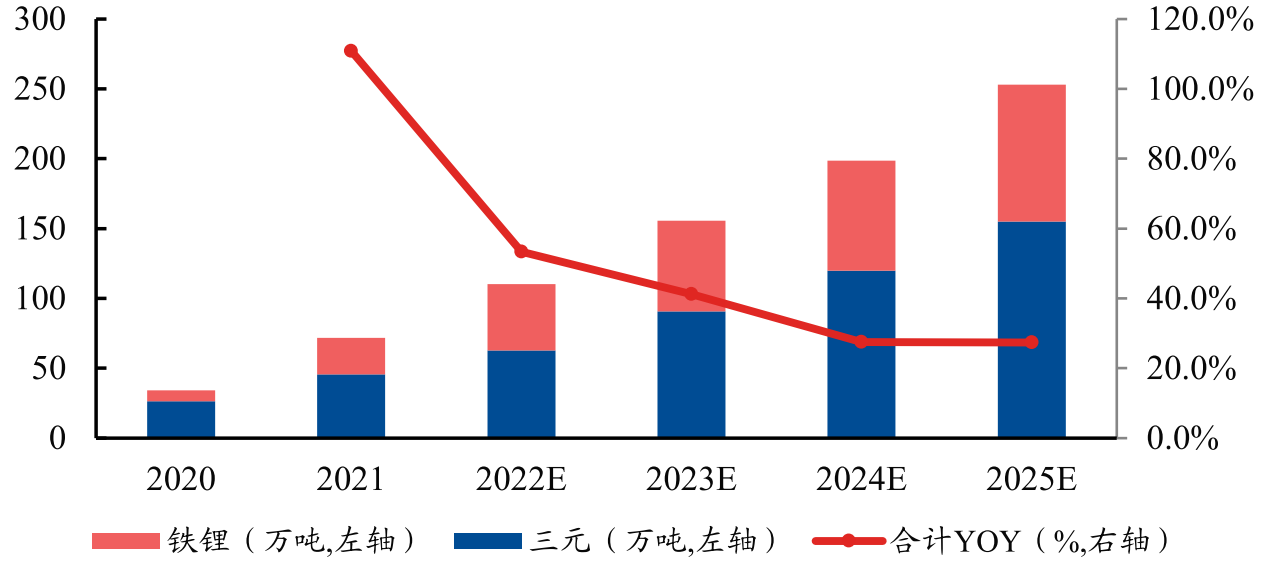

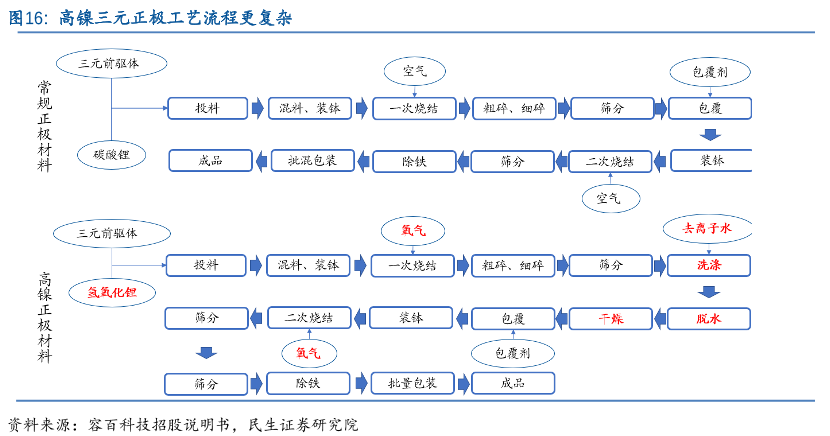

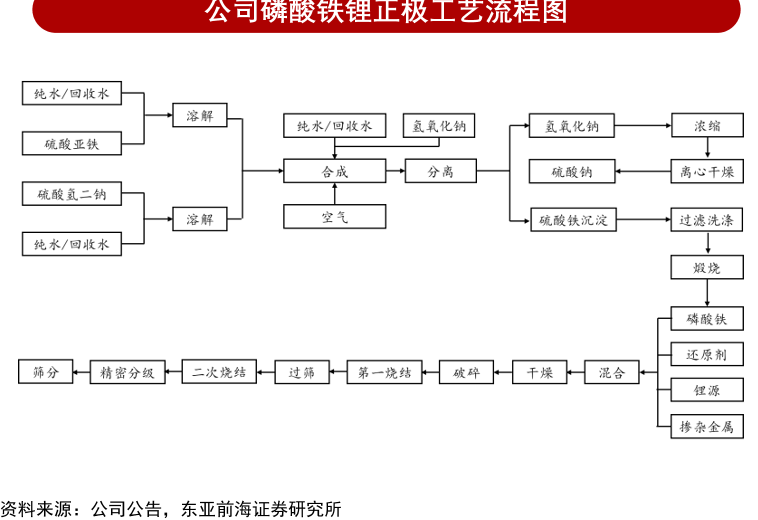

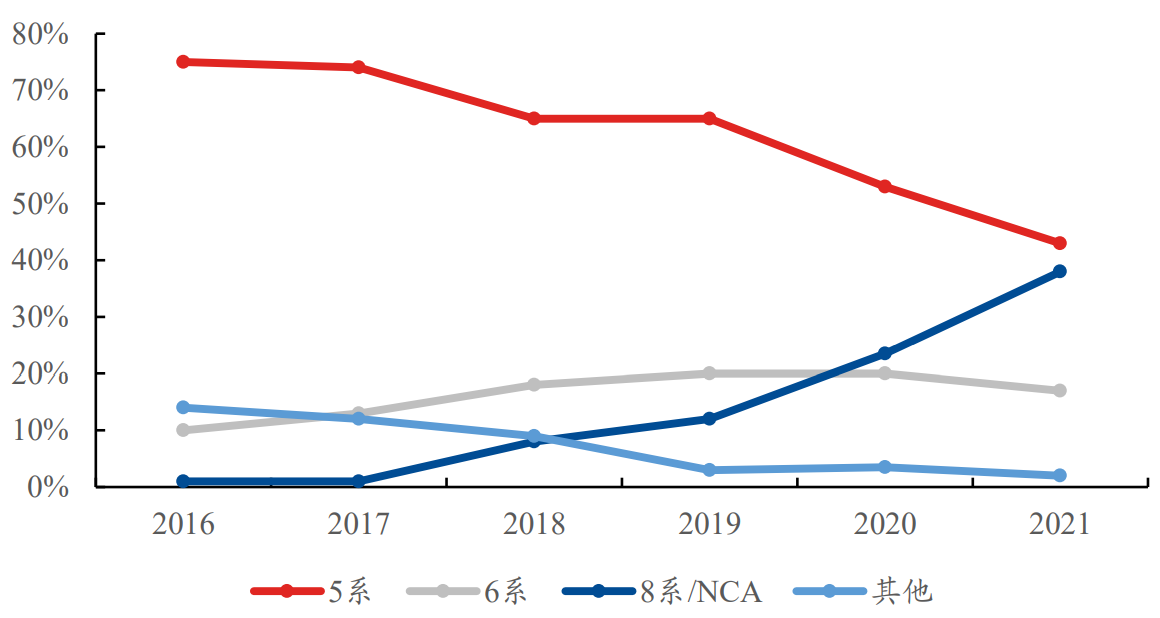

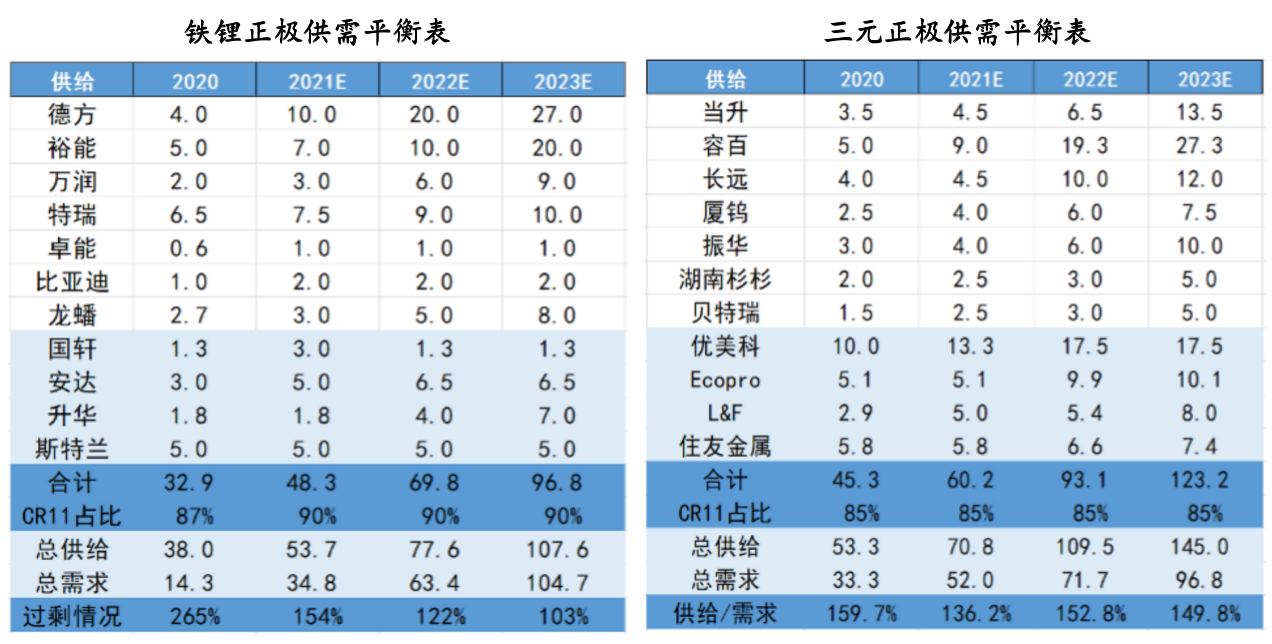

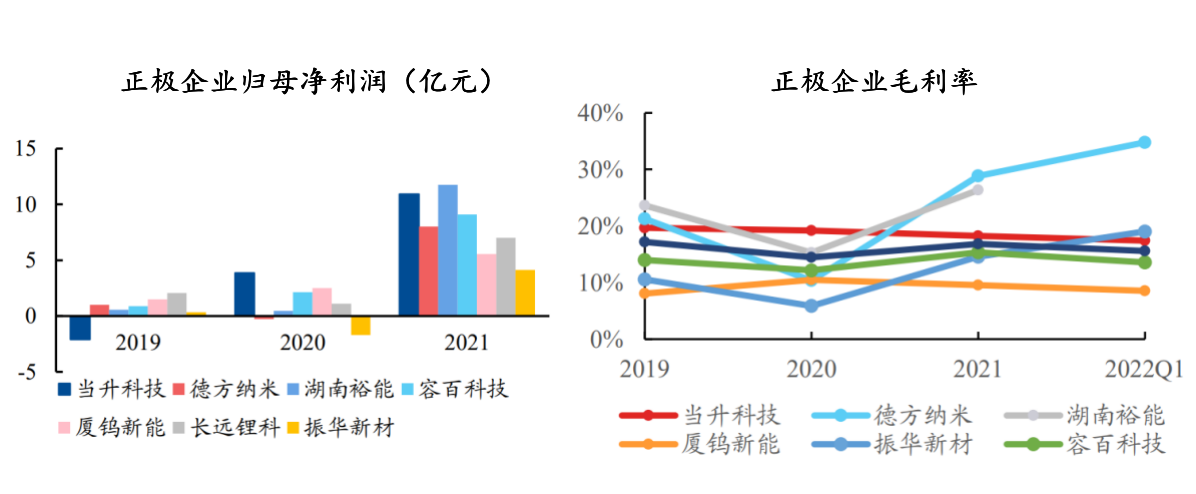

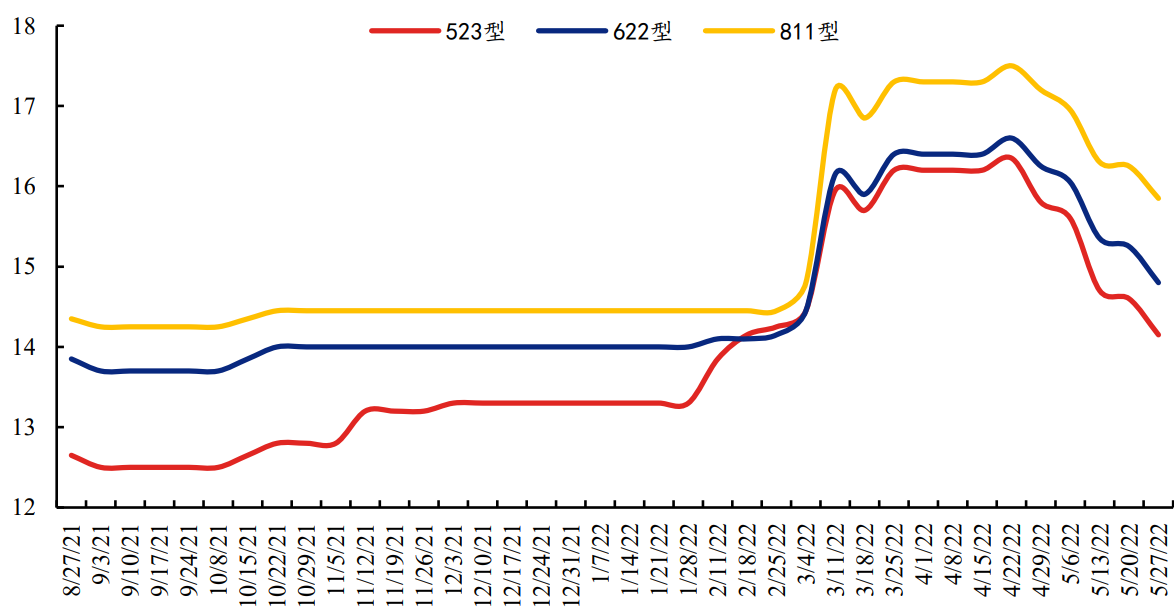

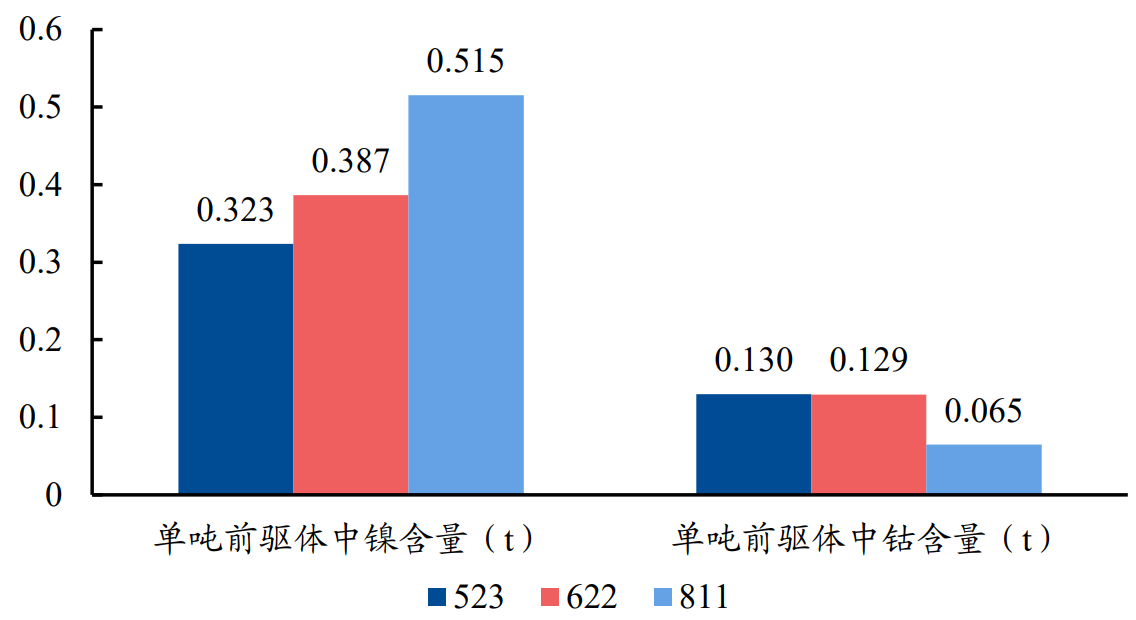

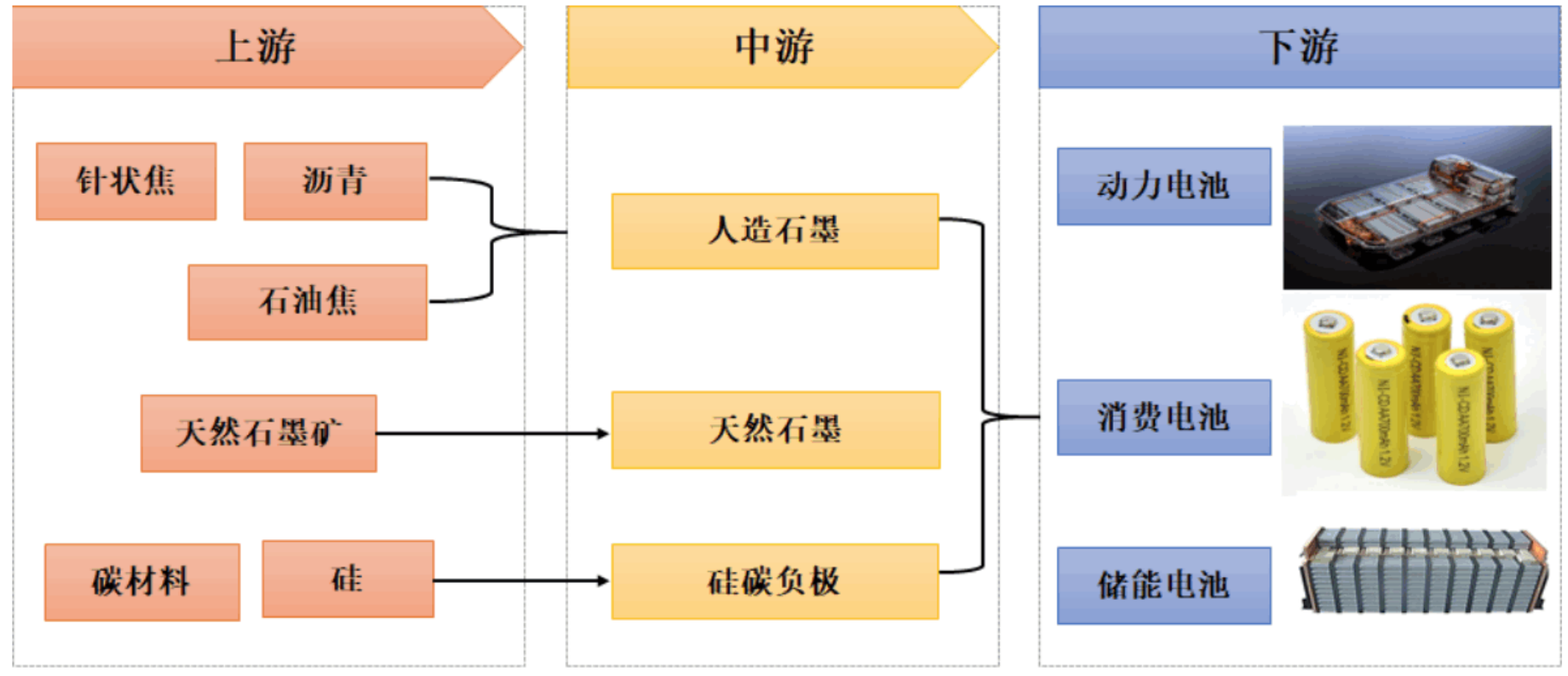

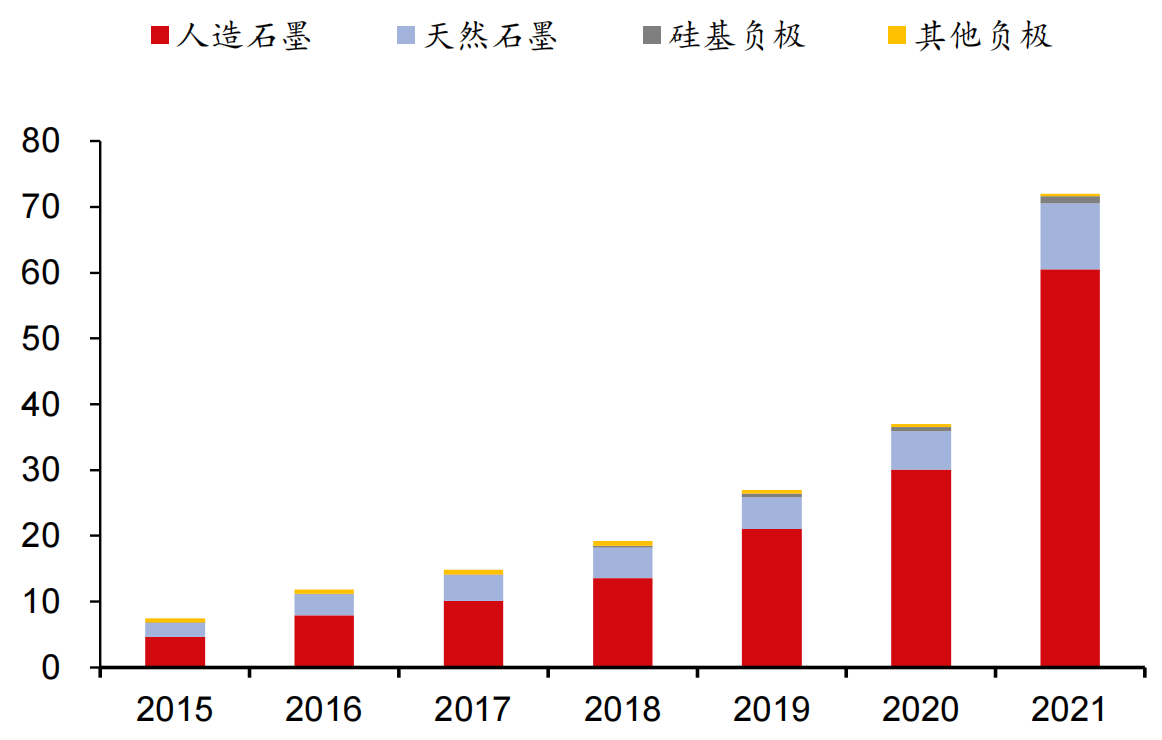

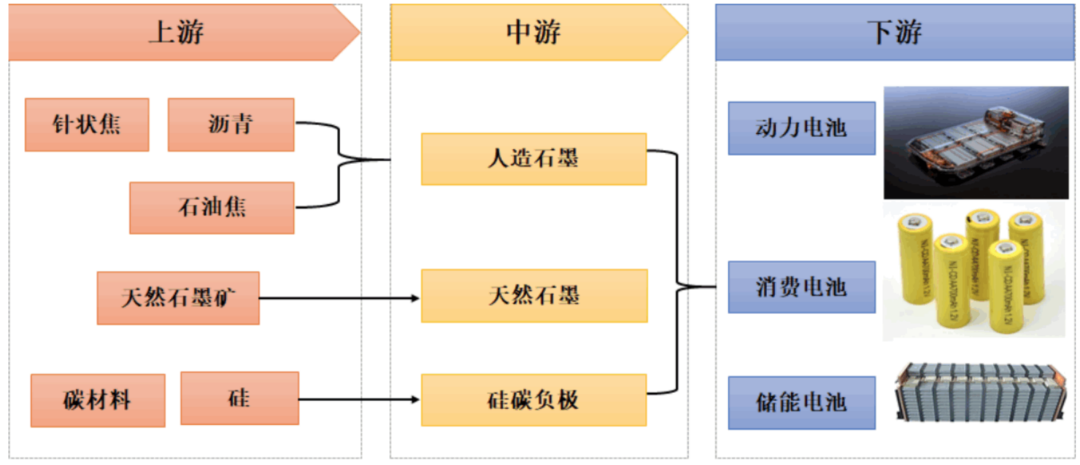

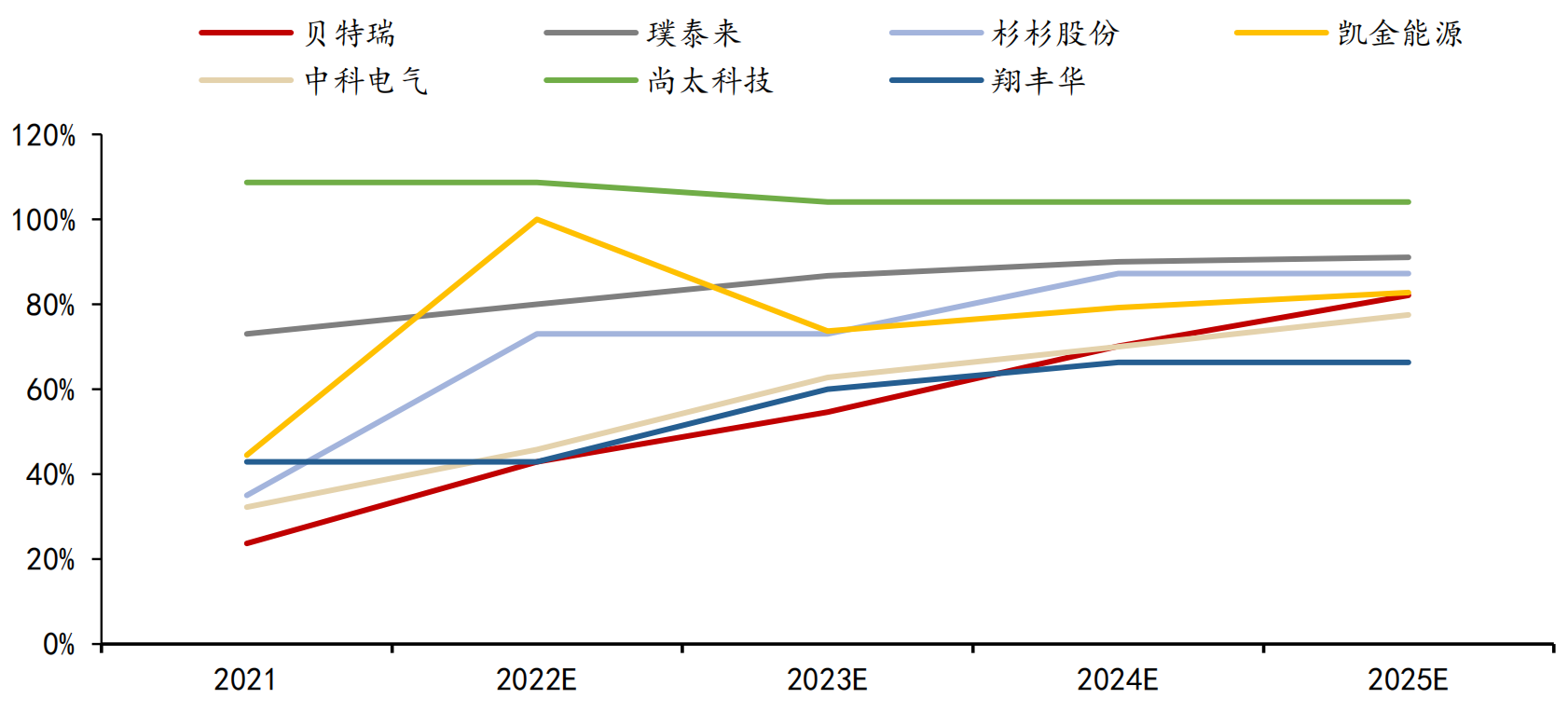

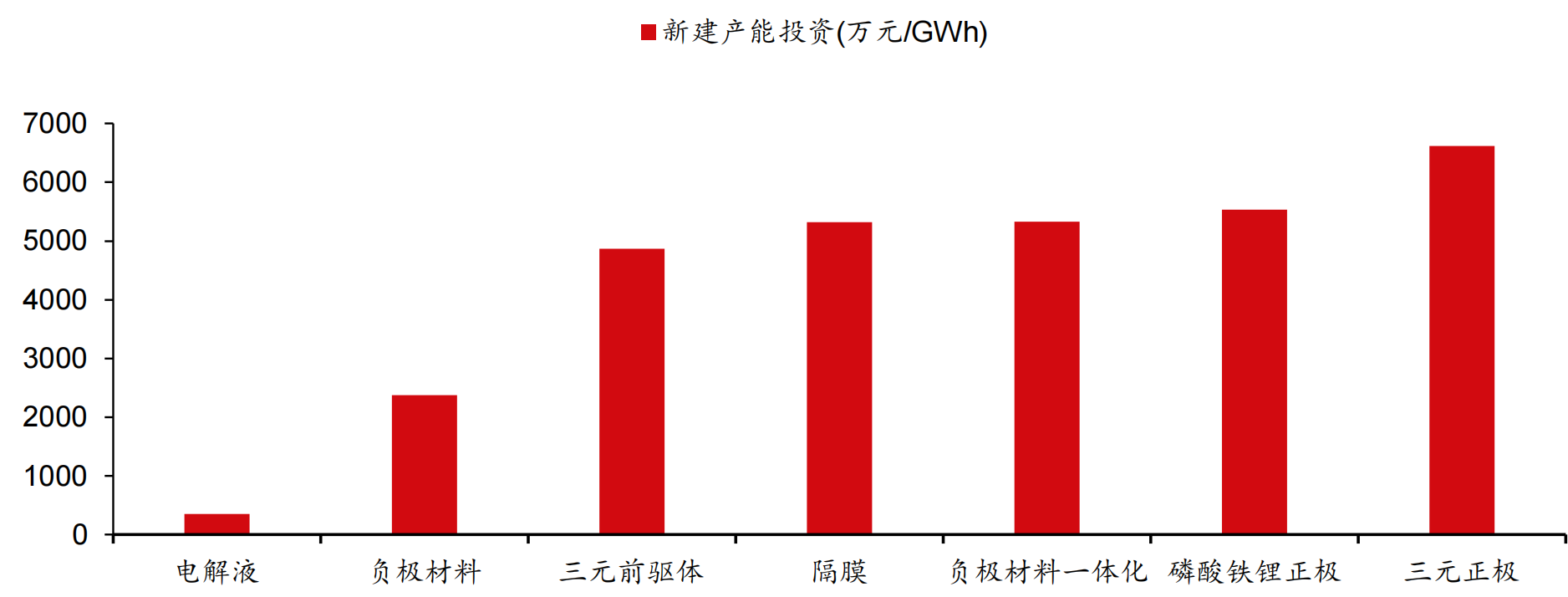

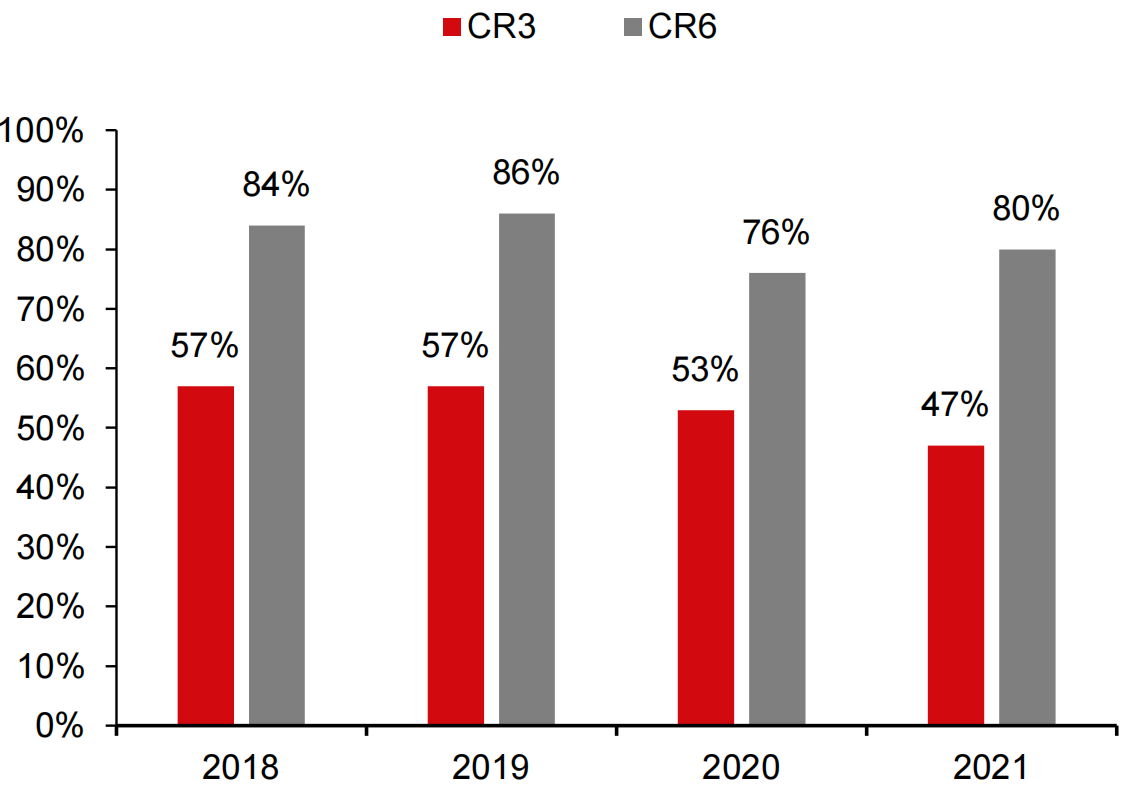

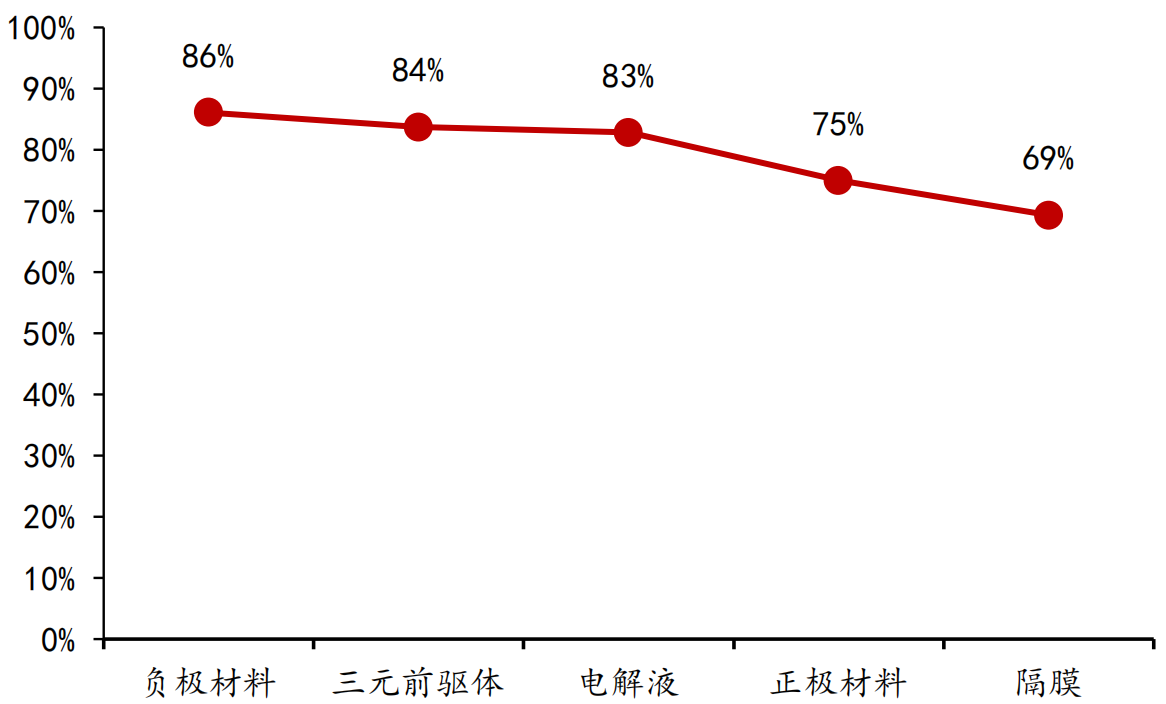

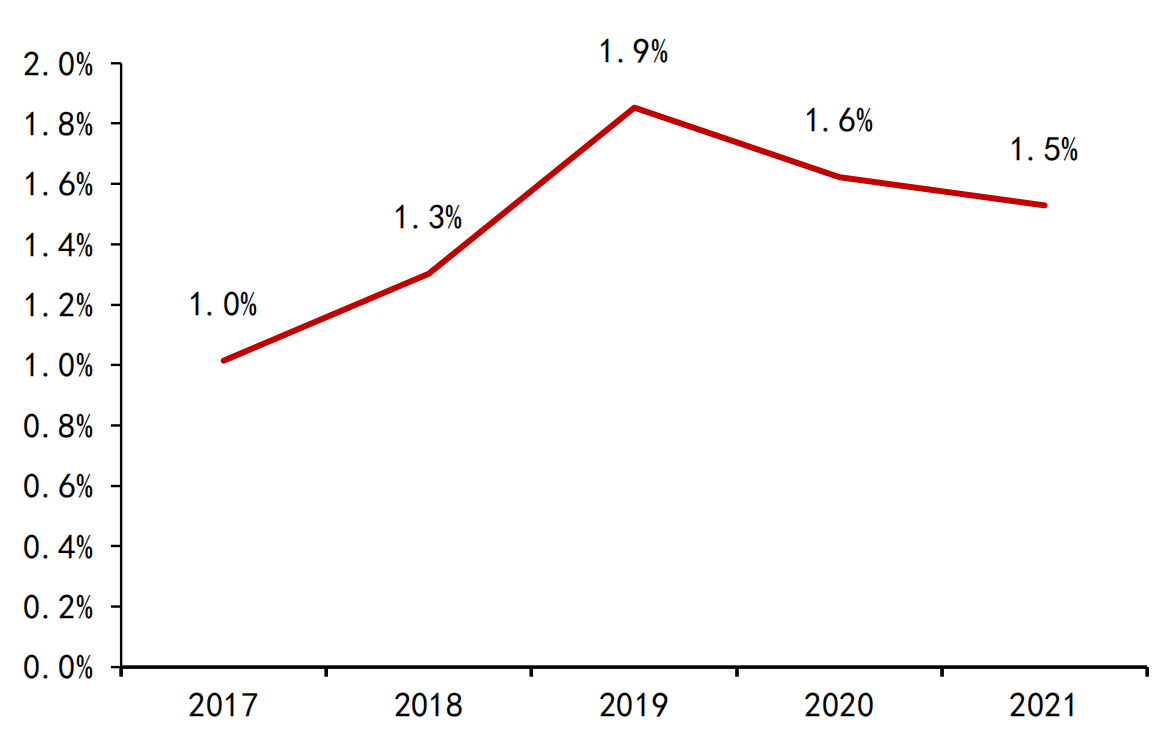

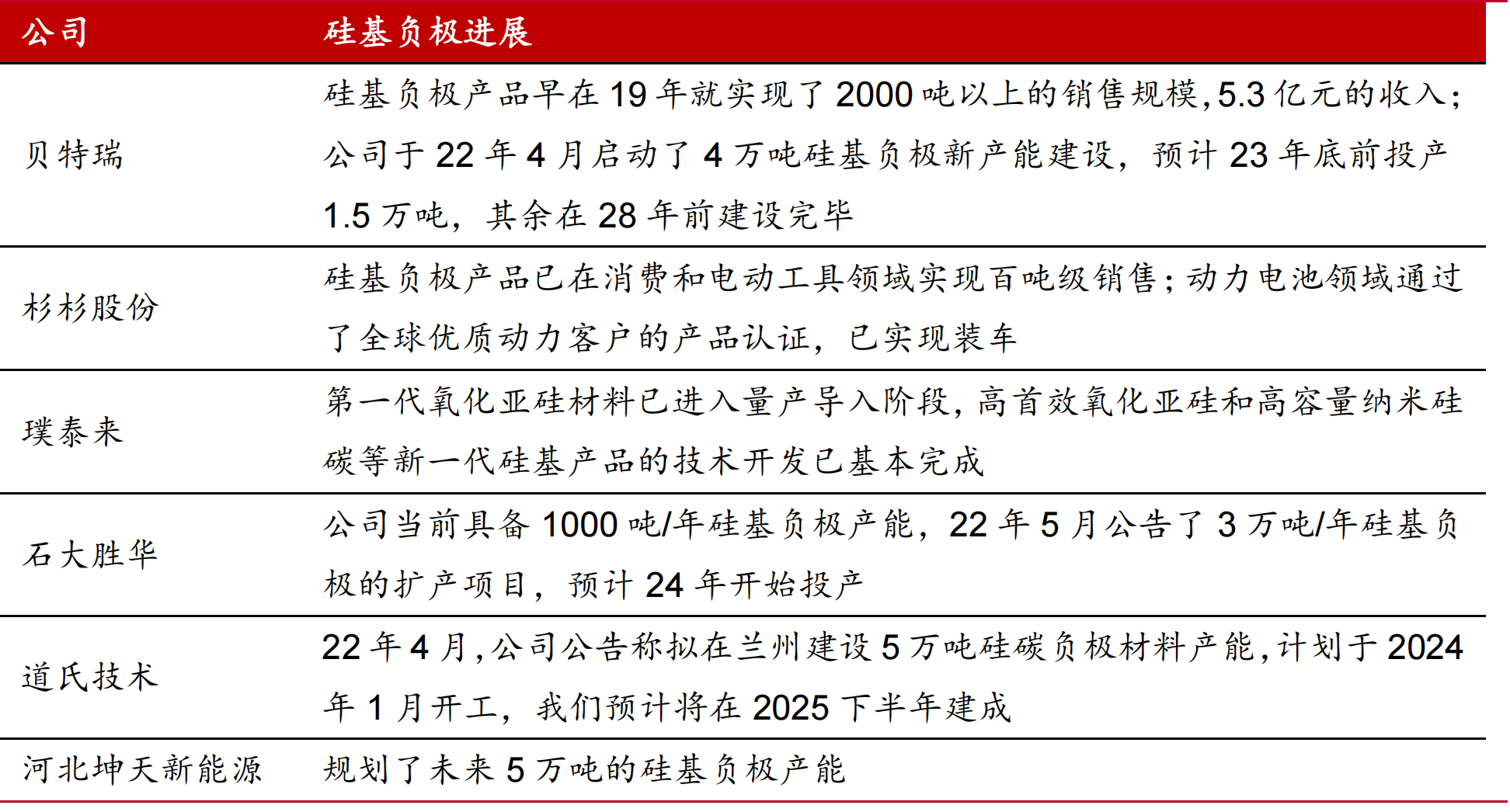

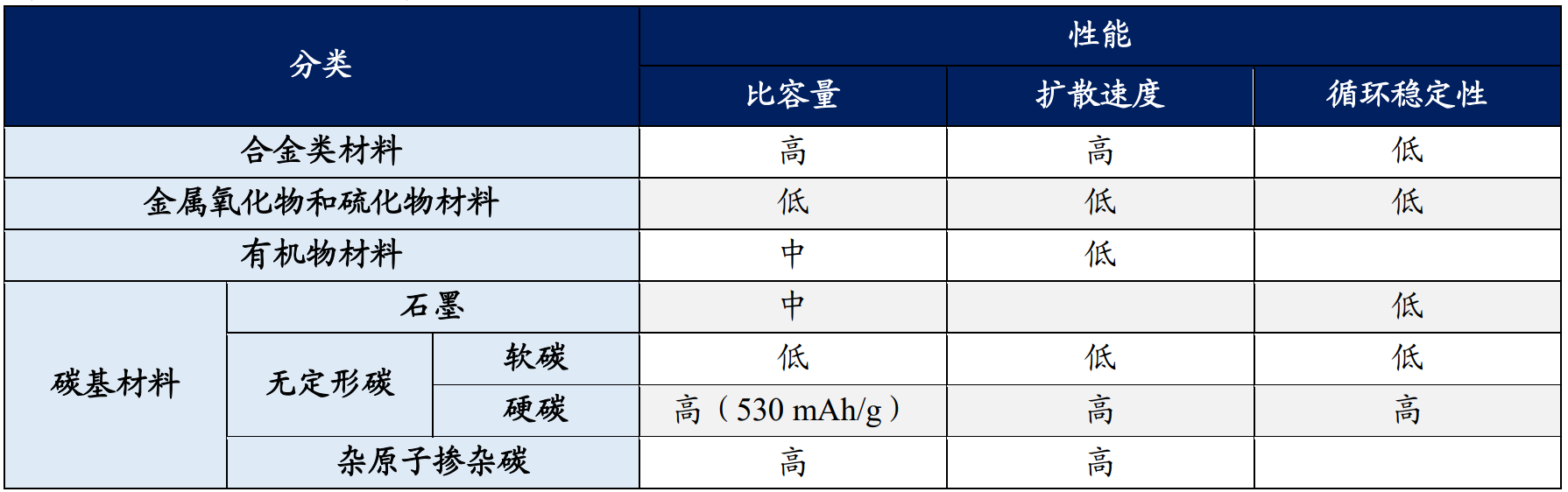

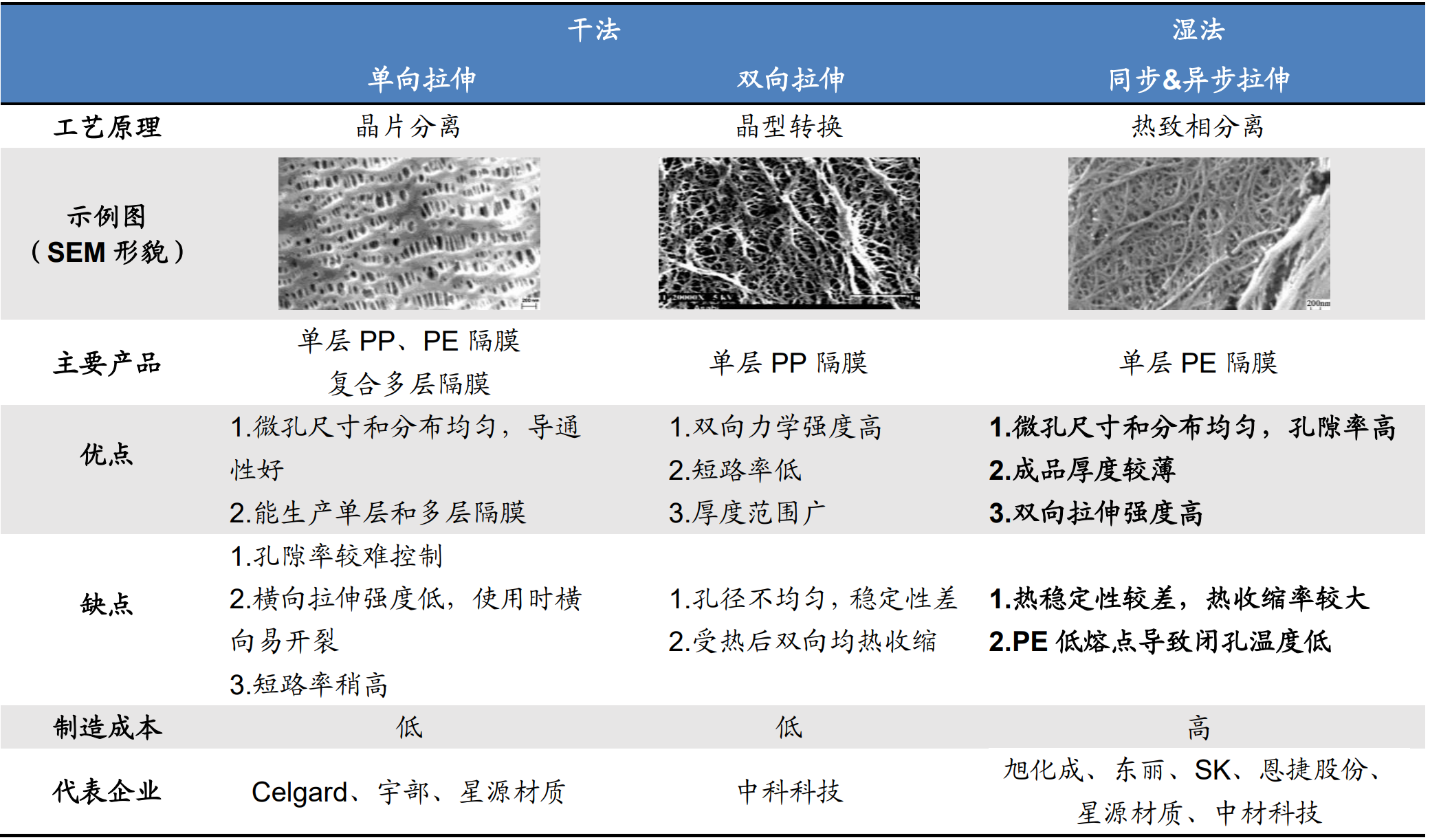

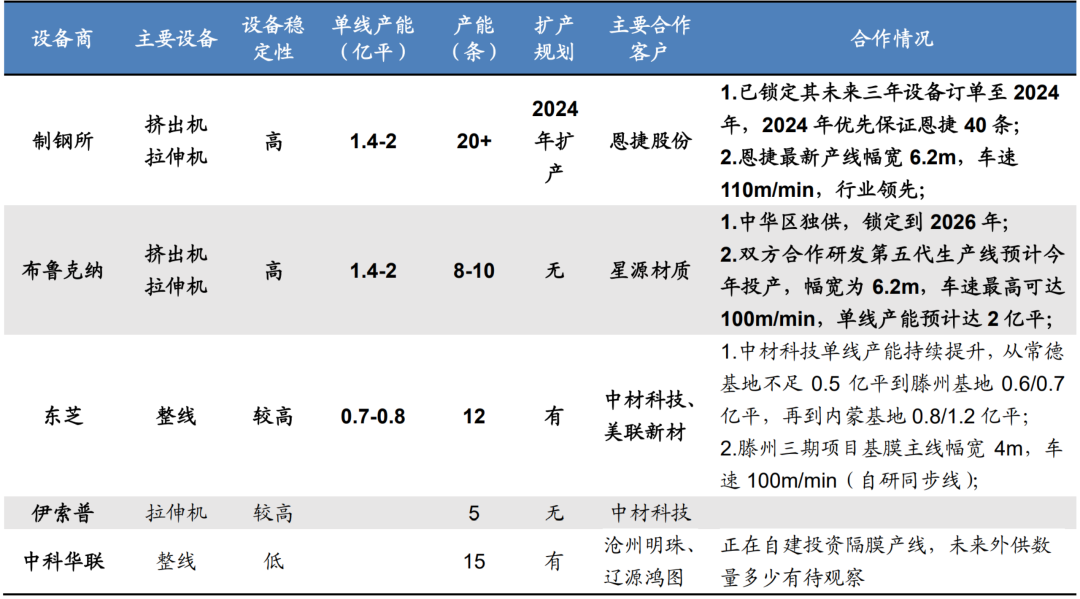

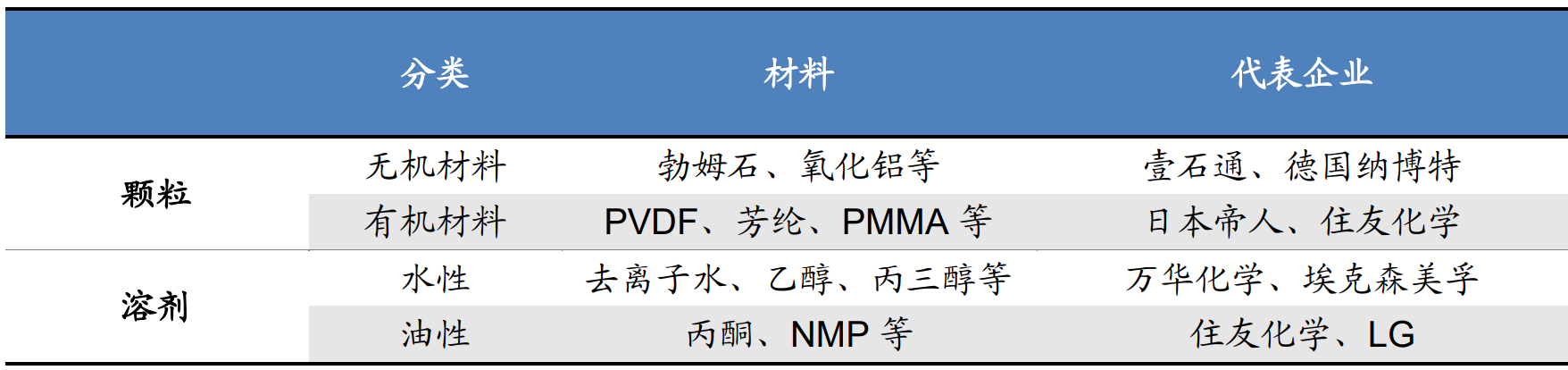

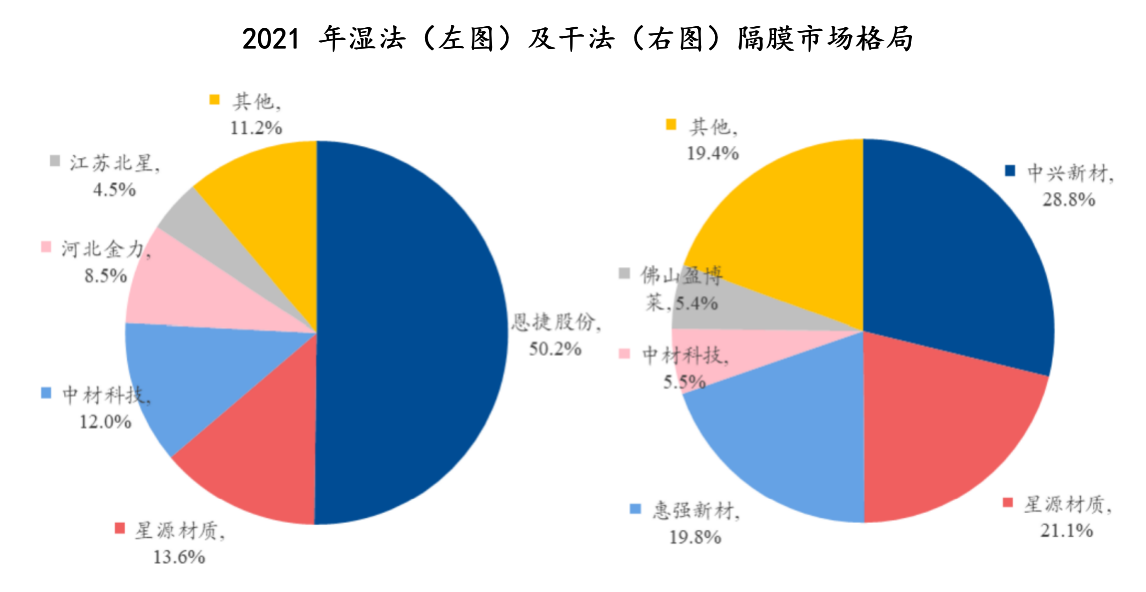

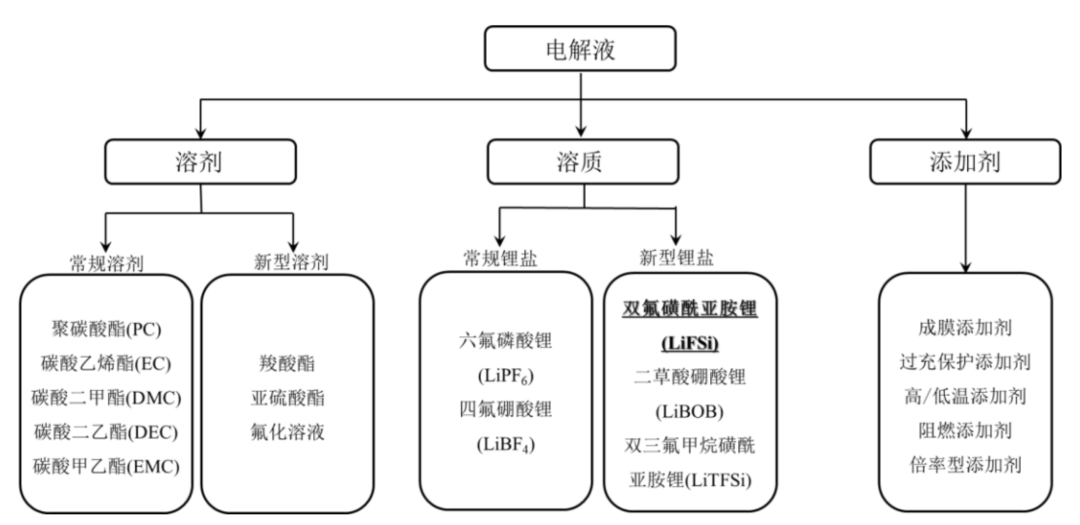

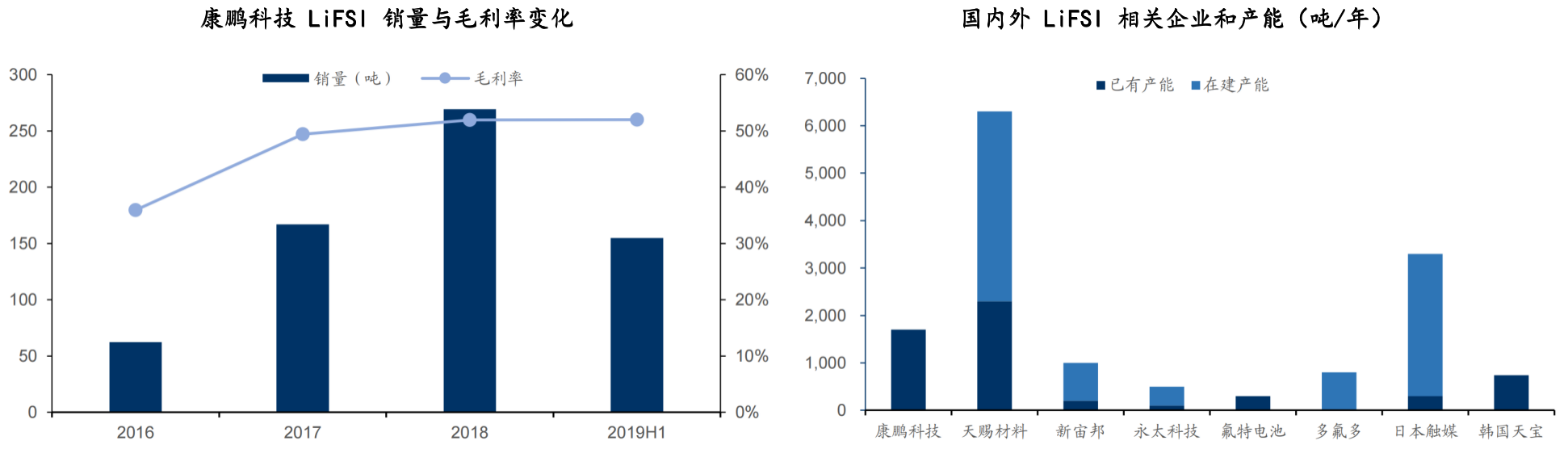

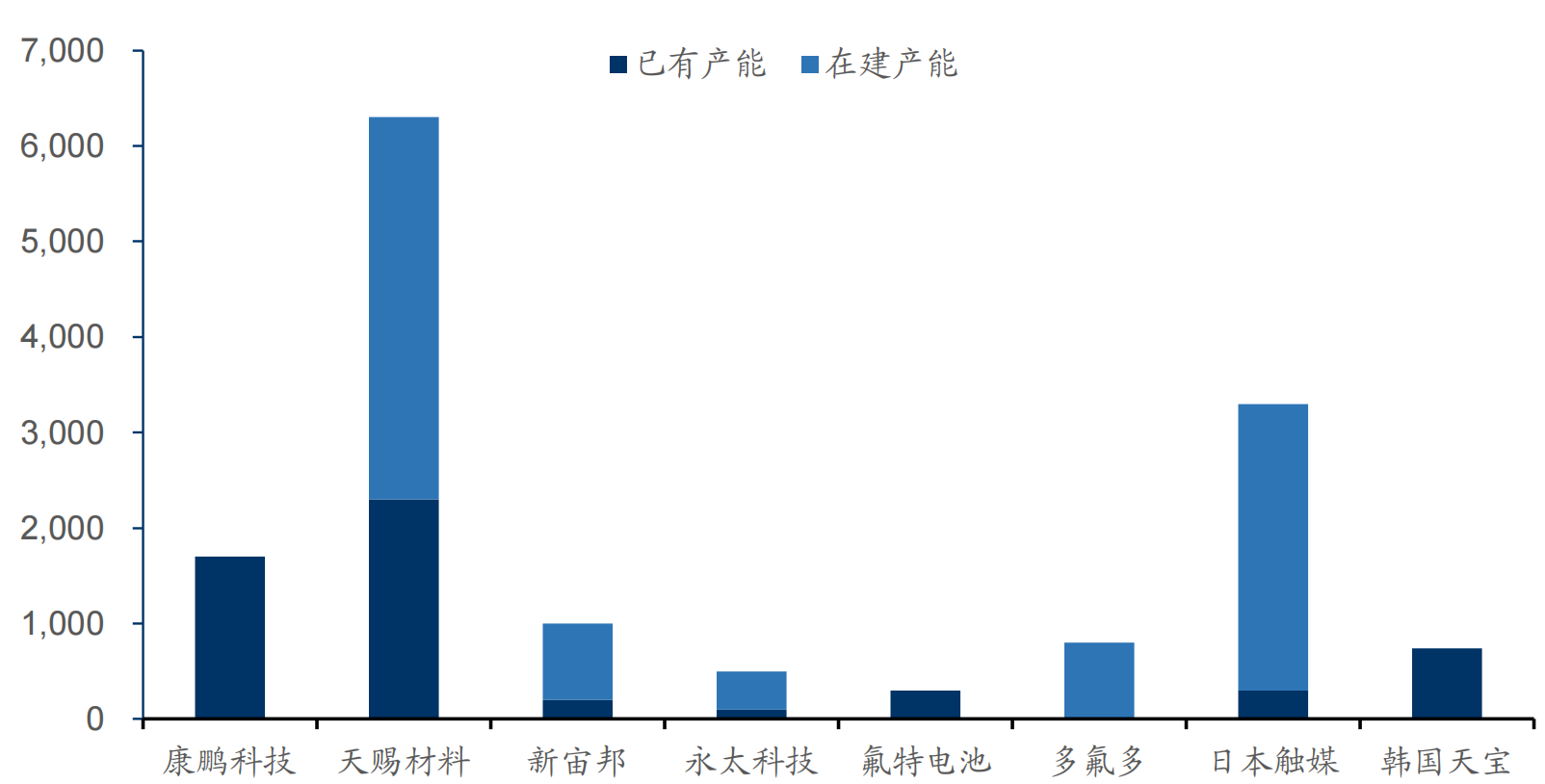

|Lithium battery industry chain diagram The four major materials of power batteries are positive electrode, negative electrode, separator and electrolyte, in addition to current collector copper foil and aluminum foil, structural parts, various conductive agents, binders and additives. |Power battery has a competitive pattern of multiple superpowers, and the leading position of the Ningde era is stable CATL occupies half of the power battery market, and Chinese companies continue to divide up the market: From January to March 2022, CATL will maintain a share of more than 30% in global power battery installed capacity, while leading Japanese and Korean companies LG New Energy (-5.1%), Panasonic (- 1%), the market share has declined; while the market share of Chinese companies has accelerated, and the global market share of domestic brands such as BYD (+1.2%) and China Innovation Airlines (+1.3%) has steadily increased. |Summary of the development trend of power battery technology 1. Continuous iteration of CTP/CTB The traditional battery pack is a three-layer structure of "cell-module-battery pack". CTP (cellto pack) is directly integrated from the cell to the battery pack. CTB (celltobody) goes a step further and integrates the upper cover of the battery with the body floor. Two in one, the body battery is integrated. The battery not only provides the energy source for the whole vehicle, but also provides structural support for the body, which completely subverts the traditional body design. CATL took the lead in bringing the battery pack CTP technology to the market, and BYD's blade battery gave full play to the advantages of lithium iron phosphate batteries, with excellent integration efficiency. BYD launched CTB technology in May 2022, and CATL is also developing CTC. 2. Tesla 4680 battery It is expected that Tesla's sales will reach 3.8 million in 2025, 60% of the models will be equipped with 4680 batteries, and the demand for 4680 batteries will reach 236GWh. At present, the mainstream battery companies at home and abroad, CATL, Yiwei Lithium, Panasonic, LG, and Samsung have accelerated the layout of the 4680. Tesla's own production capacity of 4680 batteries cannot meet the demand for complete vehicles. Panasonic and LG are expected to continue to supply 4680 batteries after 2170 batteries. Yiwei Lithium Energy has deployed 4680 batteries earlier, and has many years of experience in cylindrical projects. Yiwei Lithium Energy is expected to achieve a single-point breakthrough with 4680 batteries and increase its market share. |Positive electrode: the cost accounts for the largest proportion, and the ternary and iron-lithium develop in parallel The cost of cathode materials accounts for the largest proportion of the total cost of lithium batteries, with iron-lithium batteries and ternary batteries accounting for 48% and 58%, respectively. Ternary iron-lithium dislocation competition and parallel development. Lithium iron phosphate batteries are characterized by "low cost + high safety". Compared with ternary batteries, the cost is higher and the service life is longer, so they are mostly used in low-end and cost-effective models. Sanyuan is characterized by "high performance + long battery life", which is mostly used in mid-to-high-end models to meet the requirements of mid-to-high-end models for charging, power and battery life. The demand for cathode materials keeps growing. In 2020, the global shipments of ternary and lithium iron phosphate cathode materials will be 341,000 tons, and 719,000 tons in 2021, a year-on-year increase of 111%. It is expected that the global demand for ternary and lithium iron phosphate cathode materials will continue to grow year by year in the next four years, from the demand of 1.102 million tons in 2022 to the overall demand of 2.529 million tons in 2025, with a compound annual growth rate of 49 million tons. %. |Positive electrode: ternary and iron-lithium preparation process The technical route of the ternary cathode is relatively complex, and the demand for performance upgrades has brought about upgrades in the direction of high nickel and modification. The manufacturing and process complexity of high nickel is higher, resulting in higher technical barriers. From the perspective of the process route of positive companies, the leading companies have their own characteristics: 1) Rongbai Technology: Acquired Fenggu Energy Saving, adopted ceramic cellar furnace equipment, reduced costs, improved efficiency, and has flexible production lines for polycrystalline and monocrystalline. 2) Dangsheng Technology: Improve the coating process, direct mixing of aluminum oxide, and reduce the process flow. 3) Zhenhua New Materials: The three-burning process reduces the selection requirements of the ternary precursor, and the upstream ternary precursor end can reduce the cost accordingly. |Positive: The overall tension between supply and demand has eased, and the internal supply and demand structure is unbalanced 1. The supply and demand of high-end high-nickel ternary will continue to tighten: the high-nickel technology route has certain barriers, and it is expected that high-end production capacity will continue to be in a tight state before 2025. 2. There is a problem of excess capacity of low-end ternary: lithium iron phosphate and sodium-ion battery technology development replaces some low-end ternary, and the competitiveness of low-end ternary declines and faces excess. 3. From balance of supply and demand to relatively surplus of iron and lithium: At present, the supply and demand pattern of iron and lithium market is relatively balanced, but the planned production capacity of each company is relatively large, and many chemical companies have deployed iron and lithium production capacity, but in the short term, it is affected by the verification cycle , has limited impact on the supply and demand pattern of high-quality production capacity. It is expected that the overall supply and demand of lithium iron phosphate will be relatively loose in 2020, the high-quality supply and demand will be relatively tight in 21 years, and the low-end production capacity will face the risk of excess in 23 years. |Positive: The ternary competition pattern is scattered, and the profitability of iron and lithium is stronger Ternary positive electrode: the pattern is scattered and the competition is fierce. From 2018 to 2021, the ternary cathode material CR3 will increase from 30% to 38%, and CR5 will increase from 48% to 55%, and the industry concentration will increase. As a high-nickel leader, Rongbai Technology has benefited from the industry development trend, and its shipments have ranked first in the industry for four consecutive years. But overall, the top ten shipments in the industry have little difference, all around 10%, and the market competition is fierce. Lithium-iron cathode: The competitive landscape is relatively good and the profitability is stronger. In 2021, the CR10 of iron-lithium cathode companies will reach 84.8%, of which Hunan Yuneng and Defang Nano will occupy almost half of the shares, and the head advantage is obvious. On the whole, the gross profit margin of lithium iron phosphate is around 30%, which is higher than that of the positive electrode, which is 10%=20%. |Summary of the development trend of cathode material technology 1. Lithium iron manganese phosphate (upgraded version of lithium iron phosphate) New cathode materials are mainly developed around high-voltage platforms and manganese-based materials, and the earliest commercialized one in its branch system is lithium manganese iron phosphate. Compared with lithium iron phosphate, it has high voltage, high energy density and better low temperature performance; compared with ternary materials, it has the advantages of low cost, high safety and long cycle life. Lithium iron manganese phosphate also has performance defects, including poor conductivity and low efficiency in the first cycle. The performance can be improved by coating, doping, and modification. In response to the poor conductivity of manganese iron manganese phosphate, carbon nanotubes can be doped to improve the electrical conductivity and optimize the energy density, cycle life and rate performance; adding lithium supplements can optimize the first cycle efficiency and cycle life. In terms of technology, the existing lithium iron phosphate production line can be transformed and upgraded. Lithium iron manganese phosphate can be used purely or mixed with ternary. It is estimated that the global market demand for lithium iron manganese phosphate in 2025 will be 154,000 tons, and the market space will reach 9.2 billion yuan. The average compound growth rate from 2021 to 2025 will reach 129% . BYD, Guoxuan Hi-Tech, Defang Nano and Litai Lithium have obvious advantages in patent layout. In terms of mass production progress, Tianjin Stellan and Litai Lithium Energy announced that they will achieve mass production. In addition, Dangsheng Technology and Xiamen Tungsten New Energy have entered the pilot stage. Among the downstream battery companies, Tianneng Co., Ltd. and Phylion Power have related battery products used in the field of electric two-wheeler batteries. 2. Medium nickel high voltage The high-voltage cost, energy density and safety advantages of medium and nickel are obvious, and the outbreak is about to be ushered in. In terms of material properties, the charging voltage of Ni6 series ternary materials is increased to 4.40V, and the gram specific capacity is also increased to 181mAh/g, which basically reaches the level of Ni8 series products, and the energy density (670Wh/kg) is close to the latter (688Wh/kg) , and due to the lower nickel content, Ni6 series high-voltage products have better thermal stability. In terms of material cost, due to the relatively low Co content of Ni6 series high-voltage ternary cathodes, the raw material cost per ton of Ni6 series high-voltage products is about 311,400 yuan / ton, which is 7% lower than that of Ni8 series conventional voltage products, about 22,500 yuan / ton Ton. The Ni content of 6 series high voltage is lower than that of 8 series, and the production process is not as complicated as that of Ni8 series. Compared with 8 series products, 6 series high voltage has less process requirements (no oxygen and drying atmosphere), so the processing cost is also higher than that of Ni8 products. The reduction is about 8,000 yuan/ton. | Cathode precursor: short-term fluctuation of raw material prices, high nickel is the development trend At present, the pricing of ternary precursors adopts the pricing model of metal price + processing fee, and the processing fee is determined according to the difference in processing difficulty and technical barriers. The competitive barriers for ternary precursors lie in upstream resources and high-nickel precipitation technology. Since 2022, due to the tightening of global nickel supply and market behavior, the price of nickel has risen sharply, resulting in a significant increase in the price of precursors. The price began to fall in late April. According to the public data of Xinyu Lithium Battery, as of May 27, the price per ton of 811/622/523 precursors dropped to 15.85/14.8/141,500 yuan respectively. In 2021, the share of high nickel in cathode production will advance by leaps and bounds. The 3 series NCM has basically faded out of the market, and the 8 series accounts for 36.2%. It is expected that the high nickel share will continue to rise next year. The nickel sulfate content and cost continue to rise under the high nickel route. The content of nickel element in a single ton of 5 series, 6 series and 8 series precursors are: 0.323t, 0.387t, 0.515t, of which the cost of nickel sulfate accounts for the total cost: 5 series 48%, 6 series 53%, 8 series 72%, becoming the core direction on the road to cost reduction. |Positive Precursor: Actively deploy upstream and accelerate the integration process The precursor giants are actively deploying upstream links. GEM, Huayou, Zhongwei, etc. have all expanded upstream, investing in nickel and cobalt mines, and the proportion of self-supply is increasing. At present, my country is in a leading position in the world in the research and development and production of ternary precursors. Among the global ternary precursor production in 2021, Zhongwei Co., Ltd., GEM and Huayou Cobalt will rank among the top three in the world, accounting for 21%, 12% and 9% of the market respectively; Hunan Bangpu, as a subsidiary of Ningde Times, is the precursor of The overall market share also reached 9%. In addition, Fangyuan's NCA technology is also in a leading position in the industry. |Negative electrode: shipments are growing rapidly, artificial graphite occupies the main market At present, the anode materials of lithium batteries are mainly artificial graphite and natural graphite, and the development trend is to dope silicon into the graphite anode to form a silicon-based anode with higher energy density. The upstream of the negative electrode material is mainly petroleum coke, needle coke, pitch or natural graphite and other products, and the downstream is supplied to various battery manufacturers, which are ultimately used in new energy vehicles, energy storage, consumer electronics and other fields. According to GGII, China's lithium battery anode market shipments will be 720,000 tons in 2021, a year-on-year increase of 97%. As the consistency and cycle performance of artificial graphite is better than that of natural graphite, and it is more suitable for the needs of power and energy storage batteries, the proportion of artificial graphite production and shipments continues to increase to 84%, while the market share of natural graphite has dropped to 14%. According to Xinyu Information, with the expansion of lithium carbonate prices, the proportion of anode materials in the cost of ternary 523 cells and lithium iron phosphate cells is about 4% and 6%, respectively. (normally around 10%) |Negative electrode: the shortage of graphitization capacity has become a key restrictive factor in the industrial chain The production process of artificial graphite is long, and graphitization is the key process. The artificial graphite process mainly includes four major processes: crushing, granulation, graphitization and screening. Among them, the granulation and graphitization links can better reflect the technical level of negative electrode material enterprises. Graphitization becomes the key restrictive factor of the industrial chain, and the graphitization self-sufficiency rate is strongly linked to profitability. Generally, a single ton of graphitization production consumes 12,000 to 14,000 kWh of electricity. Affected by environmental protection and energy consumption policies, graphitization production capacity is in short supply. According to GGII, in the fourth quarter of 21, Inner Mongolia, which accounts for nearly half of domestic graphitization production capacity, strictly controls high-energy-consuming industries, and power cuts affect graphitization production by about 40%. |Negative pole: Head manufacturers speed up the integration of negative poles and raise the investment threshold of the industry Leading manufacturers accelerate the construction of large-scale integrated bases. Over the past 21 years, leading companies such as Betterray, Putailai, Shanshan and Kaijin Energy have started to build large-scale integrated projects with a production capacity of more than 200,000 tons. The investment amount of the negative electrode integration project has doubled, which has greatly improved the entry threshold of the industry. Taking the three integrated projects of Betterray, Putailai and Shanshan as an example, the total investment of the project is more than 8 billion yuan, and the unit investment is about 426 million yuan / 10,000 tons, corresponding to about 5327 million battery production. 10,000 yuan/GWh, compared with the typical lithium battery anode material investment of 190 million yuan/10,000 tons, which corresponds to about 23.75 million yuan/GWh of battery production, which is more than doubled. Graphitization self-sufficiency significantly affects profitability, and it is expected that the production capacity of small factories will gradually clear. According to the calculation of Baichuan Yingfu and Guolian Securities Research Institute, under the conditions of graphitization self-sufficiency rates of 30%, 50%, 70% and 100%, the gross profit margins of medium and high-end artificial graphite are 14.23%, 18.18%, 22.14% and 100% respectively. 28.07%. The profit margins of small factories without graphitization capabilities are gradually being compressed, and the small production capacity of the industry is constantly being cleared. |Negative: Domestic production capacity is supplied to the world, and industry concentration is expected to increase Chinese manufacturers occupy 86% of the global market share of anode materials. According to EVTank statistics, the global share of China's anode production in 2021 will further increase from 77.7% in 20 years to more than 86.1%. Among them, the market share of the global shipments of the industry leader Bettray is 19%, and the shipments of Shanshan, Putailai and Kaijin Energy are relatively close, respectively occupying more than 10% of the global market share. Domestic second-tier manufacturers mainly include Shangtai Technology, Zhongke Electric and Xiangfenghua, etc., and their global market shares in 21 years are 8%, 7% and 4% respectively. The industry concentration has declined since 2018. It is expected that with the large-scale expansion of production by leading manufacturers in the future, the concentration will rebound. With the rapid increase in downstream demand, due to the limited production capacity of leading manufacturers and full production and full sales, some small and medium-sized manufacturers have been able to receive more orders and squeezed part of the market share. In the future, leading manufacturers will actively expand production and mainly build integrated production bases including graphitization production capacity to ensure their own production capacity utilization. It is expected that the industry concentration will increase. |Anode: The graphite capacity is approaching the upper limit, and the demand for silicon-based anodes is rising Silicon-based anodes are the next-generation anode materials with good industrialization prospects. At present, the capacity of high-end graphite on the market can reach 360-365mAh/g, which is very close to the theoretical upper limit of graphite material of 372mAh/g. The theoretical gram capacity of silicon material at room temperature is 3580mAh/g, and the theoretical gram capacity at high temperature is 4200mAh/g, which is about 10 times that of graphite. It also has the advantages of relatively low delithiation potential (0.4V), environmental friendliness and abundant resources. . Silicon-based anodes are still in the early stages of the industry. According to GGII, my country's silicon-based anode shipments will be 11,000 tons in 2021, a year-on-year increase of 83.3%, but only occupy 1.5% of the anode material market share, which is still in the early stages of development. Various companies have increased the production capacity of silicon-based anodes. In addition to Bettray, companies such as Shi Dashenghua, Dow Technology and Hebei Kuntian New Energy entered the field of silicon-based anodes, planning a total production capacity of 130,000 tons. The leading manufacturers of the anode industry, Shanshan Co., Ltd. and Putailai, have made good progress in the certification of silicon-based anode customers. We expect to announce a new expansion plan within 22 years. |Anode material technology development trend summary 1. Silicon-based anode (material cost/production process) The main obstacles to development: 1) Silicon is prone to volume expansion during the reaction process, which affects the cycle life of the battery; 2) Silicon is a semiconductor material with poor conductivity; 3) Silicon is prone to react with electrolytes, resulting in capacity loss, This feature is partly reflected in the lower first-time efficiency of silicon-based anodes; 4) the higher cost. The modification research on silicon-based anodes focuses on three aspects: solving the volume effect, maintaining the stability of the SEI film and improving the first effect. The directions of optimization include: (1) Modification of silicon source. That is to improve the electrochemical performance by preparing nano silicon, porous silicon or alloy silicon, but the process is complicated; (2) Preparation of composite materials. That is, doping silicon into graphite to form a composite material, and adding a conductive agent; (3) Preparation of silicon oxide (SiOx) material. As a compromise between graphite and silicon (specific capacity is about 1500mAh/g), the volume expansion of the material is greatly reduced, and the cycle performance is improved, but the low first effect also limits the application in full batteries. 2. Carbon-based materials Carbon-based materials are regarded as very promising anode materials for sodium batteries. According to the degree of graphitization, carbon materials can be divided into two categories: graphitic carbon and amorphous carbon. Hard carbon belonging to amorphous carbon exhibits stronger sodium storage capacity and lower working potential. For example, CATL has developed hard carbon materials with unique pore structures. But the high cost of materials is the bottleneck of hard carbon. Zhongke Hai Na considers the soft carbon route, using cheaper anthracite as a precursor, and obtains anthracite-based sodium-ion battery anode materials through simple pulverization and one-step carbonization. Has the best price/performance ratio. |Diaphragm: The cost-effectiveness of wet-process diaphragms continues to improve, and the penetration rate continues to rise due to the pull of new energy vehicles The separator is a key inner layer component with technical barriers in lithium batteries, accounting for about 10% of the cost. Micropore preparation is the core technology of the diaphragm production process. According to the different pore-forming mechanisms, it can be divided into dry diaphragm and wet diaphragm. The latter has better overall performance. On the whole, dry-process diaphragms are generally used in commercial vehicles and energy storage, and wet-process diaphragms are generally used in passenger vehicles. The coating process can effectively improve the thermal stability and mechanical strength of the material, making the wet-process separator even better. The market share of wet-process diaphragms continues to increase. Usually dry-process separators are paired with lithium iron phosphate batteries, and wet-process separators are paired with ternary batteries. However, with the continuous improvement of the cost-effectiveness of wet process diaphragms, the price difference with dry process has dropped from 1.9 yuan/square meter in 2018 to 0.3 yuan/square meter in the first quarter of 2022, and the corresponding kWh price difference is 4.5 yuan/KWh, making iron phosphate in 21 The backflow of lithium did not have a significant impact on the wet separator. |Diaphragm: The technical threshold for non-standardized equipment is high, and the scarcity of supply restricts the expansion of production capacity Equipment is the key to determining the quality of the diaphragm, and the technical threshold tests the understanding of the equipment of the diaphragm factory. The production process of the diaphragm mainly includes raw material mixing, extrusion casting, heat treatment (or extraction), stretching, winding and slitting, etc. Each link requires high-precision control. The selection of equipment must be oriented and matched according to the process characteristics. The manufacturing level of the manufacturer is very high. At present, the stability of domestic equipment represented by Hualian is still insufficient to meet the needs of downstream customers. Over the years, my country's diaphragm production lines have been highly dependent on imports. There are currently only 4 major diaphragm equipment manufacturers in the world, namely Japan Steel Works, Japan Toshiba, Germany Bruckner, and France Isopp. Separator yield consists of two parts: yield and A yield. When the company slits the parent roll or semi-finished product, leftovers will be formed, and the remaining complete part/the parent roll before slitting is called the yield. Any slitting or coating process will produce A and B products, of which the B products are of relatively low quality and are often sold at low prices or disposed of as waste. The higher manufacturing difficulty causes the diaphragm yield to be low among the four main materials, and the gap between them is obvious. From a vertical perspective, the overall yield of Enjie was only 53% in 2015, and then increased to 78% in 2017 through process improvement , and its yield in 2021 is close to 90% . Horizontally, the yield rate of domestic diaphragm factories is uneven. Xingyuan material is roughly 80% , Sinoma Technology and Cangzhou Pearl are 70%+ , and Hengli Petrochemical is expected to be 65% once it is put into production . |Diaphragm: The technical barriers to customization of coating process are high, and the integration of base film coating is the general trend Coating modification is a safety pad for improving the energy density of batteries, and its importance is becoming increasingly prominent. The wet-process separator has obvious advantages in terms of physical and chemical properties and mechanical properties, but the thermal stability is not good. Coating modification can effectively reduce its thermal shrinkage rate, while improving the puncture resistance, and the safety is significantly improved. In addition, the coating material can enhance the wettability between the separator and the electrolyte and improve the ionic conductivity. In the past two years, the coating ratio of wet separators has reached more than 80%. The customization of the coating process is obvious, and it needs to be processed according to the actual needs of downstream battery factories. The difference is mainly reflected in the slurry formulation. Coating solvents can be divided into two types: water-based and oil-based. Among them, oil-based coating has better uniformity and adhesion than water-based coating. It is positioned as a mid-to-high-end product with higher cost and is more favored by overseas battery factories. Multi-layer coating is to first coat a layer of alumina on the surface of the base film, and then coat an organic layer such as PVDF to form a multi-layer composite diaphragm. Mixed coating is to mix inorganic and organic slurries together to coat the surface of the base film. Different combinations of coating solvents and particles determine the differences in final products. Overseas coating plants master the core technology of slurry formulation, and domestic manufacturers usually need to obtain patent authorization to carry out related business. Boehmite accelerates penetration with better performance and cost-effectiveness, forming a significant replacement for alumina. At present, domestic mainstream battery factories and separator factories are accelerating the switch to use boehmite. In 2021, the market share of boehmite for lithium battery separators in China will increase to 45% in inorganic coatings. In 2022, the shipment volume of boehmite is expected to exceed 30,000 tons, and the market share may exceed that of alumina. Limited by the tight coating production capacity, the integration of third-party foundry and base film coating is expected to develop in parallel in the future. In the medium and long term, the integration of base film coating is the general trend. The coating ratio of mainstream diaphragm factories is as follows: |Diaphragm: Strong asset-heavy property, patents rely on overseas authorization The "heavy asset" feature stems from the large investment in equipment. Taking the "annual output of 400 million square meters lithium-ion battery separator project (Phase I)" of Jiangxi Tongrui of Enjie Co., Ltd. as an example, the total investment amount is 1.75 billion yuan, of which equipment investment accounts for 81%, and a total of 8 wet processes are purchased. The diaphragm production line is equivalent to an investment of 350 million yuan per 100 million square meters of equipment, and an investment of 176 million yuan for single-line equipment. Enterprises with large investment in diaphragms and strong asset operation capabilities are expected to continue to expand production capacity and improve competitiveness. Patent authorization helps domestic manufacturers to speed up their overseas expansion, and patent moats raise the barriers to entry for the industry. Overseas battery factories have high requirements on the quality of separators, and prefer to choose oil-based coatings. However, most of the core patents are controlled by LG Chem and Teijin. Therefore, seeking authorization is an inevitable choice for domestic companies to enter the overseas market in the short term. Enjie has obtained the exclusive authorization of Teijin's worldwide patents related to solvent-based lithium battery coating separators, and Xingyuan material has been authorized by LG for a full set of coating patents. In terms of wet process, after Enjie acquired Chongqing Newmi in May 2021, the market share rose to 50.2%, and its leading position in the industry was stable; the wet process production capacity of Xingyuan material increased steadily, with a market share of 13.6%. In terms of dry method, as the main supplier of BYD blade batteries, the shipment of ZTE New Materials has also increased significantly. Zhongxing New Materials Dry Process will also benefit greatly. The leading position of Enjie shares is remarkable, and its profitability leads the industry. In terms of gross profit margin, Enjie shares have been maintained at more than 40% since 2018, and have steadily increased with leading technological advantages. In 2022, Q1 will reach 49%, which is significantly ahead of other companies in the industry. |Electrolyte: three major components, new products are emerging The electrolyte consists of lithium salts, solvents and additives. According to the quality, the solvent quality accounts for 80-90%, the lithium salt accounts for 10-15%, and the additive accounts for about 5%; according to the cost, the lithium salt accounts for about 40-50%, and the solvent accounts for about 30% , Additives account for about 10-30%. The cost of lithium hexafluorophosphate accounts for the highest proportion, and the historical price is consistent with the trend of electrolyte. Due to its excellent performance and low cost, lithium hexafluorophosphate is currently the mainstream lithium salt. In order to further optimize the performance of the electrolyte and overcome the defects of conventional lithium salts and solvents, lithium salts and solvents are usually modified or replaced, and functional additives are added. New solvents such as salts, carboxylate esters, and a wide variety of additives are emerging, but there is still a long way to go before large-scale commercial applications. |Lithium salt in electrolyte: LiFSI replaces LiPF6, the forerunner of ternary high nickel trend The pursuit of energy density upgrades in batteries will drive new lithium salts such as LiFSI to become mainstream solutes. From a long-term perspective, LiFSI (lithium bisfluorosulfonimide) can be used as a new lithium salt instead of lithium hexafluorophosphate, and can be used as an additive in a small amount, but due to its high cost, it is currently mainly used as an electrolyte additive. LiFSI can significantly compensate for the shortcomings of lithium hexafluorophosphate and conform to the trend of high nickelization of ternary cathodes. It is estimated that the market space will be 15 billion yuan by 2025. The technical barrier of LiFSI is higher than that of lithium hexafluorophosphate under the limitation of the process. On the one hand, the higher technical barrier makes the number of companies capable of mass production of LiFSI on one hand, and its gross profit margin remains high. While the world's leading electrolyte companies in Japan and South Korea are deploying LiFSI, domestic electrolyte and fluorine chemical companies aim at the LiFSI blue ocean market and compete to increase their layout. With the gradual release of domestic LiFSI production capacity and the decline in cost and price, opportunities for localization alternatives will come. |Electrolyte Additives: Raw Materials to Improve Electrolyte Performance The additive electrolyte has a small mass proportion and high unit value, which can directionally optimize various properties of the electrolyte, such as electrical conductivity, flame retardant performance, overcharge protection, rate performance, etc. The most widely used additives are VC, FEC and PS. Electrolyte additives have high production process and qualification certification barriers, requiring engineers to have long-term know-how accumulation. The importance of additives in electrolytes has increased. With the development of lithium batteries in the direction of high voltage and high nickel, the formulation of the required electrolyte, especially the use of additives, is becoming more and more complicated. According to EVTank data, the proportion of global electrolyte additives in 2020 will increase from 2014. From about 4.2% to about 5.6%, the current cost ratio of additives in LFP electrolyte and ternary electrolyte is 10% and 20-25% respectively. The article is an information point compiled by Jingtai and does not constitute investment advice. Please read it carefully.